Transfer Death Download For Mac

Description

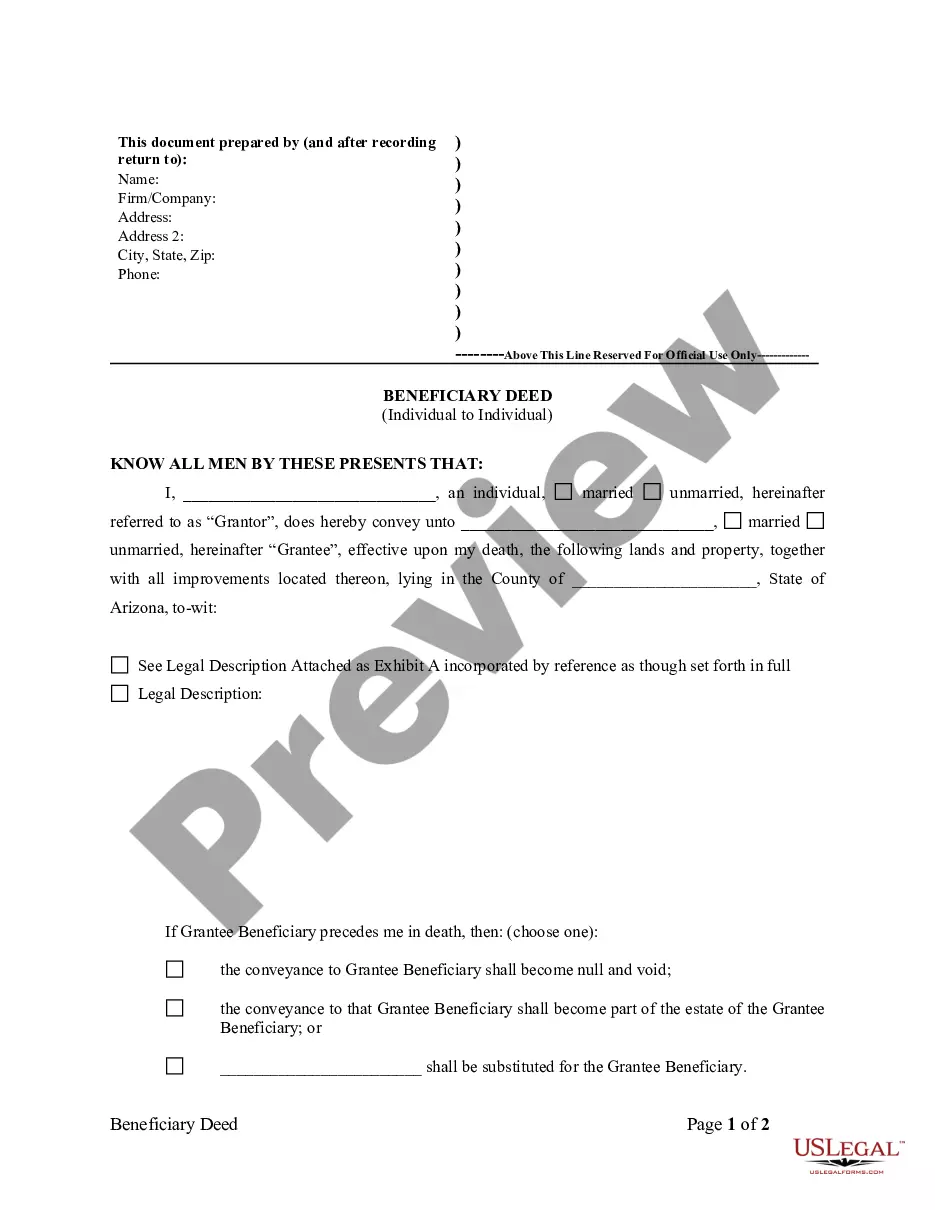

How to fill out Arizona Beneficiary Deed For Individual To Individual?

Legal papers management may be overpowering, even for knowledgeable experts. When you are interested in a Transfer Death Download For Mac and do not have the a chance to devote in search of the correct and updated version, the procedures may be stress filled. A strong online form library can be a gamechanger for everyone who wants to deal with these situations effectively. US Legal Forms is a market leader in online legal forms, with over 85,000 state-specific legal forms available at any moment.

