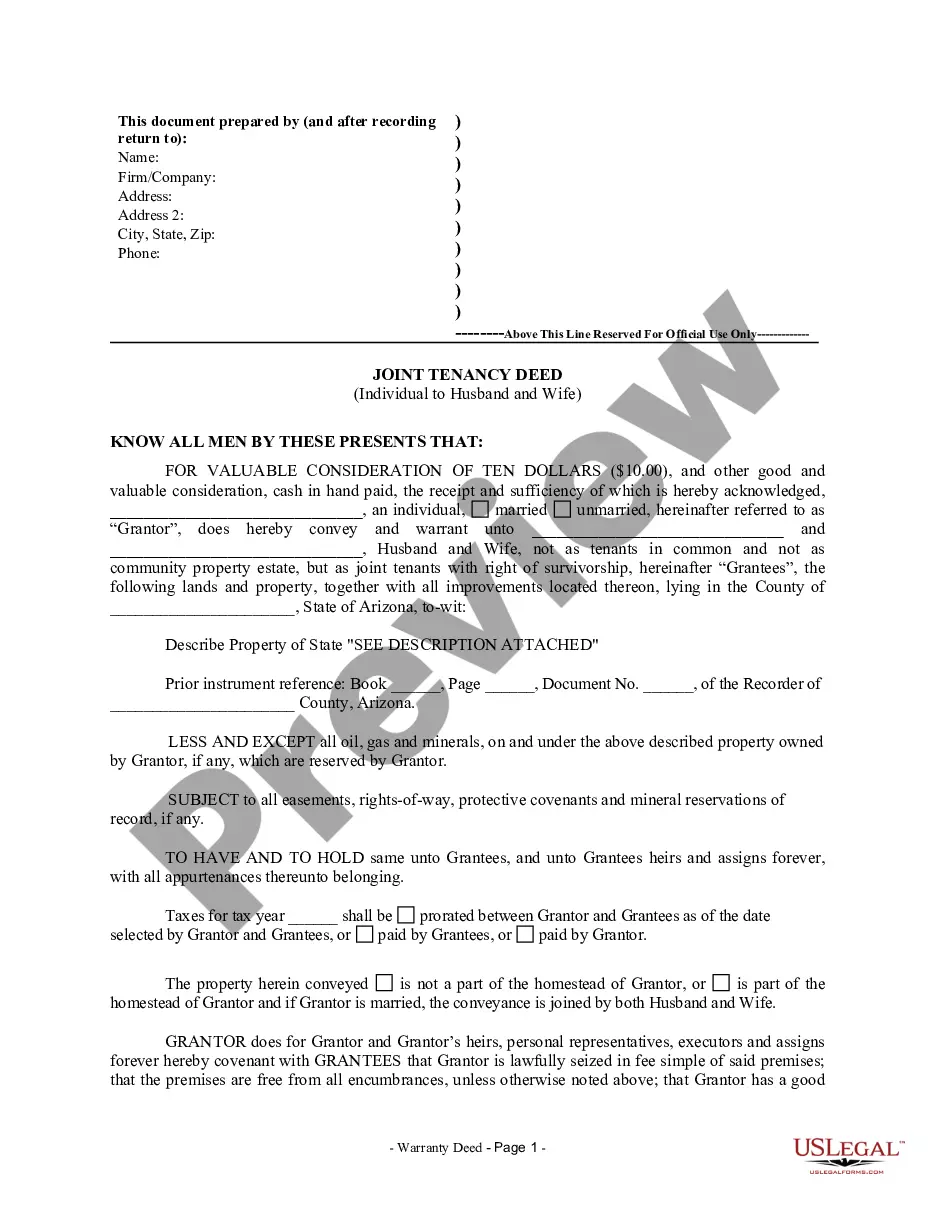

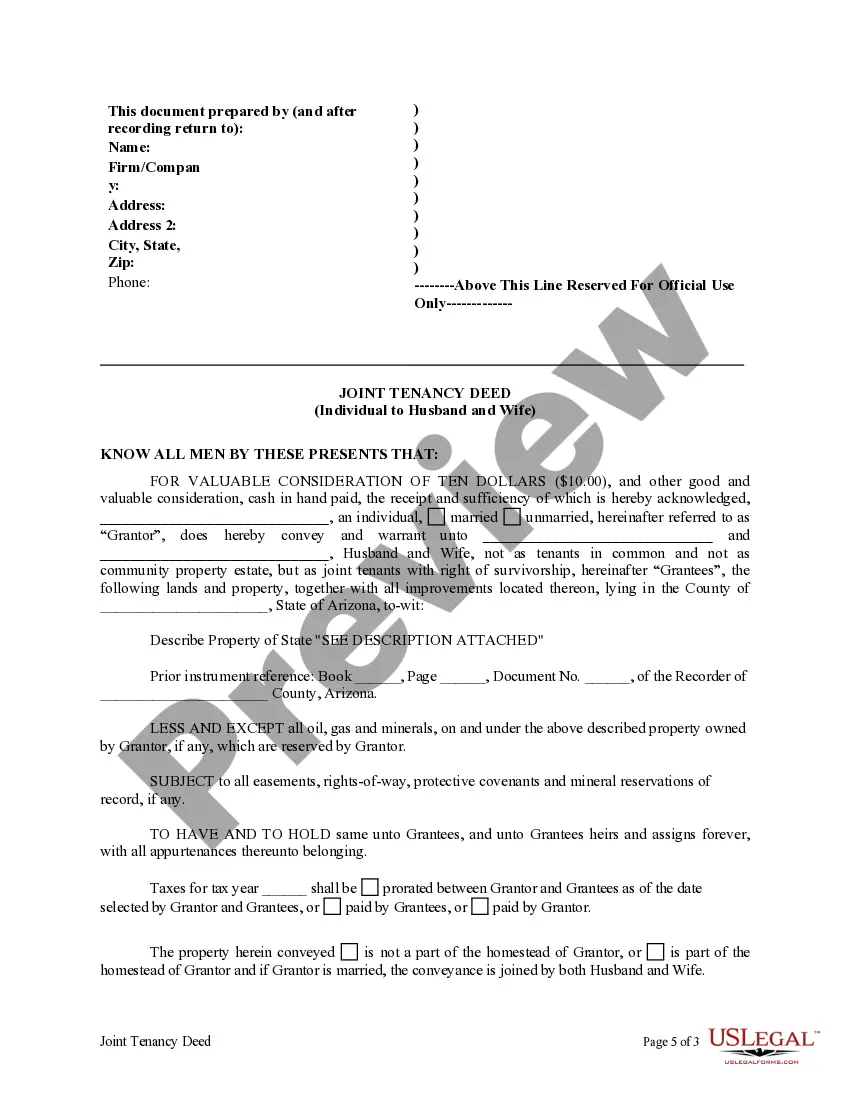

Quitclaim Deed Joint Tenancy With Right Of Survivorship

Description

How to fill out Arizona Joint Tenancy Deed From Individual To Husband And Wife?

Regardless of whether it’s for professional reasons or personal issues, each individual must confront legal circumstances at some point in their lifetime.

Completing legal paperwork requires meticulous care, starting with choosing the appropriate form template.

