Limited Liability Company For Dummies

Description

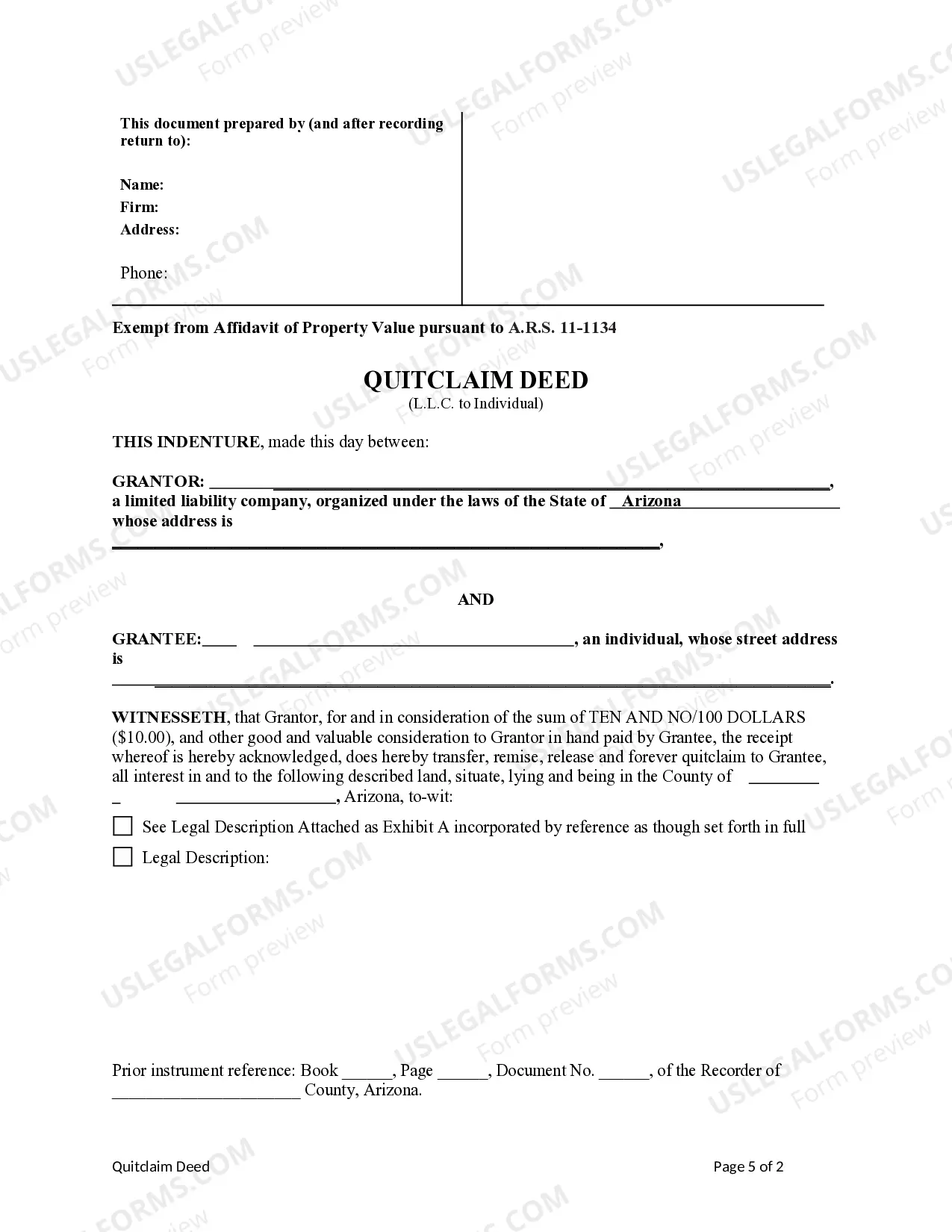

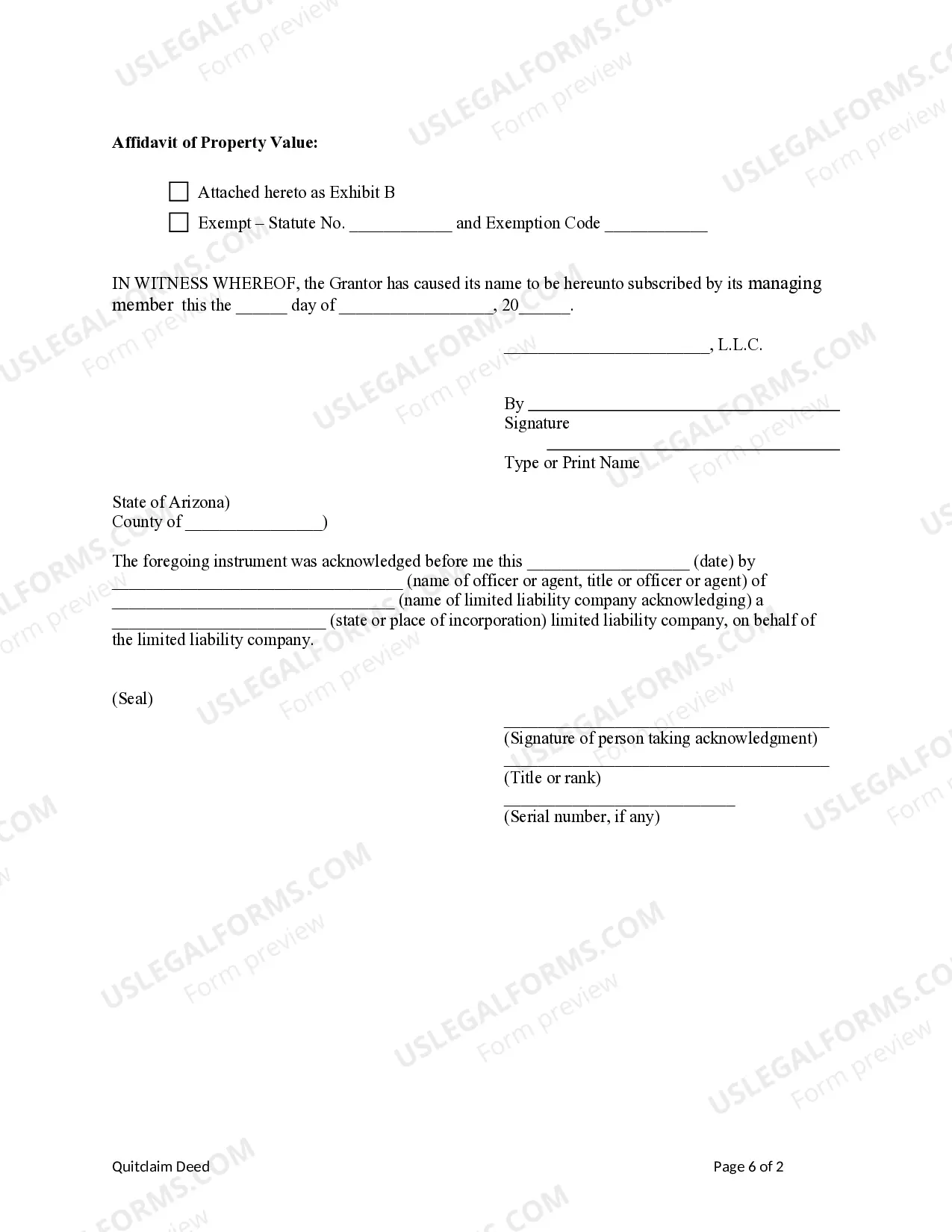

How to fill out Arizona Quitclaim Deed From A Limited Liability Company To An Individual?

- Sign in to your account on US Legal Forms or create a new account if it's your first time.

- Browse the extensive online library of over 85,000 legal forms. Use the Preview mode to check descriptions and ensure you select the right LLC form for your needs.

- If you need to adjust your search, use the Search tab to find another relevant template that meets your local jurisdiction's requirements.

- Select the LLC document you require and proceed by clicking the Buy Now button to choose your subscription plan.

- Complete the purchase by entering your payment information, including credit card details or using PayPal.

- Download your form and save it on your device. You can access it anytime from the My Forms section of your user profile.

In conclusion, using US Legal Forms can make the process of forming an LLC straightforward and efficient. Whether you're a novice or seasoned entrepreneur, their robust collection and expert assistance ensure your documents are accurate and compliant.

Start your LLC journey today with US Legal Forms and take the hassle out of legal documentation!

Form popularity

FAQ

Yes, you can file your limited liability company separately, especially if you choose to have the LLC taxed as a corporation. This means you will report your LLC's income, deductions, and credits separately from your personal finances. Using platforms like USLegalForms can help you navigate this process more effectively and ensure you’re following the correct filing procedures.

A single owner limited liability company typically files taxes as a sole proprietorship. This means you will report business income and expenses on your personal tax return using Schedule C. It’s important to keep accurate records and separate your personal finances from your LLC. Resources provided by USLegalForms can help you better understand your tax responsibilities.

The best way to file for a limited liability company is to follow your state's specific guidelines, ensuring you have all necessary documents ready. Consider taking advantage of online platforms, such as USLegalForms, which offer easy-to-use templates and resources tailored to your state. This can save you time and help you avoid errors in your application.

