Life Estate Deed With Full Powers

Description

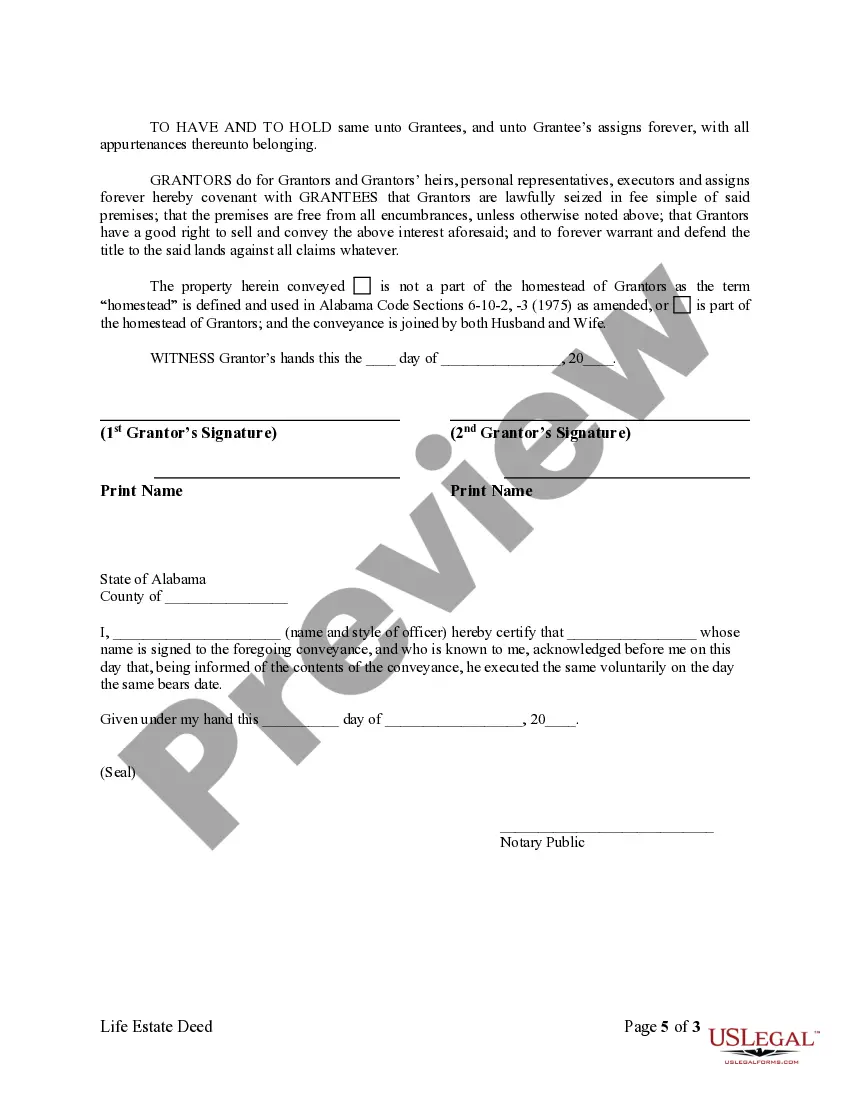

How to fill out Alabama Warranty Deed For Retention Of Life Estate (Husband And Wife To Husband And Wife)?

- Log into your US Legal Forms account if you are an existing user. Ensure your subscription is active; if it’s not, renew it to access your documents.

- Preview the form to confirm it is the correct life estate deed with full powers. Verify that it meets your local legal requirements.

- If you need to search for additional templates, utilize the Search tab to find the appropriate form tailored to your needs.

- Select and purchase the document by clicking the Buy Now button, then choose your preferred subscription plan.

- Complete your purchase by entering your payment information, whether using a credit card or PayPal.

- Download the completed form to your device and access it later in the My Forms section of your account whenever needed.

Once you've obtained your life estate deed with full powers, you can begin using it for your intended purpose. US Legal Forms not only offers a robust library of over 85,000 forms but also connects you with legal experts for assistance.

Take control of your property rights today by utilizing US Legal Forms to create your life estate deed with full powers. Get started now!

Form popularity

FAQ

A life estate deed with full powers allows you to retain use and control of your property during your lifetime, while also ensuring that your assets pass directly to your chosen beneficiaries after you pass away. This can simplify the transfer of property, avoiding probate and potential delays. Additionally, by using this deed, you retain the ability to make decisions about the property, such as renting or selling, while providing peace of mind about the property's future. Overall, a life estate deed with full powers offers flexibility, control, and efficiency in managing your estate.

Yes, a life estate deed with full powers typically supersedes a will when it comes to the transferred property. The life estate deed establishes rights that take precedence over any instructions in a will regarding that property. Therefore, if a will directs different ownership, the life estate will maintain its priority. To ensure clarity in estate planning, consider using resources from US Legal Forms to manage these legal documents effectively.

Selling a property with a life estate deed with full powers is possible, but it requires careful planning. The property owner must understand the rights given to both the life tenant and the remainderman. Although the life tenant can sell their interest, they cannot sell the entire property without the remainderman's consent. US Legal Forms offers helpful resources that outline the steps involved in selling such a property.

Yes, you can undo a life estate deed with full powers, but the process can be complex. Typically, you will need to consult with a legal professional to evaluate your options. If all parties involved agree, a formal agreement can help facilitate the reversal. Using a reliable service like US Legal Forms can provide you with the necessary documents and guidance to navigate this situation.

The negatives of a life estate deed with full powers include limited flexibility and potential confusion regarding property management. Once established, making changes can be complicated and might require the consent of all parties involved. Furthermore, life estates can impact tax considerations and real estate transactions.

A will cannot override a life estate deed with full powers. The life estate arrangement establishes a legal claim to the property that lasts until the life tenant's death. Thus, even if you name different heirs in your will, the life estate still takes precedence concerning the property's transfer.

People create life estates for several reasons, primarily to control property while ensuring it transfers to beneficiaries after death. A life estate deed with full powers allows individuals to retain certain rights during their lifetime. This arrangement can provide peace of mind and financial security for both the life tenant and the heirs.

Selling a house that is held under a life estate deed with full powers is possible, but it involves some restrictions. The life tenant typically retains the rights to live in or use the property, which may deter potential buyers. It's essential to communicate these details clearly and consult with legal professionals when considering a sale.

Navigating around a life estate deed with full powers can be challenging, but it is possible. You may need to buy out the life tenant’s interest or negotiate with them to relinquish their claim. Seeking legal advice can provide clarity and options for your specific situation.

A life estate deed with full powers can limit your control over the property after your death. The remainder beneficiaries gain ownership once you pass away, making it difficult for you to change your mind about who inherits the property. Additionally, it may complicate your estate planning and can have tax implications, which requires careful consideration.