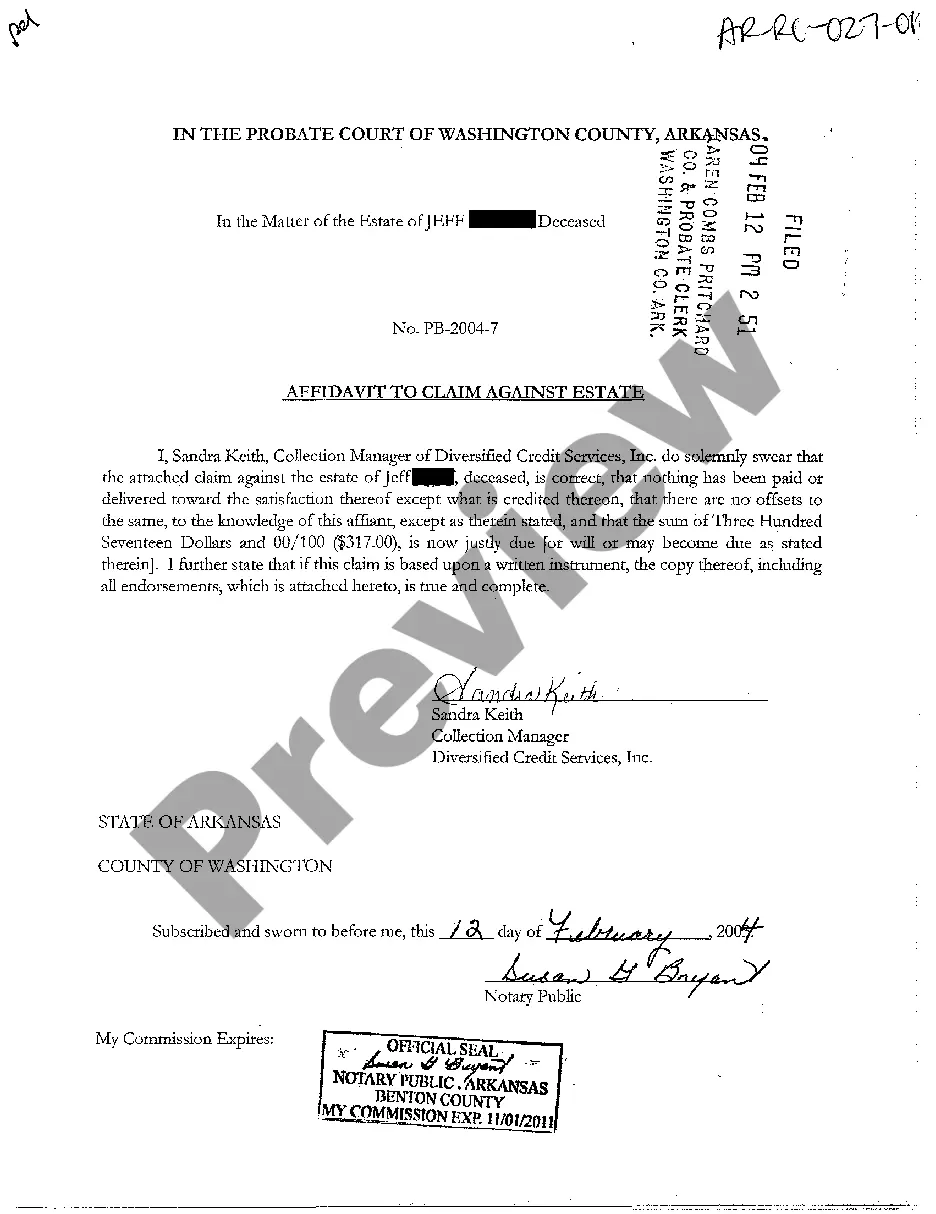

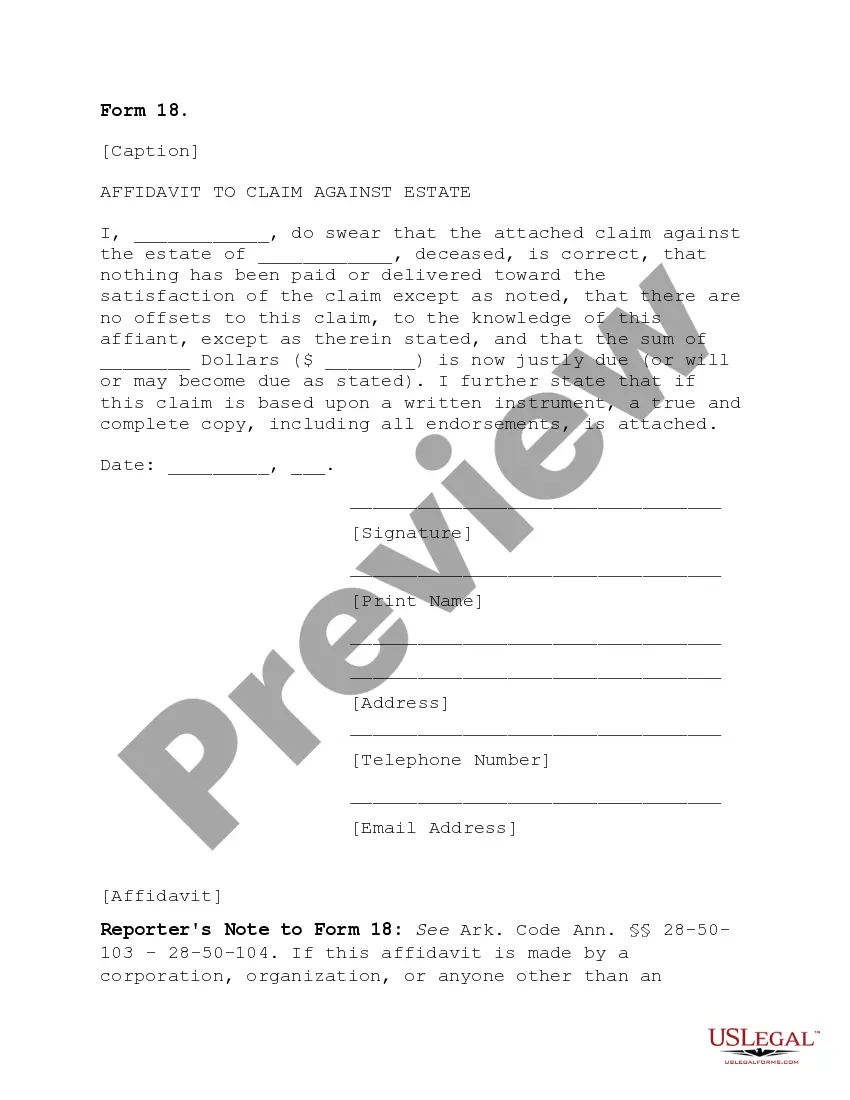

Affidavit To Claim Against Estate For Arkansas Withholding Form

Description

How to fill out Arkansas Affidavit To Claim Against Estate?

Whether you frequently handle documents or occasionally need to file a legal report, it's essential to find a reliable resource where all the templates are pertinent and current.

The initial step with an Affidavit To Claim Against Estate For Arkansas Withholding Form is to verify that it is the latest version, as this determines its eligibility for submission.

If you wish to streamline your quest for the most recent document samples, seek them out on US Legal Forms.

Forget about the headaches associated with legal documents. All your templates will be sorted and validated with a US Legal Forms account.

- US Legal Forms is a database of legal templates that includes nearly every document sample you might need.

- Look for the forms you need, immediately check their relevance, and learn more about their applications.

- With US Legal Forms, you can access over 85,000 form templates across various domains.

- Locate the Affidavit To Claim Against Estate For Arkansas Withholding Form samples in just a few clicks and save them anytime in your account.

- Having a US Legal Forms account facilitates your access to all the forms you need with ease and minimal hassle.

- Simply click Log In in the site header and visit the My documents section to have all the forms you need at your fingertips, avoiding any time lost searching for the best template or verifying its legitimacy.

- To obtain a form without an account, follow these instructions.

Form popularity

FAQ

Arkansas standard deduction for tax year 2021 is $4,400 for married filing jointly and $2,200 for all other filers.

EFile your Arkansas tax return now We last updated Arkansas Form AR1000ADJ in January 2022 from the Arkansas Department of Revenue. This form is for income earned in tax year 2021, with tax returns due in April 2022.

All new employees for your business must complete a federal Form W-4. New employees also should complete one of two related Arkansas forms: Form AR4EC, Employee's Withholding Exemption Certificate, or Form AR4ECSP,Employee's Special Withholding Exemption Certificate.

Form AR-TX is a form you should receive from your employer. Use the information on the form to complete the Texarkana portion of the Arkansas interview. Go into your Arkansas return and continue to the Border City Exemption page.

File Form AR941A. File AR941, Employers Annual Report for Income Tax Withheld and pay any tax due for the previous calendar year.