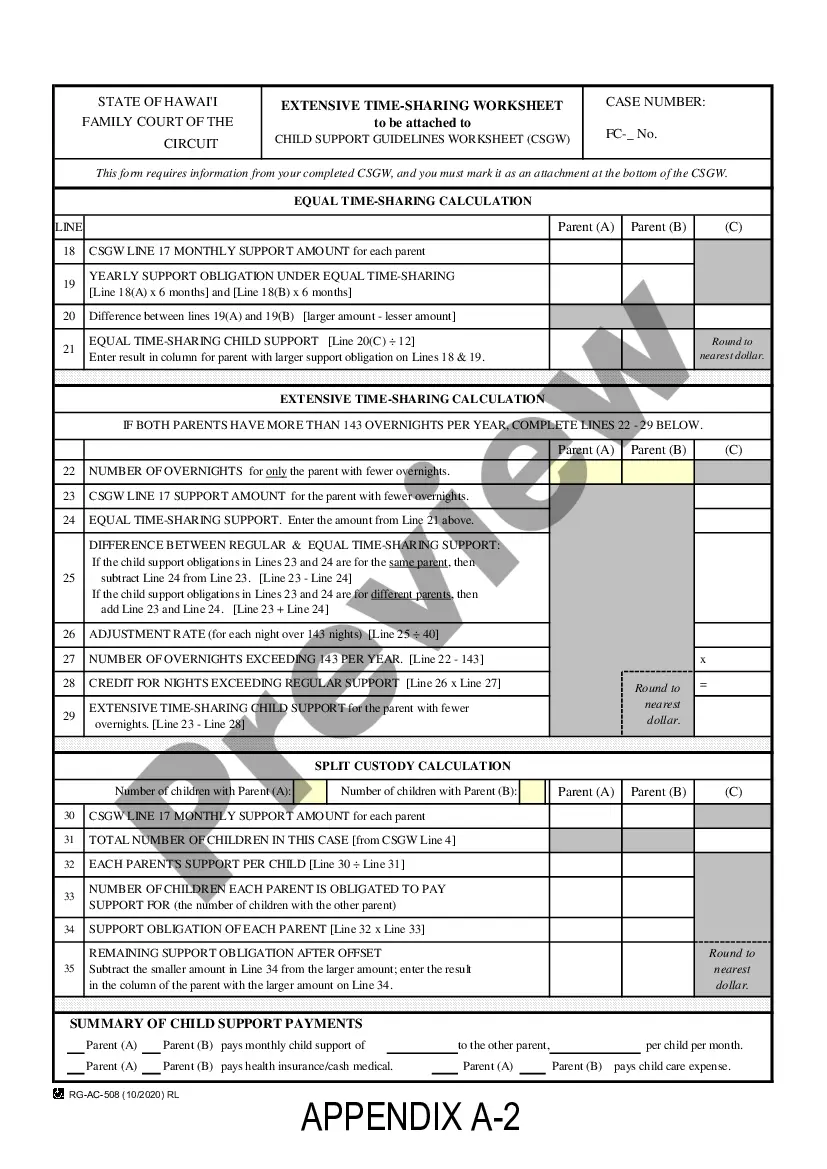

Arkansas Child Support Chart Withholding Limits

Description

How to fill out Arkansas Weekly Family Support Chart?

Whether you handle paperwork regularly or only need to submit a legal document now and then, it's essential to have a reliable source where all the templates are connected and current.

The initial step with an Arkansas Child Support Chart Withholding Limits is to ensure it is the latest version, as this determines its acceptability.

If you want to streamline your quest for the newest document templates, look for them on US Legal Forms.

To obtain a form without an account, follow these steps: Use the search feature to locate the required form. Review the Arkansas Child Support Chart Withholding Limits preview and description to ensure it is exactly the one you seek. After verifying the form, click Buy Now. Select a subscription plan that fits your needs. Create an account or Log In to your existing one. Enter your credit card details or PayPal account to finalize the transaction. Choose the download file format and confirm it. Say goodbye to confusion when dealing with legal documentation. All your templates will be organized and validated with an account at US Legal Forms.

