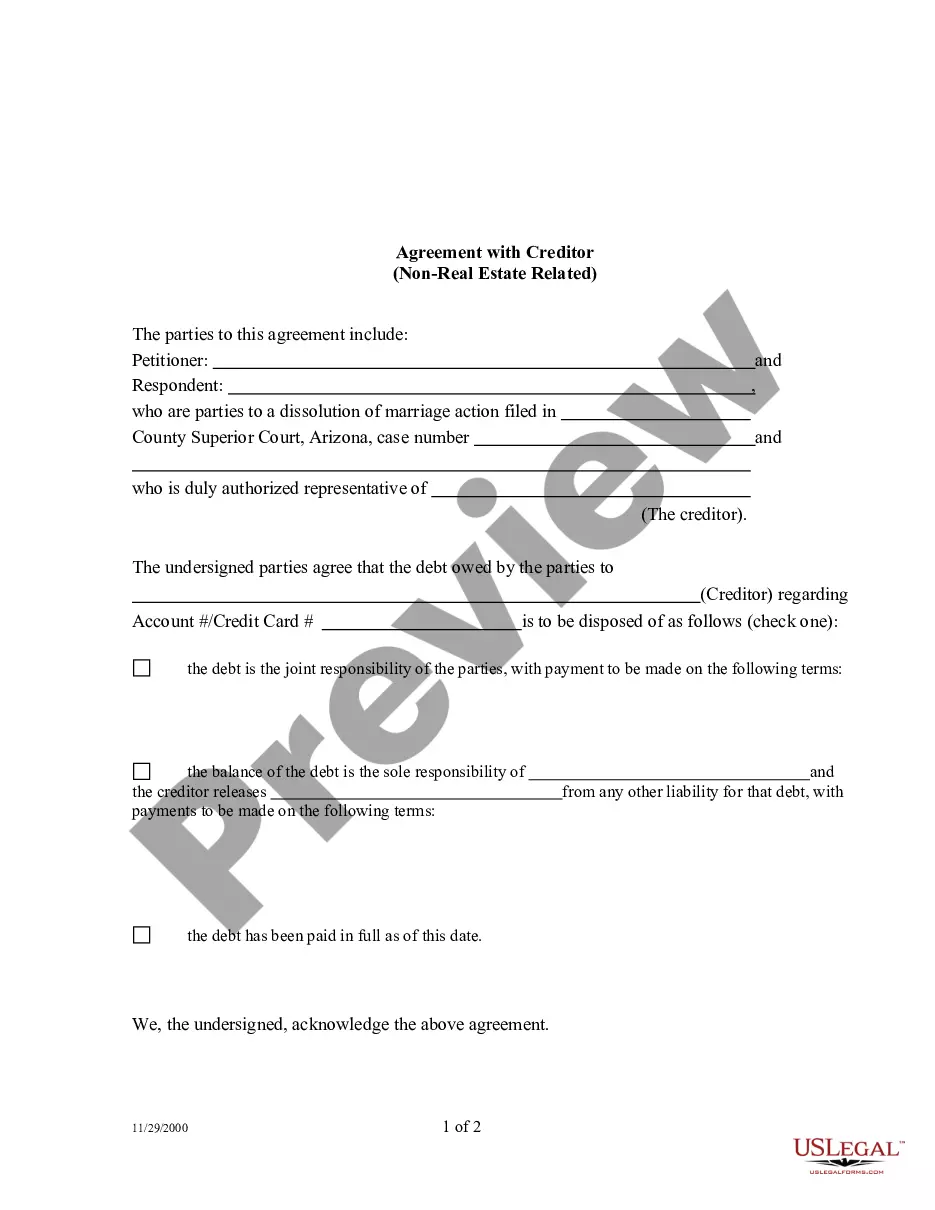

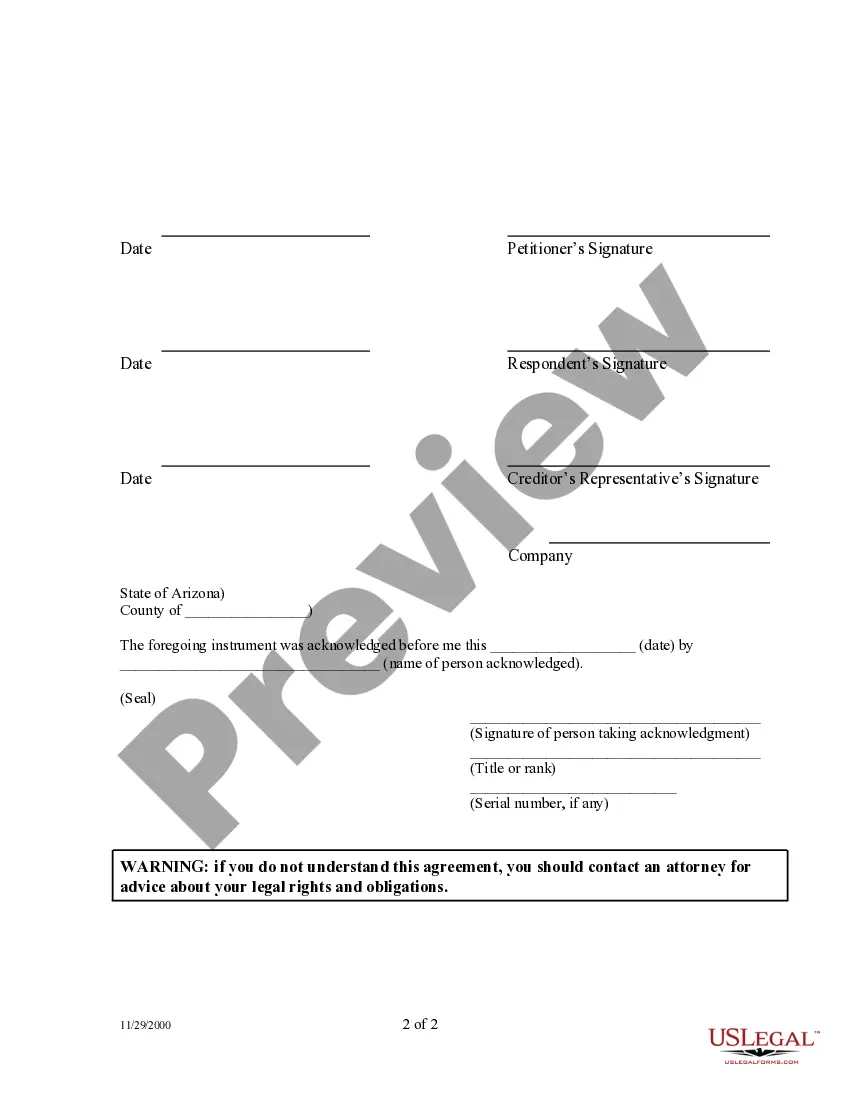

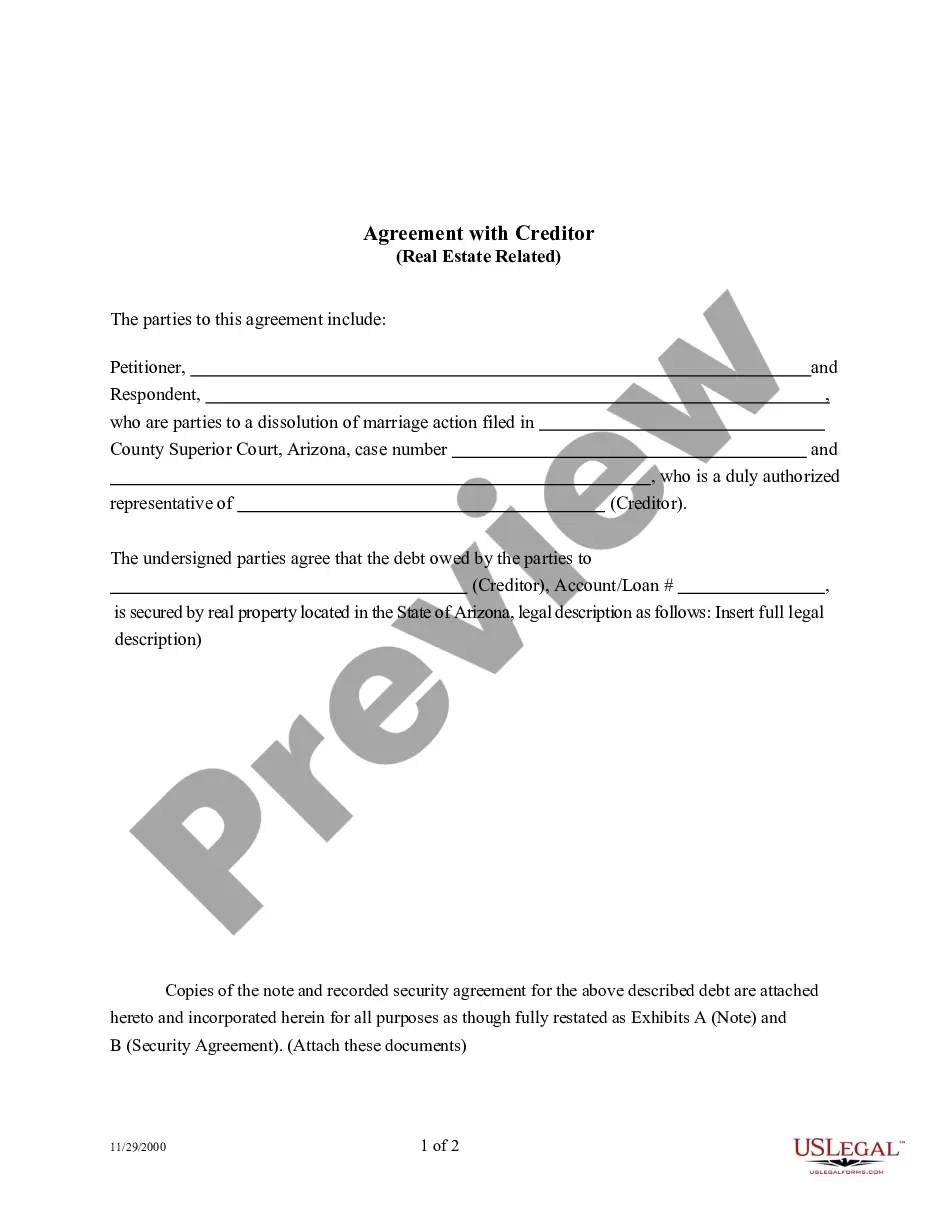

Settlement Agreement With Creditor

Description

How to fill out Arizona Agreement With Creditor - Debt Not Related To Real Estate?

Bureaucracy requires exactness and correctness.

If you do not engage in filling out documents like Settlement Agreement With Creditor regularly, it may lead to some misunderstandings.

Choosing the right sample from the beginning will ensure that your document submission proceeds seamlessly and avert any hassles of resending a document or doing the same work entirely from the beginning.

Fetching the correct and updated samples for your documentation only takes a few minutes with an account at US Legal Forms. Eliminate the bureaucratic worries and simplify your form management.

- US Legal Forms is the largest online collection of forms that holds over 85 thousand templates across various areas of interest.