With US Legal Forms, you may:

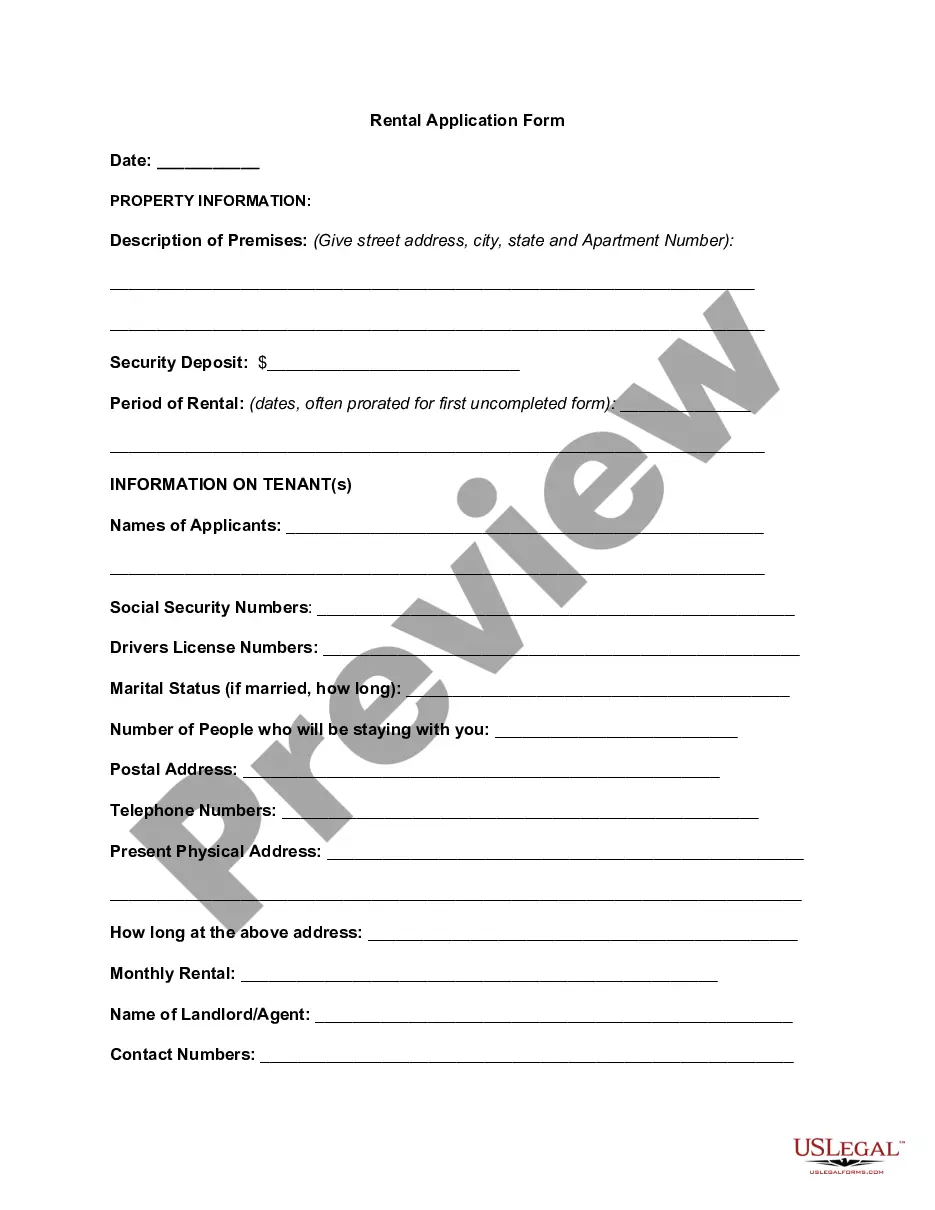

- Access state- or county-specific legal and organization forms. US Legal Forms handles any requirements you might have, from personal to enterprise documents, in one location.

- Employ innovative tools to complete and manage your Transfer Death Download For Mac

- Access a resource base of articles, tutorials and handbooks and resources connected to your situation and needs

Help save effort and time in search of the documents you will need, and utilize US Legal Forms’ advanced search and Preview tool to get Transfer Death Download For Mac and get it. In case you have a monthly subscription, log in to your US Legal Forms account, search for the form, and get it. Review your My Forms tab to find out the documents you previously saved and also to manage your folders as you see fit.

Should it be your first time with US Legal Forms, register a free account and acquire limitless usage of all benefits of the platform. Here are the steps to consider after getting the form you need:

- Validate it is the correct form by previewing it and reading its information.

- Ensure that the sample is accepted in your state or county.

- Select Buy Now when you are ready.

- Select a monthly subscription plan.

