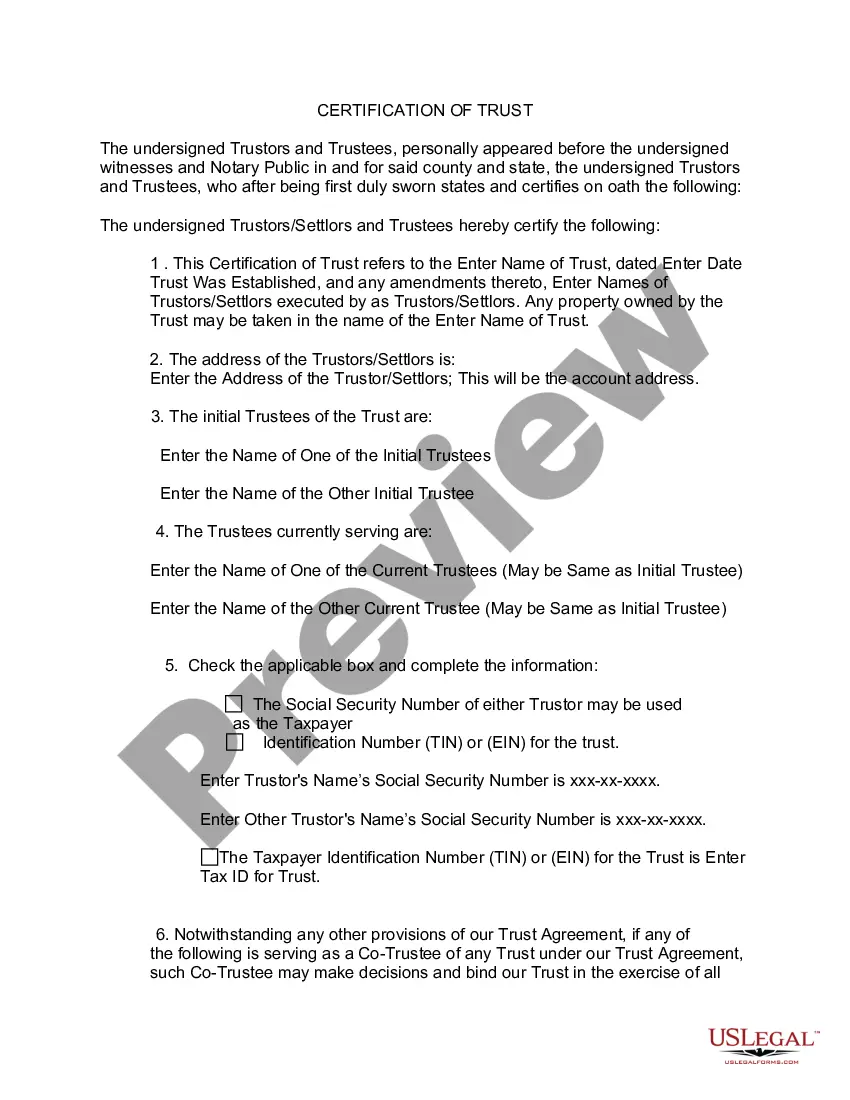

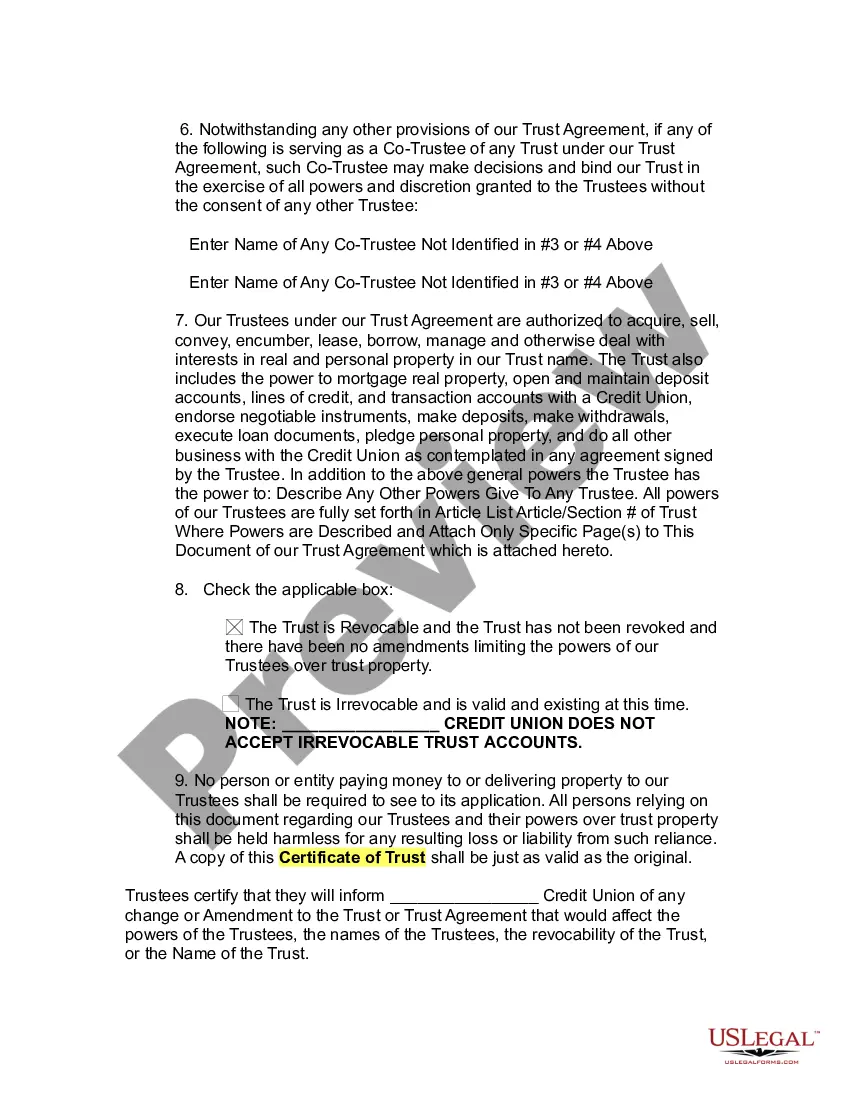

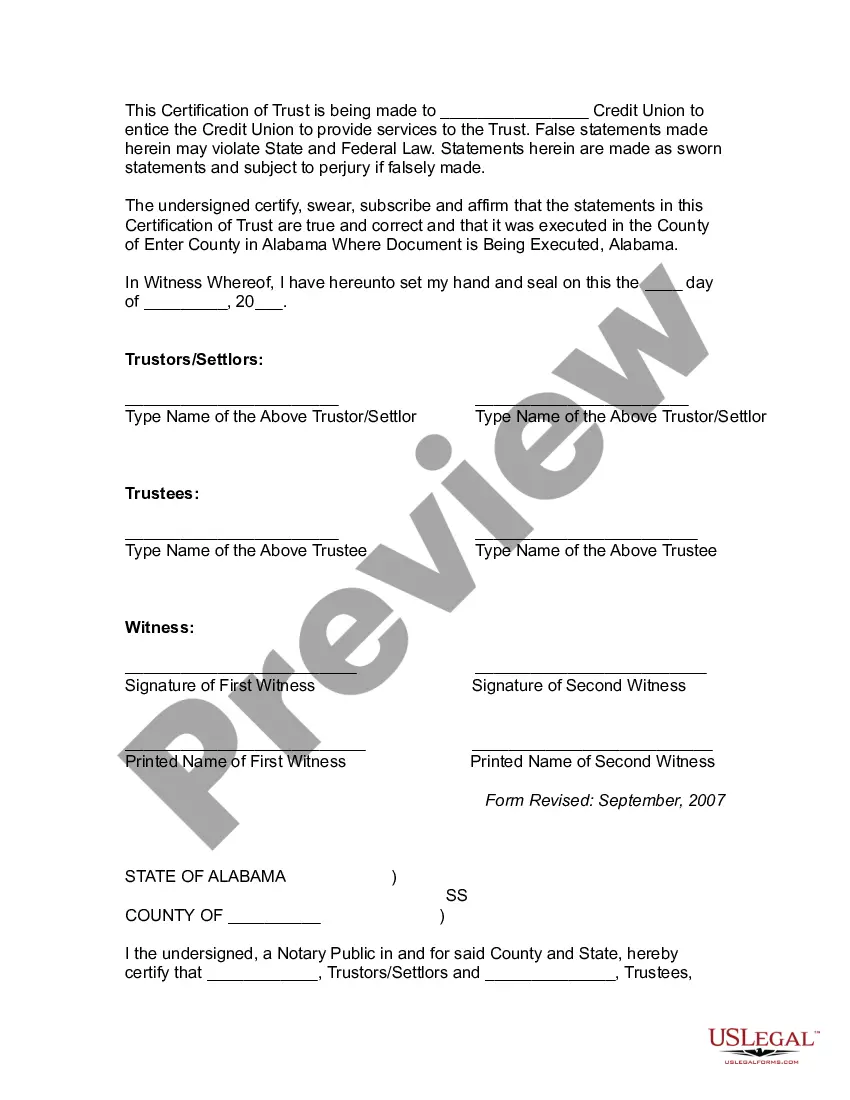

To transfer assets into a trust, a "Certificate of Trust" is needed. This is a summary or quotation of selected parts of the trust. Its purpose is to allow a person to know the correct name of the trust and to be sure that the trust has power over its assets. It usually does not identify the beneficiaries or the assets, so that information is kept confidential.

Alabama Trusts Certificate Withdrawal

Description

Form popularity

FAQ

In Alabama, some entities may be exempt from business privilege tax, including non-profits and certain organizations formed under specific state laws. Additionally, businesses with annual gross receipts below a predetermined threshold may also qualify for an exemption. If your focus is on Alabama trusts certificate withdrawal, being aware of potential tax exemptions can help enhance your financial strategy.

All corporations operating in Alabama must file a corporate tax return, regardless of whether they made a profit. This includes both domestic and foreign corporations doing business in the state. If your operations involve handling Alabama trusts certificate withdrawal, compliance with tax regulations is crucial to avoid penalties and ensure smooth transactions.

