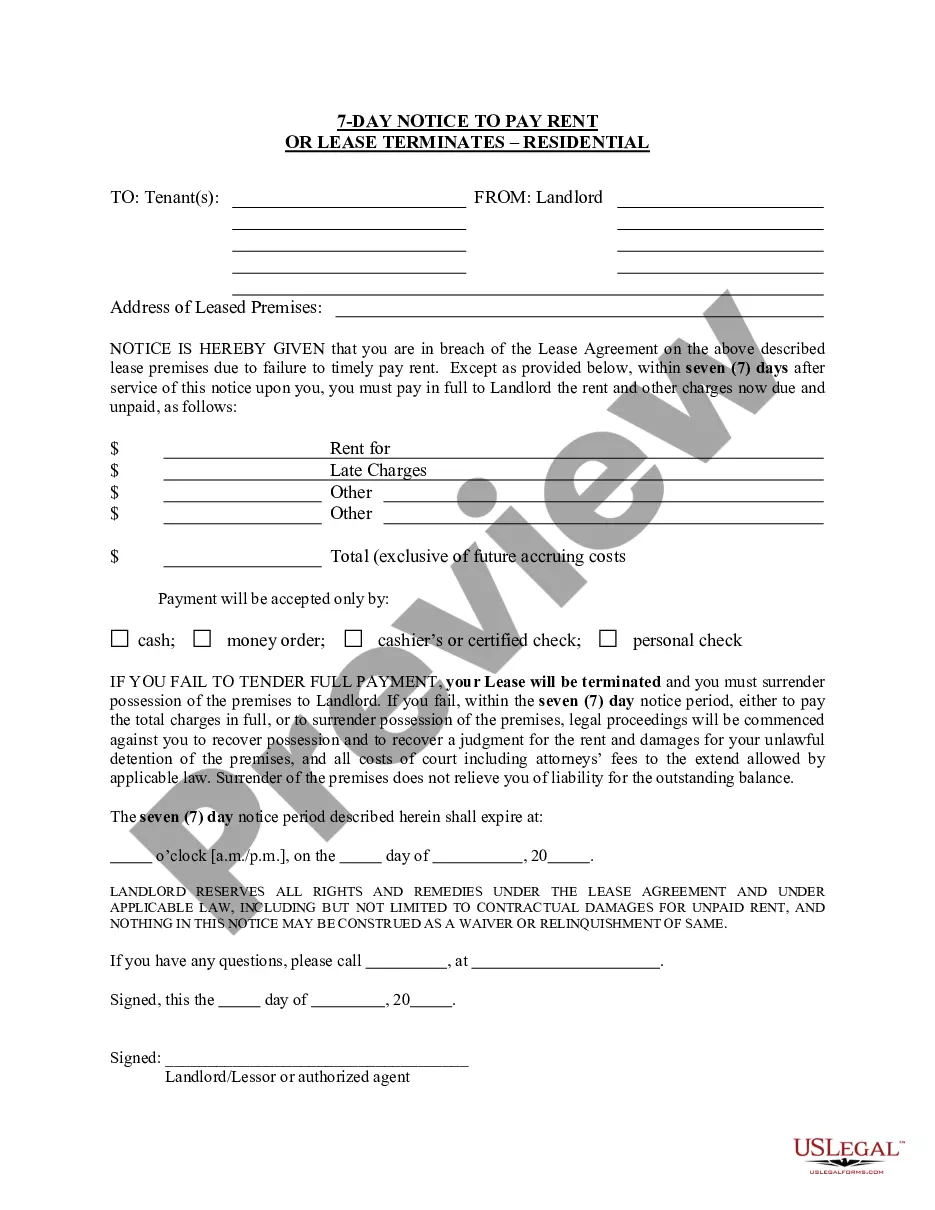

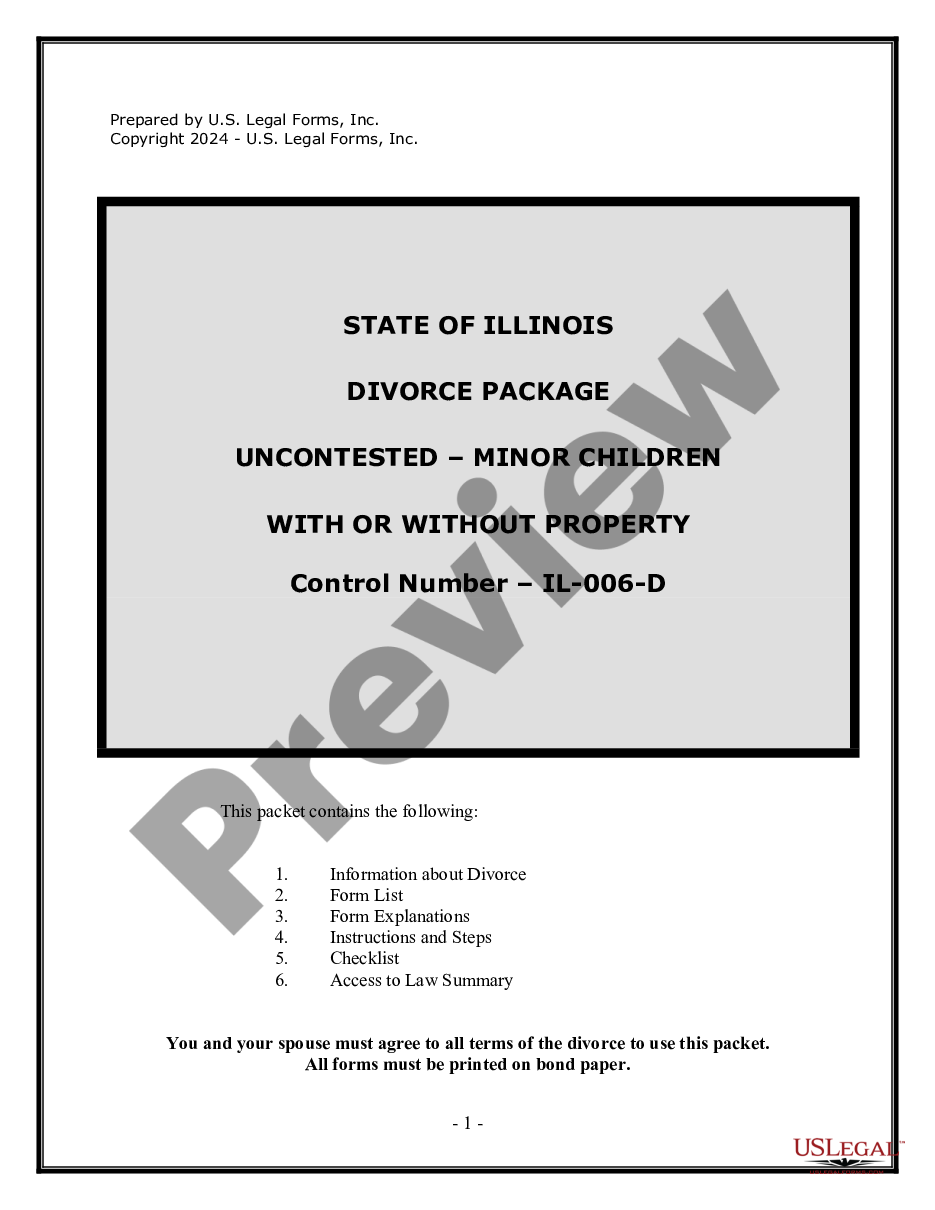

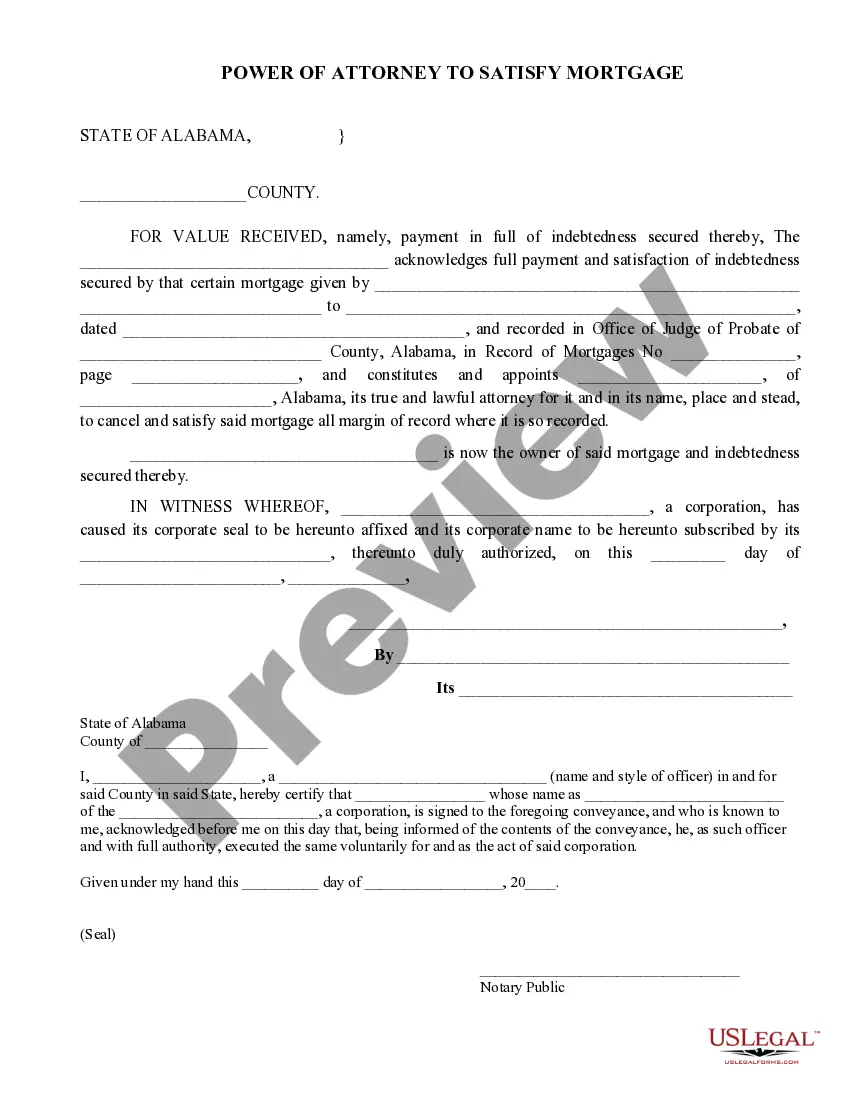

This is a sample of a Power of Attorney to Satisfy Mortgage used to acknowledge that a mortgage obligation has been satisfied and to appoint another to act on behalf of the note holder to cancel and satisfy the mortgage.

Power Of Attorney For A Mortgage Alabama Form

Description

How to fill out Alabama Power Of Attorney To Satisfy Mortgage?

Precisely composed official documents are one of the essential assurances to prevent complications and legal disputes, yet acquiring them without the aid of an attorney may require some time.

Whether you require to swiftly locate an updated Power Of Attorney For A Mortgage Alabama Form or any other forms for employment, family, or business events, US Legal Forms is always available to assist.

The procedure is even simpler for existing users of the US Legal Forms library. If your subscription is active, you only need to Log In to your account and click the Download button adjacent to the chosen file. Furthermore, you can access the Power Of Attorney