199 Superior Client For Windows 10

Description

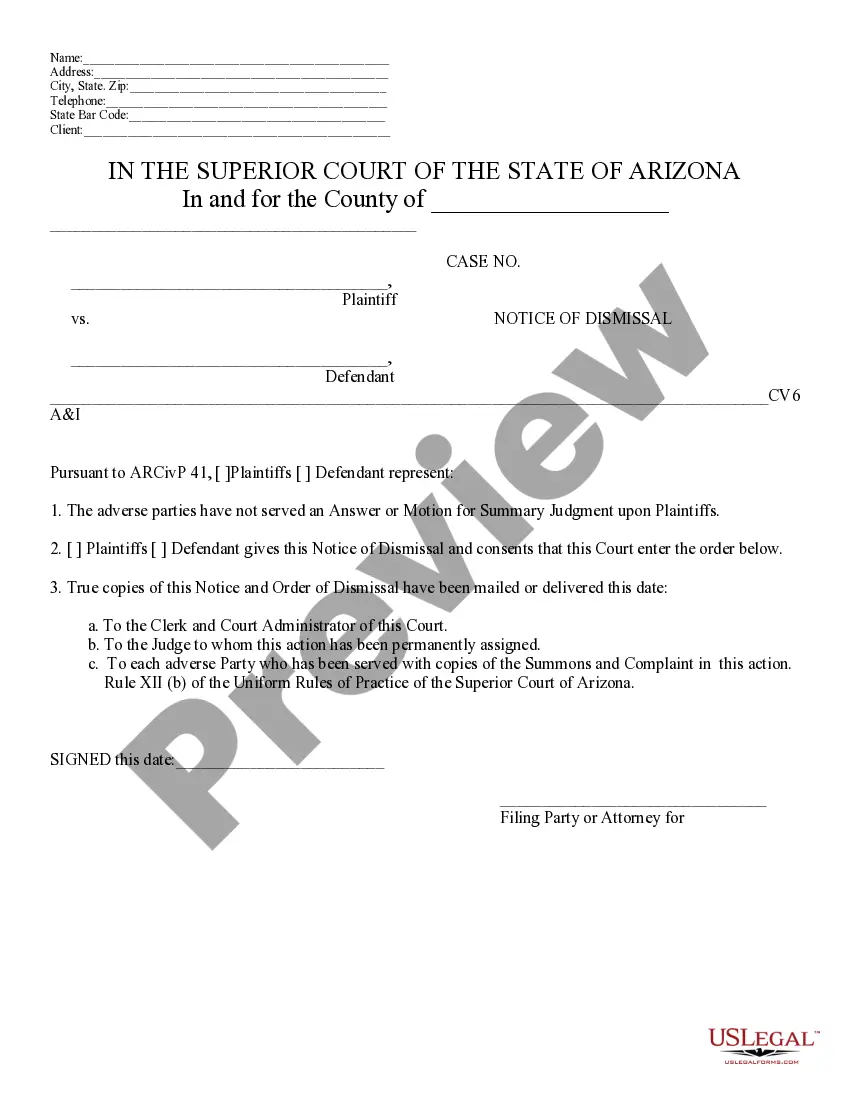

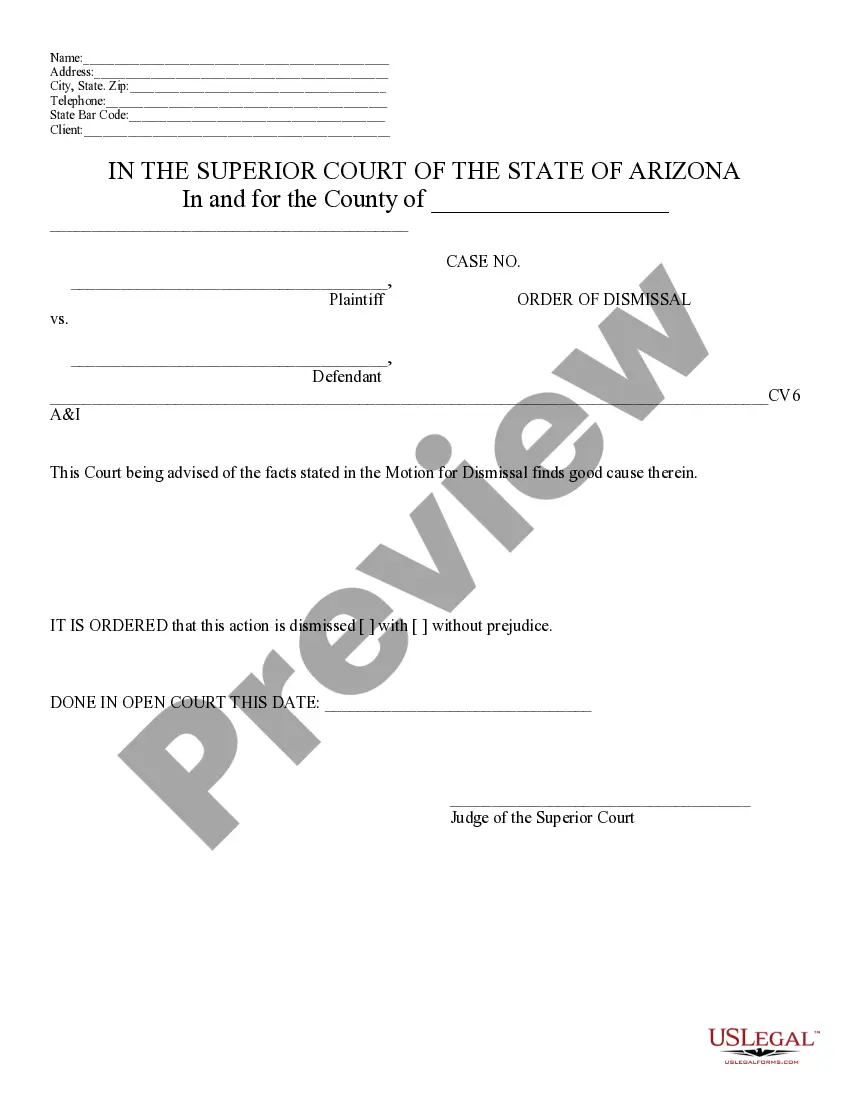

How to fill out Arizona Motion For Dismissal?

Whether for business purposes or for individual affairs, everybody has to deal with legal situations sooner or later in their life. Filling out legal papers demands careful attention, beginning from choosing the right form sample. For instance, when you choose a wrong version of the 199 Superior Client For Windows 10, it will be rejected once you submit it. It is therefore essential to get a reliable source of legal documents like US Legal Forms.

If you need to get a 199 Superior Client For Windows 10 sample, follow these simple steps:

- Find the sample you need by utilizing the search field or catalog navigation.

- Look through the form’s description to ensure it suits your case, state, and region.

- Click on the form’s preview to see it.

- If it is the incorrect document, go back to the search function to find the 199 Superior Client For Windows 10 sample you need.

- Download the file if it meets your requirements.

- If you have a US Legal Forms profile, just click Log in to access previously saved files in My Forms.

- In the event you don’t have an account yet, you may download the form by clicking Buy now.

- Choose the appropriate pricing option.

- Finish the profile registration form.

- Select your transaction method: you can use a bank card or PayPal account.

- Choose the file format you want and download the 199 Superior Client For Windows 10.

- Once it is downloaded, you are able to fill out the form by using editing applications or print it and complete it manually.

With a large US Legal Forms catalog at hand, you do not need to spend time seeking for the appropriate sample across the web. Make use of the library’s easy navigation to get the correct form for any situation.

Form popularity

FAQ

The term trade or business generally includes any activity carried on for the production of income from selling goods or performing services.

A qualified trade or business is any trade or business carried on by the taxpayer in the United States, other than: the trade or business of performing services as an employee, or. for taxpayers with taxable income above an inflation-adjusted threshold, a specified service trade or business (SSTB).

Trade Or Business Expenses. rentals or other payments required to be made as a condition to the continued use or possession, for purposes of the trade or business, of property to which the taxpayer has not taken or is not taking title or in which he has no equity.

QBI is the net amount of qualified items of income, gain, deduction, and loss from any qualified trade or business, including income from partnerships, S corporations, sole proprietorships, and certain trusts.

For example, if your taxable income equals $100,000, including $20,000 of capital gains and no capital losses, the Section 199A deduction can't exceed 20% of the $80,000 ($100,000 taxable income less $20,000 capital gains).