Life Estate Vs Beneficiary Deed

Description

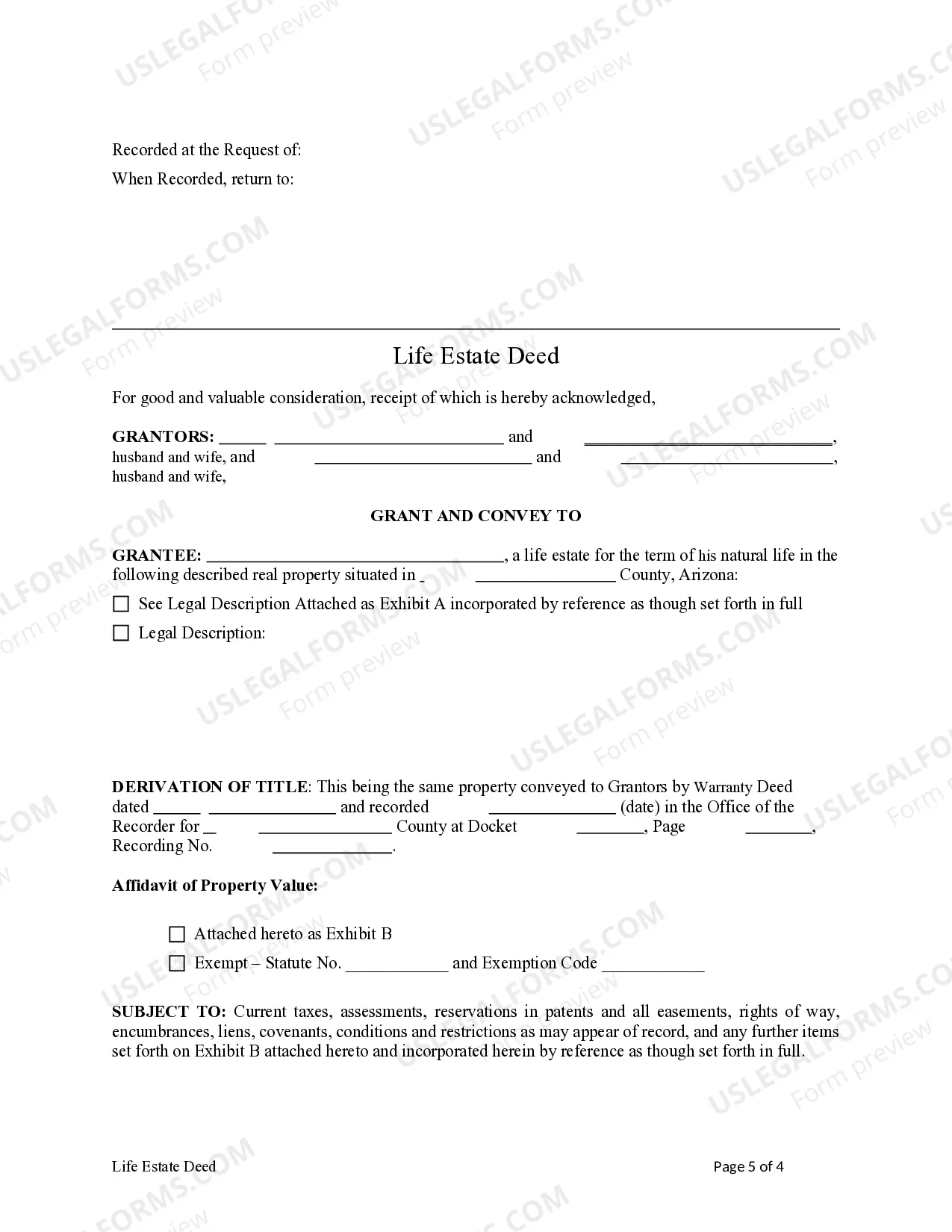

How to fill out Arizona Life Estate Deed From Two Married Couples To An Individual?

