Ar Deed Beneficiary With Distribution

Description

How to fill out Arkansas Transfer On Death Deed Or TOD - Beneficiary Deed For One Individual To Two Individuals?

The Ar Deed Beneficiary With Distribution you see on this page is a reusable formal template drafted by professional lawyers in line with federal and local laws and regulations. For more than 25 years, US Legal Forms has provided people, organizations, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal scenario. It’s the fastest, easiest and most trustworthy way to obtain the paperwork you need, as the service guarantees the highest level of data security and anti-malware protection.

Acquiring this Ar Deed Beneficiary With Distribution will take you just a few simple steps:

- Browse for the document you need and check it. Look through the file you searched and preview it or check the form description to ensure it fits your needs. If it does not, make use of the search option to get the appropriate one. Click Buy Now when you have located the template you need.

- Subscribe and log in. Choose the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to proceed.

- Get the fillable template. Select the format you want for your Ar Deed Beneficiary With Distribution (PDF, Word, RTF) and save the sample on your device.

- Fill out and sign the paperwork. Print out the template to complete it manually. Alternatively, use an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a valid.

- Download your paperwork one more time. Make use of the same document again whenever needed. Open the My Forms tab in your profile to redownload any previously downloaded forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s situations at your disposal.

Form popularity

FAQ

Hear this out loud PauseAt your death, the real estate goes automatically to the person you named to inherit it (your "grantee" or "beneficiary"), without the need for probate court proceedings. (Ark. Code Ann. § 18-12-608.)

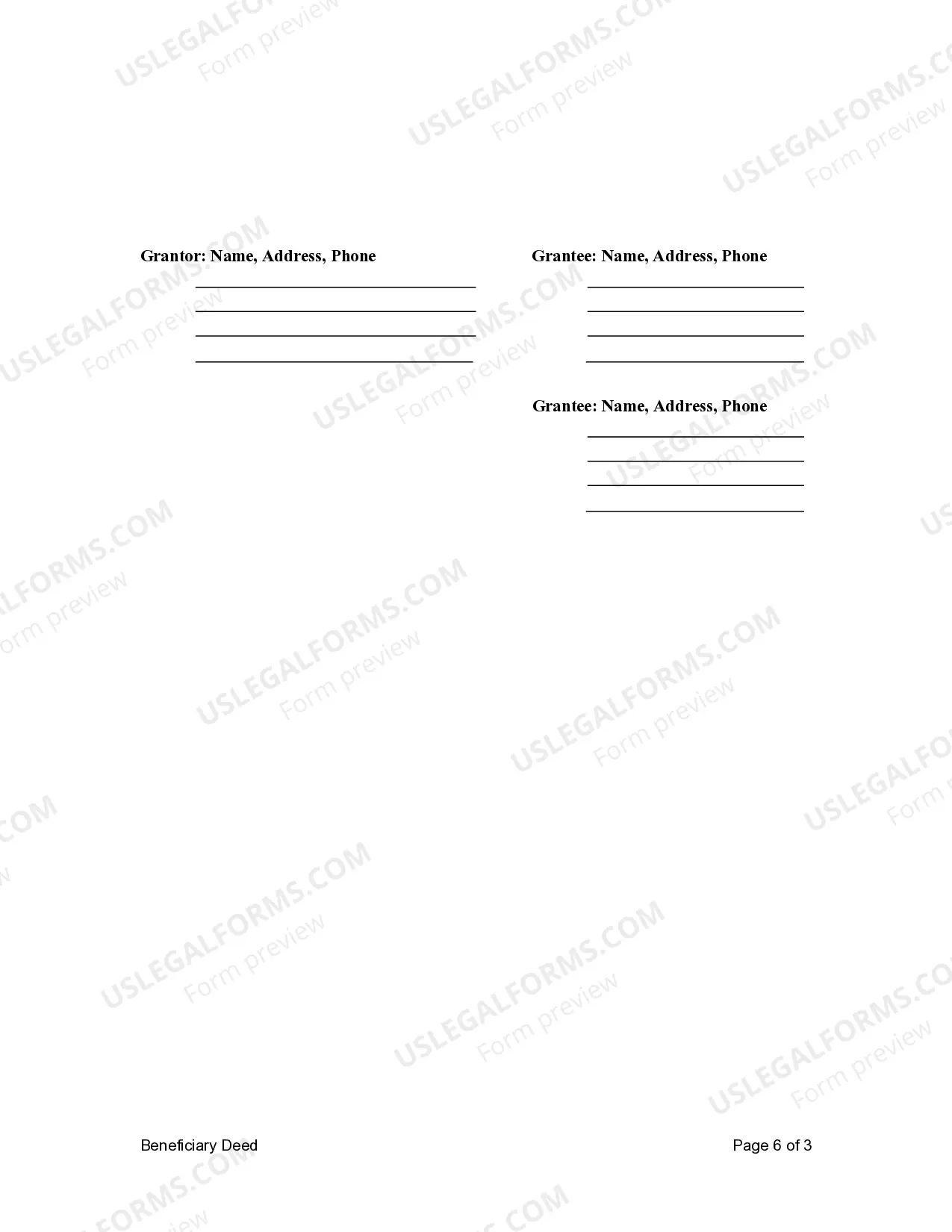

Hear this out loud PauseWhen transferring property, a seller (often called the grantor), writes out a deed, transferring property to the buyer (often called the grantee). The deed is then recorded with the recorder in the county in which the property is located.

When the first spouse dies, the surviving spouse will automatically own the whole property. If you made a beneficiary deed together, it will take effect only when the second spouse has died. If you made one alone, it will take effect at your death only if your spouse dies before you do.

Hear this out loud PauseA beneficiary deed is a type of deed that transfers property to a beneficiary. Most deeds transfer property in the present. In contrast, a beneficiary deed can be used to make arrangements today to pass down property in the future.

Hear this out loud PauseArkansas Beneficiary (Transfer-on-Death) Deed Code Ann. section 18-12-608.) You must sign the deed and get your signature notarized, and then record (file) the deed with the county recorder's office before your death. Otherwise, it won't be valid.