Garnishments For Credit Card Debt

Description

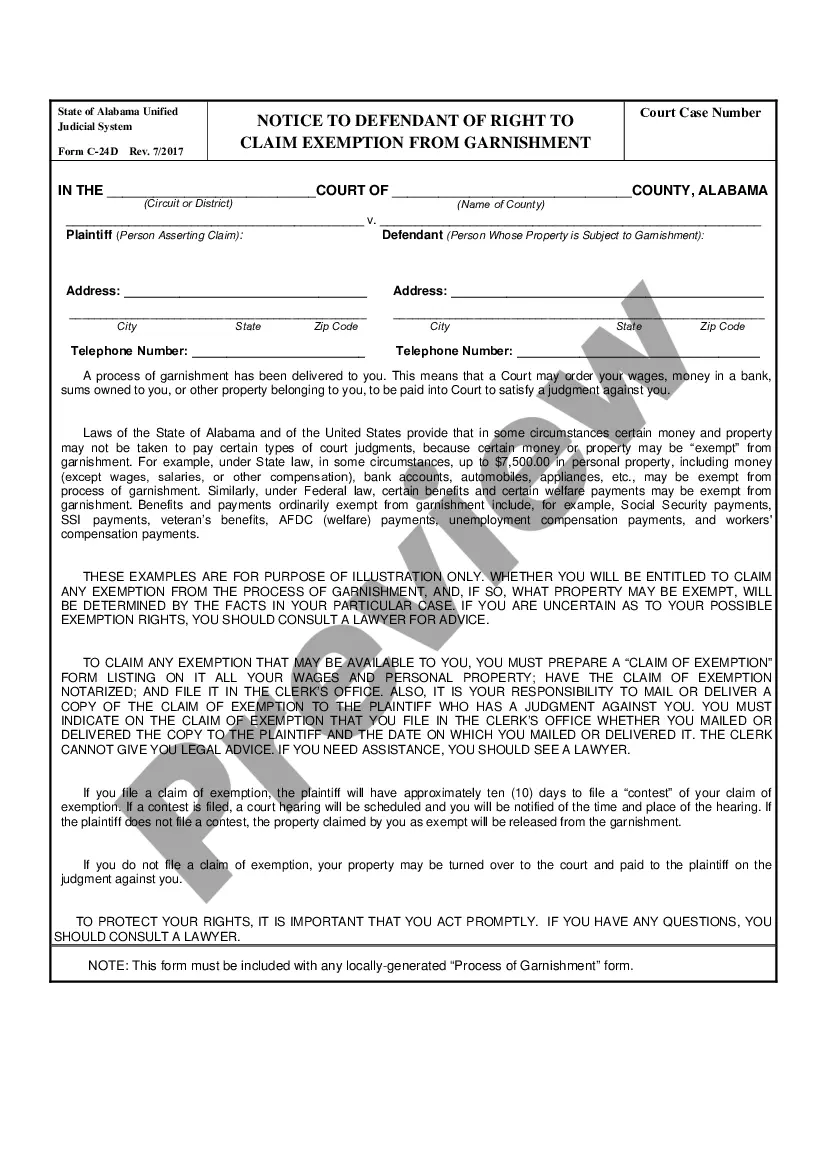

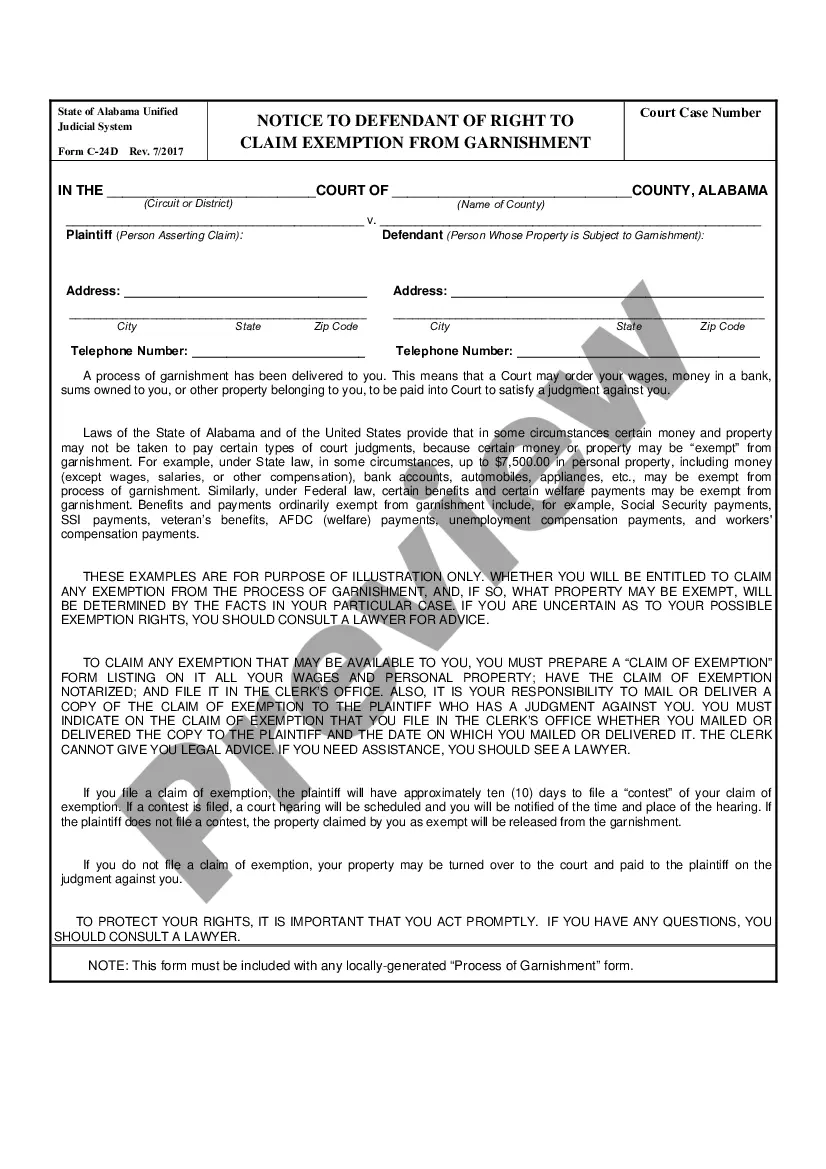

How to fill out Alabama Notice To Defendant Of Right To Claim Exemption From Garnishment?

There's no longer a reason to invest time searching for legal documents to adhere to your local state requirements.

US Legal Forms has compiled all of them in one location and made their availability easier.

Our platform provides over 85,000 templates for any business and personal legal situations organized by state and area of application. All forms are expertly crafted and authenticated for legitimacy, so you can trust in acquiring a current Garnishments For Credit Card Debt.

Complete your subscription payment using a card or through PayPal to proceed. Choose the file format for your Garnishments For Credit Card Debt and download it to your device. Print your form for manual completion or upload the sample if you wish to edit it using an online editor. Completing legal paperwork in compliance with federal and state laws is quick and straightforward with our platform. Try out US Legal Forms today to keep your documents organized!

- If you are already familiar with our service and possess an account, ensure your subscription is active before downloading any templates.

- Log In to your account, choose the document, and hit Download.

- You can also revisit all downloaded documents at any time needed by accessing the My documents tab in your profile.

- If you are new to our service, the procedure will involve a few additional steps to finalize.

- Here's how new users can acquire the Garnishments For Credit Card Debt from our database.

- Review the page content thoroughly to confirm it includes the sample you require.

- To assist, use the form description and preview options if available.

- Utilize the search bar above to look for another template if the current one does not meet your needs.

- Once you identify the appropriate one, click Buy Now next to the template title.

- Select your preferred pricing plan and create an account or Log In.

Form popularity

FAQ

