Waiver Of Inventory And Accounting Without A Contract

Description

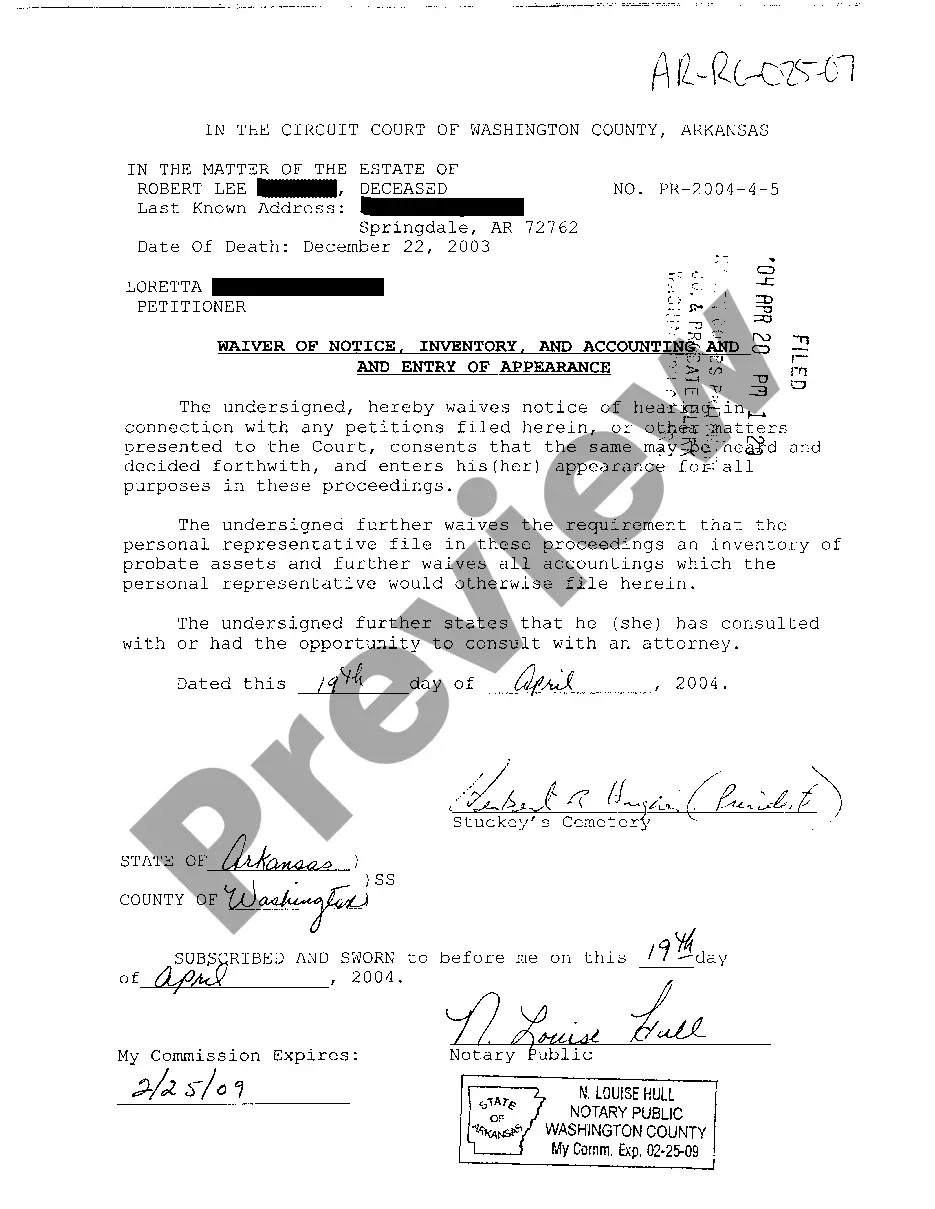

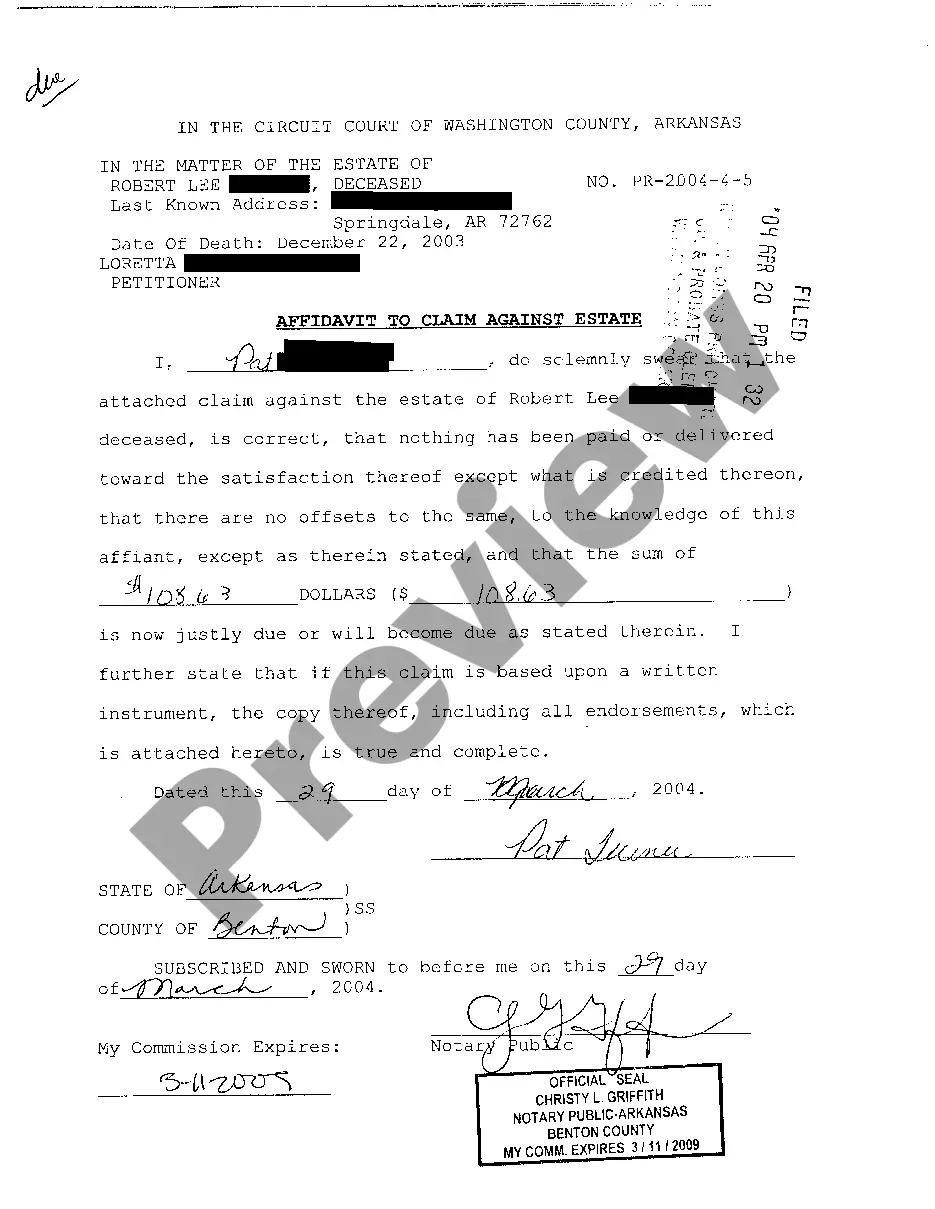

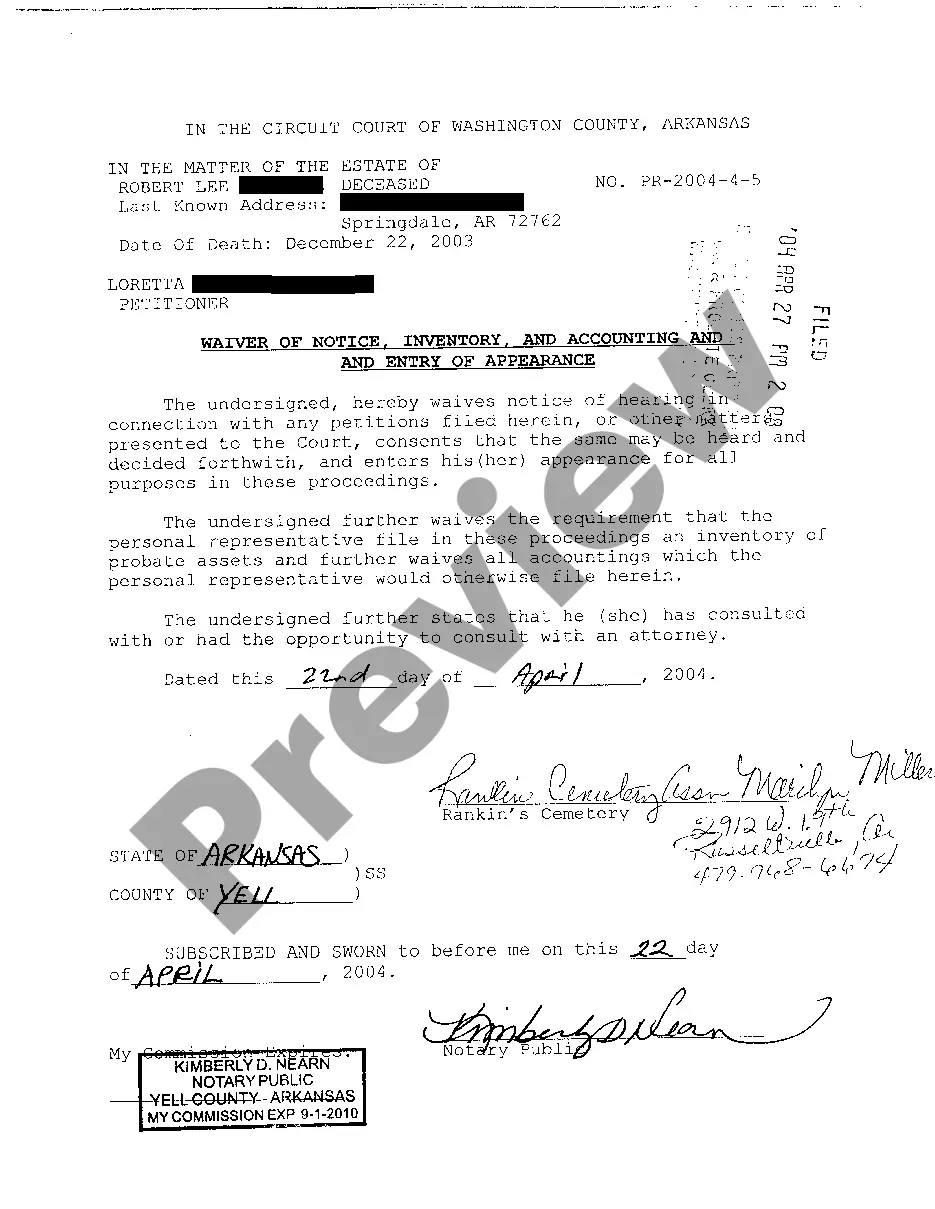

How to fill out Arkansas Waiver Of Notice, Inventory, And Accounting And Entry Of Appearance?

Using legal document samples that meet the federal and regional regulations is crucial, and the internet offers a lot of options to choose from. But what’s the point in wasting time looking for the appropriate Waiver Of Inventory And Accounting Without A Contract sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the largest online legal catalog with over 85,000 fillable templates drafted by lawyers for any business and life case. They are easy to browse with all files arranged by state and purpose of use. Our experts keep up with legislative updates, so you can always be sure your form is up to date and compliant when getting a Waiver Of Inventory And Accounting Without A Contract from our website.

Obtaining a Waiver Of Inventory And Accounting Without A Contract is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the right format. If you are new to our website, adhere to the steps below:

