Arkansas Foreign Llc Registration With Irs

Description

How to fill out Arkansas Registration Of Foreign Corporation?

Obtaining legal templates that adhere to federal and state regulations is essential, and the internet provides a plethora of choices to choose from.

However, what’s the use in spending time searching for the correctly crafted Arkansas Foreign Llc Registration With Irs example online when the US Legal Forms digital repository already has such documents gathered in one place.

US Legal Forms is the premier online legal repository featuring over 85,000 editable templates created by legal professionals for any business and personal circumstance.

Review the template using the Preview option or through the written description to verify it meets your requirements.

- They are straightforward to navigate, with all documents organized by state and intended usage.

- Our experts keep abreast of legislative updates, ensuring that your form remains current and compliant when acquiring an Arkansas Foreign Llc Registration With Irs from our site.

- Acquiring an Arkansas Foreign Llc Registration With Irs is swift and effortless for both existing and new users.

- If you already have an account with a valid subscription, Log In and preserve the document sample you require in the appropriate format.

- If you are new to our website, follow the instructions below.

Form popularity

FAQ

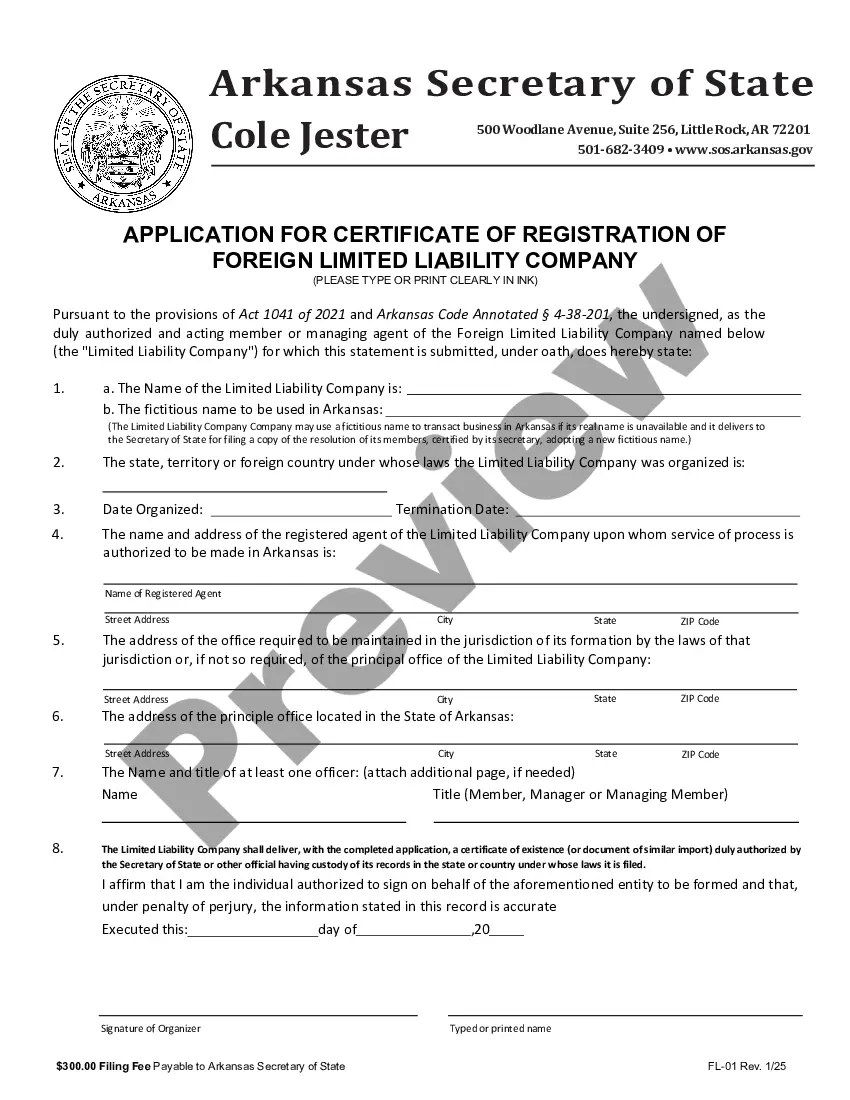

An Arkansas Foreign LLC is an LLC that does business in Arkansas but was formed in another state or jurisdiction. When a foreign LLC wants to do business in Arkansas, it must register with the Arkansas Secretary of State and pay the $300 state filing fee ($270 online).