In Alabama, there are specific categories of workers exempt from workers' compensation coverage, such as sole proprietors, partnerships with just owners, and certain farm laborers. Additionally, businesses with fewer than five employees may be exempt. If you operate a trust and deal with Alabama trusts certificate withdrawal, understanding these exemptions could save you costs associated with coverage.

Shutting down a business in Alabama involves a few essential steps. First, you must formally dissolve your business entity with the Secretary of State. Next, settle any outstanding debts, and ensure all final tax returns, including sales and business privilege taxes, are filed. For those managing Alabama trusts certificate withdrawal, this process can affect the final distribution of trust assets.

In Alabama, certain organizations and entities may qualify for sales tax exemption, including non-profit organizations, government agencies, and educational institutions. Additionally, items sold for resale or specific purposes, like manufacturing, may also qualify. If you handle or manage Alabama trusts certificate withdrawal, understanding these exemptions can be beneficial, as they may impact the overall financial health of your entity.

A certificate withdrawal, often confused with a certificate of withdrawal, refers to the action of formally withdrawing the records of a legal entity. It involves submitting paperwork to ensure that the entity is no longer recognized as active by the state. Knowing the difference is essential for business owners in Alabama, especially when dealing with legal matters.

To obtain a certificate of good standing in Alabama, you need to file the appropriate request with the Secretary of State’s office. This certificate confirms that your business entity is legally registered, has completed all required filings, and is in compliance with state regulations. For convenience, you can utilize services like US Legal Forms to guide you through the process smoothly.

A PPT form, or Property and Privilege Tax form, relates toBusiness Privilege Tax obligations that some businesses in Alabama must complete. This form details the business's income and can be necessary for determining tax responsibilities. Understanding the PPT form is important for any business owner, and you can easily find resources on this through platforms like US Legal Forms.

Proof of withdrawal is documentation that demonstrates a business entity has completed the withdrawal process in Alabama. This proof typically comes in the form of a certificate of withdrawal issued by the state. Having this proof is vital for closing the business's financial matters and protecting the owners from any future liabilities associated with the business.

Certain entities are exempt from the Alabama Business Privilege Tax (BPT), including nonprofit organizations and certain types of government entities. Understanding these exemptions can significantly benefit businesses operating in Alabama, allowing them to focus on more essential aspects of their operations. If you are unsure about your eligibility for an exemption, consider consulting US Legal Forms for personalized guidance.