- Take a look at the template utilizing the Preview feature or through the text outline to make certain it fits your needs.

- Locate a different sample utilizing the search tool at the top of the page if necessary.

- Click Buy Now when you’ve found the correct form and choose a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Pick the format for your Waiver Of Inventory And Accounting Without A Contract and download it.

All templates you find through US Legal Forms are multi-usable. To re-download and fill out previously purchased forms, open the My Forms tab in your profile. Take advantage of the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

A waiver is a demonstration, usually in written form, of a party's intent to relinquish a legal right or claim. The key point to note is that the relinquishment is voluntary, and can apply to a variety of legal situations. Essentially, a waiver removes a real or potential liability for the other party in the agreement.

Until the 30-day period reserved for objections has not passed and the final accounting is accepted by all the parties involved, the estate will not be closed. A Waiver of Accounting is a document that allows both the personal representative and the beneficiaries to circumvent this impediment.

Generally speaking, a waiver of notice is a legal document that waives an individual's right to formal notification. The purpose of a waiver of notice is usually to allow legal proceedings to commence unencumbered by frequent notices, allowing the proceedings to be more timely and efficient.

Generally, beneficiaries have to wait a certain amount of time, say at least six months. That time is used to allow creditors to come forward and to pay them off with the estate assets. (In some cases, an executor may make partial distributions to the heirs after he or she estimates the debts.

A waiver of accounting is a voluntary waiver by all heirs and beneficiaries that eliminates a very time-consuming and expensive accounting process by the Personal Representative. In order for a probate estate to be closed, the court requires the filing of a petition for final distribution.