Arkansas Small Court Affidavit Creditor Withholding

Description

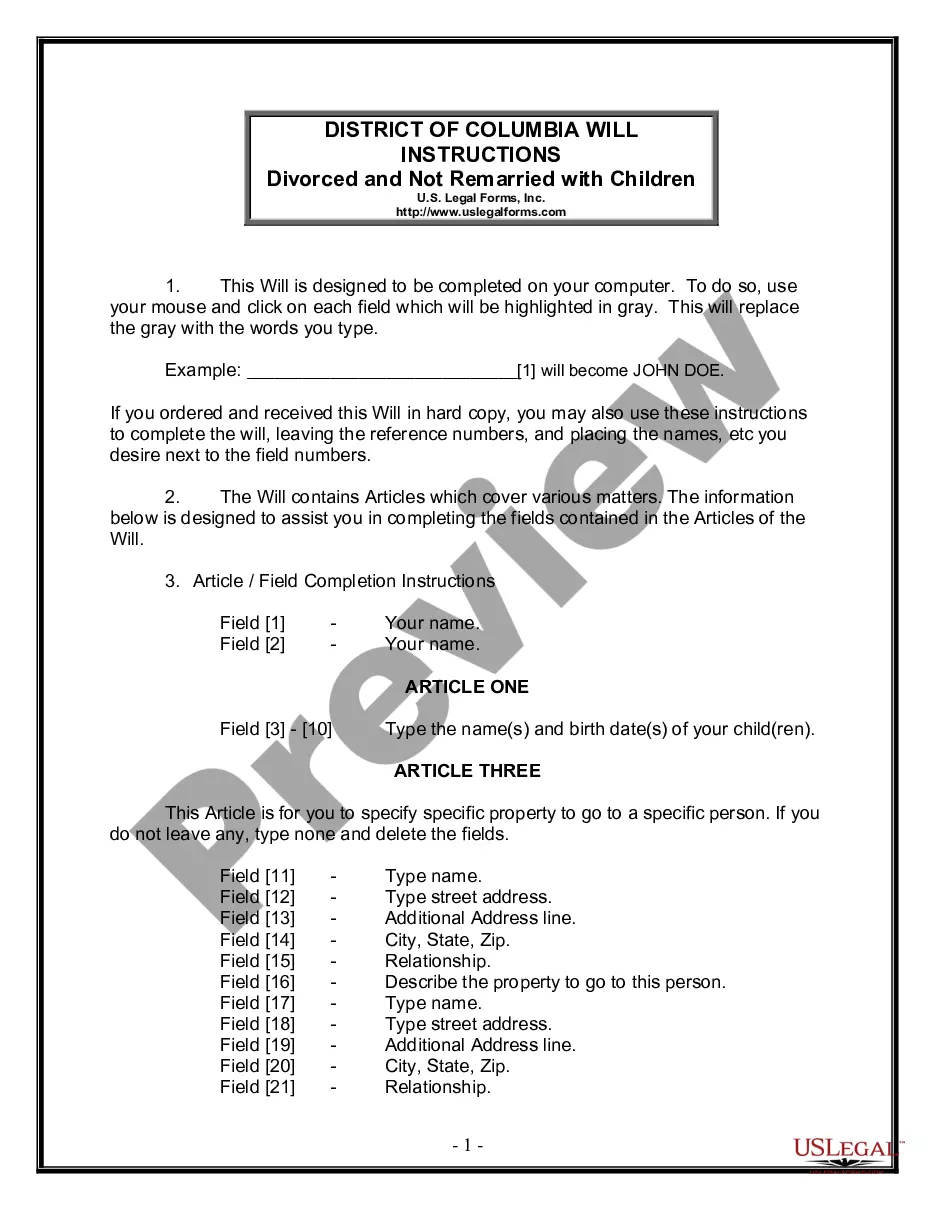

How to fill out Arkansas Small Estate Affidavit For Estates Under $100,000?

Bureaucracy necessitates exactness and correctness.

If you do not engage with completing documents such as Arkansas Small Court Affidavit Creditor Withholding daily, it can lead to some misunderstanding.

Selecting the appropriate template from the outset will ensure that your document submission proceeds smoothly and avert any complications of re-sending a file or doing the same task entirely from scratch.

