Az Deed Beneficiary Without Social Security Number

Description

How to fill out Arizona Transfer On Death Deed Or TOD - Beneficiary Deed - Individual To Two Individuals?

Accessing legal document examples that adhere to federal and state regulations is essential, and the internet provides numerous choices.

However, what's the benefit of spending time looking for the suitable Az Deed Beneficiary Without Social Security Number template online when the US Legal Forms digital library already has such documents gathered in one spot.

US Legal Forms is the largest online legal repository with over 85,000 editable templates crafted by attorneys for any business and personal situation. They are easy to navigate with all documents organized by state and intended use. Our specialists stay updated with legislative modifications, ensuring that your documents are always current and compliant when obtaining an Az Deed Beneficiary Without Social Security Number from our site.

All templates you discover through US Legal Forms are reusable. To re-download and complete previously acquired forms, navigate to the My documents section in your profile. Take full advantage of the most comprehensive and user-friendly legal documentation service!

- Acquiring an Az Deed Beneficiary Without Social Security Number is quick and easy for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document sample you need in the desired format.

- If you are unfamiliar with our website, follow the steps below.

- Review the template using the Preview feature or via the text outline to ensure it satisfies your needs.

- Search for another sample using the search tool at the top of the page if needed.

- Click Buy Now when you've located the correct form and choose a subscription plan.

- Create an account or Log In and process a payment with PayPal or a credit card.

- Select the format for your Az Deed Beneficiary Without Social Security Number and download it.

