Transfer On Death Deed Form Arkansas With Signature Required

Description

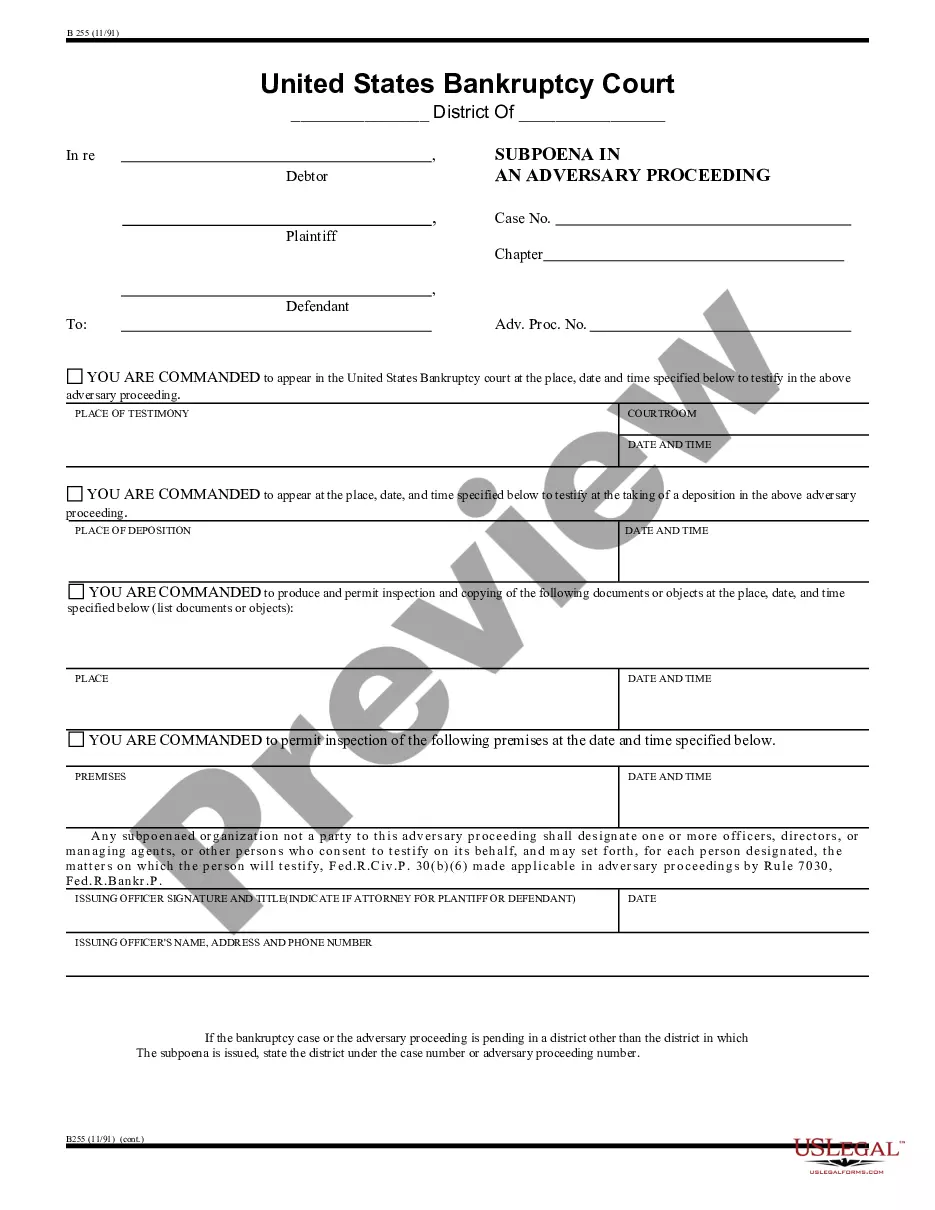

How to fill out Arkansas Beneficiary Or Transfer On Death Deed Or TOD - Husband And Wife Or Two Individuals To Husband And Wife Or Two Individuals?

