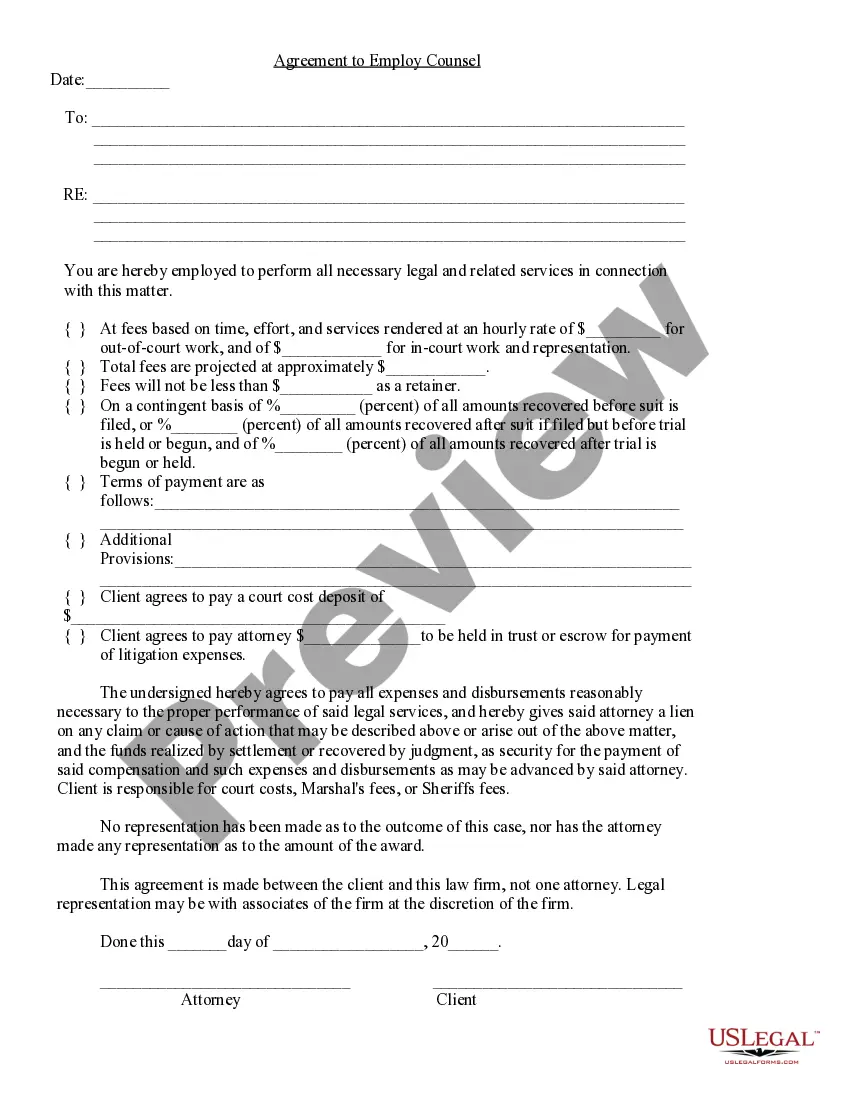

Attorney Fee

Description

How to fill out Alabama Attorney Fee Agreement?

- If you're a returning user, log into your account and download the necessary form template by clicking the Download button. Ensure your subscription is active; if not, renew it as per your chosen payment plan.

- For first-time users, start by reviewing the Preview mode and form description to confirm you’ve selected the correct document that fits your requirements and local jurisdiction.

- If you encounter any discrepancies, use the Search tab to find the suitable template. Ensure it aligns with your needs before proceeding.

- Purchase the document by clicking the Buy Now button and selecting the subscription plan that suits you best. You will need to create an account for access to the library's offerings.

- Complete your purchase by entering your credit card information or opting for PayPal to finalize your subscription.

- Download your form. Save the document on your device for completion and easily access it later through the My Forms section of your profile.

US Legal Forms offers individuals and attorneys an unparalleled advantage with more forms available than competitors, boasting over 85,000 legal documents that are easy to fill and edit.

In conclusion, US Legal Forms provides not only a wide array of templates but also access to premium experts for guidance on document completion. Start managing your legal forms today and ensure they're precise and legally sound!

Form popularity

FAQ

You can obtain attorney's fees in Texas when there is a statutory allowance, such as in cases involving fraud, breach of contract, or family law disputes. If you are relentless in pursuing your rights, the court may grant you attorney fees if your claim is meritorious. Also, agreements in contracts can specify when attorney fees are reasonable and collectible. Using tools like UsLegalForms can guide you toward understanding the conditions under which you can claim these fees.

The American rule for attorney fees in Texas holds that each party generally pays its own attorney fees, regardless of the outcome of the case. This contrasts with other legal systems that allow the winning party to recover attorney fees from the losing side. However, exceptions exist within certain statutes and contracts that can permit recovery of attorney fees. It's essential to be aware of these nuances when planning your legal strategy.

In Texas, you can recover attorney fees under certain conditions, such as when a statute explicitly allows it. For instance, if you win a civil case and the opposing party acted in bad faith, you may be eligible to receive your attorney fees. Additionally, if your case involves a valid contract that includes a clause for recovering attorney fees, you can pursue this option. Understanding the specifics of these situations can help you navigate the complexities of attorney fees effectively.

Attorney fees may be included as part of closing costs in real estate transactions, but they are not universally categorized that way. Usually, closing costs encompass various fees related to the transaction, including attorney fees. Understanding how attorney fees fit into your overall closing costs can help you plan your budget effectively.

An attorney can bill for various services, including legal advice, preparation of documents, court appearances, and communication with other parties. Expenses related to case management, research, and filing fees may also be included in your attorney fees. It's wise to discuss what is billable upfront to avoid surprises later.

Reasonable attorney fees are fees that align with the market rates for similar legal services and reflect the complexity of the case. Courts often assess these fees based on factors like the attorney's experience, the intricacy of the case, and the time spent. Ensuring your attorney’s fees are reasonable helps maintain fairness and clarity.

The American rule states that each party in a legal case usually pays for their own attorney fees, regardless of the outcome. This contrasts with the 'loser pays' principle found in some other legal systems. Understanding the American rule can help you anticipate the costs associated with attorney fees.

Attorney fees cover a range of services provided by legal professionals. These may include consultations, contract reviews, representation in court, and negotiations with opposing parties. It's essential to clarify what specific services your attorney fees will encompass to ensure transparency.

The terms lawyer and attorney are often used interchangeably, but they have distinct meanings. A lawyer is someone who has completed law school and may provide legal advice, while an attorney is a lawyer who actively practices law in court. It is important to understand this distinction when discussing attorney fees and representation.

To report legal fees, include them in your business expenses on your tax return. Legal fees are typically deductible if they relate to business activities. Ensure you have proper documentation and invoices that detail the attorney fees incurred. Consulting a tax professional can help you navigate these reporting requirements effectively.