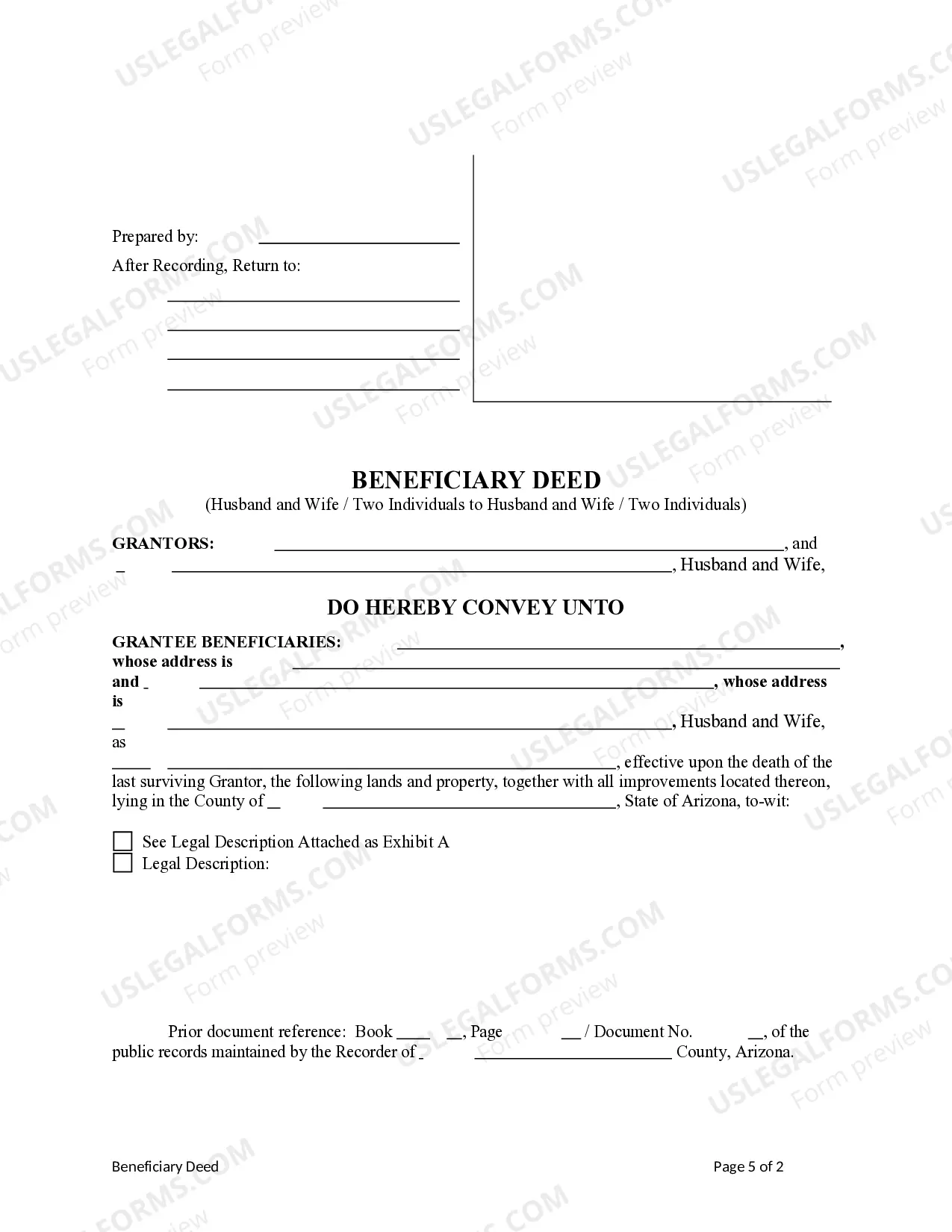

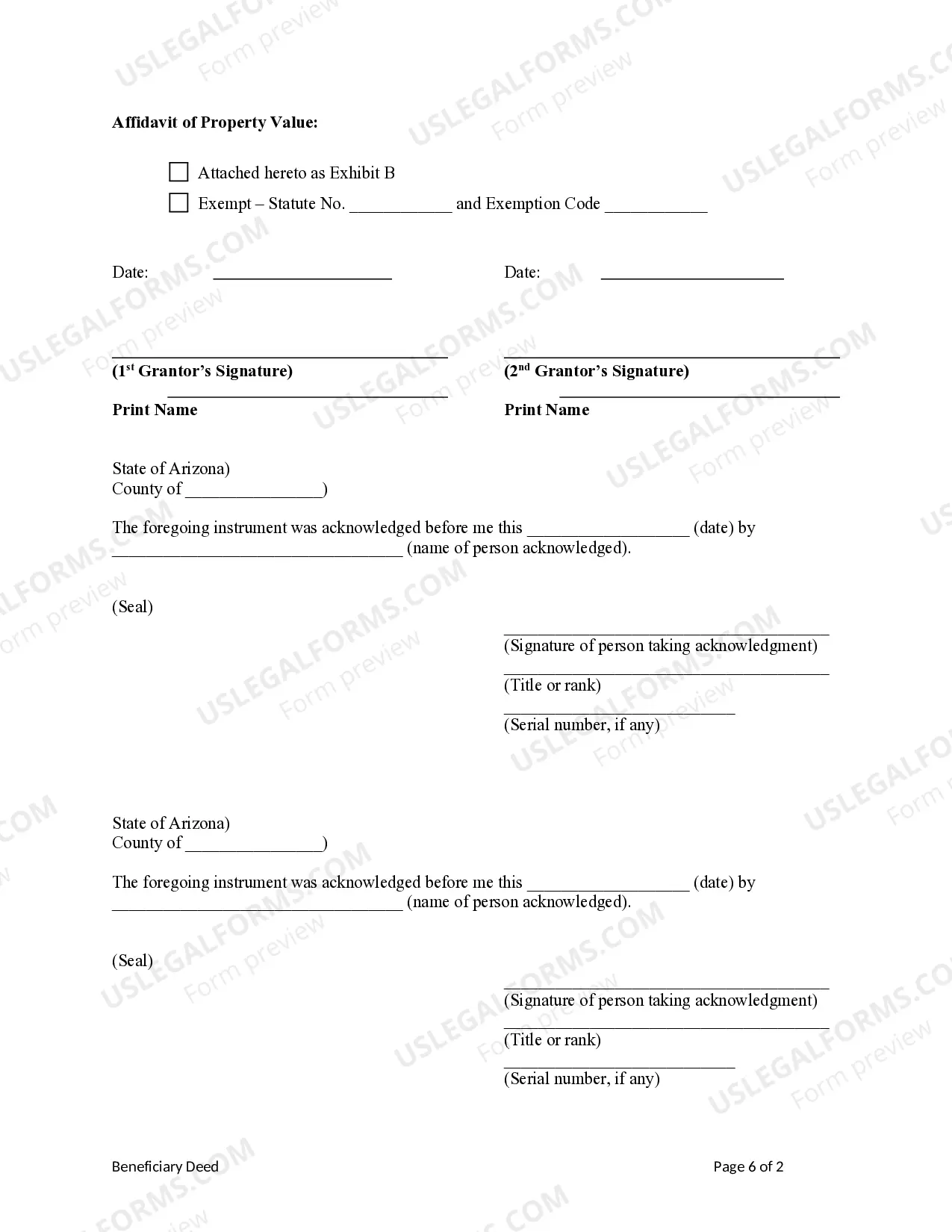

This form is a Transfer on Death Deed where the Grantors are husband and wife / two individuals and the Grantees are husband and wife / two individuals. This transfer is revocable by either Grantor until their death and effective only upon the death of the last surviving Grantor. This deed complies with all state statutory laws.

Goes Dies Survivorship For The Future

Description

How to fill out Arizona Beneficiary Or Transfer Of Death (TOD) Deed - Husband And Wife / Two Individuals To Husband And Wife / Two Individuals?

