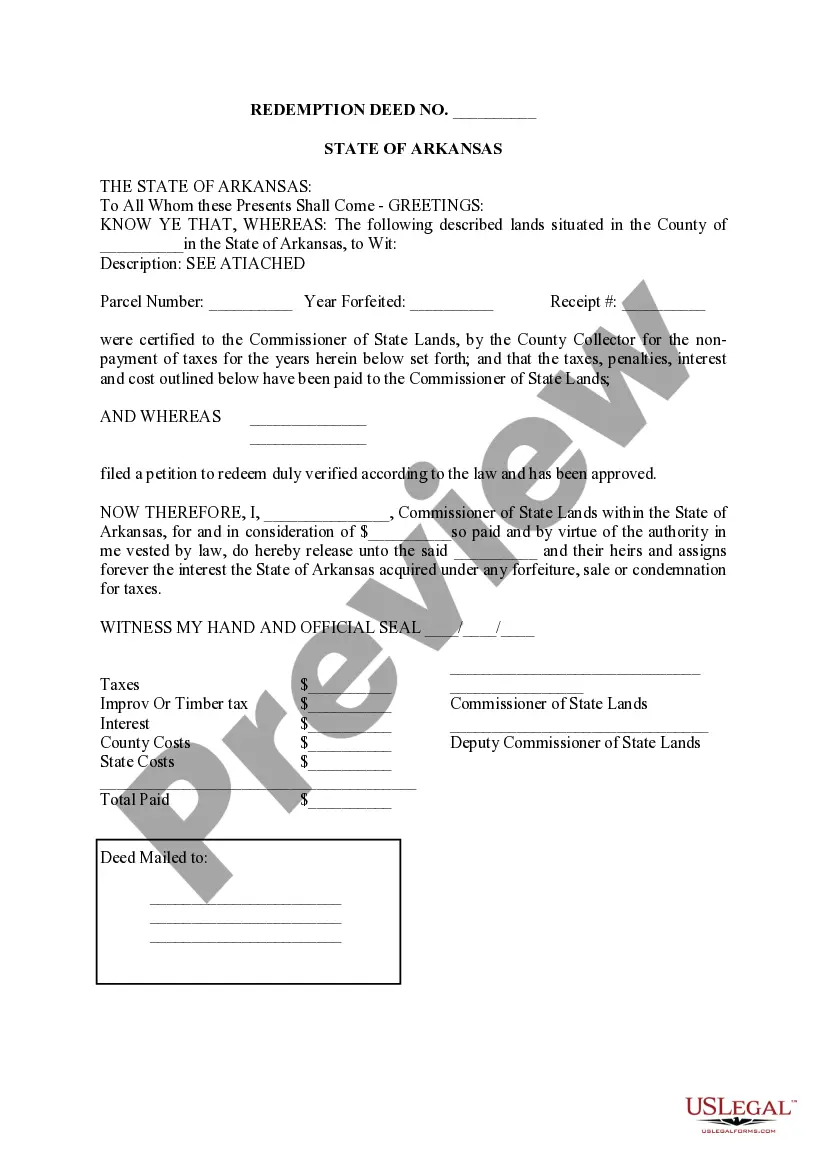

Redemption Deed Format

Description

How to fill out Arkansas Redemption Deed?

Regardless of whether for corporate objectives or personal issues, each individual must confront legal matters at some stage in their existence.

Filling out legal paperwork requires meticulous focus, starting with selecting the right form template.

With an extensive US Legal Forms catalog available, you won’t need to waste time searching for the precise template across the internet. Utilize the library’s straightforward navigation to find the correct form for any situation.

- Acquire the necessary template using the search feature or through catalog navigation.

- Review the form’s description to verify its suitability for your situation, state, and locality.

- Select the form’s preview to examine it.

- If it is not the correct document, return to the search function to find the Redemption Deed Format sample you require.

- Download the template once it fulfills your requirements.

- If you possess a US Legal Forms account, simply click Log in to access previously stored templates in My documents.

- If you do not have an account yet, you can download the form by clicking Buy now.

- Choose the appropriate pricing option.

- Fill out the profile registration form.

- Select your payment method: a debit/credit card or PayPal account.

- Choose the document format you desire and download the Redemption Deed Format.

- After it is downloaded, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

To acquire proof of your deed, start by contacting your local county clerk’s office or recorder’s office, where deeds are usually filed. You can request a copy of your redemption deed format by providing the necessary information, such as your name, the property's address, and the date of the transaction. Another option is to utilize online platforms like US Legal Forms, which offer templates and guidance on obtaining legal documents, including deeds. This can streamline the process and ensure you have the correct evidence of ownership.

The right of redemption in real estate enables property owners to reclaim their property after a foreclosure sale or tax sale by paying outstanding obligations. This right ensures owners can recover ownership rather than losing their asset permanently. Familiarity with the redemption deed format is important for executing this right effectively. For templates and detailed guidance, consider using resources like USLegalForms to streamline the process.

Property owners generally do not receive redemption rights if their property is sold through a judicial foreclosure where the right of redemption is waived. Additionally, some states exclude properties sold in certain circumstances from redemption opportunities. Understanding these exceptions is crucial, and referring to the appropriate redemption deed format can clarify any confusion. USLegalForms can help owners assess their rights in specific situations.

The right to redeem refers to a property owner's legal ability to reclaim their property after a sale, typically due to unpaid taxes. This legal right serves as a safeguard for owners, allowing them to correct their financial situation. Knowledge of the redemption deed format is essential for successfully exercising this right. Resources such as USLegalForms can provide valuable insights and templates to facilitate this process.

Several states offer redeemable deeds, including Florida, Illinois, and Maryland. In these states, property owners retain the right to redeem their property within a specified timeframe after a tax sale. Understanding the redemption deed format specific to your state is vital for compliance. To find detailed information, platforms like USLegalForms can assist in navigating these rules.

In Florida, the redemption period typically lasts for two years after the tax deed sale. During this time, the property owner can reclaim their property by paying the required fees and following the correct redemption deed format. This window gives owners a clear opportunity to recover from financial difficulties. For specific details, checking with local regulations or resources like USLegalForms can be helpful.

The right to redeem allows property owners to reclaim their property after it has been sold due to unpaid taxes or other reasons. This right ensures that owners have a chance to resolve their financial obligations and regain ownership. It's important to understand the redemption deed format in your state to navigate this process effectively. Using platforms like USLegalForms can provide essential templates and guidance.

In most cases, the original property owner can redeem their property. This process is crucial when the property has been sold due to tax delinquency or foreclosure. To initiate the redemption, the owner must be aware of the applicable redemption deed format and the jurisdiction's specific requirements. It's beneficial to consult resources like USLegalForms for guidance on the proper procedures.

A deed redemption is the act of restoring ownership of a property to the original owner after fulfilling their financial obligations. This process is documented and often involves utilizing a redemption deed format to reflect the transaction appropriately. Utilizing platforms like USLegalForms can help you navigate this process efficiently.

The procedure for redeeming a mortgage typically involves contacting your lender and paying the overdue amount. Be prepared to provide necessary documents, including the redemption deed format. This ensures you follow all legal requirements to reclaim your property effectively.