Az Deed Beneficiary Withdrawal

Description

How to fill out Arizona Transfer On Death Deed Or TOD - Beneficiary Deed - Individual To Two Individuals?

Legal documents handling can be daunting, even for seasoned professionals.

When you are looking for an Az Deed Beneficiary Withdrawal and lack the time to dedicate to finding the correct and updated version, the process can be overwhelming.

Access state- or county-specific legal and business forms.

US Legal Forms meets any needs you may have, from personal to business documents, all in one place.

If this is your first time with US Legal Forms, create an account and enjoy unlimited access to all the benefits of the library. Here are the steps to follow after accessing the form you need: Confirm it is the right form by previewing it and reviewing its details. Ensure that the template is recognized in your state or county. Click Buy Now when you are ready. Select a subscription plan. Choose the format you need, and Download, fill out, eSign, print, and send your documents. Take advantage of the US Legal Forms online catalog, backed by 25 years of experience and reliability. Streamline your daily document management into a smooth and user-friendly process today.

- Utilize advanced tools to complete and manage your Az Deed Beneficiary Withdrawal.

- Access a resource library of articles, tutorials, and guides related to your situation and needs.

- Save time and effort searching for the documents you require, and use US Legal Forms' sophisticated search and Preview feature to find Az Deed Beneficiary Withdrawal and download it.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to see the documents you have previously downloaded and manage your folders as desired.

- A robust online form repository can be a game changer for anyone aiming to manage these matters efficiently.

- US Legal Forms is a leader in online legal documents, offering over 85,000 state-specific legal forms available at any time.

- With US Legal Forms, you can.