- US Legal Forms is a repository of legal documents that includes nearly every type of template you may want to find.

- Search for the forms you require, assess their applicability immediately, and learn more about their usage.

- With US Legal Forms, you can access more than 85,000 form templates across multiple sectors.

- Obtain the Arkansas Child Support Chart Withholding Limits samples with just a few clicks and keep them stored in your account.

- Having a US Legal Forms account grants you easier access to all the templates you require with greater convenience and less effort.

- You only need to click Log In in the site header and navigate to the My documents section where all the necessary forms are at your disposal, eliminating the need to waste time searching for the suitable template or verifying its authenticity.

Form popularity

FAQ

In Arkansas, child support calculations primarily consider the gross income of the non-custodial parent. This means all earnings before taxes and deductions help determine the appropriate child support amount. It's important to understand that the Arkansas child support chart withholding limits reflect these calculations, ensuring fair support for children while considering the parent's financial obligations. By using the US Legal Forms platform, you can easily access resources and tools to navigate child support issues in Arkansas.

Yes, there is a cap on maximum child support in Arkansas, which is defined by the Arkansas child support chart withholding limits. This cap aims to maintain a balance between the child's financial needs and the paying parent's ability to support. Courts use these established limits to ensure that child support payments are reasonable and consistent. If you are unsure how these limits apply to your situation, USLegalForms can provide guidance and support throughout the process.

The maximum child support in Arkansas is determined according to the state's guidelines, detailed in the Arkansas child support chart withholding limits. These guidelines consider the combined income of both parents and the number of children involved. Typically, the court will use this chart to establish a fair payment schedule that adequately meets the child's needs. For tailored information, consider consulting resources such as USLegalForms to navigate this complex area effectively.

The highest child support payment can vary based on several factors, including income and the number of children. In Arkansas, payments must adhere to the guidelines set in the Arkansas child support chart withholding limits. These limits help ensure that support obligations remain manageable for the paying parent while also providing for the child's needs. You can find detailed information about these payments through reliable sources or platforms like USLegalForms.

The maximum rate of child support in Arkansas is determined using the Arkansas child support chart withholding limits, which take into account the non-custodial parent's income. Effective rates ensure that child support remains manageable yet sufficient to meet the child's needs. To stay compliant and well-informed, consider using resources like USLegalForms to guide you through the complexities of child support calculations.

Recently, changes to the laws regarding child support in Arkansas aim to clarify the calculation process. The Arkansas child support chart withholding limits were updated, allowing for a more straightforward and fair evaluation of each case. Staying informed about these changes can help you understand your rights and responsibilities.

The maximum child support amount in Arkansas varies based on factors such as income and the needs of the child. The state uses the Arkansas child support chart to determine the appropriate amount based on these factors. This structured approach ensures that support is equitable and sufficient for a child's welfare.

The maximum amount that can be withheld for child support in Arkansas is guided by the Arkansas child support chart withholding limits. Generally, this amount does not exceed 50% of your disposable income if you are supporting more than one child. By knowing these limits, you can better manage your finances while ensuring that your child’s needs are met.

In Arkansas, the amount that child support can take from a paycheck is based on the Arkansas child support chart withholding limits. Typically, a percentage of your disposable income will be garnished, depending on the number of children you support. Understanding these limits ensures that the child support taken from your paycheck is fair and reasonable.

To fill out a check for child support, write the payee name as designated by your court order, often the Arkansas Child Support Enforcement. Next, enter the amount of support you are paying both in numbers and words right above the signature line. Additionally, include your case number in the memo section for proper identification. This will help ensure your payment aligns with the Arkansas child support chart withholding limits and gets credited correctly.