Form popularity

FAQ

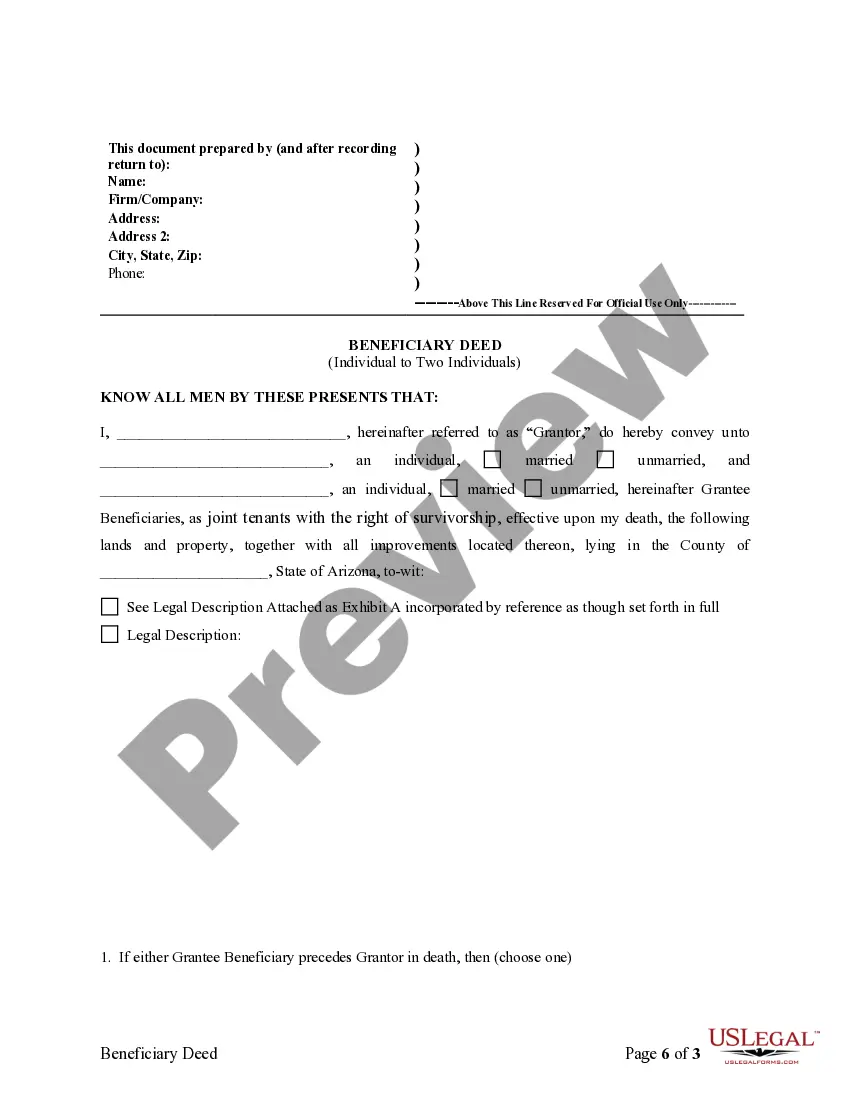

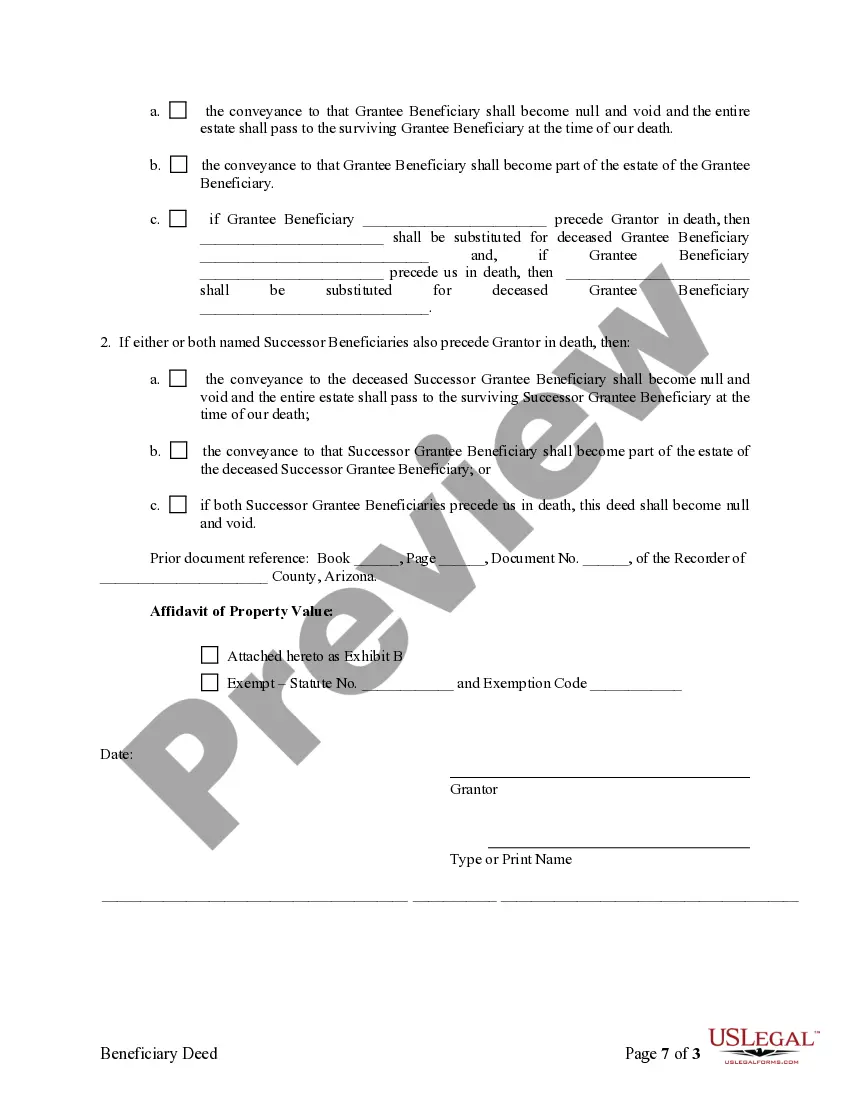

What do I need to do to ensure the beneficiary deed is valid? A beneficiary deed has to be signed by the property owner and notarized, recorded in the county where the property is located during the owner's lifetime, and must accurately state the property's legal description.

At your death, ownership passes automatically to the beneficiary named in the deed. Any mortgage or debt attached to the land goes along with it. To retitle the real estate in the new owner's name, the new owner should record a sworn statement (affidavit) and a copy of the death certificate.

To establish a beneficiary deed in Arizona, the deed must: Grant the real estate property to a beneficiary designated by the owner of said property. Be recorded in the office of the county where the property is located. Be recorded in the county office before the property owner's death.

Avoiding probate: Property passed to another individual through a beneficiary deed skips the probate process and passes directly to the beneficiary. Probate can be a costly and time-consuming legal process. Stay in control: With a beneficiary deed, you continue to control your property until you die.

4. After an Arizona Beneficiary Deed is signed and recorded, the owners may sell, encumber or otherwise deal with their property without any restrictions or limitations. 5. Signing and recording an Arizona Beneficiary Deed has no gift tax liability because it is not a present transfer of property.