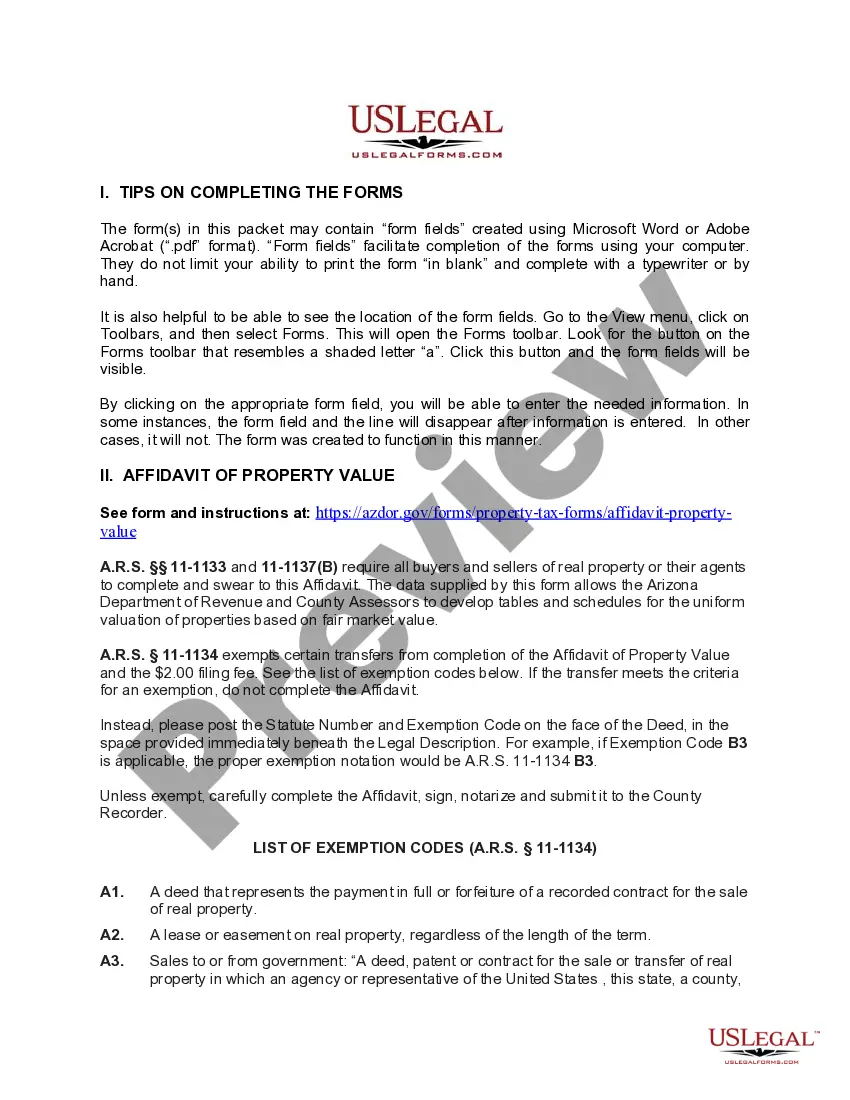

After it is saved, you can fill out the form using editing software or print it out and complete it by hand. With an extensive US Legal Forms catalog available, you no longer have to waste time searching for the correct template online. Make use of the library’s user-friendly navigation to discover the right form for any situation.

- Obtain the template you require by utilizing the search box or catalog exploration.

- Review the form’s details to confirm it aligns with your case, jurisdiction, and area.

- Click on the form’s preview to check its contents.

- If it is not the correct form, return to the search option to find the Quitclaim Deed Joint Tenancy With Right Of Survivorship sample you need.

- Download the template when it fulfills your specifications.

- If you already possess a US Legal Forms account, simply click Log in to access previously stored documents in My documents.

- In case you don’t have an account yet, you can download the form by clicking Buy now.

- Choose the appropriate pricing plan.

- Complete the profile registration form.

- Select your payment option: use a credit card or PayPal account.

- Choose the document format you desire and download the Quitclaim Deed Joint Tenancy With Right Of Survivorship.

