Quitclaim Deed For Trust

Description

How to fill out Arizona Quitclaim Deed From An Individual To A Nonprofit Corporation?

- Log in to your US Legal Forms account. If you're a new user, create an account to access their services.

- Browse the library and search for 'quitclaim deed for trust'. Ensure the selected form meets your state’s requirements.

- Review the form description using the Preview mode to ensure it fits your needs perfectly.

- Purchase your document by clicking the Buy Now button, and choose a subscription plan that suits you.

- Complete the payment process, entering your credit card information or using PayPal.

- Download the quitclaim deed form for trust to your device. You can access it anytime from the My Forms section of your profile.

By utilizing US Legal Forms, individuals and attorneys can easily draft and execute legal documents with confidence. Their robust form collection and access to premium experts ensure that you’re making legally sound decisions.

Start your legal document journey today with US Legal Forms and experience the ease of having the right forms at your fingertips!

Form popularity

FAQ

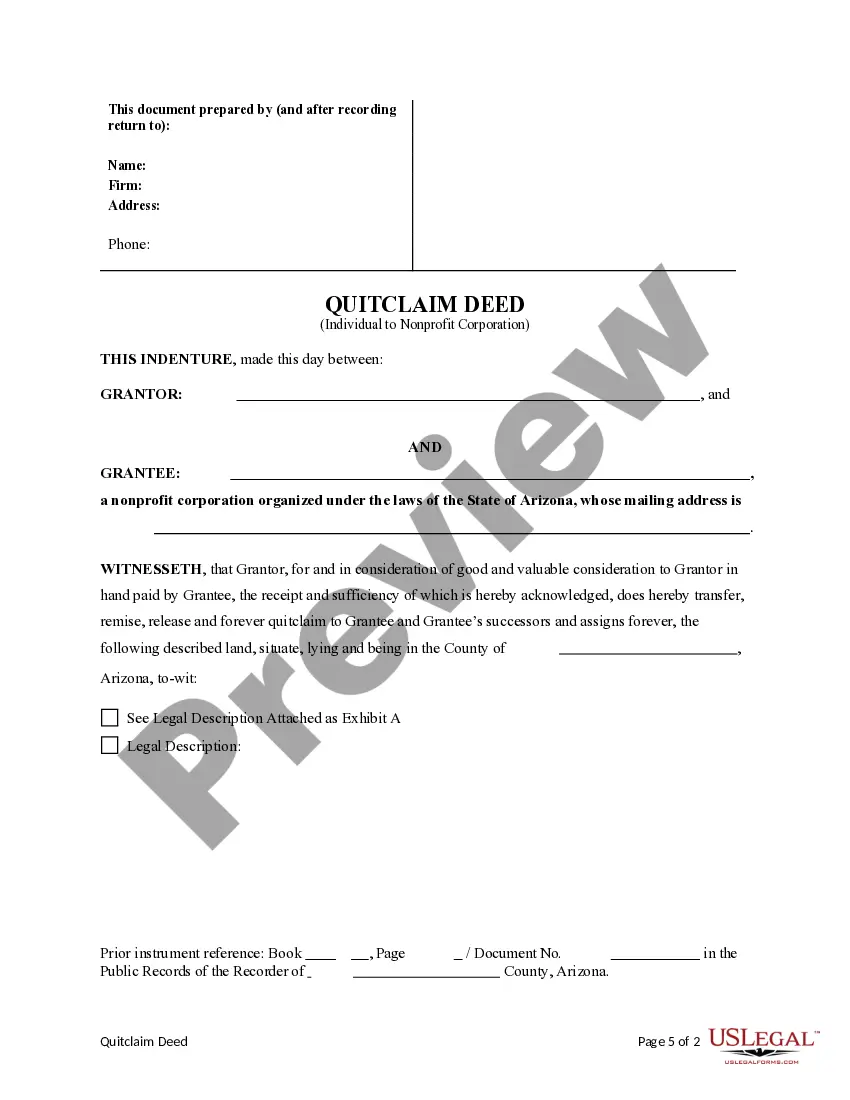

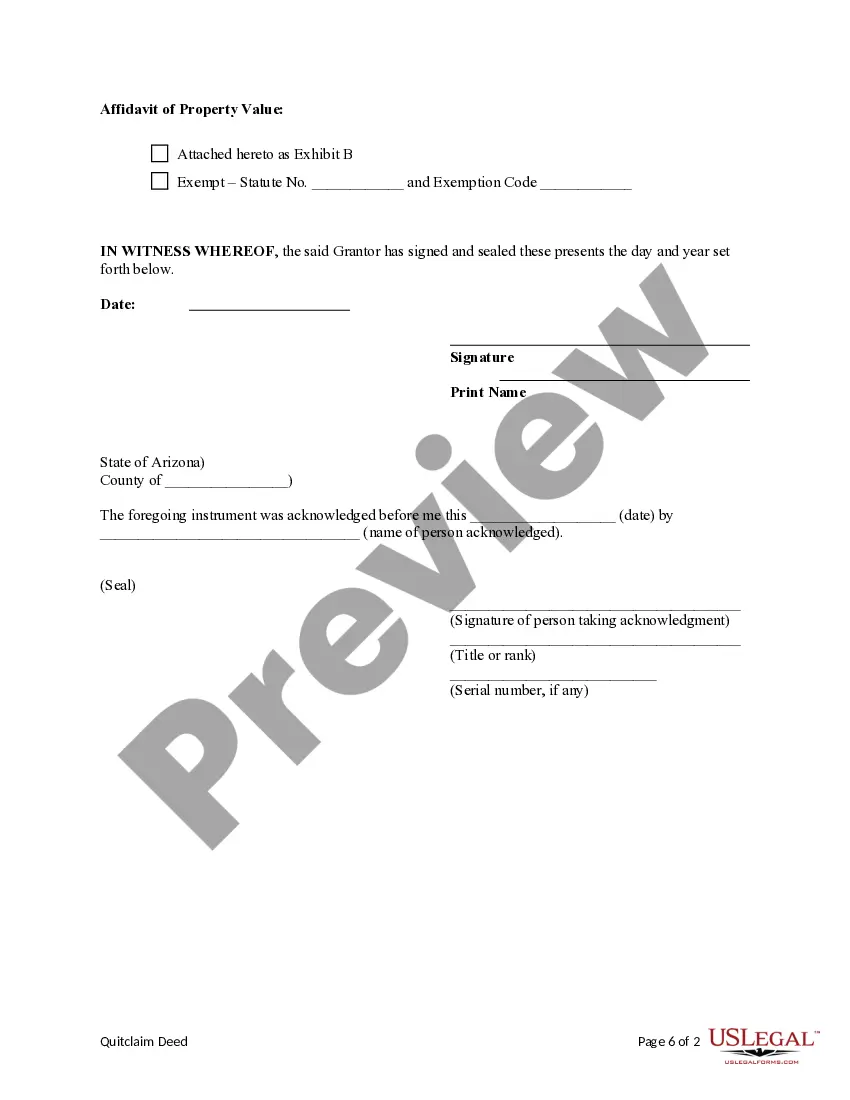

To properly fill out a quitclaim deed for trust, ensure you have all necessary information, including the full legal description of the property. Clearly indicate the grantor’s and grantee’s names, then sign and date the document with a notary present. After completing the form, submit it to the appropriate local authority for recording. Utilizing services like U.S. Legal Forms can help you navigate the paperwork with ease and accuracy.

To fill out a quitclaim deed form for trust, start by entering the names of the grantor and the grantee clearly. Next, specify the property location and details accurately to ensure clarity. You should then explain the intention to transfer ownership, followed by signing the document in the presence of a notary. Using U.S. Legal Forms can provide you with a reliable template that simplifies this process.

While putting your house in trust offers advantages, there are also some disadvantages to consider. You may face upfront costs for drafting the trust document, and managing the trust might require ongoing legal advice. Additionally, once you transfer the property using a quitclaim deed for trust, you may limit your own access to the property for personal use. It's crucial to weigh these factors when deciding the best way to manage your estate.

