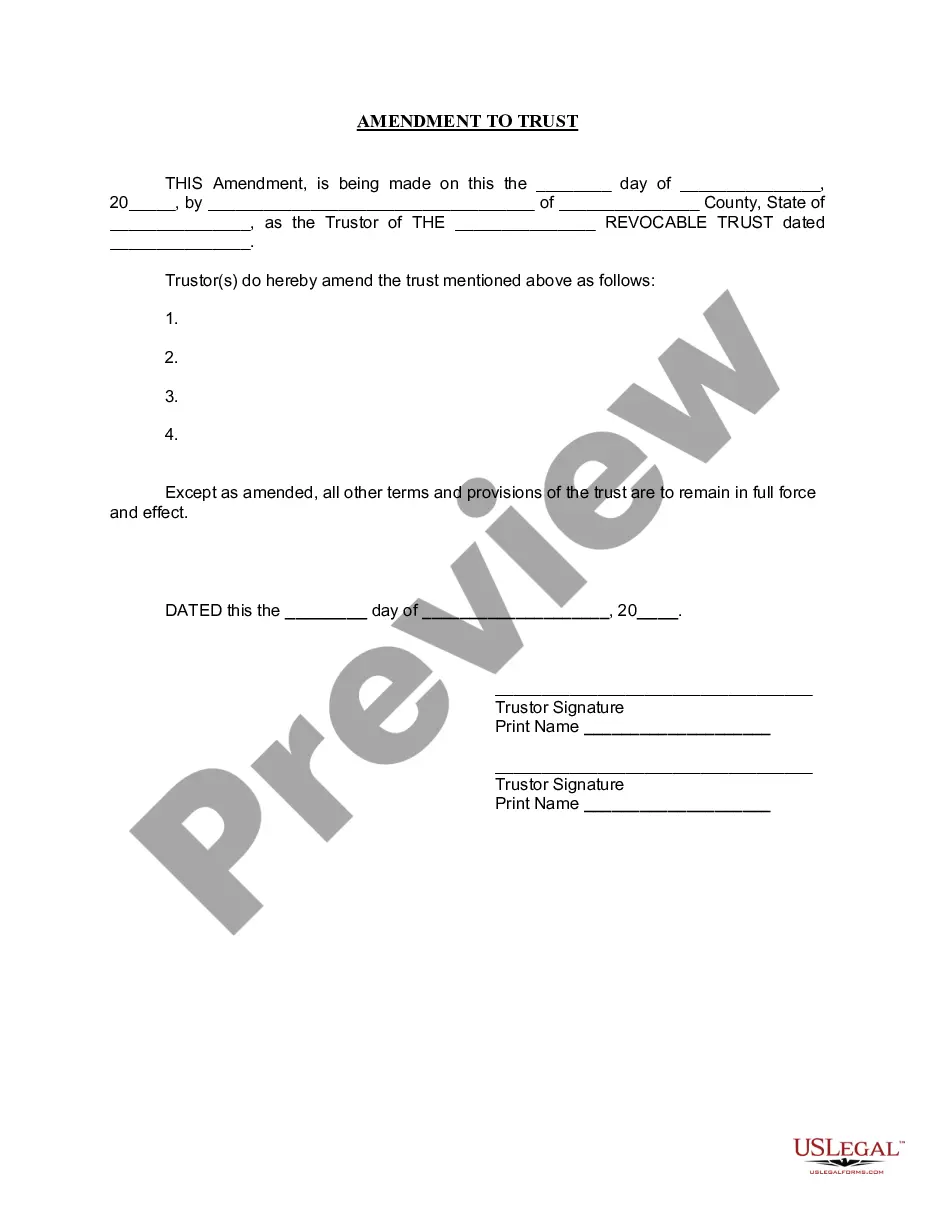

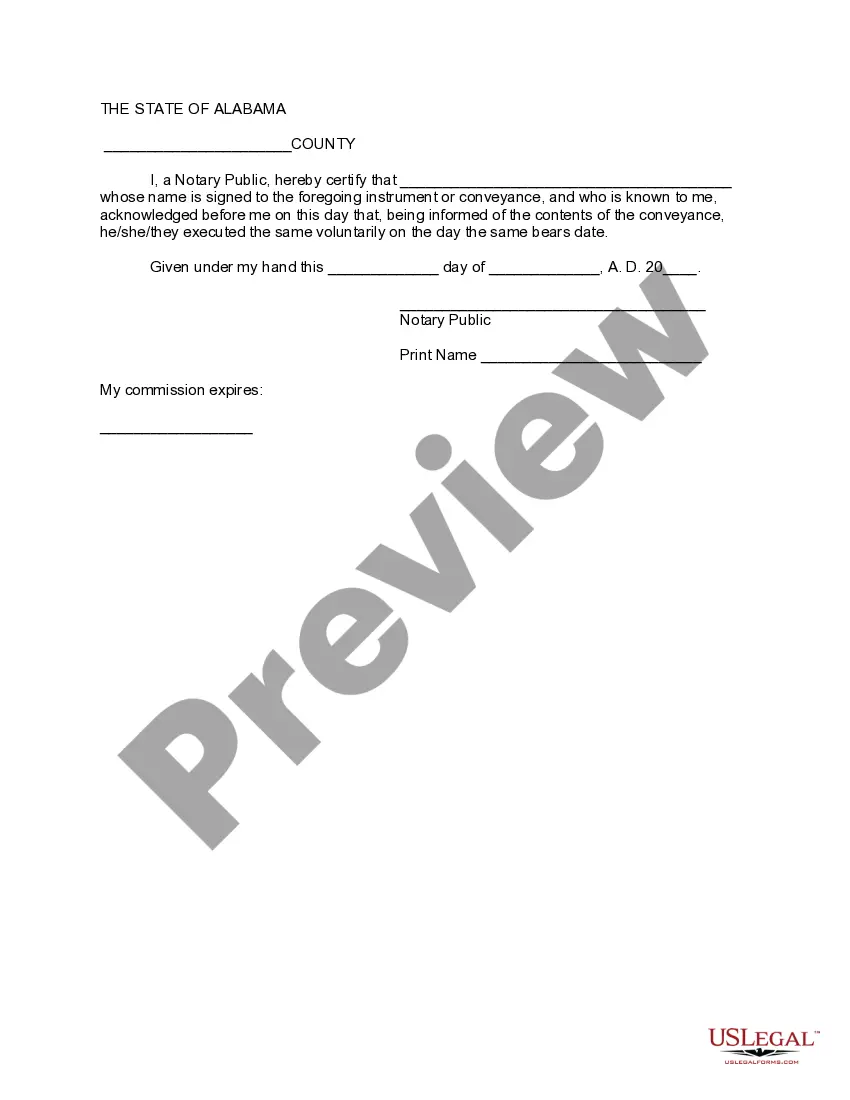

Amending a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form permits the Trustor to amend certain properties of the trust without changing the purpose or nature of the trust. Except for the amended provisions, all other parts of the trust will remain in full force and effect. The Trustor(s) signature(s) is needed, and it must be signed in front of a notary public.