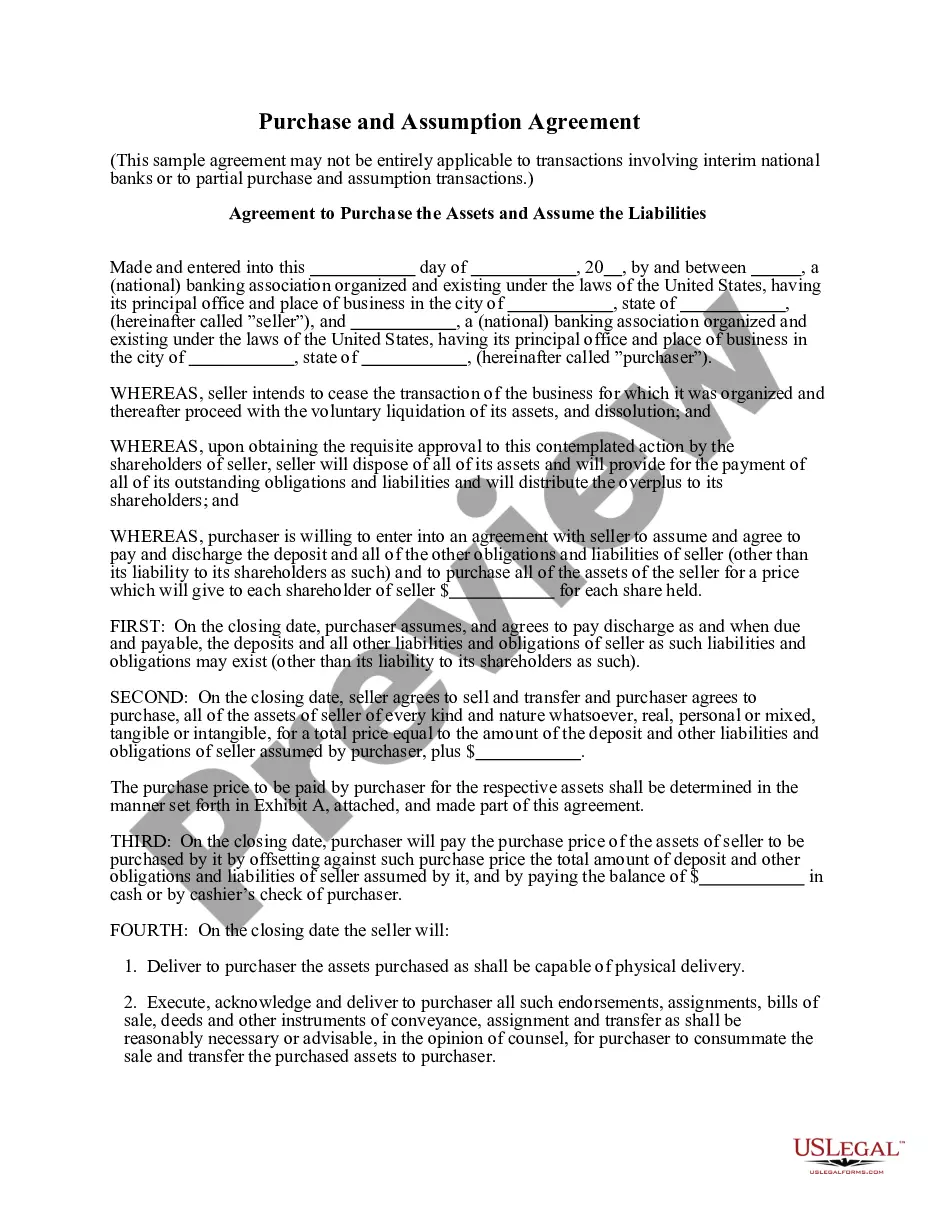

Obtaining legal templates that meet the federal and regional regulations is essential, and the internet offers a lot of options to pick from. But what’s the point in wasting time looking for the right Life Estate Vs Beneficiary Deed sample on the web if the US Legal Forms online library already has such templates collected in one place?

US Legal Forms is the biggest online legal catalog with over 85,000 fillable templates drafted by lawyers for any business and life scenario. They are simple to browse with all documents collected by state and purpose of use. Our experts stay up with legislative changes, so you can always be confident your paperwork is up to date and compliant when getting a Life Estate Vs Beneficiary Deed from our website.

Obtaining a Life Estate Vs Beneficiary Deed is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the right format. If you are new to our website, adhere to the steps below:

- Examine the template using the Preview feature or through the text description to make certain it meets your requirements.

- Browse for another sample using the search function at the top of the page if needed.

- Click Buy Now when you’ve located the correct form and opt for a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Pick the format for your Life Estate Vs Beneficiary Deed and download it.

All documents you find through US Legal Forms are reusable. To re-download and fill out earlier obtained forms, open the My Forms tab in your profile. Benefit from the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

A beneficiary deed is a type of deed that transfers property to a beneficiary. Most deeds transfer property in the present. In contrast, a beneficiary deed can be used to make arrangements today to pass down property in the future.

Cons To Using Beneficiary Deed Estate taxes. Property transferred may be taxed. No asset protection. The beneficiary receives the property without protection from creditors, divorces, and lawsuits. Medicaid eligibility. ... No automatic transfer. ... Incapacity not addressed. ... Problems with beneficiaries.

An additional potential problem with a Life Estate is that it does not offer creditor protection to the beneficiary, so if the heir has a debt or is sued, the creditor or court can come after the house. As you can see, a traditional Life Estate has the potential to create major conflict within a family.

The life tenant is the property owner for life and is responsible for costs such as property taxes, insurance, and maintenance. Additionally, the life tenant also retains any tax benefits of homeownership.

There is no simple way to reverse a life estate because a life estate deed is a legal transfer of the title of a property. This is legally binding and the transaction is complete when the life estate is executed. Essentially, in order to reverse a life estate both parties would need to agree to make it happen.