For A Mortgage Alabama Form whenever needed, as all the documents obtained on the platform are retrievable within the My documents section of your profile. Save time and money on preparing formal documents. Experience US Legal Forms today!

- Verify that the form is appropriate for your situation and area by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar in the header.

- Click Buy Now when you discover the correct template.

- Select the pricing plan, sign in to your account or create a new one.

- Choose your preferred payment option to purchase the subscription plan (via credit card or PayPal).

- Select PDF or DOCX file format for your Power Of Attorney For A Mortgage Alabama Form.

- Click Download, then print the template to complete it or incorporate it into an online editor.

Form popularity

FAQ

One must mention the following details on the Power of Attorney format PDF:The name of the principal.The name of the agent.Signature.Details and legal authorities provided to the agent.Other details depending on the Power of Attorney format for authorized signatories.

1. The mortgaged property can not be dealt with in any way with out the written consent of the mortgagee bank. 2. So, your GPOA holder will not be able to deal with the said mortgaged property legally even if you execute and register a GPOA in his favour authorising him/her to do the said jobs.

While Alabama does not technically require you to get your POA notarized, notarization is very strongly recommended. Under Alabama law, when you sign your POA in the presence of a notary public, you signature is presumed to be genuinemeaning your POA is more ironclad.

The laws governing PoA forms vary in each state; however, in Alabama, your Power of Attorney will require notarization. If your agent will have the ability to handle real estate transactions, the Power of Attorney will need to be signed before a notary and recorded or filed with the county.

How To Get an Alabama Financial Power of Attorney FormChoose an agent. Your agent must be over age 18 and willing and able to act in your best interests.Assign duties to your agent. Your agent's duties depend entirely on you.Hire a notary public.Distribute copies.Revoking a Financial Power of Attorney.