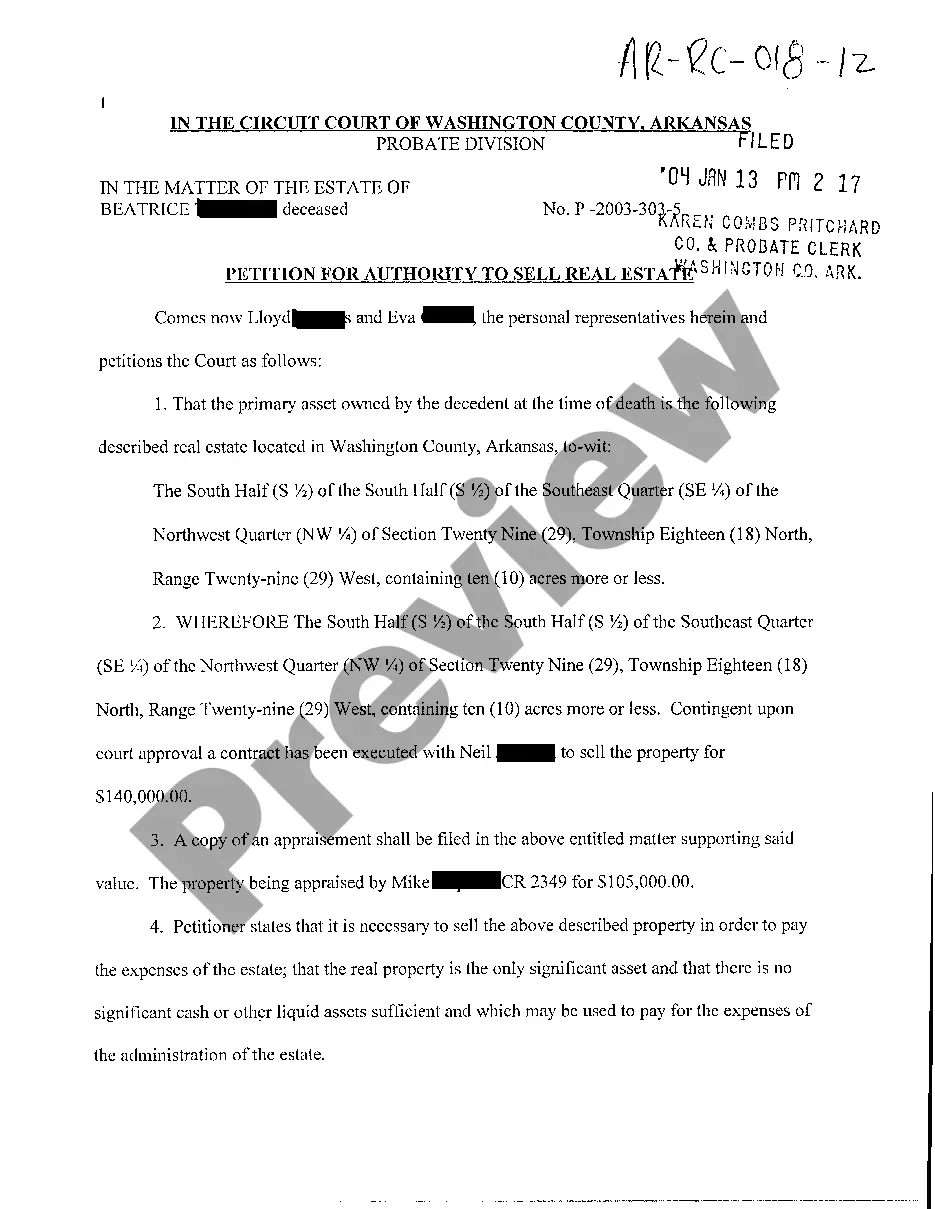

Authority To Sell With Commission

Description

How to fill out Arkansas Petition For Authority To Sell Real Estate?

Dealing with legal paperwork and procedures can be a lengthy addition to your overall day.

Authority To Sell With Commission and similar forms generally necessitate you to locate them and comprehend the method to fill them out accurately.

Thus, whether you are addressing financial, legal, or personal issues, utilizing a comprehensive and efficient online library of templates when required will be very beneficial.

US Legal Forms is the leading online platform for legal documents, featuring over 85,000 state-specific templates and various tools to help you finalize your paperwork effortlessly.

Is it your first experience with US Legal Forms? Register and establish your account in a few moments and you will gain access to the library of forms and Authority To Sell With Commission. Then, follow the outlined steps below to complete your document.

- Explore the collection of pertinent documents accessible to you with just a single click.

- US Legal Forms provides state- and county-specific templates available at any time for download.

- Protect your document management processes using a superior service that allows you to create any form within minutes without any extra or concealed fees.

- Simply Log In to your account, find Authority To Sell With Commission and download it immediately in the My documents section.

- You may also access forms that you have saved previously.

Form popularity

FAQ

Filing a UCC-1 statement allows creditors to collateralize or ?secure? their loan by utilizing the personal property assets of their customers. In the event of a customer defaulting on their loan or filing for bankruptcy, a UCC-1 elevates the lender's status to a secured creditor, ensuring that it will be paid.

A Uniform Commercial Code filing, also known as a UCC filing, is a document that lenders use to establish their legal right to assets that a borrower uses to secure a loan. This notice allows the lender to seize the borrower's collateral in the case of default.

One of the most well known UCC provisions is the requirement of perfecting a security interest. In general, a secured transaction is designed to provide a lender with recourse in the event that the borrower is unable to repay the loan, primarily by taking possession of the asset and selling it.

The UCC is a set of laws concerning commercial transactions, such as the sale of goods. It also covers secured transactions, where a lender gains the right to foreclose on a borrower's collateral should the borrower default on the loan. This is also called a security interest.

Article 9 of the Uniform Commercial Code (UCC), as adopted by all fifty states, generally governs secured transactions where security interests are taken in personal property. It regulates creation and enforcement of security interests in movable property, intangible property, and fixtures.