Choosing between gifting a house or placing it in a trust depends on your situation. A quitclaim deed for trust offers significant benefits, such as avoiding gift tax and keeping control over the property during your lifetime. When you place a home in a trust, you can manage how the property is used and distributed after your passing. This can preserve your wealth and ensure it aligns with your wishes.

The best way to leave a house to your child often involves using a quitclaim deed for trust. This method helps avoid probate, ensuring your child receives the property quickly and without complications. By placing your home in a trust, you provide clear instructions on asset distribution. This approach can also protect your child’s inheritance against legal issues.

A quitclaim deed in a trust allows one party to transfer their interest in property held within a trust. This transfer occurs without any warranties, meaning the recipient does not receive guarantees about the property’s title. Essentially, if you're looking to add or remove assets in a trust, using a quitclaim deed for trust can streamline that process while ensuring clarity in ownership among beneficiaries.

A quitclaim deed for trust carries some disadvantages. Firstly, it does not provide any guarantee regarding the ownership of the property. This means you could inherit hidden liens or claims that were unknown at the time. Additionally, once you transfer a property using a quitclaim deed, it can complicate future sales or financial transactions since buyers often prefer a warranty deed.

Yes, you can prepare a quit claim deed yourself using online resources or templates. However, ensure you include all necessary information to avoid future complications. If you feel uncertain, USLegalForms offers user-friendly templates and expert assistance, making it easier to create a valid quitclaim deed for trust that meets your needs.

To quit claim a deed to a trust, you must first prepare the quitclaim deed form, ensuring all parties’ names and property details are correct. Next, the current property owner must sign the deed, and then it should be recorded with the local government. This process can effectively place the property in the trust, simplifying future management and transfer. Consider using USLegalForms to access the necessary templates and guidance to complete this task accurately.

Quitclaim deeds can be viewed skeptically because they provide no warranty or guarantee about the property title. Consequently, this can lead to potential risks, such as undisclosed liens or ownership disputes. Despite these concerns, using a quitclaim deed for trust can be a viable option in certain situations, especially within family transfers where trust is high.