To be your own LLC Registered Agent, you need to have a physical address in Arkansas. This is because Registered Agents must have a physical street address in the state. PO Boxes are not allowed. (Note: The address of a Registered Agent is the Registered Office.

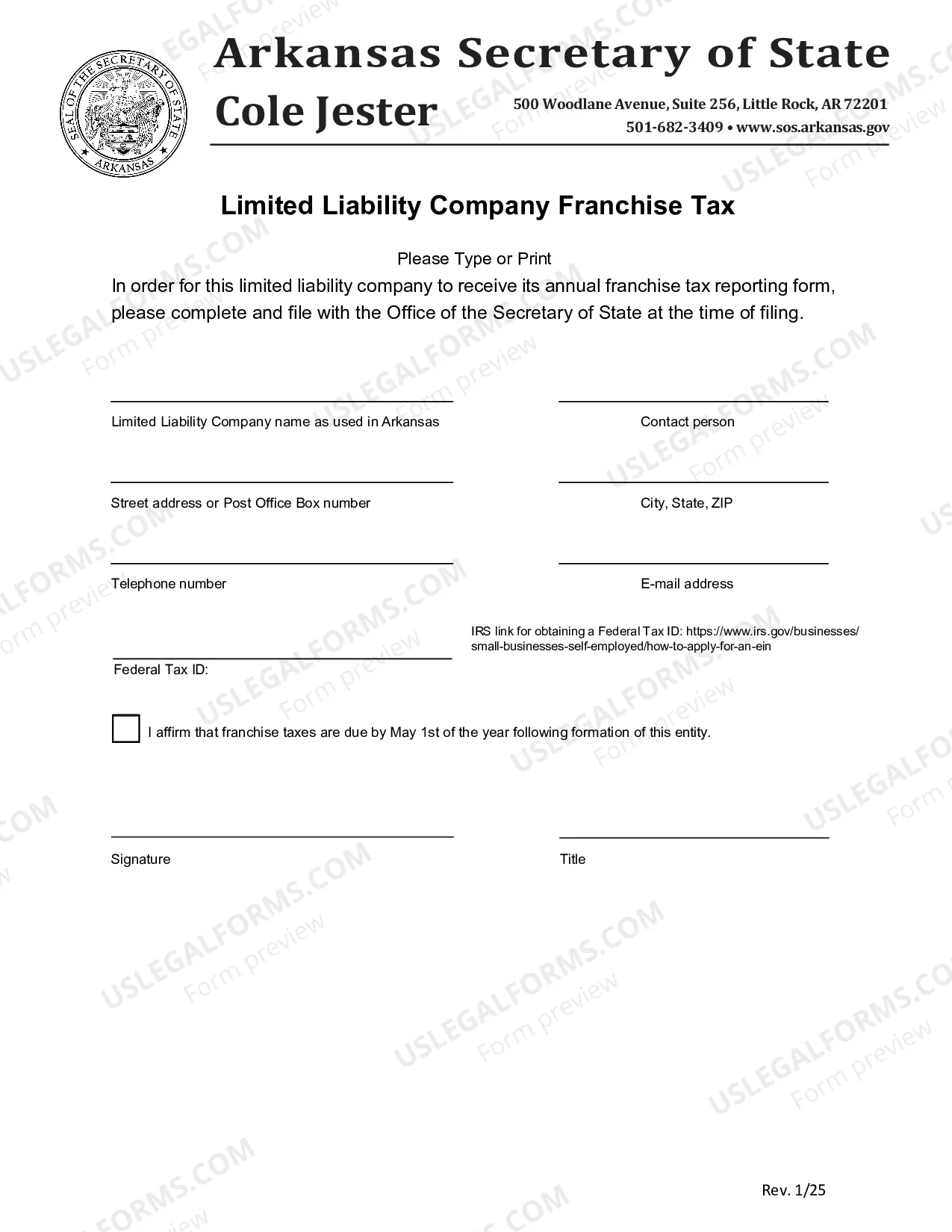