You can certainly file your limited liability company on your own, but the process can be complicated. Each state has unique rules and requirements that you must follow carefully. If you prefer a streamlined and guided approach, using platforms like USLegalForms can simplify your filing process significantly.

One significant disadvantage of a limited liability company is the complexity of compliance requirements. While they offer personal liability protection, LLCs still must adhere to various state regulations, including annual reports and fees. This could be daunting for those new to business structures. The USLegalForms platform can help simplify these requirements by providing essential documents and guidance.

Failing to file taxes for your limited liability company can lead to serious consequences. The IRS may impose penalties, which can accumulate rapidly if left unaddressed. Additionally, your LLC may lose its good standing, making it difficult to operate legally. It’s important to stay on top of your tax obligations, and USLegalForms can provide the information you need to avoid these issues.

Filing taxes for a limited liability company can be straightforward. LLCs typically have multiple tax options, allowing you to choose how you want to be taxed. You might choose to be taxed as a sole proprietor, partnership, or corporation. Using resources like the USLegalForms platform can help guide you through the specifics.

The correct way to write LLC is simply 'LLC' at the end of your business name, ensuring that you capitalize each letter. This abbreviation stands for Limited Liability Company, which signifies your business's legal structure. Taking care to write it correctly helps reinforce the nature of your organization as a limited liability company for dummies.

To write LLC correctly, make sure to always use uppercase letters—LLC—appearing at the end of your business name. It's important to follow the proper legal format to avoid confusion. This clarity is particularly crucial if you're sharing your business with others who may not be familiar with the concept of a limited liability company for dummies.

When you write 'LLC,' it should typically be presented without a preceding comma, such as 'Your Business Name LLC.' However, if you include the full name of the business, a comma may separate the name from the designation. For example, 'Your Business Name, LLC' is correct, making it easier to read and understand that it is a limited liability company for dummies.