Amendment Living Trust With Mortgage

Description

Form popularity

FAQ

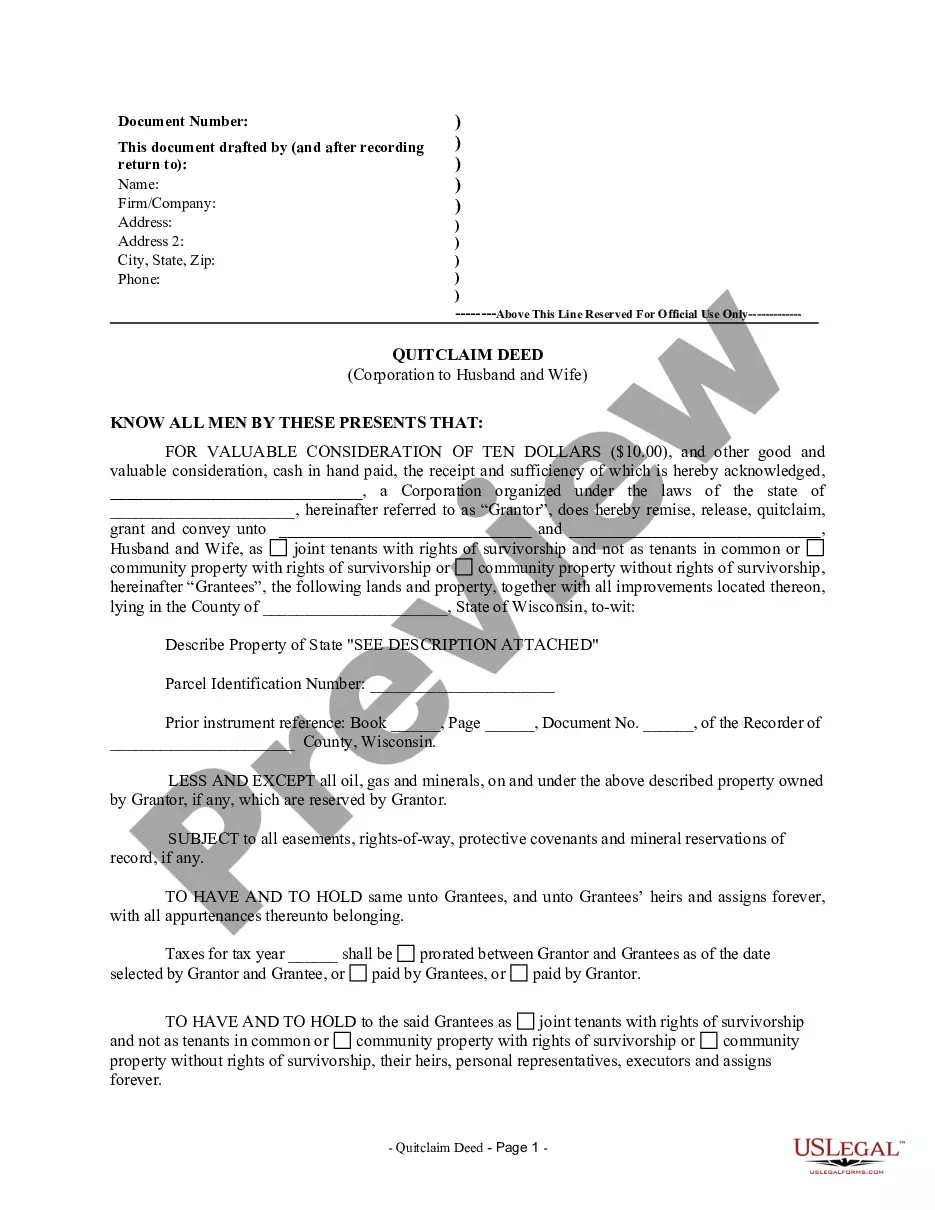

When you place a mortgaged property into a living trust, the mortgage generally remains in your name. This means you are still responsible for mortgage payments, but the trust holds the title to the property. An amendment living trust with mortgage helps clarify the relationship between the trust and the mortgage lender, ensuring your estate is managed effectively.

Yes, you can transfer a property with an existing mortgage into a trust. However, it's crucial to check your mortgage agreement for any due-on-sale clauses. These clauses may require you to notify your lender about the transfer. Using an amendment living trust with mortgage can help you navigate this process while keeping your assets protected.

Amending a trust is generally a straightforward process. You can modify the terms of your trust by creating an amendment document, which specifies the changes you want to make. This document should be signed and dated, following your state's legal requirements. If your trust involves a mortgage, it's essential to address these details in the amendment living trust with mortgage to ensure consistency.

You can place your home into an amendment living trust with mortgage while it still has an outstanding mortgage balance. Just ensure that you inform your lender about the trust. This allows for smoother management of the property and aids in your estate planning objectives. For guidance through the process, consider platforms like US Legal Forms, which provide resources for creating trusts that meet your needs.

While putting your house in an amendment living trust with mortgage has many benefits, there are some disadvantages. For instance, you may incur fees for setting up the trust and potential ongoing administrative expenses. Furthermore, if the trust is not managed correctly, it can create complications for your heirs. Always weigh these factors carefully to make an informed decision.

Yes, a home with a mortgage can be transferred to a trust, but it’s important to notify your lender. Transfering your property into an amendment living trust with mortgage may not trigger the due-on-sale clause, which can protect your equity and allow for easier estate planning. However, you should always consult with your lender and a legal professional to understand any implications. This process can help ensure that your home is managed according to your wishes.

Yes, you can place a house with an existing mortgage into a trust, but there are important considerations. When you create an amendment to your living trust with a mortgage, inform your lender about the change in ownership. This ensures that the mortgage terms remain intact and that you comply with any lender requirements. Using a platform like USLegalForms can guide you through the process of transferring property into a trust smoothly.

Amending a living trust involves creating a document that clearly outlines the changes you wish to make. This document, often called an amendment or a restatement, should specify the sections of the trust being altered. Once you draft this amendment, you need to sign it in front of a notary to ensure its legality. Remember, if you have a living trust with a mortgage, it's crucial to address how these changes align with your financial obligations.

To write a codicil to a trust, identify the trust and outline the specific changes you want to make. It is essential to include the date and your signature, ensuring clarity in your intentions. When creating a codicil for an amendment living trust with mortgage, consider consulting legal resources or platforms to ensure compliance with local laws.

Writing an amendment to a living trust involves clearly stating the changes you want to implement. Begin by referring to the original trust document, then specify what you are amending and provide a date. Ensure you sign the amendment and comply with any state requirements to make it legally binding, especially concerning an amendment living trust with mortgage.