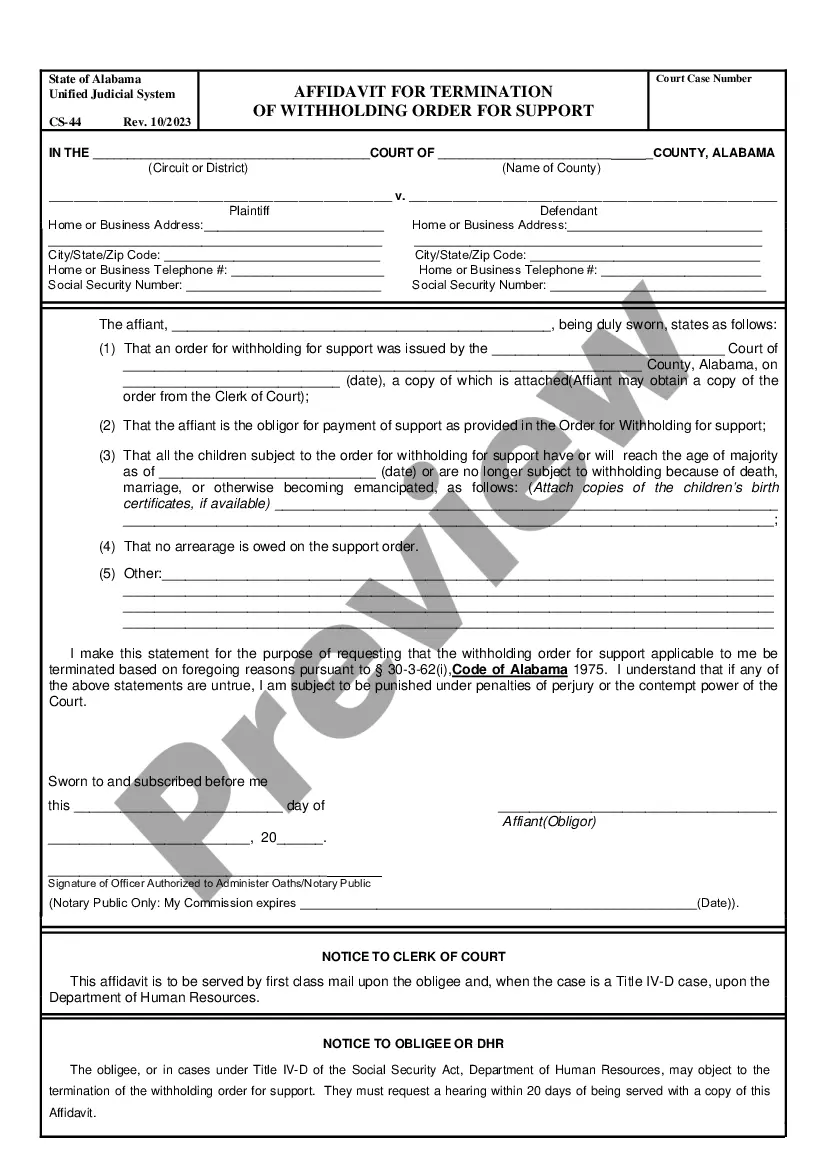

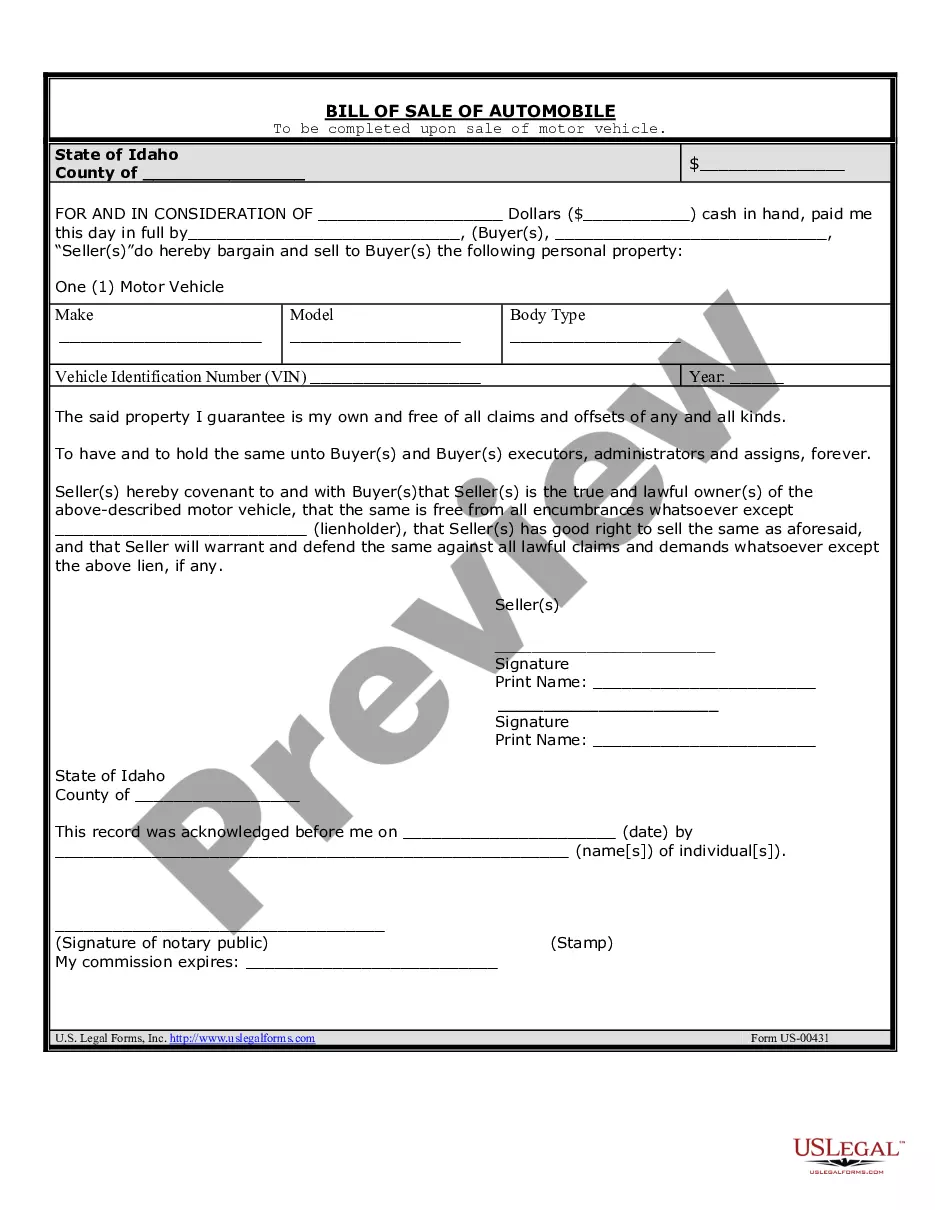

This official Affidavit for Termination of Withholding Order for Support is signed by the person obligated to pay child support when the child or children reaches the age of majority and there is not past due amounts owed.

Form To Cancel Child Support

Description

How to fill out Alabama Affidavit For Termination Of Withholding Order For Support?

Finding a go-to place to take the most current and appropriate legal samples is half the struggle of handling bureaucracy. Discovering the right legal papers calls for precision and attention to detail, which is the reason it is important to take samples of Form To Cancel Child Support only from trustworthy sources, like US Legal Forms. An improper template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to worry about. You can access and see all the information regarding the document’s use and relevance for the situation and in your state or county.

Take the listed steps to complete your Form To Cancel Child Support:

- Make use of the catalog navigation or search field to locate your sample.

- Open the form’s information to ascertain if it suits the requirements of your state and county.

- Open the form preview, if available, to make sure the template is definitely the one you are looking for.

- Go back to the search and find the proper template if the Form To Cancel Child Support does not match your needs.

- When you are positive about the form’s relevance, download it.

- If you are a registered customer, click Log in to authenticate and access your picked templates in My Forms.

- If you do not have a profile yet, click Buy now to get the template.

- Pick the pricing plan that fits your requirements.

- Go on to the registration to complete your purchase.

- Finalize your purchase by choosing a payment method (credit card or PayPal).