Form popularity

FAQ

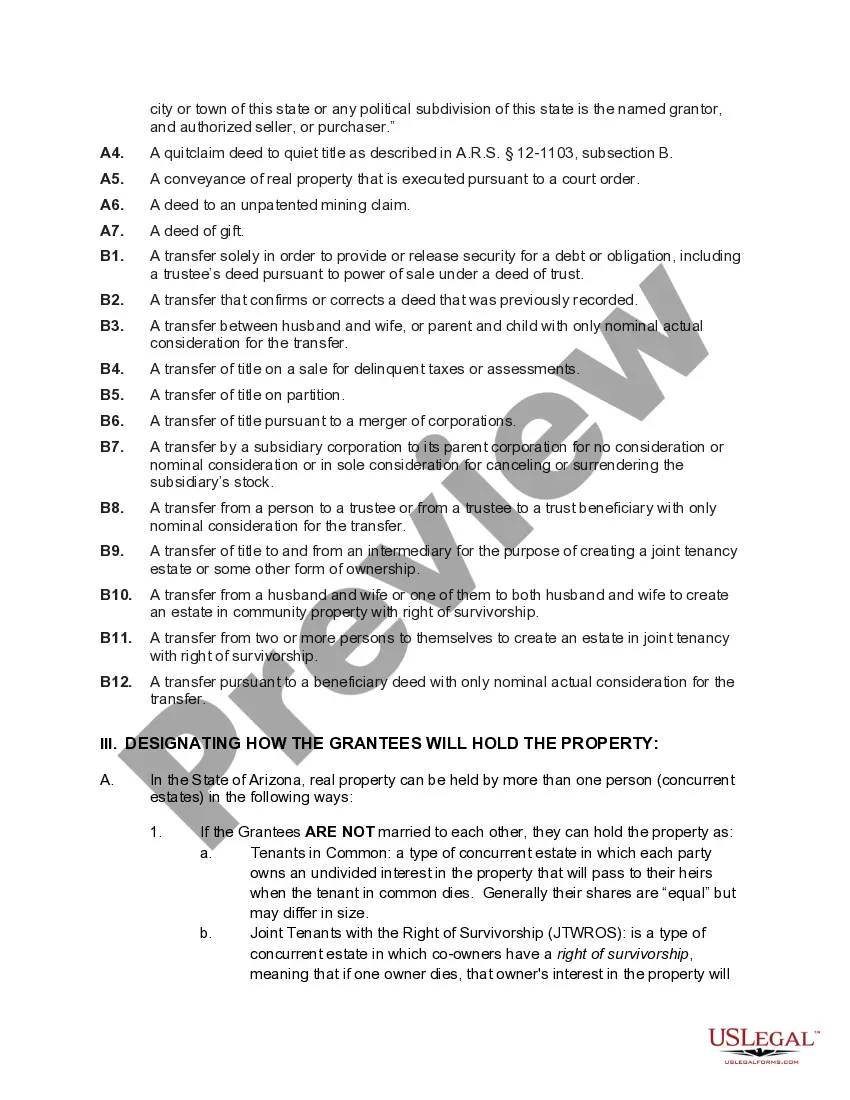

The primary difference between joint tenancy and joint tenancy with rights of survivorship lies in what happens to ownership when one owner dies. In joint tenancy with rights of survivorship, the deceased owner's share transfers automatically to the surviving owner, avoiding probate. In contrast, without the right of survivorship, the ownership stake might go to the deceased's heirs, complicating the transfer process.