Form popularity

FAQ

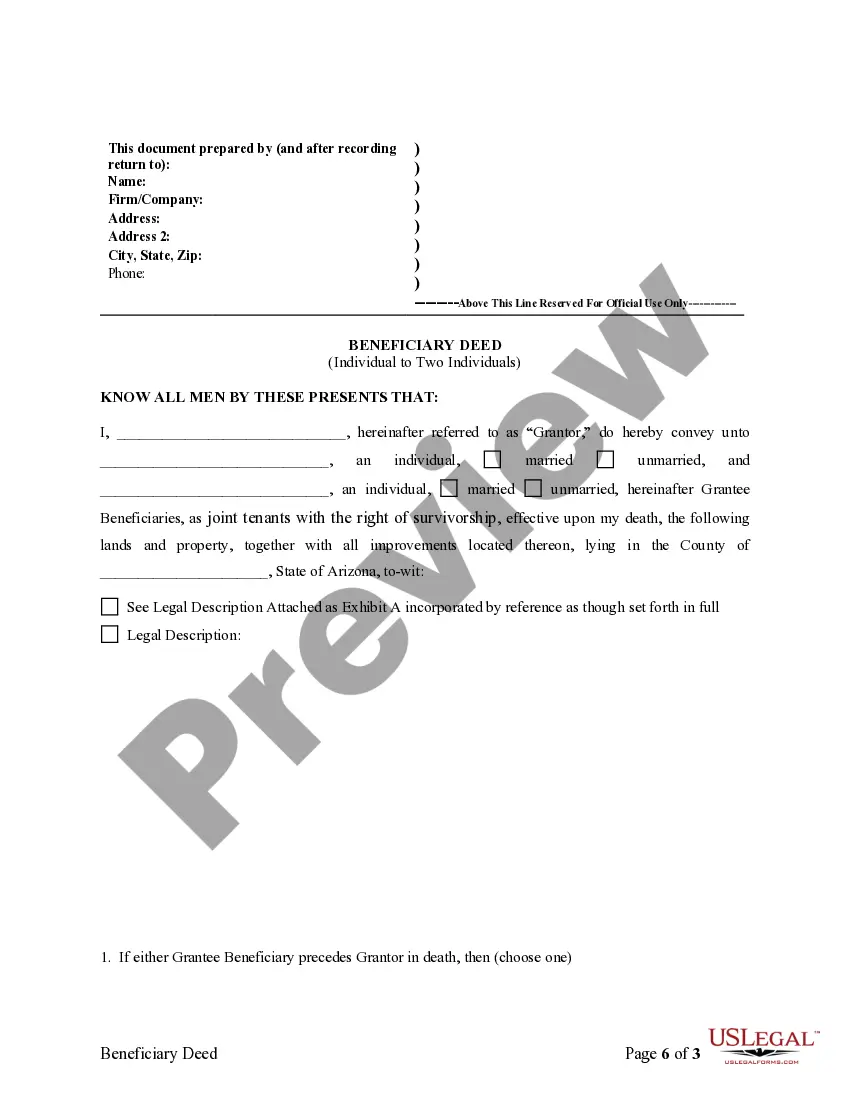

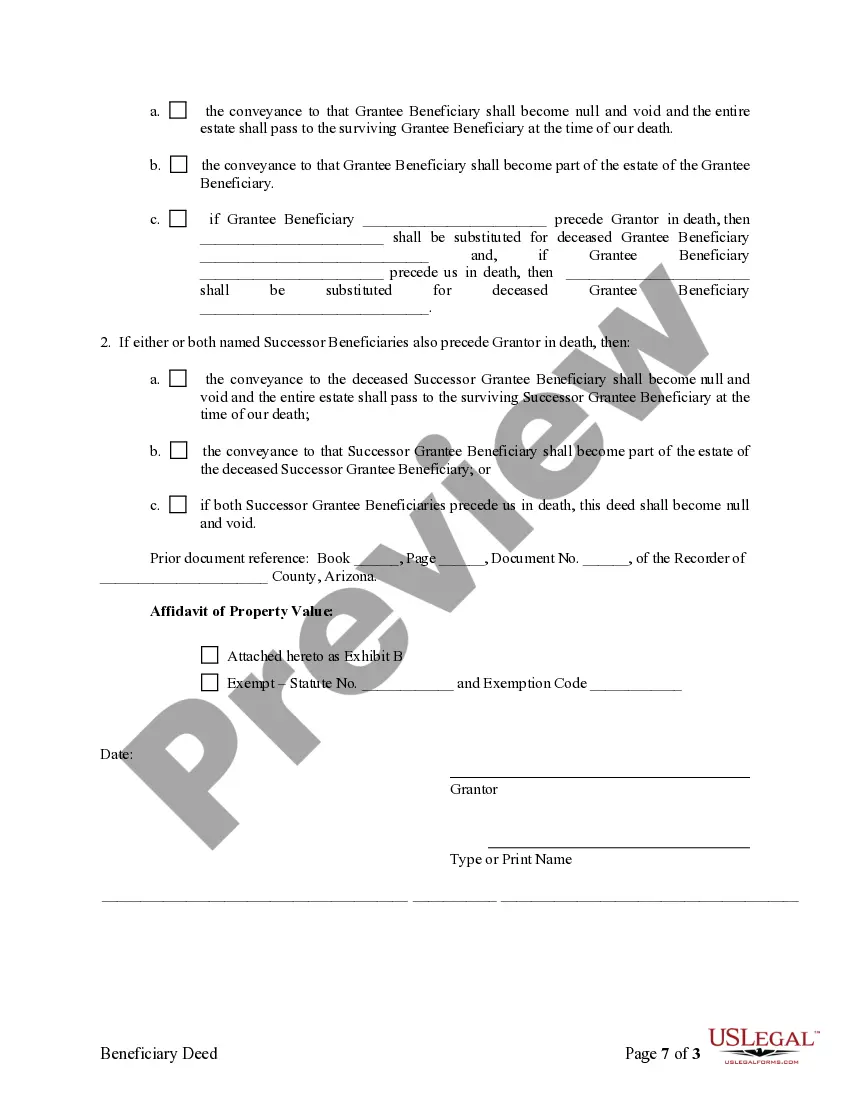

Once you create a beneficiary deed, it needs to be recorded with the county recorder in the county where the property is located.

You must sign the deed and get your signature notarized, and then record (file) the deed with the recorder's office before your death. Otherwise, it won't be valid. You can make an Arizona beneficiary deed with WillMaker.

The owner or owners must sign the deed in front of a notary and file the completed form with the land records for the county where the property is situated. After the owner's death, the remaining interest in land transfers to the beneficiary outside of the probate process.

An Arizona Beneficiary Deed is much simpler than creating and administering a trust. In addition, the owner retains complete control over the property with an Arizona Beneficiary Deed. No gift tax liability. Since an Arizona Beneficiary Deed does not transfer property as a ?gift,? it is not subject to gift taxes.

If you wish to remove someone from a deed, you will need their consent. This can be done by recording a new deed, which will require their signature. If the person in question is deceased, you will need their death certificate and a notarized affidavit along with the new deed.