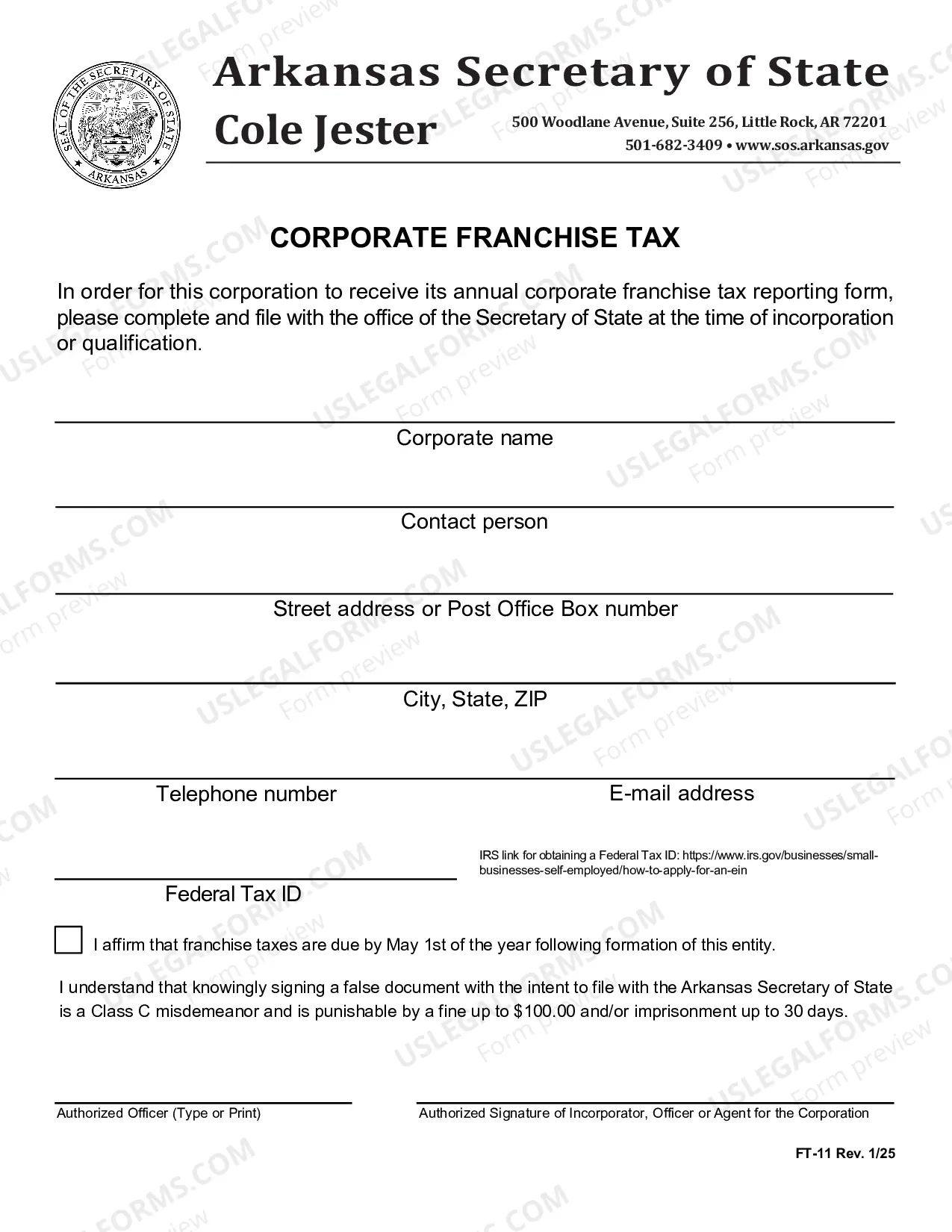

File Your Business Taxes Businesses that operate within Arkansas are required to register for one or more tax-specific identification numbers, licenses or permits, including income tax withholding, sales and use tax (seller's permit), and unemployment insurance tax.