- Pick the document format for downloading Form To Cancel Child Support.

- Once you have the form on your gadget, you may modify it with the editor or print it and complete it manually.

Remove the inconvenience that comes with your legal documentation. Explore the comprehensive US Legal Forms collection to find legal samples, check their relevance to your situation, and download them immediately.

Form popularity

FAQ

Requirements: Who qualifies for the child tax credit? Taxpayers can claim the child tax credit for the 2023 tax year when they file their tax returns in 2024. Generally, there are seven ?tests? you and your qualifying child need to pass. Age: Your child must have been under the age of 17 at the end of 2023.

If your income goes above £60,000 the extra you pay in tax will cancel out what you get in Child Benefit. You can choose to stop your claim so that you don't have to pay the tax - although if one of you isn't working or is working part-time it might be might be best to keep your claim going.

What happens after Child Benefit stops? Any tax charge owed for each tax year up to the date that your Child Benefit stops will have to be paid, and even once your payments have come to an end, you will need to report any changes in your personal life that could have an impact on your entitlement to Child Benefit.

If you're affected by the High Income Child Benefit charge and want to stop your Child Benefit payments, you can use the online service. To use apply online, you need a Government Gateway user ID and password. If you do not have a user ID, you can create one when you use the service.

Your Child Benefit stops on 31 August on or after your child's 16th birthday if they leave education or training. It continues if they stay in approved education or training, but you must tell HM Revenue and Customs ( HMRC ).