Ar Deed Beneficiary Without Social Security Number

Description

How to fill out Arkansas Transfer On Death Deed Or TOD - Beneficiary Deed For One Individual To Two Individuals?

Using legal document samples that meet the federal and regional laws is a matter of necessity, and the internet offers numerous options to pick from. But what’s the point in wasting time searching for the correctly drafted Ar Deed Beneficiary Without Social Security Number sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the biggest online legal catalog with over 85,000 fillable templates drafted by lawyers for any professional and life situation. They are simple to browse with all documents organized by state and purpose of use. Our experts keep up with legislative updates, so you can always be sure your form is up to date and compliant when getting a Ar Deed Beneficiary Without Social Security Number from our website.

Obtaining a Ar Deed Beneficiary Without Social Security Number is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the preferred format. If you are new to our website, adhere to the steps below:

- Examine the template using the Preview option or through the text description to make certain it meets your needs.

- Browse for a different sample using the search tool at the top of the page if necessary.

- Click Buy Now when you’ve located the correct form and choose a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Pick the format for your Ar Deed Beneficiary Without Social Security Number and download it.

All templates you find through US Legal Forms are reusable. To re-download and complete earlier purchased forms, open the My Forms tab in your profile. Take advantage of the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

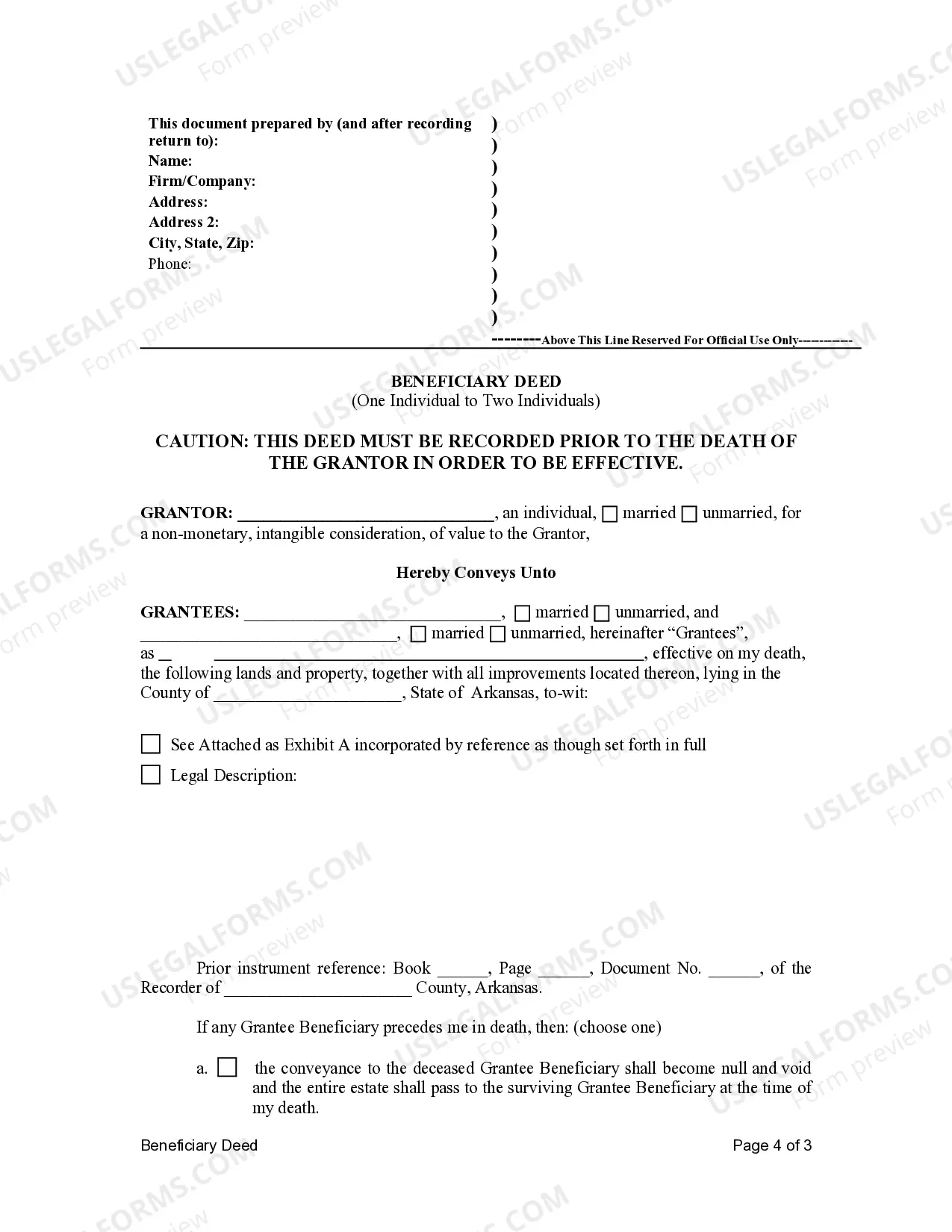

In Arkansas, real estate can be transferred via a TOD deed, otherwise known as a beneficiary deed. This deed allows a property owner to designate a beneficiary who will automatically inherit the property upon the owner's death, avoiding probate.

