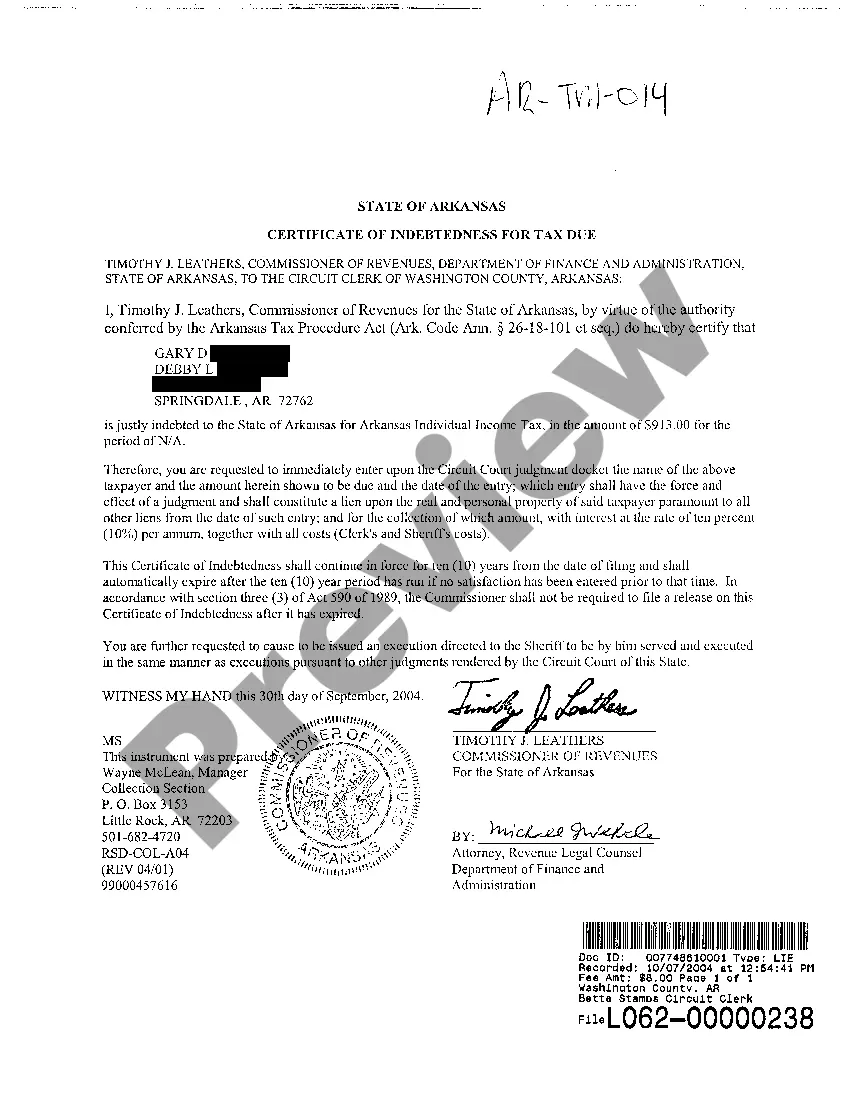

Arkansas Certificate Of Indebtedness Withdrawal

Description

How to fill out Arkansas Certificate Of Indebtedness For Tax Due?

Bureaucracy necessitates exactness and precision.

If you do not manage completing documents like the Arkansas Certificate Of Indebtedness Withdrawal on a regular basis, it may lead to some misunderstandings.

Selecting the correct sample from the beginning will guarantee that your document submission proceeds without a hitch and avert any hassles of resending a file or repeating the task from the beginning.

If you are not a subscribed user, locating the necessary sample may involve a few additional steps: First, find the template using the search bar. Ensure the Arkansas Certificate Of Indebtedness Withdrawal you’ve found is suitable for your state or district. Review the preview or read the description containing the details regarding the use of the template. If the outcome matches your search, click the Buy Now button. Select the appropriate option from the suggested pricing plans. Log In to your account or create a new one. Complete the purchase using a credit card or PayPal account. Save the form in your preferred format. Quickly locating the correct and updated samples for your documentation takes just a few minutes with an account at US Legal Forms. Eliminate bureaucratic concerns and simplify your paperwork tasks.