Legal document management can be overpowering, even for knowledgeable professionals. When you are interested in a Transfer On Death Deed Form Arkansas With Signature Required and do not get the time to commit trying to find the correct and up-to-date version, the procedures can be demanding. A strong online form library could be a gamechanger for anyone who wants to take care of these situations successfully. US Legal Forms is a market leader in online legal forms, with over 85,000 state-specific legal forms available anytime.

With US Legal Forms, you may:

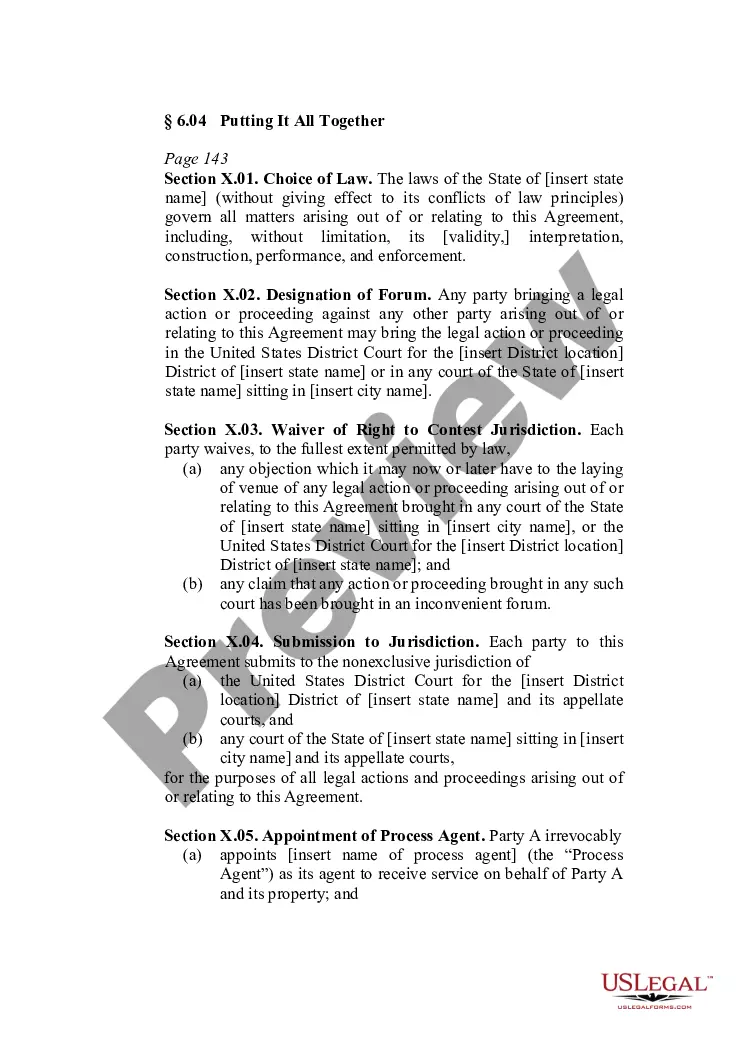

- Access state- or county-specific legal and organization forms. US Legal Forms handles any needs you could have, from personal to organization paperwork, all in one spot.

- Employ innovative tools to accomplish and handle your Transfer On Death Deed Form Arkansas With Signature Required

- Access a resource base of articles, guides and handbooks and resources related to your situation and requirements

Save effort and time trying to find the paperwork you need, and make use of US Legal Forms’ advanced search and Review feature to locate Transfer On Death Deed Form Arkansas With Signature Required and get it. In case you have a subscription, log in in your US Legal Forms account, search for the form, and get it. Take a look at My Forms tab to see the paperwork you previously downloaded as well as handle your folders as you can see fit.

If it is the first time with US Legal Forms, create a free account and have unlimited access to all benefits of the platform. Listed below are the steps to consider after getting the form you want:

- Validate it is the correct form by previewing it and reading through its information.

- Be sure that the sample is acknowledged in your state or county.

- Pick Buy Now when you are all set.

- Choose a monthly subscription plan.

