What To Do With Business Credit

Description

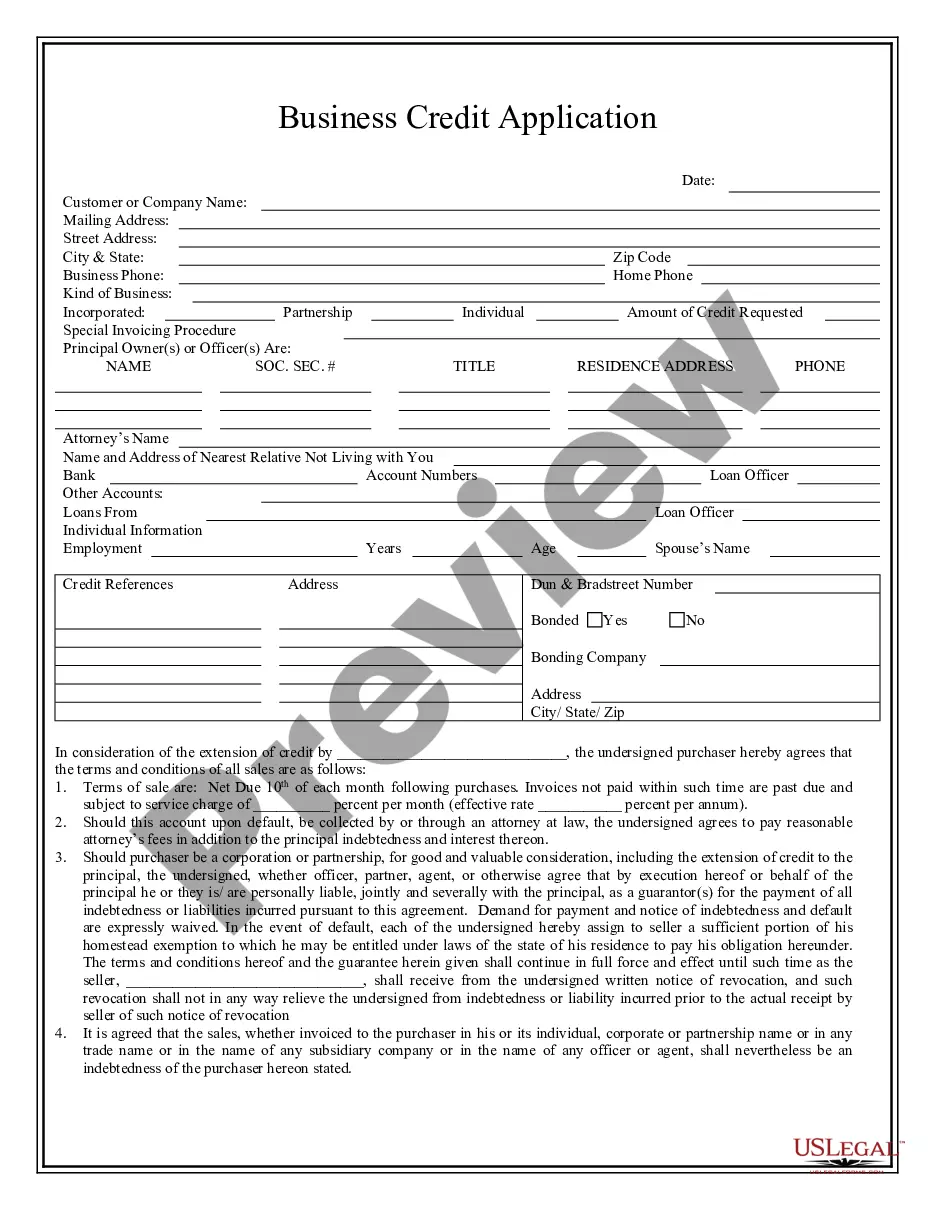

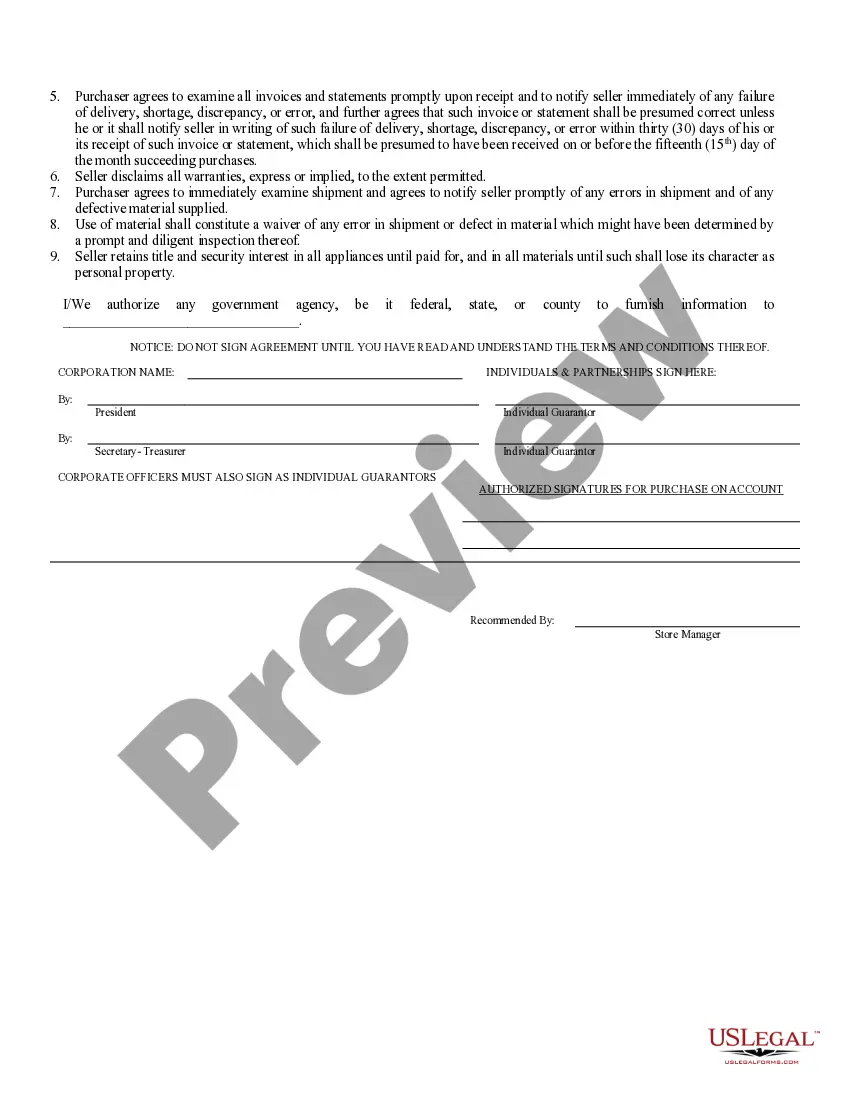

How to fill out Alabama Business Credit Application?

- Log in to your US Legal Forms account if you’re a returning user, and check your subscription status before downloading the form template you need.

- If you're new to the service, start by previewing the form descriptions to ensure they meet your specific needs and comply with local jurisdiction regulations.

- If you need a different document, use the Search function to find the exact template suited for your requirements.

- Once you locate the appropriate form, click the Buy Now button and select a subscription plan that works for you. An account registration is necessary to access the library's resources.

- Complete your purchase by entering your credit card details or using PayPal for the subscription payment.

- Finally, download your chosen form to your device, where you can access it anytime from the My Forms section of your account.

By following these steps, you'll be able to effectively make use of your business credit while ensuring accuracy in your legal documentation.

Take advantage of US Legal Forms’ extensive resources—start managing your business credit smarter today!

Form popularity

FAQ

When filling out a business credit card application, provide accurate information about your LLC, including its legal name, address, and employer identification number (EIN). Be prepared to disclose your business's revenue, ownership structure, and financial history. A well-completed application increases your chances of approval and helps you understand what to do with business credit effectively.

To build LLC credit fast, start by registering your business with credit bureaus and ensuring all your business information is up to date. Open accounts with vendors that extend credit and report payments. Make timely payments and consider obtaining a business credit card to establish a strong credit presence. By understanding what to do with business credit, you can enhance your financial standing quickly.

Building credit for an LLC usually takes anywhere from six months to a year. The timeline largely depends on how actively you engage with credit accounts and the overall management of your business finances. Consistent, on-time payments and responsible credit usage will set a strong foundation. Knowing what to do with business credit can speed this process up.

A new LLC typically starts with no established credit score, as it is considered a blank slate. However, once you begin to engage with credit accounts and financial activities, such as applying for loans or credit cards, your credit history will begin to form. Understanding what to do with business credit at this stage is crucial, as any actions you take will directly impact your score moving forward.

