This form is a Transfer on Death Deed, or Beneficiary Deed, where the Grantor are two individuals or hsuband and wife and the Grantees are two individuals or husband and wife. If one Grantee Beneficiary fails to survive the Grantors their interest goes to their estate or the surviving Grantee Beneficiary. If neither Grantee Beneficiary survive the Grantors, the transfer fails and the deed is null and void. This transfer is revocable by Grantors until death and effective only if filed prior to the surving Grantor's death. This deed complies with all state statutory laws.

Transfer On Death Deed Form Arkansas With Florida

Description

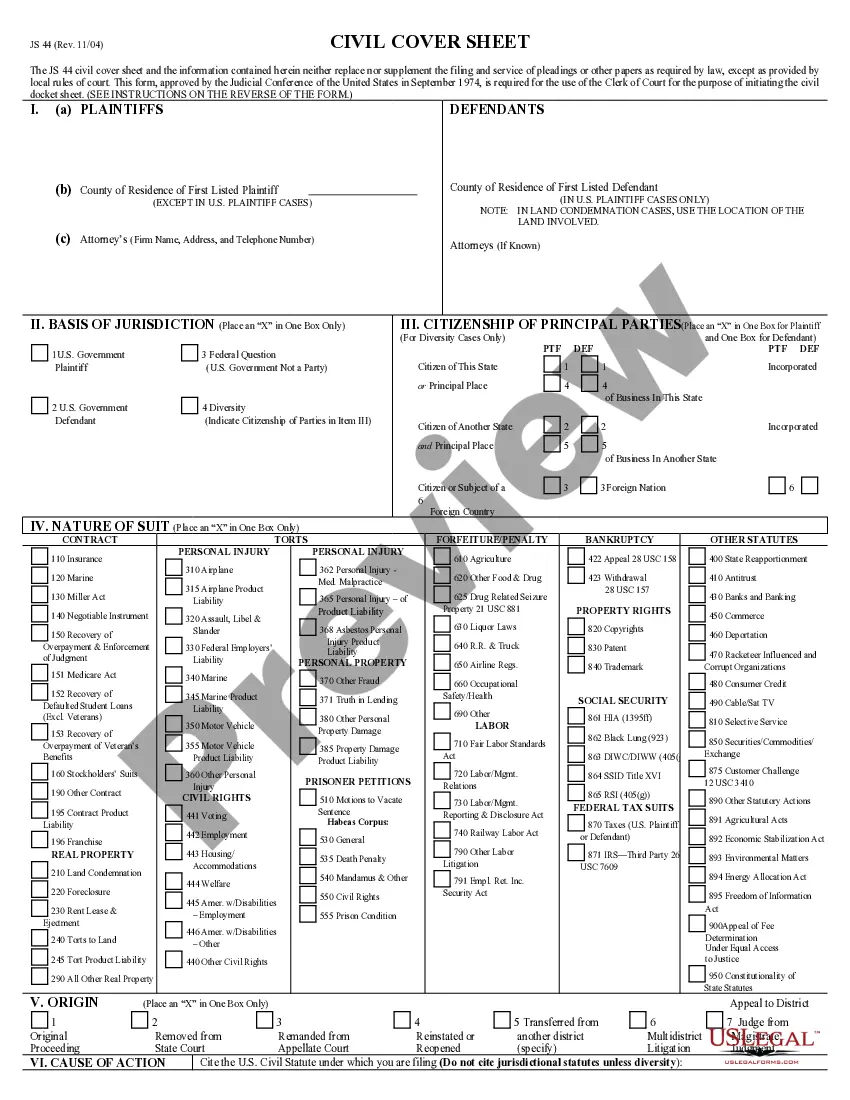

How to fill out Arkansas Beneficiary Or Transfer On Death Deed Or TOD - Husband And Wife Or Two Individuals To Husband And Wife Or Two Individuals?

Using legal templates that meet the federal and local laws is essential, and the internet offers many options to pick from. But what’s the point in wasting time searching for the appropriate Transfer On Death Deed Form Arkansas With Florida sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the biggest online legal catalog with over 85,000 fillable templates drafted by lawyers for any business and life situation. They are easy to browse with all files collected by state and purpose of use. Our professionals stay up with legislative changes, so you can always be confident your paperwork is up to date and compliant when obtaining a Transfer On Death Deed Form Arkansas With Florida from our website.

Obtaining a Transfer On Death Deed Form Arkansas With Florida is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the preferred format. If you are new to our website, follow the instructions below:

- Examine the template using the Preview option or via the text outline to make certain it fits your needs.

- Look for a different sample using the search function at the top of the page if needed.

- Click Buy Now when you’ve found the correct form and select a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Select the best format for your Transfer On Death Deed Form Arkansas With Florida and download it.

All documents you find through US Legal Forms are reusable. To re-download and fill out previously obtained forms, open the My Forms tab in your profile. Enjoy the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

In particular, Florida law does not provide for transfer on death deeds. Florida has not adopted the Uniform Real Property Transfer on Death Act, which would otherwise allow people to use a transfer on death deed for their property. However, a lady bird deed accomplishes the same thing as a TOD deed.

Any assets that pass to a beneficiary as a result of a TOD registration will be outside the probate estate and therefore avoid probate.

Arkansas allows you to leave real estate with transfer-on-death deeds. These deeds are also called beneficiary deeds. You sign and record the deed now, but it doesn't take effect until your death.

When transferring property, a seller (often called the grantor), writes out a deed, transferring property to the buyer (often called the grantee). The deed is then recorded with the recorder in the county in which the property is located.

To get title to the property after your death, the beneficiary must take a few administrative steps. The beneficiary can call the county clerk, circuit clerk, or recorder's office for details, but the process will likely require recording a certified copy of the death certificate. No probate is necessary.