- Pick the file format you want, and Download, complete, eSign, print and send your document.

Take advantage of the US Legal Forms online library, supported with 25 years of expertise and trustworthiness. Change your daily document management in a smooth and intuitive process today.

Form popularity

FAQ

A beneficiary who receives real estate through a transfer on death deed becomes personally liable for the debts of the dead property owner without proper counsel from an estate planning professional or a title company. The beneficiary becomes liable to potential financial obligations as a result.

A transfer on death (TOD) bank account is a popular estate planning tool designed to avoid probate court by naming a beneficiary. However, it doesn't avoid taxes.

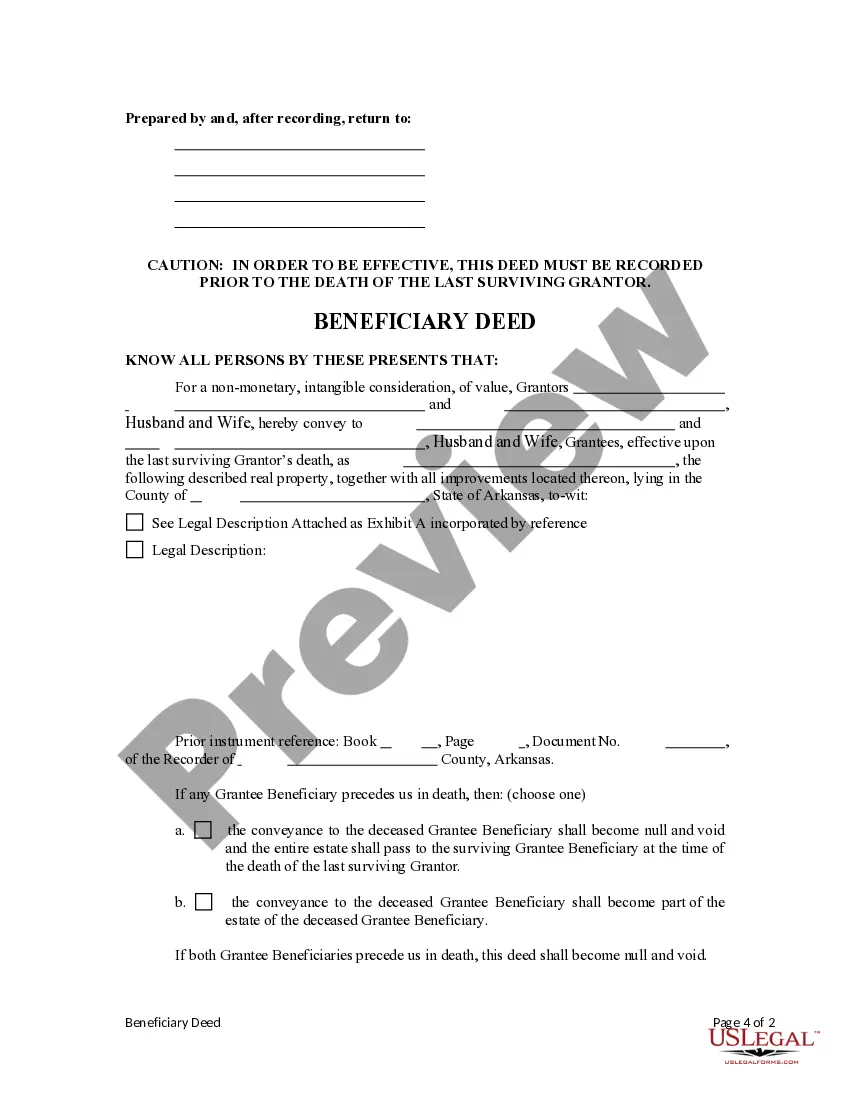