To quickly build credit for your LLC, focus on establishing trade lines with suppliers and vendors that report payments to credit bureaus. Additionally, consider applying for a business credit card that reports your payment history. By using these tools responsibly and paying on time, you can rapidly improve your business credit profile. This will help you understand what to do with business credit effectively.

To properly use a business line of credit, focus on maintaining a low balance relative to your credit limit. Utilize the funds for essential business expenses, such as inventory or operational costs, rather than personal expenses. Additionally, ensure you set a budget for repayments to avoid accumulating interest charges. Understanding what to do with business credit can help you leverage this resource effectively while promoting financial stability.

Yes, a business line of credit can affect your credit score, particularly if you have guaranteed it personally. When lenders report to credit bureaus, they may consider your credit utilization and payment history for both business and personal credit scores. It's wise to keep your utilization low and make timely payments to maintain a strong score. If you’re unsure about the implications, learning what to do with business credit can guide you through best practices.

Typically, a business line of credit does not appear on your personal credit report unless you personally guarantee the line. This means that if you want to separate your business and personal finances, it’s important to avoid guaranteeing business credit products. However, if you do provide a personal guarantee, remember that your personal credit could be affected. Knowing what to do with business credit is key, so consider your options carefully.

Yes, your business credit can impact your personal credit, especially if you are a sole proprietor or personally guarantee business debts. When lenders look at your application, they may evaluate your personal credit alongside your business credit. This relationship is crucial because managing your business credit wisely helps protect your personal finances. Therefore, understanding what to do with business credit is essential for maintaining a healthy financial profile.

Business credit and personal credit are generally separate, but they can affect each other. If your business suffers financial difficulties, it may impact your personal credit, especially if you've personally guaranteed business loans. Understanding what to do with business credit means recognizing this connection and taking steps to build both credits independently. Tools like uslegalforms can guide you in maintaining these important financial distinctions.