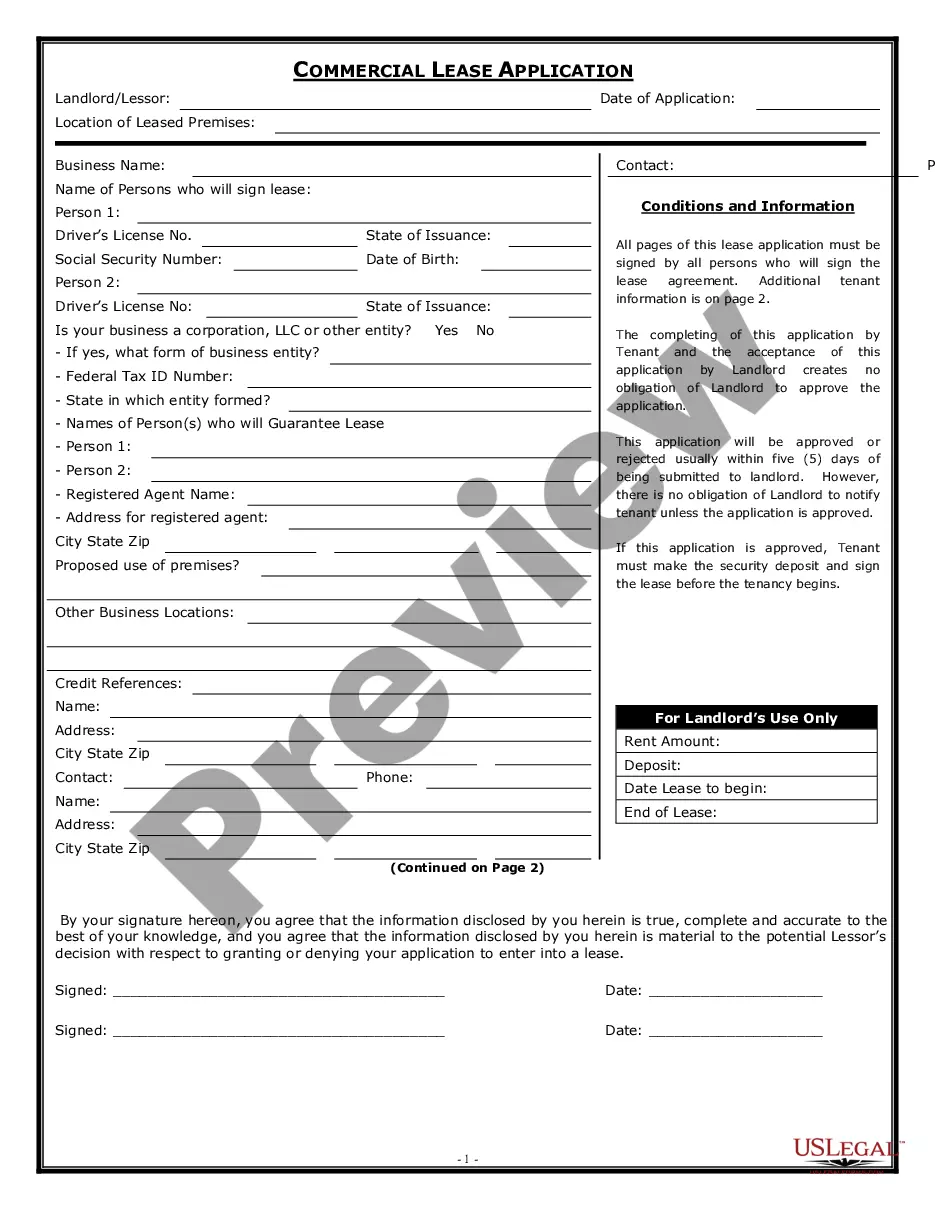

If you are not a subscribed user, locating the required template would involve a few extra steps: Find the template using the search bar.

- You can always acquire the right template for your documentation in US Legal Forms.

- US Legal Forms is the largest online repository of forms, holding over 85 thousand samples across various subjects.

- You can obtain the latest and most suitable version of the Arkansas Small Court Affidavit Creditor Withholding by simply searching on the platform.

- Locate, store, and download templates in your account or review the description to confirm you have the right one available.

- With an account at US Legal Forms, you can gather, keep in one place, and browse through the templates you save for easy access.

- When on the site, click the Log In button to authenticate.

- Next, navigate to the My documents page, where your form history is kept.

- Review the description of the forms and download the ones you need at any time.

