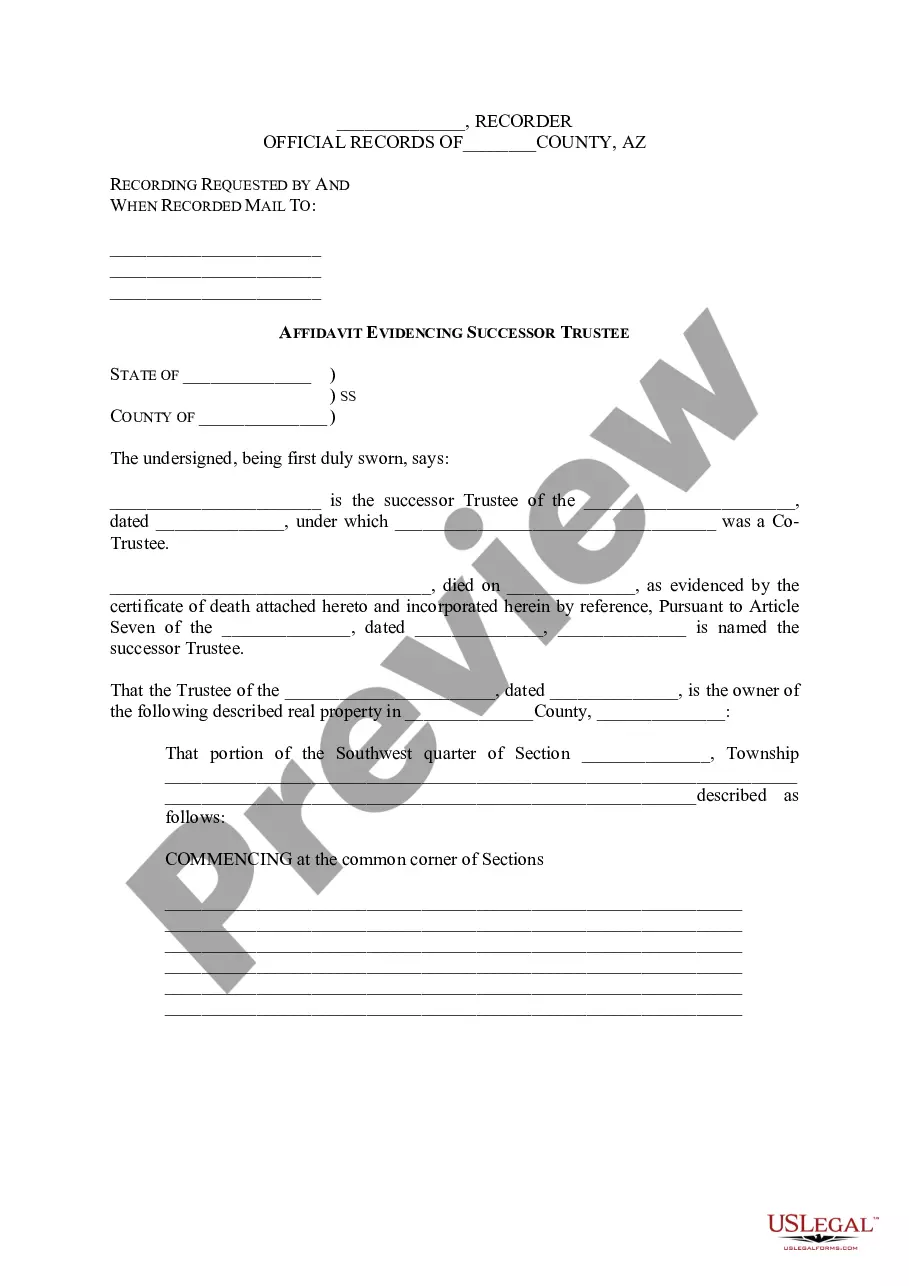

Affidavit Successor Trustee Form Withholding

Description

How to fill out Arizona Affidavit Evidencing Successor Trustee?

How to acquire professional legal documents that are in accordance with your state statutes and complete the Affidavit Successor Trustee Form Withholding without consulting a lawyer.

Numerous online services offer templates to cover various legal matters and requirements. However, it may require time to identify which of the accessible samples meet both your intended use and legal standards.

US Legal Forms is a trusted service that assists you in finding official documents crafted in line with the most recent updates of state laws and saving expenses on legal help.

If you lack an account with US Legal Forms, please follow these instructions: Review the webpage you've accessed and confirm if the form meets your requirements. To verify, utilize the form description and preview options if available. Search for another template in the header showing your state if necessary. Click the Buy Now button when you locate the suitable document. Select the most appropriate pricing plan, then Log In or register for an account. Choose the payment method (credit card or PayPal). Alter the file format for your Affidavit Successor Trustee Form Withholding and click Download. The obtained templates are yours: you can always revisit them in the My documents section of your profile. Join our library and create legal documents independently like a seasoned legal professional!

- US Legal Forms is not an ordinary online library.

- It is a collection of more than 85,000 validated templates for numerous business and personal situations.

- All documents are categorized by area and state to enhance your search experience, making it quicker and more straightforward.

- It also works with advanced tools for PDF editing and eSigning, enabling users with a Premium subscription to swiftly complete their documents online.

- It requires minimal effort and time to acquire the necessary documentation.

- If you already possess an account, Log In and verify if your subscription remains active.

- Download the Affidavit Successor Trustee Form Withholding using the corresponding button next to the file name.

Form popularity

FAQ

HOW DO I RECORD AN AFFIDAVIT? Take a certified copy of the death certificate of the deceased joint tenant and your affidavit to the recorder's office in the county where the real property is located. The recorder's office also requires a Preliminary Change of Ownership Report (PCOR) when filing the affidavit.

If title to an interest in real property is affected by a change of trustee, the successor trustee may execute and record in the county in which the property is located an affidavit of change of trustee.

The Trustee should include the following information in the notification package:The name of the Grantor and the date that the trust instrument execution date.Contact information for each Trustee, including name, address, county of residence, and phone number.Certified copy of the death certificate of the Grantor.More items...

It's perfectly legal to name a beneficiary of the trust (someone who will receive trust property after your death) as successor trustee. In fact, it's common. EXAMPLE: Mildred names her only child, Allison, as both sole beneficiary of her living trust and successor trustee of the living trust.

The successor trustee will take over assets in the trust in the event of your death, and he or she is responsible to ensure that your property is distributed to your beneficiaries according to the terms of the trust.