- You can consistently obtain the suitable sample for your paperwork from US Legal Forms.

- US Legal Forms is the most extensive online collection of forms, providing over 85 thousand samples across various topics.

- To find the latest and most applicable version of the Arkansas Certificate Of Indebtedness Withdrawal, just search for it on the website.

- Locate, save, and download templates in your profile or check the description to confirm you possess the correct one.

- With an account at US Legal Forms, you can obtain, keep in one location, and browse through the templates you store for easy access.

- When on the website, click the Log In button to authenticate.

- Next, go to the My documents page, where your document history is retained.

- Review the description of the forms and download those you require at any time.

Form popularity

FAQ

In Arkansas, seniors aged 65 and older may qualify for property tax relief under certain programs, including the Property Tax Relief Program. While they may not completely stop paying property taxes, they can receive significant reductions. Eligibility criteria can vary, so it's vital to check specific requirements. For more information on tax relief options, consider the benefits of researching the Arkansas certificate of indebtedness withdrawal.

Paying property taxes does not grant ownership of a property in Arkansas; it signifies your financial responsibility toward the property. Ownership is legally confirmed through a deed. Thus, while timely tax payments can help protect against liens or forfeiture, they do not equate to ownership rights. If you are uncertain about property claims, looking into the Arkansas certificate of indebtedness withdrawal might provide some insights.

While paying property taxes is an important aspect of property ownership, it does not serve as definitive proof of ownership in Arkansas. Proof of ownership comes from legal documents, such as deeds. Therefore, relying solely on tax payments without proper documentation can lead to misunderstandings about property rights. For clarity on ownership issues, exploring resources like the Arkansas certificate of indebtedness withdrawal can be helpful.

Paying property tax does not automatically transfer ownership of a property in Arkansas. Ownership is typically established through a formal deed recorded with the county. However, consistent payment of property taxes can strengthen a person's claim to a property, especially if disputes arise. If you need detailed guidance on the nuances of property ownership, consider the Arkansas certificate of indebtedness withdrawal as a point of reference.

Yes, Arkansas requires 1099 filing for certain payments made throughout the year. This includes reporting income such as freelance payments and dividends. If you understand the implications of Arkansas certificate of indebtedness withdrawal, properly managing your 1099 forms is crucial for tax compliance. Using platforms like US Legal Forms can help you navigate these requirements efficiently.

Yes, you can file your Arkansas state taxes online for convenience and efficiency. Utilizing online services simplifies the process and allows for quicker processing of your returns. When you focus on areas like Arkansas certificate of indebtedness withdrawal, ensuring accuracy in your tax filings is essential. You can benefit from platforms like US Legal Forms, which guide you through various tax-related documents.

Failing to file taxes in Arkansas can lead to severe repercussions, including penalties and interest on owed taxes. Over time, this can escalate into a tax lien against your property, resulting in the need for an Arkansas certificate of indebtedness withdrawal if not addressed. You may also face legal action from the state for non-compliance. If you find yourself in this situation, consider using platforms like US Legal Forms to guide you in resolving your tax issues effectively.

A certificate of indebtedness is a formal document issued by the state when there are unpaid taxes owed on a property. This certificate serves as evidence of the debt and can result in additional penalties or interest if not resolved. For anyone dealing with such issues, seeking assistance with the Arkansas certificate of indebtedness withdrawal process can help clarify next steps and avoid further complications. Understanding this certificate is crucial for proper management of your financial responsibilities.

In Arkansas, when property taxes remain unpaid, the government may place a tax lien on the property. This tax lien essentially secures the debt owed to the state or local authority. Once a tax lien is established, it can lead to a certificate of indebtedness withdrawal if the lien is not addressed. It's important to understand the implications of tax liens, as they can affect your property ownership and credit standing.

Several states, including Florida, Nevada, and Texas, do not tax Social Security benefits and 401k withdrawals. This can significantly influence your retirement planning and financial decisions. When assessing your options, it can be helpful to look at how an Arkansas certificate of indebtedness withdrawal fits into your overall strategy.