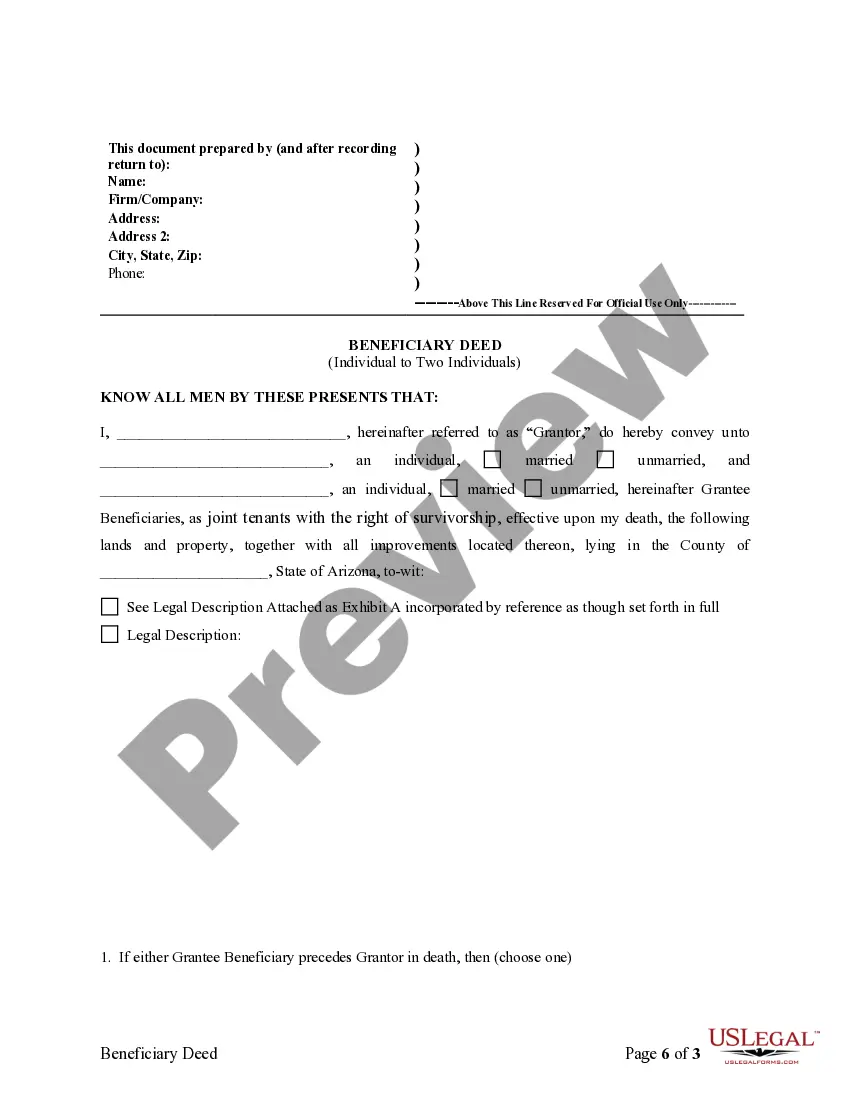

This form is a Transfer on Death Deed where the Grantor Owner is an individual and the Grantee Beneficiaries are two individuals. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. The Grantees take the property as tenants in common or joint tenants with the right of survivorship. This deed complies with all state statutory laws.

Az Transfer Death Deed With Mortgage Owed

Description

How to fill out Arizona Transfer On Death Deed Or TOD - Beneficiary Deed - Individual To Two Individuals?

Legal document managing can be frustrating, even for knowledgeable experts. When you are searching for a Az Transfer Death Deed With Mortgage Owed and do not have the time to devote in search of the right and up-to-date version, the operations may be stress filled. A strong web form library might be a gamechanger for anyone who wants to deal with these situations successfully. US Legal Forms is a industry leader in online legal forms, with over 85,000 state-specific legal forms accessible to you anytime.

With US Legal Forms, you can:

- Access state- or county-specific legal and business forms. US Legal Forms covers any demands you could have, from personal to enterprise papers, all in one spot.

- Use innovative resources to accomplish and manage your Az Transfer Death Deed With Mortgage Owed

- Access a resource base of articles, instructions and handbooks and resources related to your situation and requirements

Help save time and effort in search of the papers you will need, and use US Legal Forms’ advanced search and Preview feature to get Az Transfer Death Deed With Mortgage Owed and acquire it. In case you have a subscription, log in in your US Legal Forms profile, search for the form, and acquire it. Take a look at My Forms tab to find out the papers you previously downloaded as well as to manage your folders as you can see fit.