Spouse, partner, children, parents, brothers and sisters, business partner, key employee, trust and charitable organization.

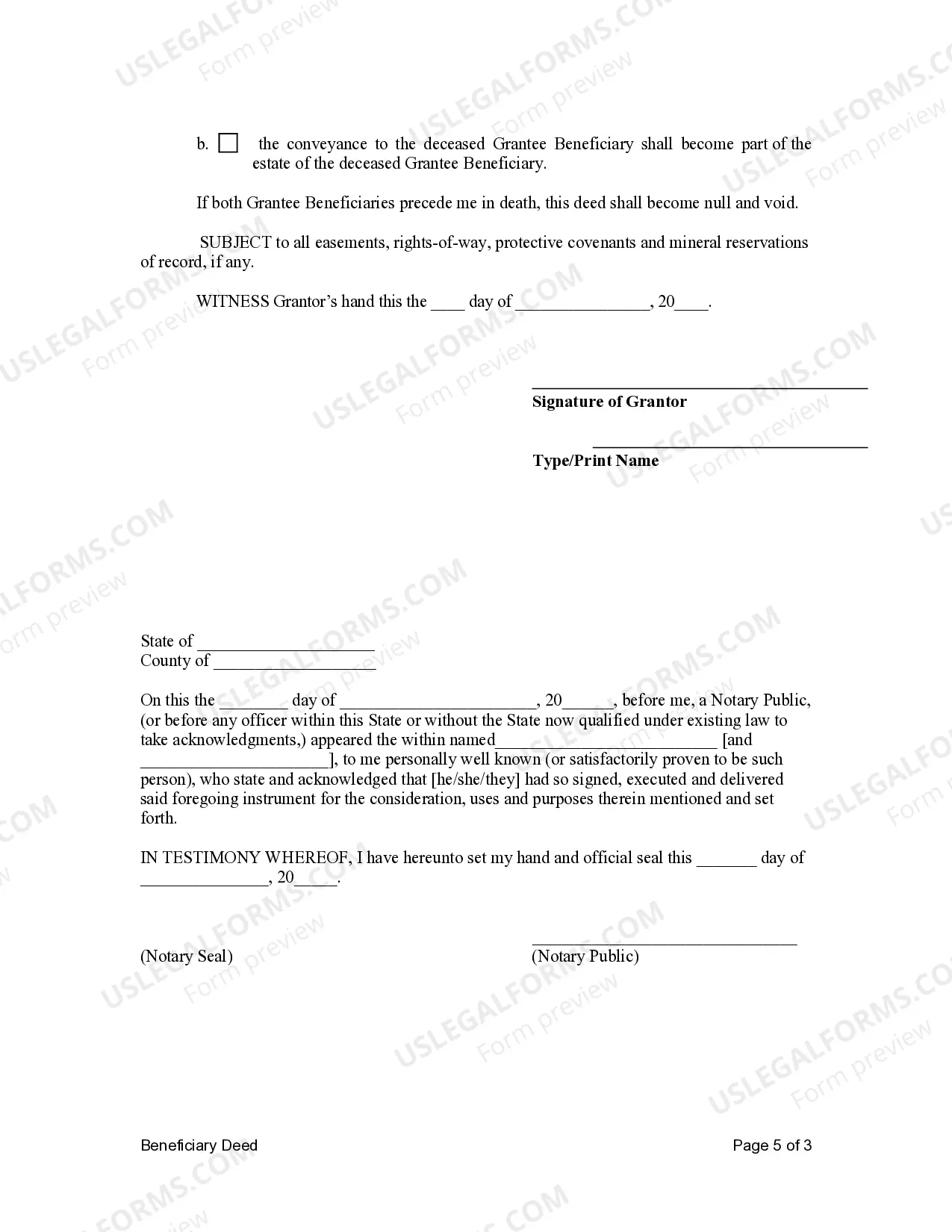

Arkansas Beneficiary (Transfer-on-Death) Deed Code Ann. section 18-12-608.) You must sign the deed and get your signature notarized, and then record (file) the deed with the county recorder's office before your death. Otherwise, it won't be valid.

Most beneficiary designations will require you to provide a person's full legal name and their relationship to you (spouse, child, mother, etc.). Some beneficiary designations also include information like mailing address, email, phone number, date of birth and Social Security number.

What if I don't have the social security number for my beneficiary? Many insurance companies do not require a beneficiary's SSN on the application however, they will require the beneficiary's SSN, DOB, and address when it comes to paying a death benefit.