Garnishments for credit card debt can generally take a portion of your wages, but the exact amount depends on state laws and your individual financial situation. In many cases, creditors can seize up to 25% of your disposable earnings, but certain exceptions may apply. Additionally, federal law protects a minimum wage threshold from being garnished, ensuring that you retain some income. Understanding these limits can guide your financial planning and help you find solutions, such as those offered by US Legal Forms, to address your debts effectively.

The IRS can garnish up to 15% of your disposable income for unpaid taxes, but this amount can vary based on your specific financial situation. It’s essential to understand that this garnishment can affect your credit card debt payments as well. To effectively handle any garnishment related to tax debts or other obligations, using platforms like US Legal Forms can provide you with the necessary legal documentation and insights to navigate your financial challenges.

A creditor can garnish up to 25% of your disposable income for unpaid credit card debt, according to federal law. However, some states have stricter limits, often lower than the federal maximum, aimed at ensuring you have enough funds to support your household. Knowing these limits is crucial for budgeting and maintaining your financial stability. The US Legal Forms platform can guide you through the garnishment process and help you understand your options.

The maximum garnishment allowed for credit card debt varies by state, but generally, it cannot exceed 25% of your disposable income. Disposable income is what remains after necessary deductions, such as taxes. It's important to know your rights and the specific limits set by your state, as these laws aim to protect your ability to meet essential living expenses. You can explore resources such as US Legal Forms to understand these regulations better.

The amount that can be garnished from your paycheck primarily depends on state laws and federal regulations. Generally, creditors can take up to 25% of your disposable earnings. However, if you face garnishments for credit card debt, it’s essential to consult with a financial advisor or legal professional to understand how this affects your income and expenses.