Arizona Business Registration Fee

Description

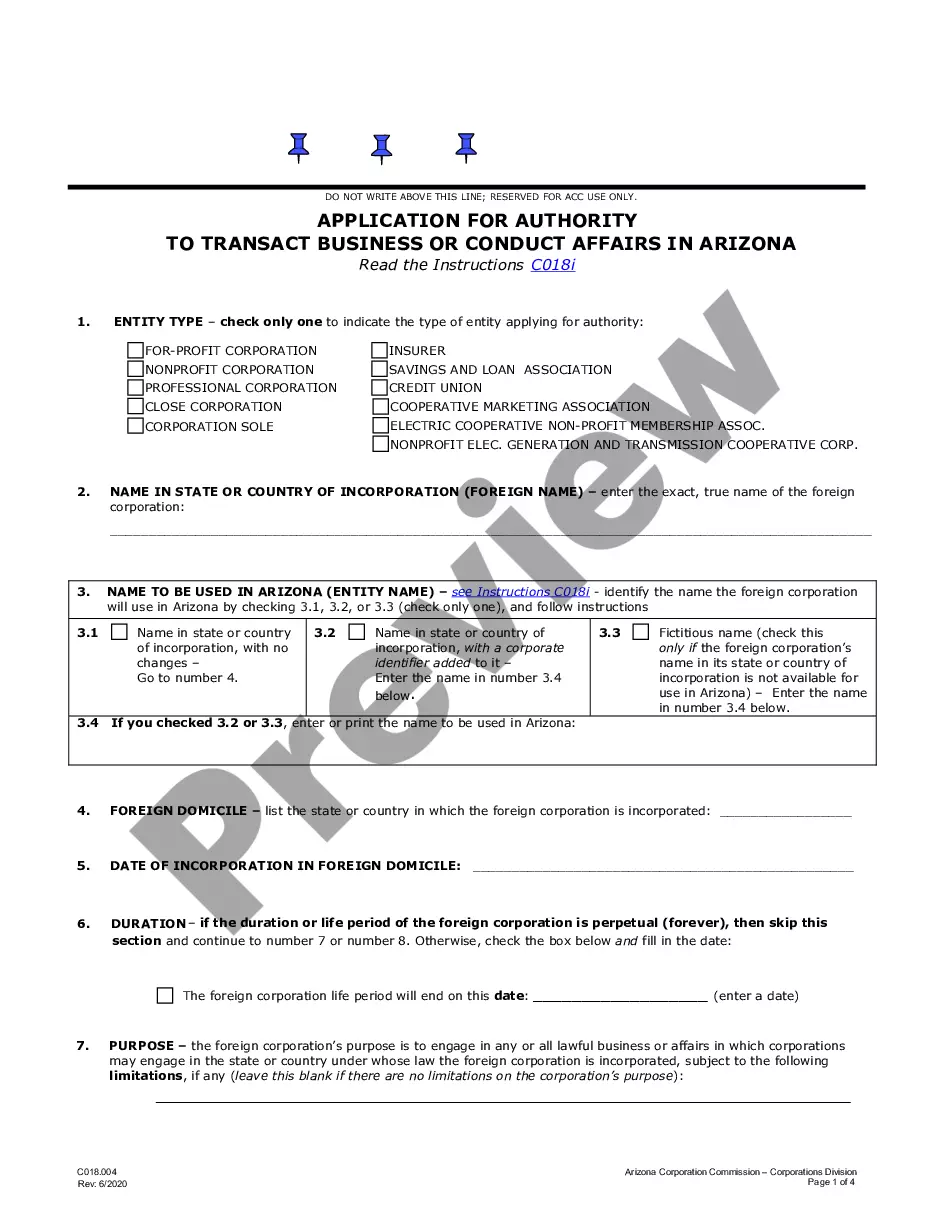

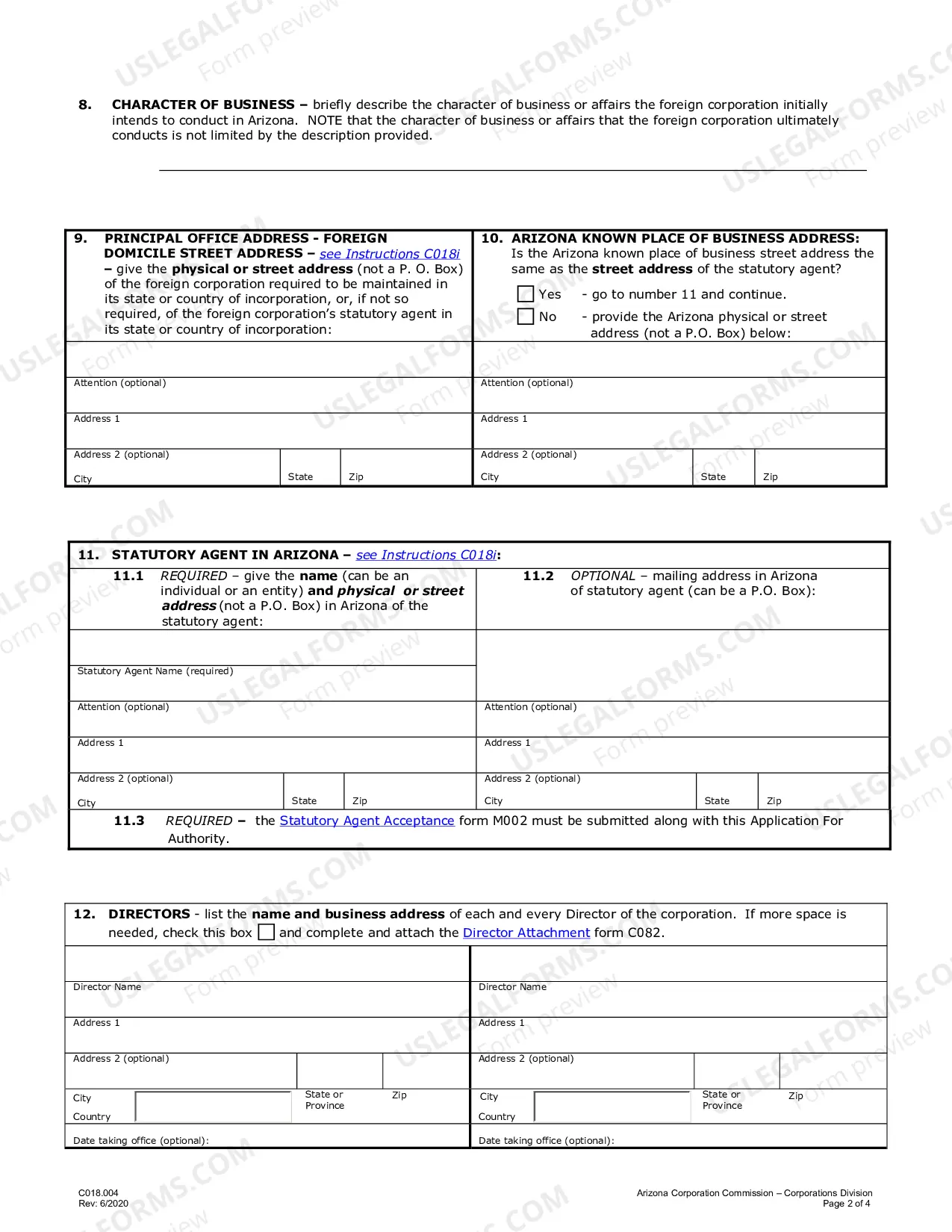

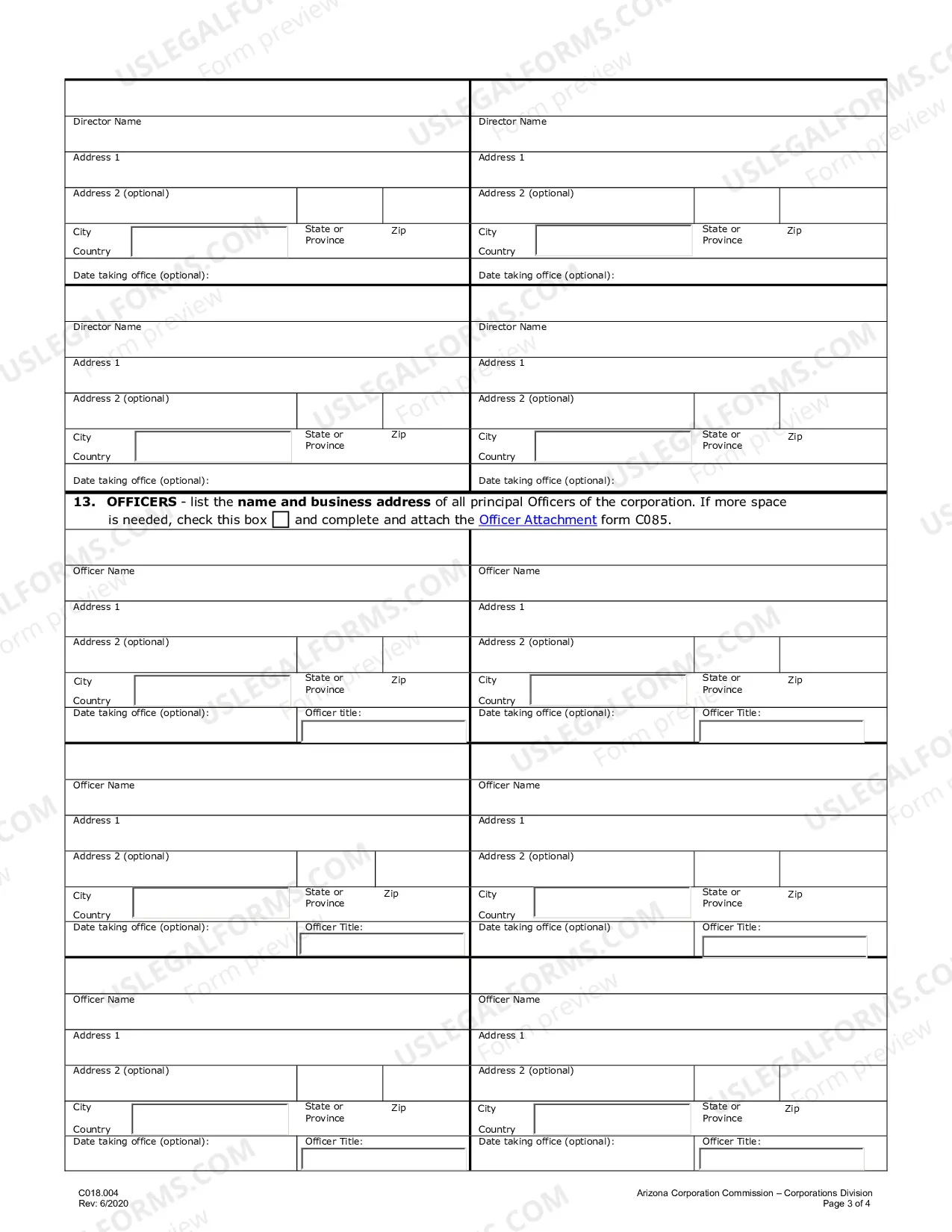

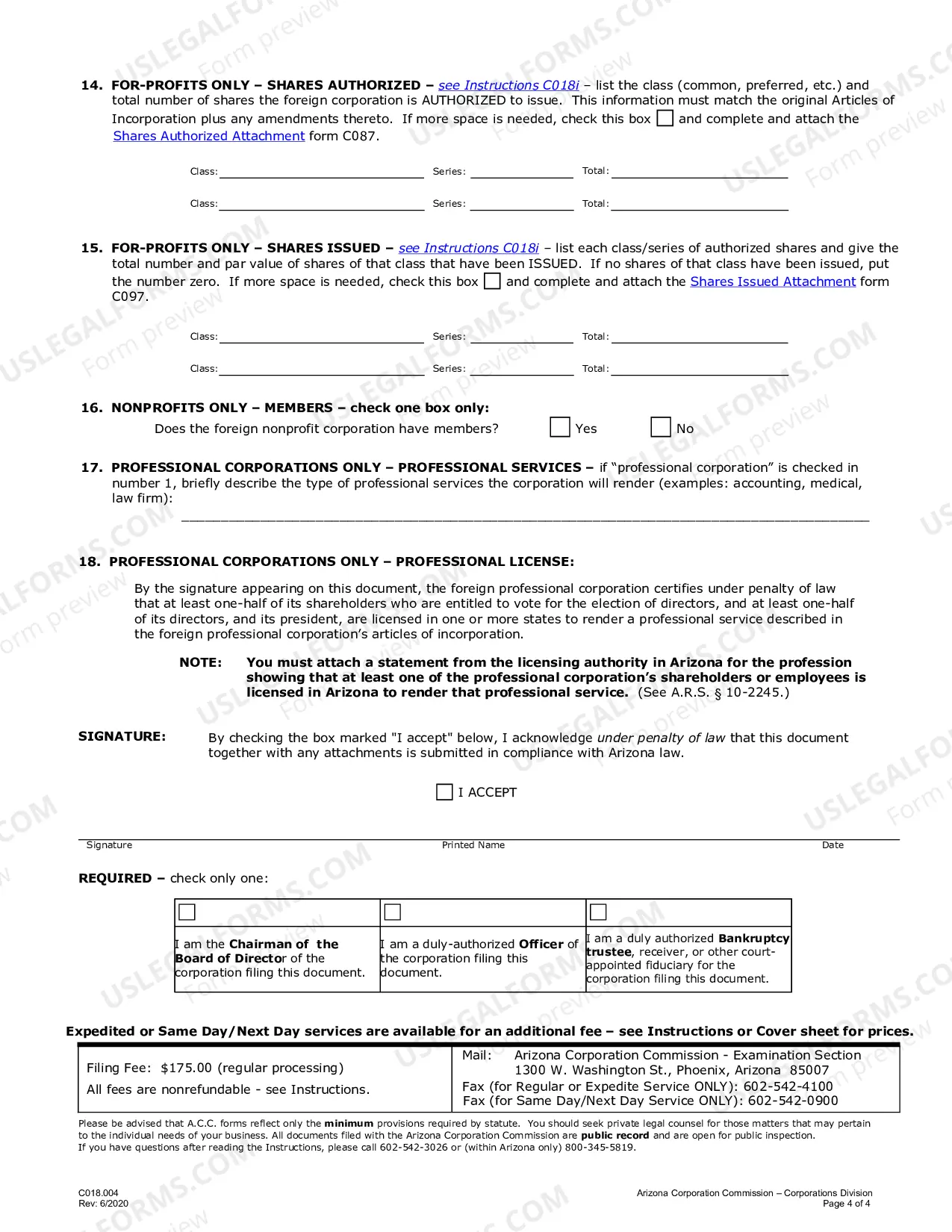

How to fill out Arizona Registration Of Foreign Corporation?

Working with legal papers and operations can be a time-consuming addition to the day. Arizona Business Registration Fee and forms like it usually require that you look for them and understand how to complete them effectively. As a result, regardless if you are taking care of financial, legal, or individual matters, having a thorough and practical online catalogue of forms on hand will greatly assist.

US Legal Forms is the best online platform of legal templates, offering more than 85,000 state-specific forms and numerous tools that will help you complete your papers easily. Explore the catalogue of pertinent papers available to you with just a single click.

