Mortgage Release Form With Equity

Description

How to fill out Alabama Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

Which is the most reliable service to obtain the Mortgage Release Document With Equity and other current iterations of legal paperwork? US Legal Forms is the solution! It's the finest compilation of legal templates for any purpose.

Each template is professionally drafted and verified for adherence to federal and local laws. They are organized by field and state of applicability, making it effortless to find what you require.

US Legal Forms is an excellent option for anyone needing to manage legal documentation. Premium users benefit even more, as they can electronically fill out and approve previously saved files at any time using the built-in PDF editing tool. Explore it today!

- Veteran users of the platform only need to Log In to the system, verify if their subscription is active, and click the Download button next to the Mortgage Release Document With Equity to obtain it.

- Once saved, the template will be accessible for continued use within the My documents section of your account.

- If you do not have an account with our library yet, here are the steps to follow to create one.

- Document compliance review. Before you obtain any template, ensure that it meets your usage requirements and adheres to your state's or county's regulations. Review the template description and utilize the Preview option if available.

Form popularity

FAQ

What Documents Can You Expect?Canceled promissory note (note). A promissory note states that someone promises to pay somethingin this case, a mortgage.Deed of trust or mortgage deed (deed).Certificate of satisfaction.Final mortgage statement.Loan payoff letter.

A satisfaction of mortgage is a signed document confirming that the borrower has paid off the mortgage in full and that the mortgage is no longer a lien on the property.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.

After you pay off your mortgage, your lender should also return the original note to you. You can also contact the company that paid off your loan to find out if the lien was released. Note that there may be a delay between the time you pay off your mortgage and the release of your lien.

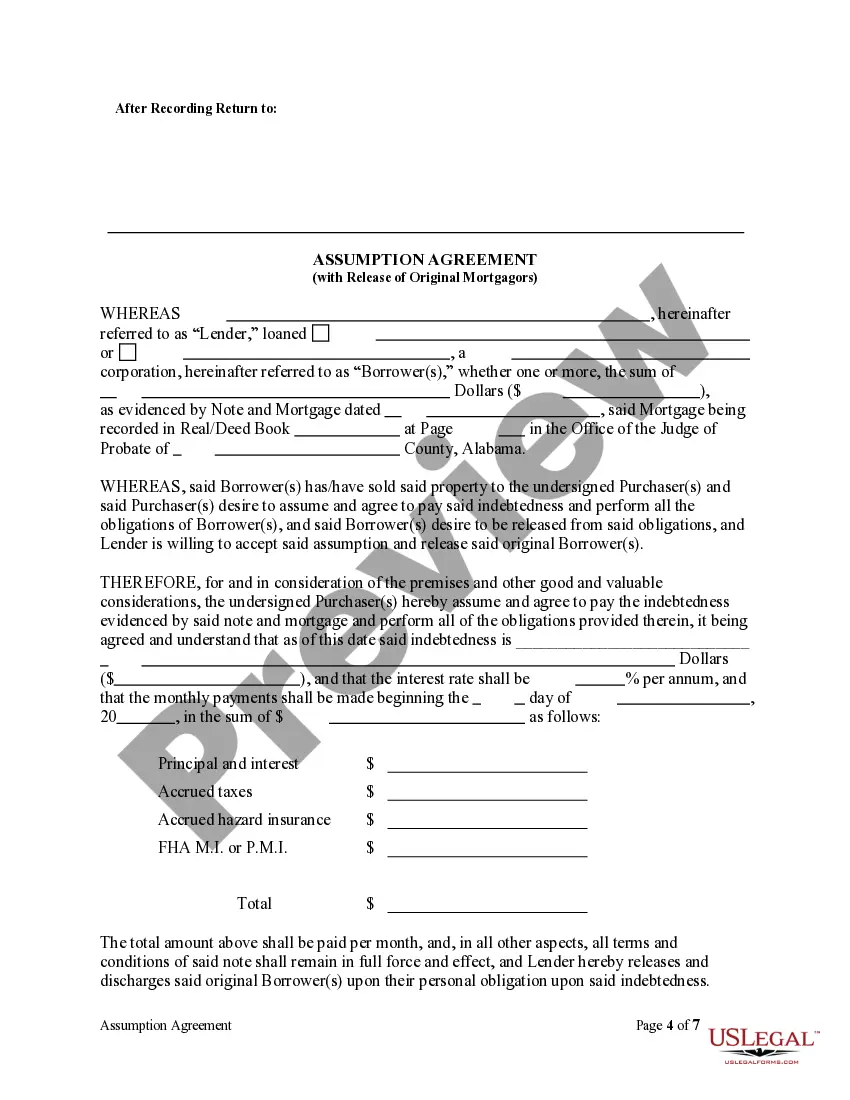

How to Complete a Satisfaction of MortgageStep 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage.Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued.Step 3 File and Record the Form.