Is Transfer On Death The Same As Beneficiary

Description

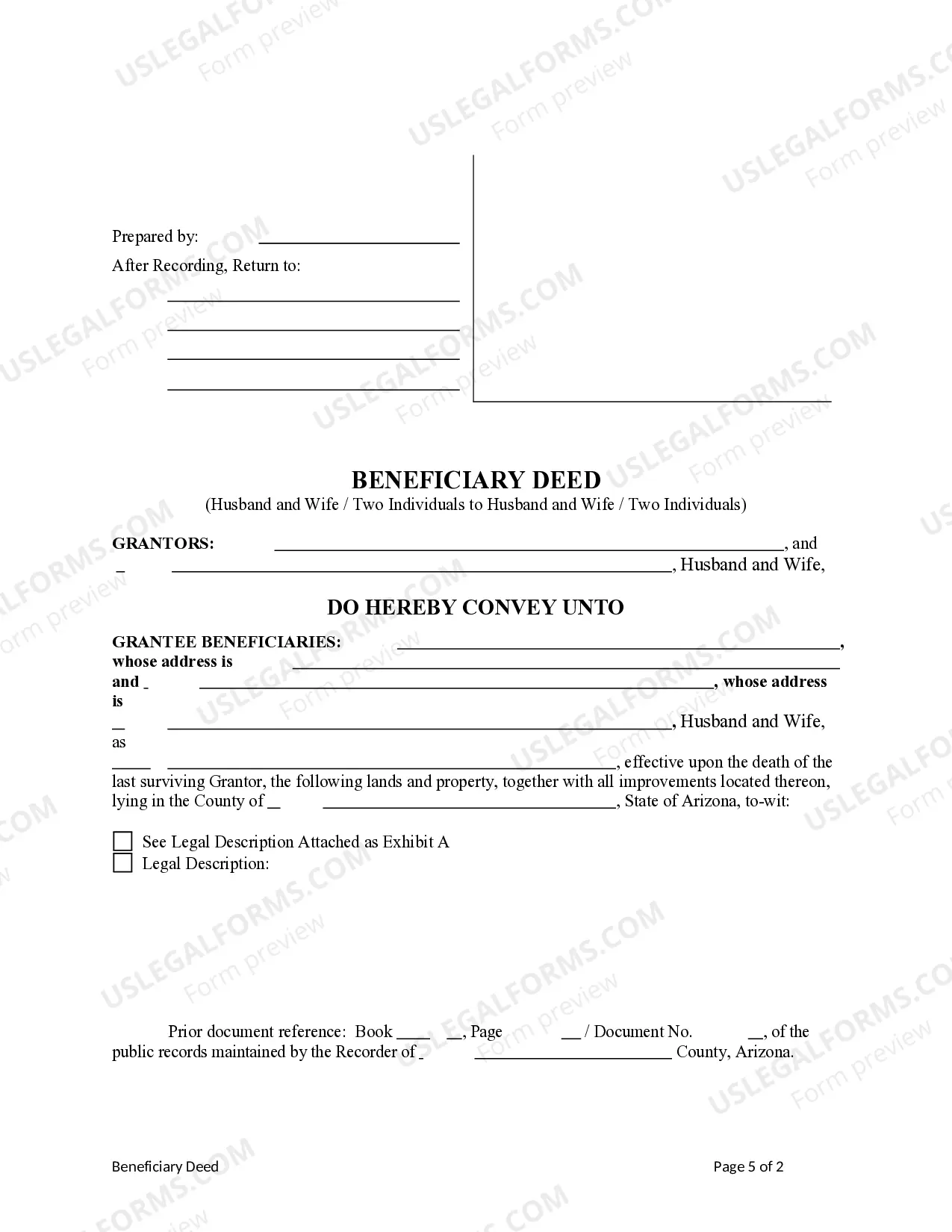

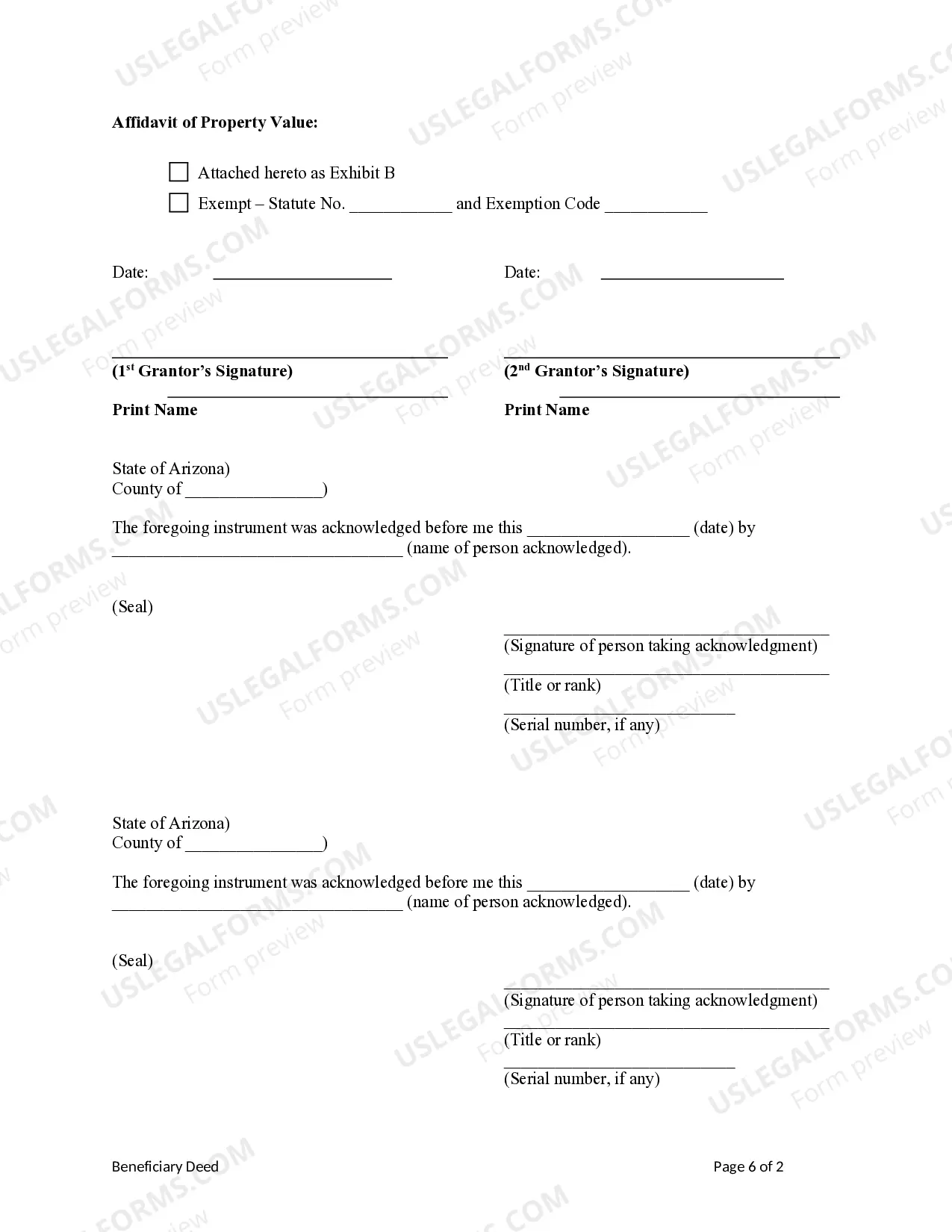

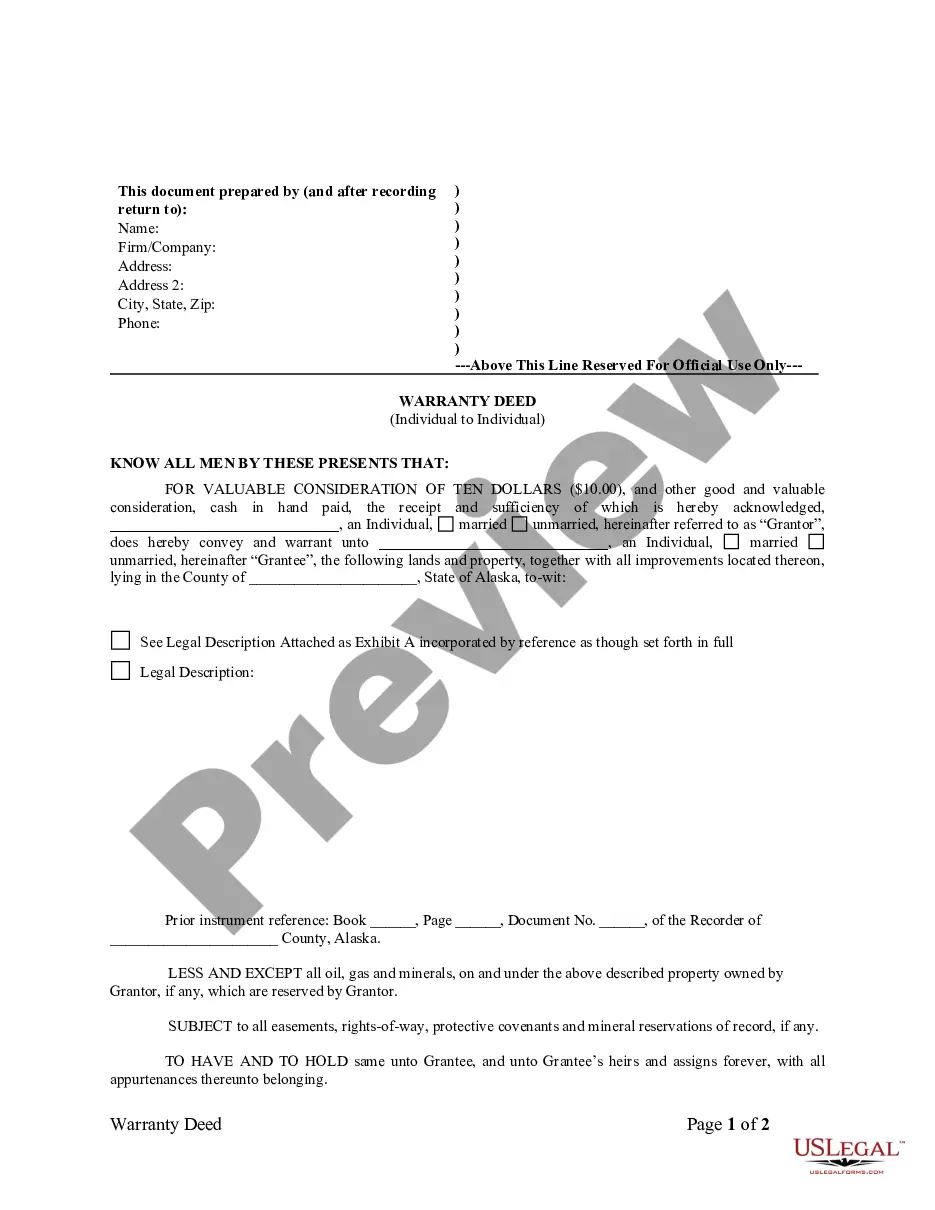

How to fill out Arizona Beneficiary Or Transfer Of Death (TOD) Deed - Husband And Wife / Two Individuals To Husband And Wife / Two Individuals?

- If you already have an account with US Legal Forms, log in and download your necessary form template by pressing the Download button, ensuring your subscription is up to date. If expired, renew via your payment plan.

- If you are new to the service, start by selecting the appropriate form by checking the Preview mode and description. Verify that it meets your needs and complies with local laws.

