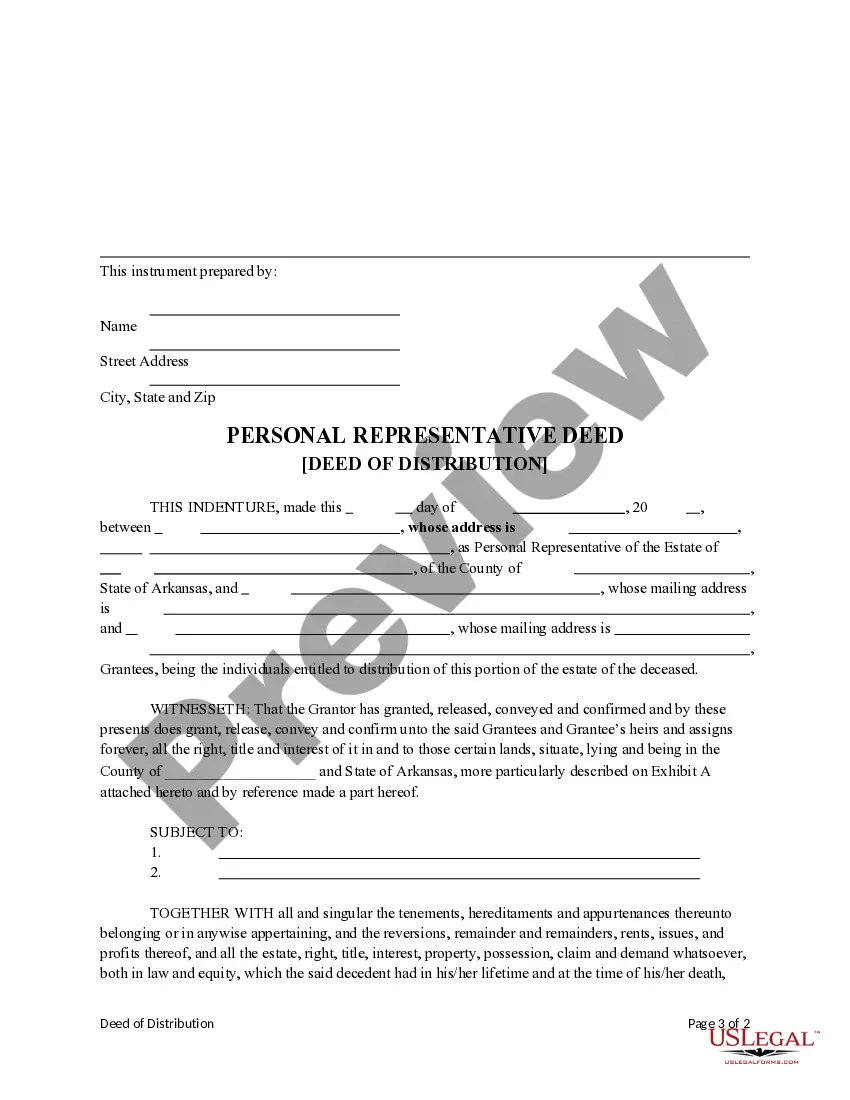

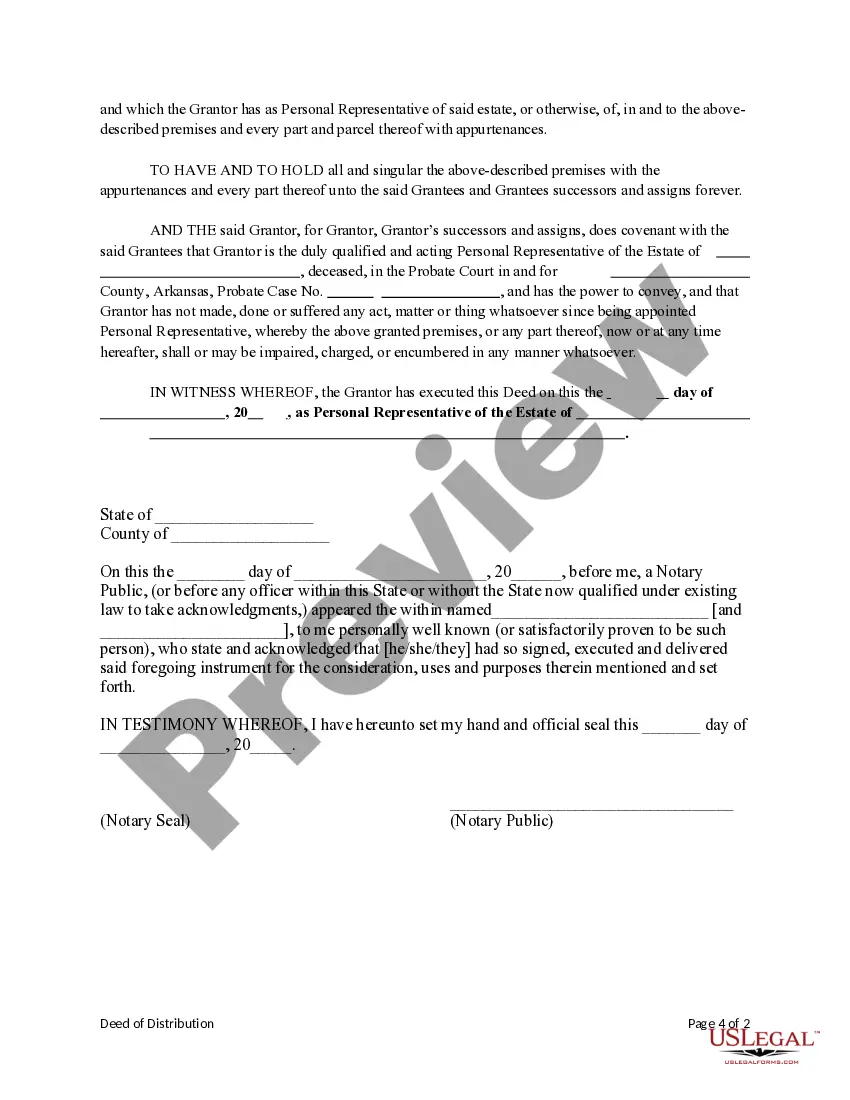

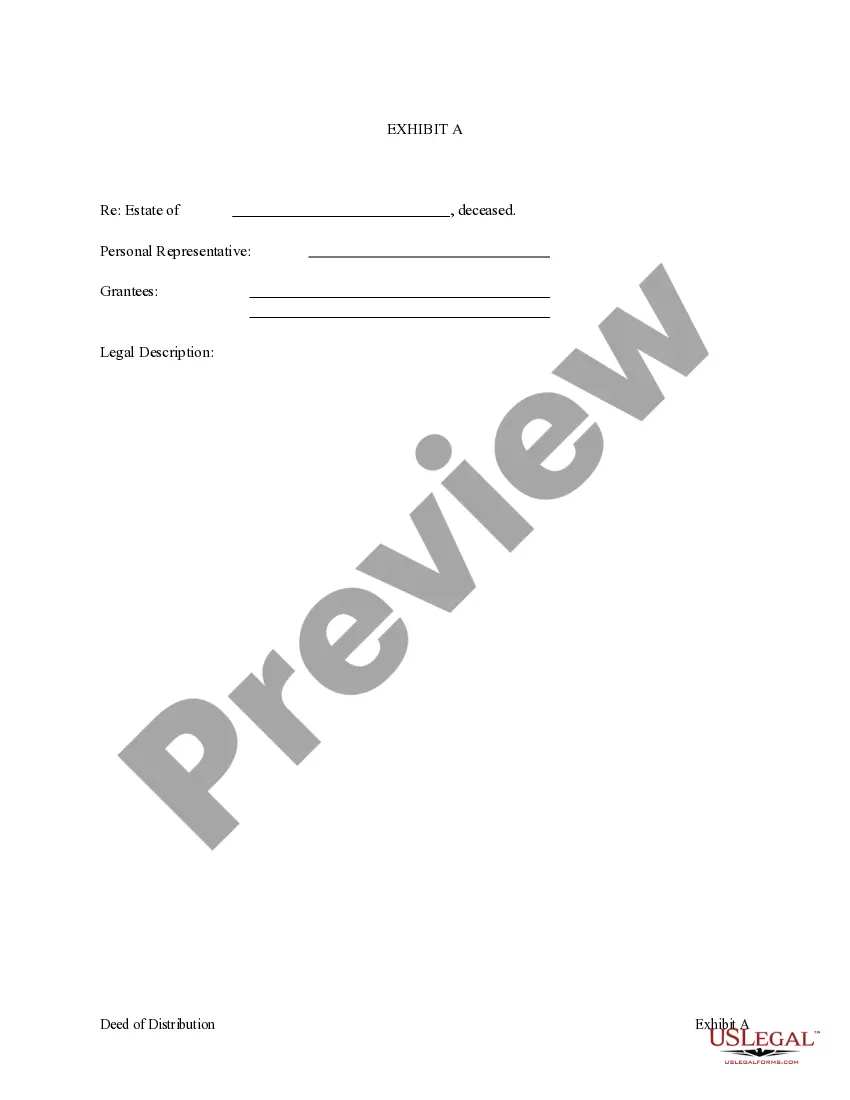

This form is a Deed of Distribution where the Grantor is the personal representative of an estate and the Grantees are two beneficiaries of the estate. Grantor conveys the described property to the Grantees. This deed complies with all state statutory laws.