US Legal Forms gives you state- and county-specific forms offered at any time for downloading. Shield your papers administration processes with a high quality service that lets you prepare any form in minutes without having extra or hidden charges. Just log in to the profile, find Arizona Business Registration Fee and download it immediately within the My Forms tab. You can also gain access to previously saved forms.

Could it be the first time utilizing US Legal Forms? Sign up and set up up a free account in a few minutes and you’ll gain access to the form catalogue and Arizona Business Registration Fee. Then, stick to the steps below to complete your form:

- Be sure you have discovered the proper form using the Review feature and reading the form information.

- Pick Buy Now as soon as all set, and select the monthly subscription plan that suits you.

- Select Download then complete, eSign, and print out the form.

US Legal Forms has twenty five years of expertise supporting consumers handle their legal papers. Discover the form you require right now and improve any operation without breaking a sweat.

Form popularity

FAQ

Any license(s) you need to be in business could be - and often is - generically referred to as a "business" license, however, there are basically three different types of "business" licenses in Arizona: Transaction Privilege (Sales) Tax (TPT), Business, and Regulatory (professional/special).

The price of a business license or permit can vary depending on the type of license, business location, processing fees and recurring fees. Phoenix charges an application fee from $24 up to $1,665 and a license/permit fee between $10 and $360, depending on the type of business.

Great news, the Arizona Corporation Commission (AZCC) doesn't require an Annual Report (or fee) for an Arizona LLC. Although most states have annual reports and fees, Arizona is one of the few states that doesn't require LLCs to file (or pay) an Annual Report. This doesn't mean that Arizona LLCs don't pay taxes though.

Corporations may use AZTaxes.gov or ACH Credit to make EFT payments. International businesses without a US bank can make electronic payments through ACH credit for routine payments, extension payments, and estimated payments. If you wish to use the ACH Debit option, please register at .AZTaxes.gov.

However, an EIN is for federal withholding tax, excise tax, business information returns, and other IRS-related tax issues. An Arizona tax ID number is the number you use on returns that you file with the Arizona Department of Revenue.