Should it be your first time with US Legal Forms, register a free account and acquire unrestricted usage of all advantages of the library. Here are the steps to take after accessing the form you need:

- Validate this is the right form by previewing it and reading its description.

- Ensure that the sample is approved in your state or county.

- Choose Buy Now when you are all set.

- Select a subscription plan.

- Pick the file format you need, and Download, complete, eSign, print and send out your papers.

Benefit from the US Legal Forms web library, supported with 25 years of expertise and trustworthiness. Transform your day-to-day papers management in a smooth and user-friendly process today.

Form popularity

FAQ

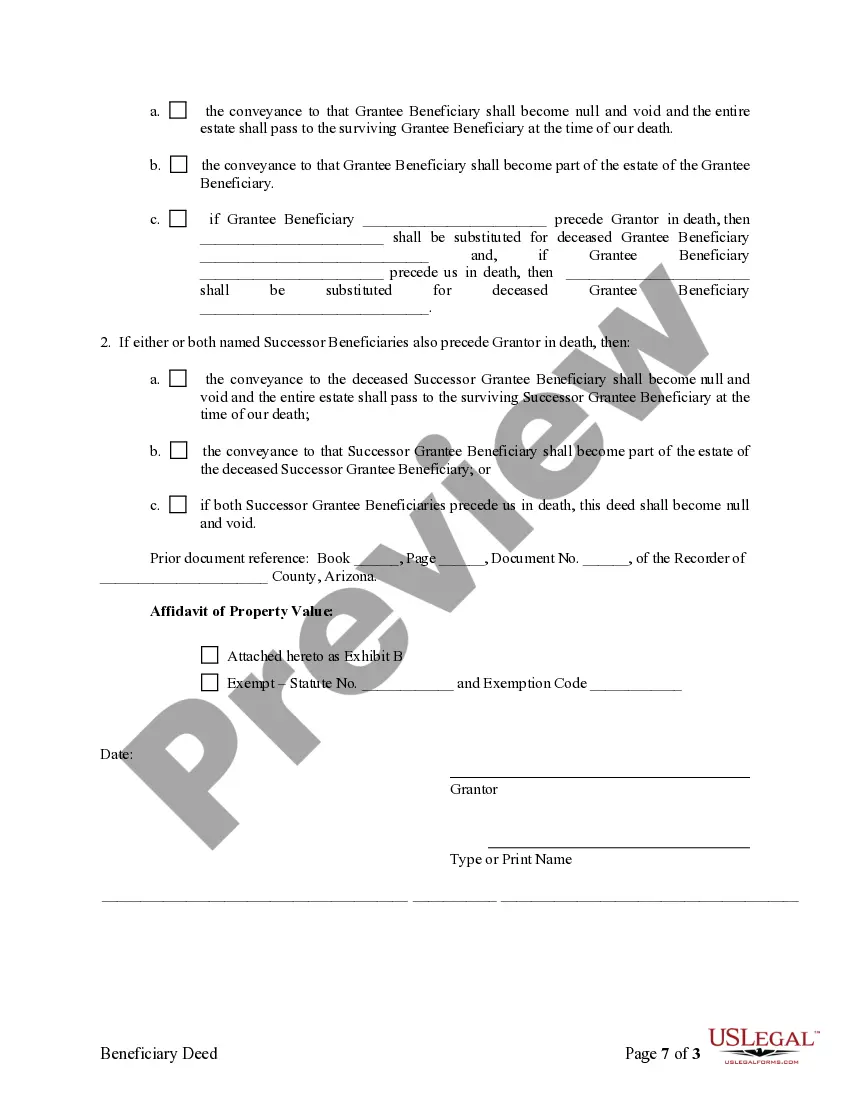

An Arizona beneficiary deed, referred to as a transfer on death deed in other states, is a legal document used to transfer real property to descendants outside of probate proceedings. For this deed to be valid in Arizona, it must be signed before a notary and recorded with the respective county recorder's office.

To get title to the property after your death, the beneficiary must record a certified copy of the death certificate in the recorder's office. No probate is necessary. Use Nolo's Quicken WillMaker to make a beneficiary deed or transfer on death deed in any state that allows it.

Invalidation and Probate The transfer on the death deed is rendered ineffective if the designated recipient passes away before the property owner. This could cause the property to enter probate without adequate planning or execution, negating the goal of using a transfer on the death deed to avoid probate.

You must sign the deed and get your signature notarized, and then record (file) the deed with the recorder's office before your death. Otherwise, it won't be valid.

An Arizona Beneficiary Deed is much simpler than creating and administering a trust. In addition, the owner retains complete control over the property with an Arizona Beneficiary Deed. No gift tax liability. Since an Arizona Beneficiary Deed does not transfer property as a ?gift,? it is not subject to gift taxes.