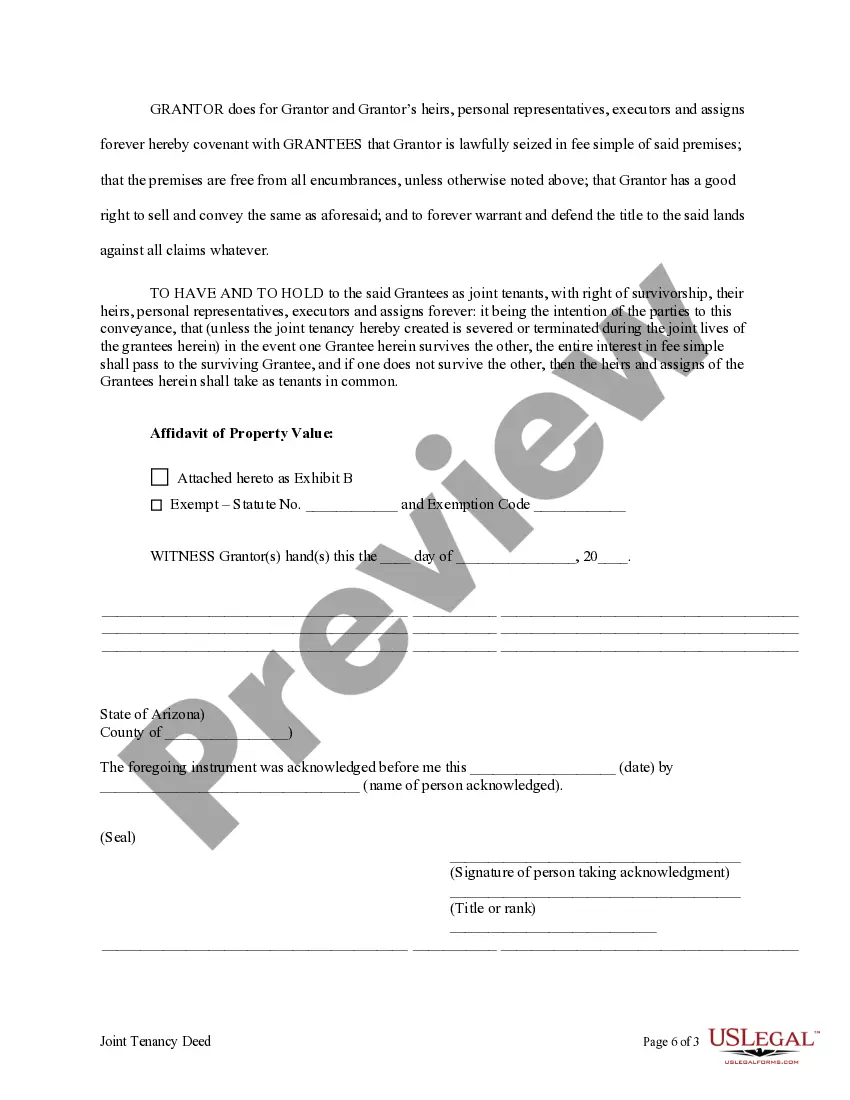

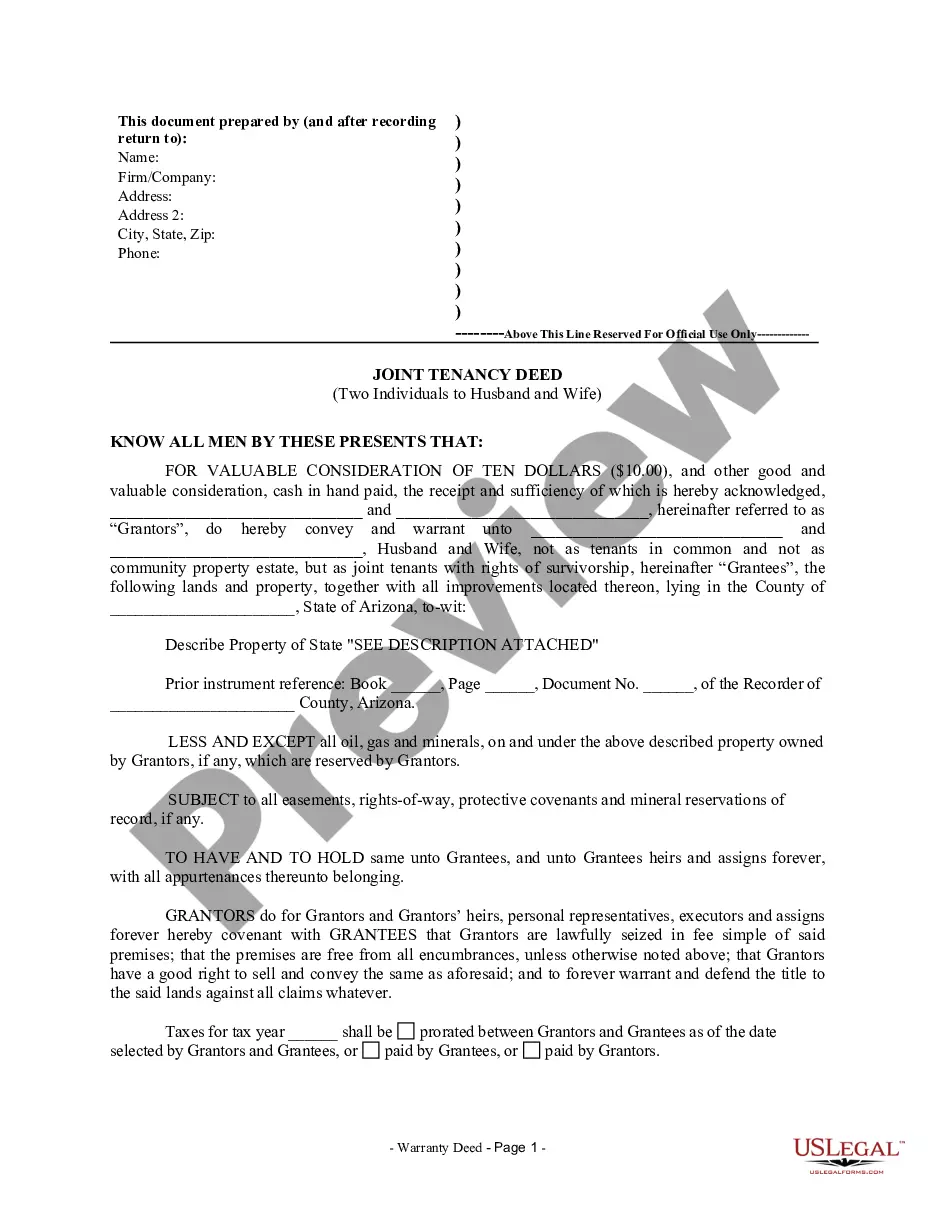

To fill out a quitclaim deed, start by providing the names of the grantor and grantee, along with their addresses. Then, describe the property clearly, including its legal description, to avoid confusion. Lastly, sign and date the document in front of a notary public, which makes the quitclaim deed official and effective in conveying joint tenancy with right of survivorship.

An example of an account held in joint tenancy with right of survivorship is a shared bank account opened by spouses. Both individuals have equal access and rights to the funds in the account. If one spouse passes away, the remaining spouse automatically becomes the sole owner of the account, facilitating smooth financial management during a difficult time.

An example of joint tenancy with right of survivorship occurs when two or more individuals, such as partners, buy a house together. Each owner holds an equal share of the property, and if one owner passes away, their share automatically transfers to the surviving owner without going through probate. This arrangement provides clear benefits for estate planning, ensuring that the surviving partner retains full ownership.

The disadvantage of the right of survivorship lies in its lack of control over how a person's share of the property is managed. Upon death, the share automatically goes to the remaining co-owner, which can lead to complications if the deceased had different intentions for their assets. Moreover, this arrangement can perpetuate financial burdens associated with property ownership, making it essential to consider all options thoroughly.