Deed Of Distribution Example With Solutions

Description

How to fill out Deed Of Distribution Example With Solutions?

When you need to file a Deed of Distribution Example with Solutions that adheres to your local state's regulations, there may be numerous options to choose from.

There's no need to scrutinize every form to guarantee it fulfills all the legal requirements if you are a US Legal Forms member.

It is a trustworthy service that can assist you in obtaining a reusable and current template on any subject.

Explore the suggested page and verify it for conformity with your requirements. Utilize the Preview mode and examine the form description if available. Search for another sample using the Search field in the header if necessary. Click Buy Now upon finding the correct Deed of Distribution Example with Solutions. Select the most appropriate subscription plan, sign in to your account, or create a new one. Purchase a subscription (PayPal and credit card options are available). Download the sample in your preferred format (PDF or DOCX). Print the document or complete it electronically through an online editor. Obtaining professionally drafted official documents is made easy with US Legal Forms. Additionally, Premium users can take advantage of comprehensive integrated tools for online PDF editing and signing. Give it a try today!

- US Legal Forms is the most extensive online directory with a collection of over 85,000 ready-to-use documents for business and personal legal situations.

- All templates are verified to comply with each state's laws.

- Thus, when downloading the Deed of Distribution Example with Solutions from our platform, you can be assured that you have a legitimate and updated document.

- Acquiring the necessary sample from our platform is exceptionally straightforward.

- If you already possess an account, simply Log In to the system, ensure your subscription is active, and save the chosen file.

- In the future, you can access the My documents tab in your profile to retrieve the Deed of Distribution Example with Solutions at any time.

- If it is your first time using our library, please follow the instructions below.

Form popularity

FAQ

The best deed to avoid probate is often a Revocable Living Trust, as it allows you to maintain control over your assets while ensuring a smooth transition upon your death. However, you may also consider a Deed of distribution, which can specify how your property is distributed without the need for probate court interference. US Legal Forms offers various Deed of distribution examples with solutions that can assist in selecting the best option for your specific needs.

To avoid probate in the UK, one effective method is to use a trust or joint ownership, which allows property to pass directly to beneficiaries without going through probate. Additionally, gifting assets during your lifetime can reduce the value of your estate. Implementing a Deed of distribution example with solutions may also help clarify asset distribution among heirs, consequently bypassing the probate process. Always consult a legal expert for tailored advice.

To fill out a SC Deed of distribution, you first need to gather all relevant information regarding the estate and its beneficiaries. Next, specify the property involved, detailing how it should be distributed among the heirs. It's important to ensure that you comply with South Carolina laws while drafting this deed. For a comprehensive Deed of distribution example with solutions, consider resources from US Legal Forms that provide templates and guidelines.

The purpose of a deed of distribution in South Carolina is to legally transfer property from a deceased individual to their heirs or beneficiaries. This document acts as a formal record of the distribution process, ensuring that all parties acknowledge their rights to the property. It streamlines the transfer process, avoiding complications and disputes. For guidance, consider using a deed of distribution example with solutions.

The weakest type of deed is typically a quitclaim deed. This type of deed transfers whatever interest the grantor may have in the property, without any warranties or guarantees. This means that if there are any encumbrances or issues with the title, the new owner may face unexpected problems. For more robust solutions, look at deed of distribution examples that offer more security in property transfer.

To fill out a South Carolina deed of distribution, you must provide the decedent's information, details of the heirs, and describe the distributed property. Clearly state how the property is divided among the beneficiaries according to the will or state law. You can find helpful resources, including a deed of distribution example with solutions, to help ensure that you complete this document correctly.

The best deed to avoid probate is often a transfer on death (TOD) deed or a life estate deed. These types of deeds allow property to pass directly to beneficiaries upon your death without going through the probate process. In South Carolina, using a deed of distribution can also help simplify the transfer of assets after death. Ensure you explore a deed of distribution example with solutions for clarity on how to proceed.

Filling out a quit claim deed in South Carolina requires basic information about the property and the parties involved. You'll need to list the current owner's name, the new owner's name, and describe the property adequately. Be sure to include a legal description, which is often found on the previous deed. For specific templates, you can refer to a deed of distribution example with solutions, which simplifies the process.

To transfer a property deed from a deceased relative in South Carolina, you will typically need to file a deed of distribution. This document acts as proof that the new owner has received the property as part of the estate. It's important to gather necessary documents, such as the death certificate and a copy of the will. You can find a detailed deed of distribution example with solutions to guide you through this process.

A deed of distribution is a legal document that outlines how property is distributed after a person's death. It effectively transfers ownership of assets to beneficiaries, simplifying the estate settlement process. For comprehensive guidance, consider using US Legal Forms, where you can find clear examples and solutions for a deed of distribution.