- Log in to your US Legal Forms account if you're a returning user. Ensure your subscription is active before proceeding. If your subscription is expired, renew it according to your plan.

- For first-time users, start by checking the preview mode and form description for the desired template that fits your legal requirements in your jurisdiction.

- If adjustments are needed, use the search feature to locate another appropriate template. Select one that suits your needs.

- Purchase the document by clicking on the 'Buy Now' button and selecting the subscription plan that works best for you. Make sure to create an account for access.

- Complete your transaction by entering your payment details via credit card or PayPal.

- Download the completed form to your device for easy access, which you can also find later in the 'My Forms' section of your account.

US Legal Forms empowers individuals and attorneys alike to swiftly execute legal documents through a robust collection of over 85,000 forms. This extensive library ensures that you have precisely what you need for your legal matters.

By choosing US Legal Forms, you're not only accessing an unparalleled resource but also gaining assistance from premium experts who can guide you through form completion. Take the stress out of legal documentation today and visit US Legal Forms for all your needs!

Form popularity

FAQ

In many cases, deeds do supersede wills, particularly in the context of property ownership. When you have a deed that designates right of survivorship, that property automatically passes to the surviving owner upon death. Understanding the relationship between deeds and wills is key in estate planning. Utilize uslegalforms to ensure your property is handled as you intend, safeguarding your and your heirs' future.

Yes, the right of survivorship generally supersedes a will when it comes to jointly owned property. This means that if one owner passes away, their share automatically transfers to the surviving owner, regardless of what the will states. It's crucial to understand this distinction, as it helps in planning your estate effectively. To ensure you make informed choices, uslegalforms provides valuable resources tailored to your needs.

To file a right of survivorship, you need to prepare and complete a deed that reflects this arrangement. You can typically do this through your local county recorder's office. It’s important to ensure that the deed clearly states the right of survivorship and lists all joint owners. For expert assistance, uslegalforms can guide you through the process, making it easier to secure your future.

To write a deed with a right of survivorship, include language that explicitly states this right. You might use a phrase like, 'This property is owned jointly with right of survivorship.' This ensures that upon the death of one owner, the property automatically transfers to the surviving owner, reinforcing the goes dies survivorship for the future principle. You can use tools and resources from USLegalForms to guide this process effectively.

A straightforward example of a survivorship clause is, 'Upon my death, all my shares in the business shall pass directly to my partner.' This type of clause clearly outlines the desired outcome, eliminating ambiguity. It emphasizes the concept of goes dies survivorship for the future, ensuring continuity in business ownership.

You would use a survivorship clause when you want to ensure smooth transfer of property without it going through probate. This is especially useful when co-owning real estate or bank accounts. It simplifies the process, providing clarity about ownership and intent, aligning with the principle of goes dies survivorship for the future.

A residuary clause specifies how any remaining assets should be distributed after specific bequests are fulfilled. For instance, a will might include, 'I leave my personal belongings and the rest of my estate to my children jointly.' This can ensure that even after specific gifts, the remainder is accounted for, reflecting a complete strategy for goes dies survivorship for the future.

A survivorship clause typically states that if one co-owner of a property passes away, the other co-owner automatically inherits the entire property. For example, in a will, you might see a clause like, 'If I die before my spouse, all my property goes to my spouse, and if my spouse dies first, then it goes to our children.' Understanding the goes dies survivorship for the future can clarify estate transitions.

Typically, the right of survivorship does not override the terms of a trust. A trust holds specific assets according to the specified directives, regardless of survivorship agreements. This distinction is crucial for estate planning, as individuals should consider the implications of Goes dies survivorship for the future when drafting trusts and wills to ensure their intentions are honored.

The survivorship clause in a will establishes how properties will be managed after the death of an owner. Its purpose is to clarify intentions about who should inherit specific assets, thereby reducing potential disputes among heirs. Understanding the Goes dies survivorship for the future can help individuals recognize the importance of such clauses in creating a clear estate plan.