A quitclaim deed with rights of survivorship is a legal document that transfers ownership of property between parties while ensuring that, upon the death of one owner, the surviving owner automatically inherits the property. This method provides a clear path to ownership without the complexities of probate. Therefore, it is vital to approach it with a clear understanding and proper legal advice to avoid pitfalls.

Joint tenancy offers both benefits and drawbacks. On the positive side, it allows for seamless transfer of ownership upon death, avoiding probate. However, the cons include potential disputes among co-owners and limited control over how shares are distributed, which can lead to unintended consequences, particularly regarding heirs and beneficiaries.

Yes, joint tenancy with right of survivorship does override a will. When one owner passes away, the property will transfer directly to the surviving owner, regardless of what the deceased's will states. This can create conflicts if the deceased had specific wishes outlined in their will regarding the distribution of their assets.

Joint tenancy with right of survivorship has several disadvantages. For instance, it does not allow the owners to dictate how their share will be passed on, as the asset automatically transfers to the surviving owner. Furthermore, this setup can complicate financial matters, especially if there are debts or liabilities attached to the property, which may affect the surviving owner's financial stability.

One key disadvantage of joint tenancy is the potential for conflicts among co-owners. If one owner wishes to sell their share, they may face challenges in reaching an agreement with others. Additionally, without proper estate planning, joint tenancy can inadvertently lead to unintended beneficiaries when one owner passes away, as the assets transfer automatically.