- Pick the file format you need, and Download, complete, eSign, print out and send your papers.

Benefit from the US Legal Forms online library, backed with 25 years of experience and stability. Enhance your daily papers administration in a smooth and intuitive process today.

Form popularity

FAQ

A transfer on death (TOD) bank account is a popular estate planning tool designed to avoid probate court by naming a beneficiary. However, it doesn't avoid taxes.

A beneficiary form states who will directly inherit the asset at your death. Under a TOD arrangement, you keep full control of the asset during your lifetime and pay taxes on any income the asset generates as you own it outright. TOD arrangements require minimal paperwork to establish.

Invalidation and Probate The transfer on the death deed is rendered ineffective if the designated recipient passes away before the property owner. This could cause the property to enter probate without adequate planning or execution, negating the goal of using a transfer on the death deed to avoid probate.

How to Minimize Capital Gains Tax on Inherited Property Sell the inherited property quickly. ... Make the inherited property your primary residence. ... Rent the inherited property. ... Qualify for a partial exclusion. ... Disclaim the inherited property. ... Deduct Selling Expenses from Capital Gains.

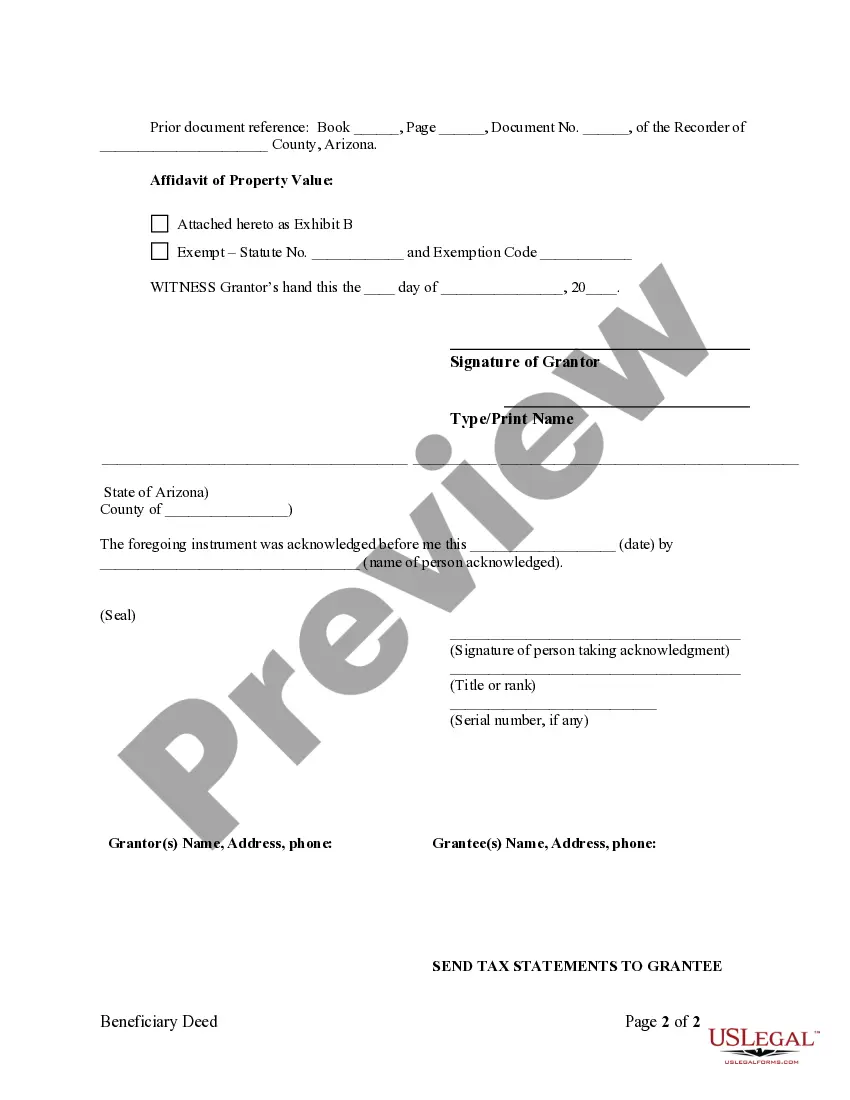

And while the process may vary slightly from state to state, there are some general, basic steps to follow. Get Your State-Specific Deed Form. Look up the requirements for the state the property is in. ... Decide on Your Beneficiary. ... Include a Description of the Property. ... Sign the New Deed. ... Record the Deed.