Dissolve Irrevocable Trust Form

Description

Form popularity

FAQ

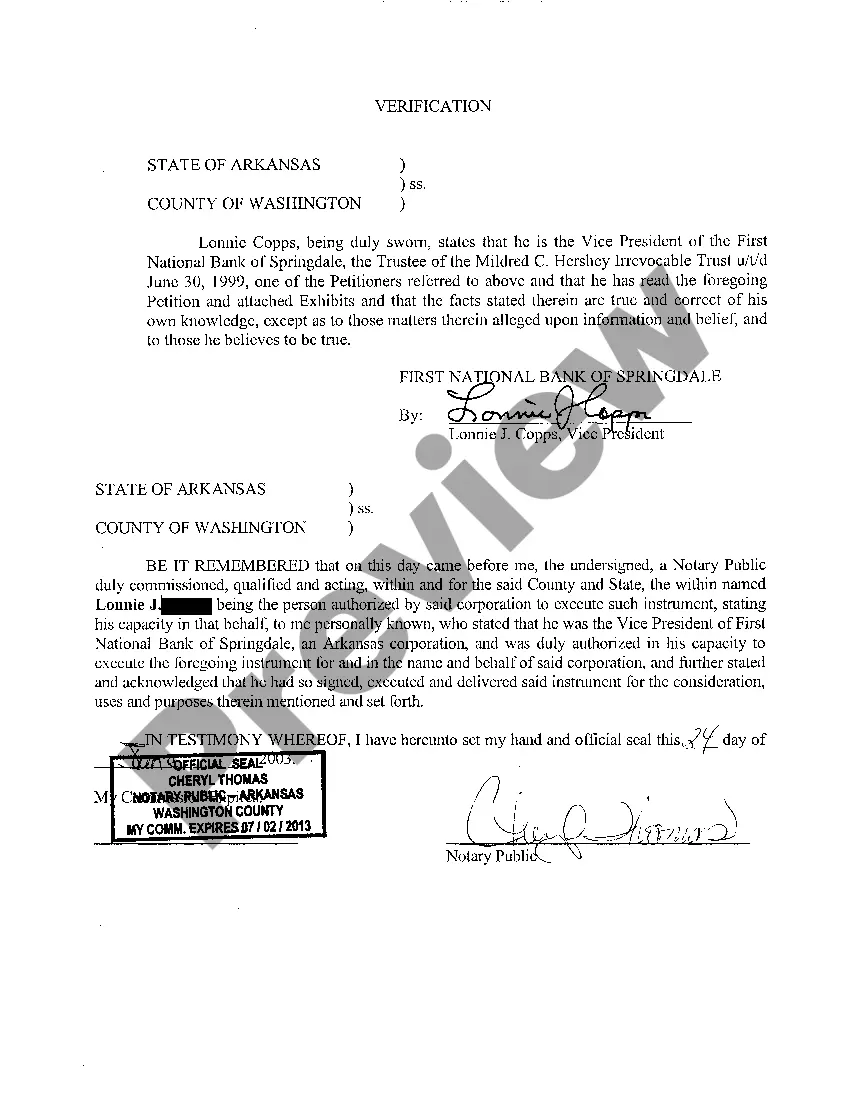

A letter of termination of a trust is a formal document that signals the end of a trust arrangement. This letter outlines important information such as the trust's name, identifying details, and the reasons for termination. It serves as an official record, notifying all relevant parties, including beneficiaries and trustees. Using the appropriate dissolve irrevocable trust form along with the letter provides clear documentation, ensuring a smooth dissolution process.

Bringing a trust to an end involves systemic steps to finalize the arrangements properly. Start by consulting the trust document for any termination clauses, then gather necessary documents, like the dissolve irrevocable trust form. After completing the form, communicate with all beneficiaries about your intention to dissolve the trust. Finally, execute the distribution of assets according to the trust's guidelines to ensure all legal requirements are satisfied.

Dissolving a trust involves several steps to ensure compliance with legal requirements. First, review the trust document to understand any specific procedures or stipulations. Next, you will need to fill out and submit the proper dissolve irrevocable trust form, followed by notifying all beneficiaries and trustees of the decision. Finally, settle any outstanding obligations before distributing assets as per the terms outlined in the trust.

A form to dissolve a trust is a legal document used to officially terminate a trust. This form outlines the specific details concerning the trust, including its name, date of establishment, and the parties involved. By utilizing this dissolve irrevocable trust form, you ensure that all involved parties acknowledge the trust's termination. It is essential to follow the proper legal steps to ensure that the dissolution is recognized by all relevant authorities.

A trust can become null and void for several reasons. Typically, if the trust lacks valid purpose, fails to meet legal requirements, or the trustees do not follow the terms, it may be rendered ineffective. Additionally, if the settlor, or the person who created the trust, no longer possesses legal capacity, the trust may also dissolve. Understanding these factors can help you effectively manage your estate by filling out the appropriate dissolve irrevocable trust form when needed.

Breaking a trust can lead to significant legal and financial consequences, including penalties or litigation from beneficiaries. It's crucial to understand the implications before taking any steps to dissolve an irrevocable trust. Completing a dissolve irrevocable trust form correctly can help mitigate risks and protect your interests. Consulting with a legal expert can further safeguard your actions.

Dissolving an irrevocable trust typically requires following the terms specified in the trust agreement. Generally, options include obtaining consent from beneficiaries or a court order. Completing a dissolve irrevocable trust form streamlines the process and ensures that all steps are aligned with legal requirements. Enlisting the help of a legal professional can ensure a smooth dissolution.

Dissolving an irrevocable trust can trigger different tax implications, including capital gains or income tax on the assets. Understanding these implications is vital before you proceed. Filing a dissolve irrevocable trust form ensures that you are aware of reporting requirements and potential liabilities. Consulting a tax advisor can also provide personalized guidance tailored to your situation.

The difficulty of dissolving a trust largely depends on its structure and provisions outlined in the trust document. If it's irrevocable, you may face additional challenges compared to revocable trusts. Using a dissolve irrevocable trust form simplifies the process and clarifies any legal obligations. It’s wise to consult an expert to navigate any complexities during dissolution.

In most cases, a trust itself cannot be declared bankrupt since it is not a legal entity but a fiduciary relationship. However, if the trust holds significant debts, it may face legal action that could affect its assets. If you're concerned about financial issues with your trust, consulting with a professional can guide you through the process of dissolving the irrevocable trust form with minimal consequences.