199 Superior Client Forum

Description

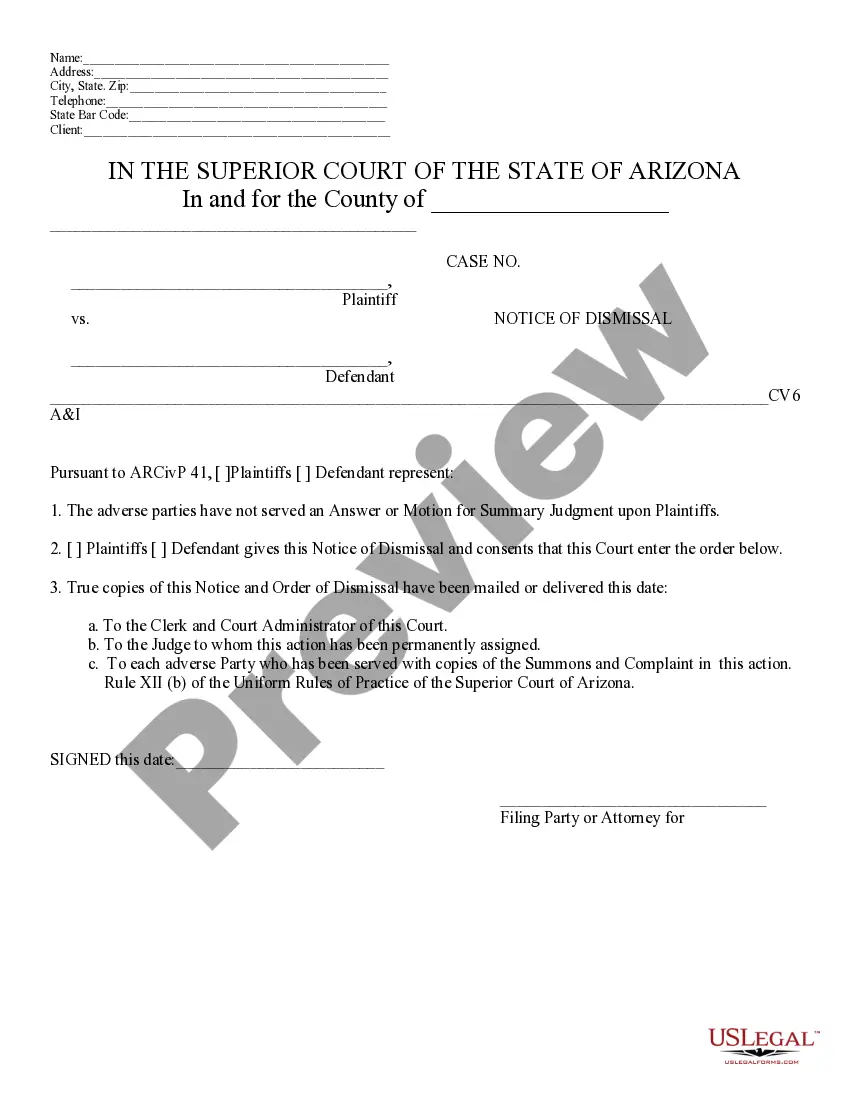

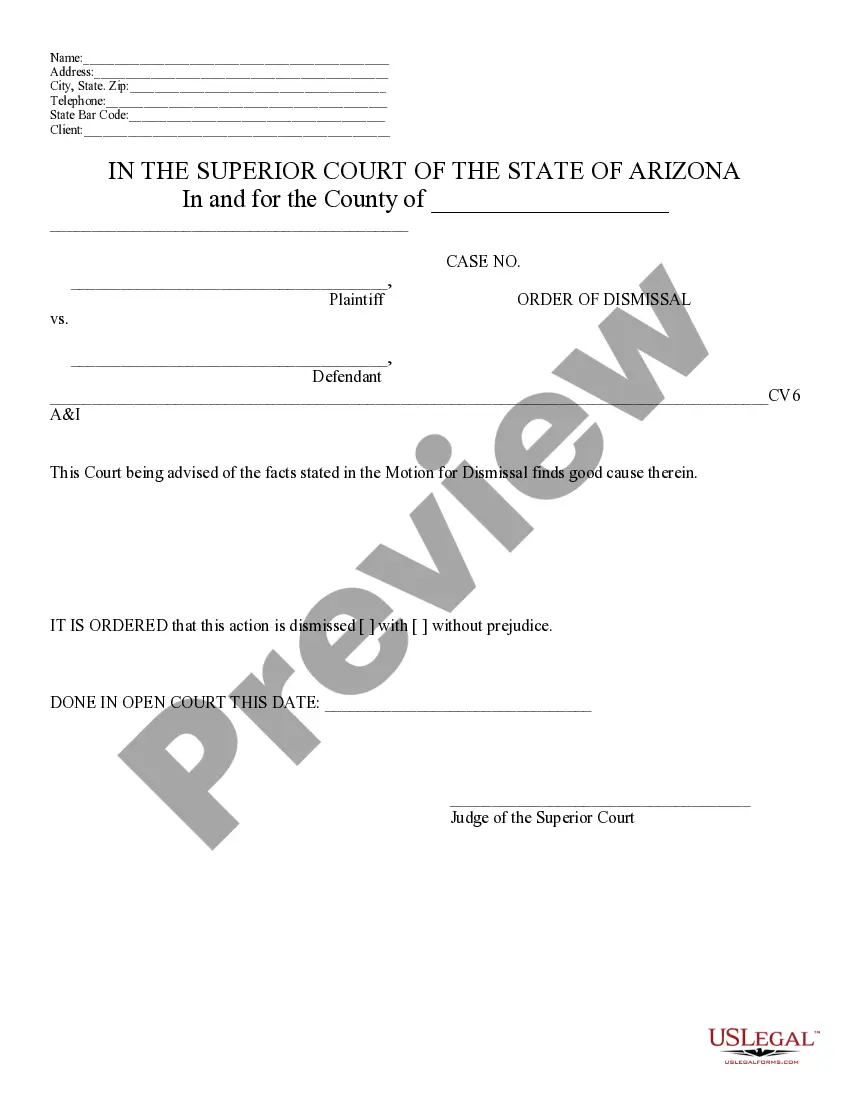

How to fill out Arizona Motion For Dismissal?

Using legal document samples that comply with federal and regional laws is crucial, and the internet offers many options to choose from. But what’s the point in wasting time looking for the correctly drafted 199 Superior Client Forum sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the greatest online legal library with over 85,000 fillable templates drafted by lawyers for any professional and life situation. They are easy to browse with all papers organized by state and purpose of use. Our professionals stay up with legislative updates, so you can always be confident your form is up to date and compliant when getting a 199 Superior Client Forum from our website.

Obtaining a 199 Superior Client Forum is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you require in the preferred format. If you are new to our website, follow the steps below:

- Analyze the template using the Preview option or through the text description to ensure it meets your needs.

- Locate another sample using the search tool at the top of the page if necessary.

- Click Buy Now when you’ve found the correct form and choose a subscription plan.

- Register for an account or log in and make a payment with PayPal or a credit card.

- Select the best format for your 199 Superior Client Forum and download it.

All templates you locate through US Legal Forms are reusable. To re-download and complete previously saved forms, open the My Forms tab in your profile. Benefit from the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

California Tax Filing Requirements for Churches ing to the Franchise Tax Board (FTB), organizations that are tax exempt in California may be required to file one or more of the following: FTB 199N (California e-Postcard) Form 199 (Exempt Organization Annual Information Return)

Most tax-exempt organizations are required to file Form 199 or FTB 199N. Some types of organizations do not have a filing requirement. Form 199 is used by the following organizations: Organizations granted tax-exempt status by the FTB.

Organizations with gross receipts that are normally $50,000 or less may choose to electronically file FTB 199N. For more information, go to ftb.ca.gov/forms and search for 199N. * Organizations eligible to file FTB 199N may choose to file Form 199.

Payment of Filing Fee. Beginning January 1, 2021, exempt organizations are no longer required to pay the $10 annual information return filing fee for form FTB 199.

How to File CA Form 199 Electronically Add Organization Details. Search for your EIN, and our system will import your organization's details from the IRS. ... Choose Tax Year and Form. Tax 990 supports current and previous tax years' filing. ... Provide Required Information. ... Review Your Form Summary. ... Transmit it to the FTB.