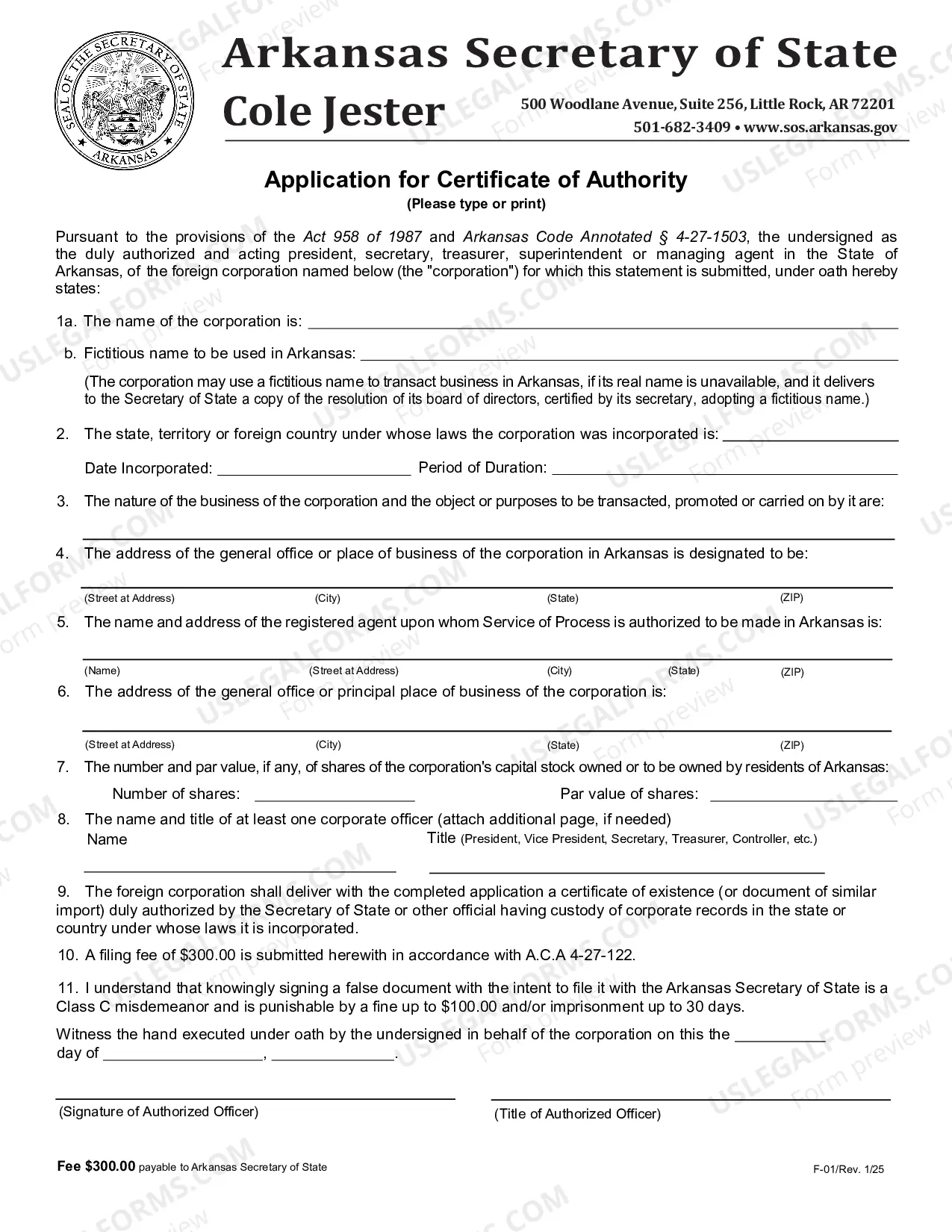

An ?Application for Certificate of Authority? is filed along with an original certificate of existence (?good standing?) from the ?home? state. The filing fee is $300.00 for business corporations and $300.00 for nonprofit corporations and can be filed online.

Yes, you can be your own registered agent in Arkansas. With that said, however, after considering the registered agent requirements most business owners elect to hire a registered agent service instead.