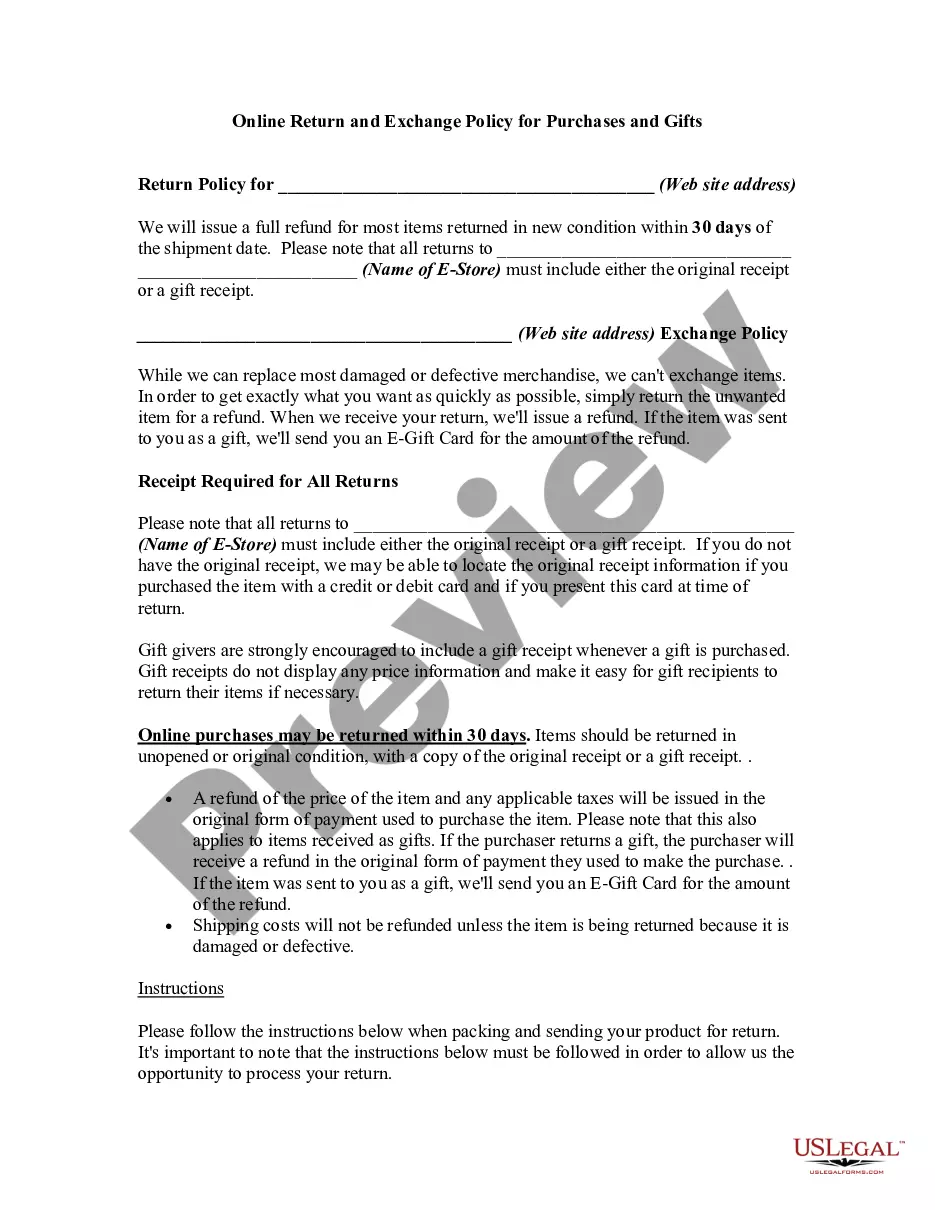

To get title to the property after your death, the beneficiary must take a few administrative steps. The beneficiary can call the county clerk, circuit clerk, or recorder's office for details, but the process will likely require recording a certified copy of the death certificate. No probate is necessary.

In Arkansas, every legal transfer of real property requires a Real Property Transfer Tax Affidavit form. This form should be completed by the grantee and filed with the instrument (A.C.A. 26-60-107). When real property is conveyed as a gift, no transfer tax is due.

When transferring property, a seller (often called the grantor), writes out a deed, transferring property to the buyer (often called the grantee). The deed is then recorded with the recorder in the county in which the property is located.