- Should you need a different template, use the Search feature at the top to locate the right document. Confirm its suitability before proceeding.

- Purchase your chosen document by clicking on the Buy Now button and selecting your desired subscription plan. You'll need to create an account to access the forms.

- Complete your purchase using credit card or PayPal, securing your subscription to access the library.

- After your purchase, download the form onto your device for easy access and completion later. You can find it anytime in the My Forms section of your profile.

US Legal Forms enables both individuals and attorneys to efficiently create legal documents through its vast library of over 85,000 fillable forms. This service stands out due to its extensive collection, which is more robust than many competitors.

With access to premium experts for assistance, you can ensure your documents are completed accurately and in compliance with all legal requirements. Don’t delay—visit US Legal Forms today to simplify your legal processes.

Form popularity

FAQ

The question, 'Is transfer on death the same as beneficiary?' highlights a common misunderstanding. While both mechanisms allow for the transfer of assets without probate, they differ in application. A transfer on death deed is typically used for real estate, while designated beneficiaries apply to financial accounts. Understanding these differences can guide you in choosing the right option for your situation.

A notable downside of a transfer on death deed is that it may not provide comprehensive coverage for your assets. Unlike a will, a TOD does not convey power over your entire estate or address debts, taxes, or other liabilities. Additionally, if you fail to attach a TOD to all applicable properties, those assets may still go through probate. For thoroughness, reviewing your estate with platforms like US Legal Forms can help clarify these aspects.

Whether a transfer on death is better than a designated beneficiary account often depends on your needs. A TOD allows for direct transfer of specific property, bypassing probate, while beneficiary designations work well for financial accounts. However, a TOD might not address all aspects of estate management, such as debts or tax implications. Therefore, aligning your choice with your overall estate plan is critical.

Payable on death (POD) accounts can simplify the transfer of assets, but they have disadvantages too. For example, they do not avoid creditors, meaning any outstanding debts can claim the funds. Additionally, POD accounts cannot be used to manage complex family dynamics, potentially leading to disputes among heirs. When weighing options, also consider the full scope of how each account impacts your estate.

One disadvantage of a transfer on death deed is that you may overlook other estate planning needs. While a TOD deed allows property to transfer outside probate, it does not address debts or taxes that may affect the estate. Additionally, if you don't update the deed after major life events, like a divorce, your wishes may not be honored. In this context, consider a comprehensive estate plan to cover all bases.

You do not necessarily need a lawyer for a transfer on death (TOD) deed. However, consulting with a legal expert can help ensure that you understand the implications and complete the process correctly. A lawyer can provide insight into your specific situation and help you avoid potential pitfalls. Ultimately, the decision depends on your comfort level and familiarity with legal documents.

Using a transfer on death can be a smart choice for many individuals looking to streamline asset transfer after death. It circumvents probate, saving time and costs for your heirs. However, consider your overall estate planning strategy before proceeding, as it might not be suitable for everyone. For assistance, consider using a platform like USLegalForms to create a comprehensive plan that meets your needs.

Transfer on death accounts, while beneficial, come with certain challenges. One issue is that they might not effectively manage all of your financial affairs after your death, potentially leading to conflicts among heirs. Furthermore, if the recipient faces financial issues, they could unknowingly put your asset at risk. A thorough understanding of these challenges is essential when considering a TOD.

Choosing between a transfer on death and a beneficiary designation often depends on the context of the asset. A TOD usually applies to real estate and allows direct transfer without probate, making it very effective. In contrast, a beneficiary designation is primarily used for accounts like life insurance and retirement benefits. Evaluate your assets and goals to make an informed decision.

Determining whether a transfer on death is better than a trust depends on your specific needs and circumstances. A TOD is generally easier to establish and maintain, as it requires less documentation and no trust management. However, a trust offers more comprehensive control over asset distribution, particularly for complex situations. Understanding your situation can help you decide which route is best.