Form popularity

FAQ

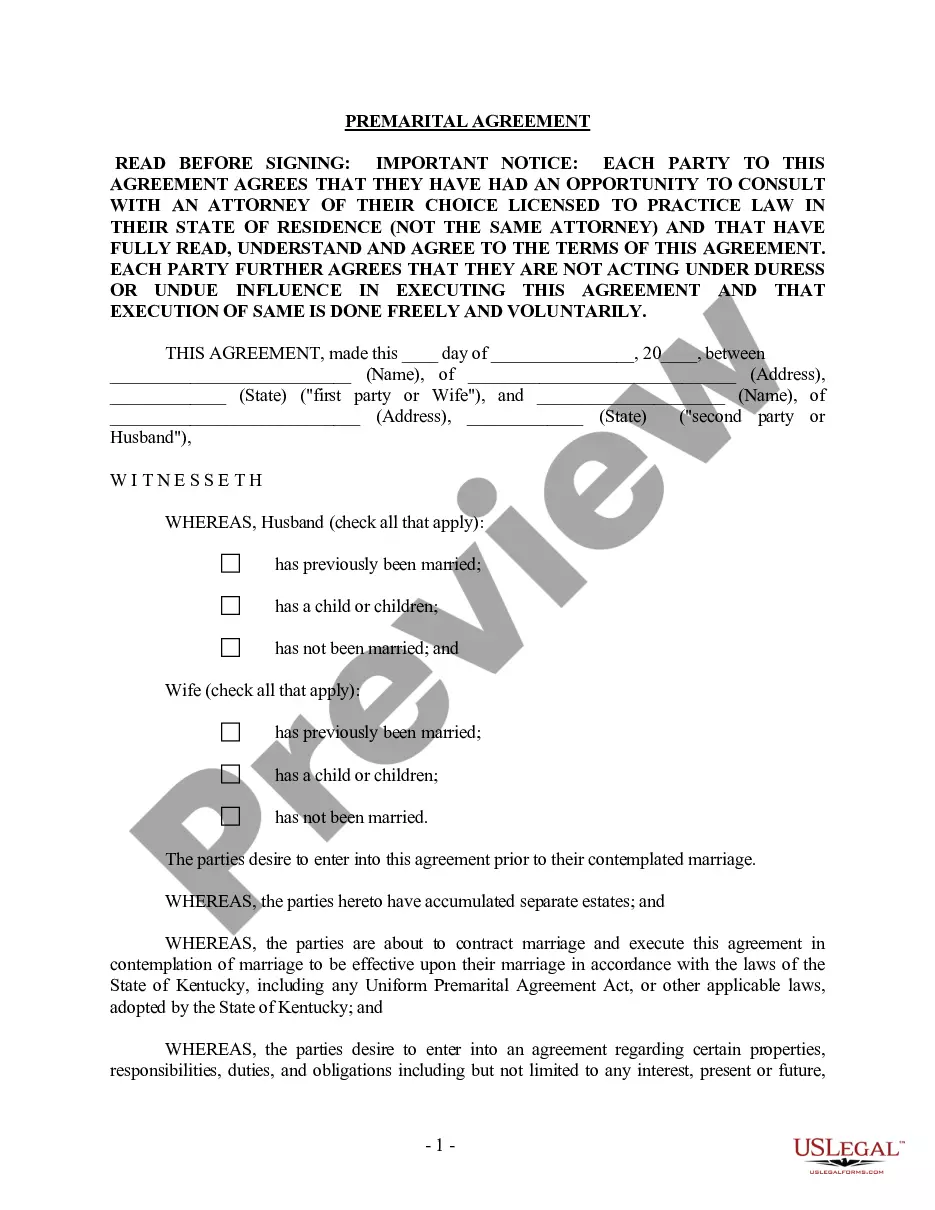

Arkansas generally follows federal wage garnishment law. For most people, when a creditor garnishes your wages in Arkansas, it can only take 25% of your wages at most. But Arkansas offers more protection for laborers and mechanics.

An Arkansas small estate affidavit is used to collect the personal property of a person who died in situations where the person had an estate valued at less than $100,000. It cannot be filed until 45 days have elapsed since the death of the decedent.

Arkansas also places a five-year statute of limitations on debt collection. Debt older than five years does not have to be honored.

The estate executor must attach a copy and pay a $25 filing fee to file the affidavit in the probate court clerk's office. If the decedent owned property, a death notice and affidavit must be published in a local, widely-distributed newspaper within 30 days of the filing.

How do I fill out a form WG-006? Write the name and contacts of the attorney, the address of the court, case number and names of the plaintiff and the defendant as stated in the notice of levy. Don't write anything in the left corner of your Claim of Exemption.