- You can discover the latest and most pertinent version of the Settlement Agreement With Creditor by simply searching on the platform.

- Find, save, and download templates in your account or consult the description to confirm you have the correct one available.

- With an account at US Legal Forms, you can effortlessly obtain, store in one location, and browse the templates you save for quick access.

- When on the webpage, click the Log In button to authenticate.

- Next, navigate to the My documents page, where your list of documents is saved.

- Review the descriptions of the forms and download those you need at any point.

- If you are not a registered user, locating the desired sample will involve a few extra steps.

Form popularity

FAQ

When you're negotiating with a creditor, try to settle your debt for 50% or less, which is a realistic goal based on creditors' history with debt settlement. If you owe $3,000, shoot for a settlement of up to $1,500.

Your debt settlement proposal letter should contain the following:Your current financial situation.Debt settlement offer.Personal information.What you expect in return.Acceptance of the proposal.Acceptance of the proposal upon adjusting (negotiating) the amount to be paid.Rejection of the proposal.

The percentage of a debt typically accepted in a settlement is 30% to 80%. This percentage fluctuates due to several factors, including the debt holder's financial situation and cash on hand, the age of the debt, and the creditor in question.

The following terms and conditions should be included in a settlement.Original creditor and collection agent's company name.Date the letter was written.Your name.Your account number.Outstanding balance owed on the account (optional)Amount agreed to as settlement.More items...

Offer a specific dollar amount that is roughly 30% of your outstanding account balance. The lender will probably counter with a higher percentage or dollar amount. If anything above 50% is suggested, consider trying to settle with a different creditor or simply put the money in savings to help pay future monthly bills.