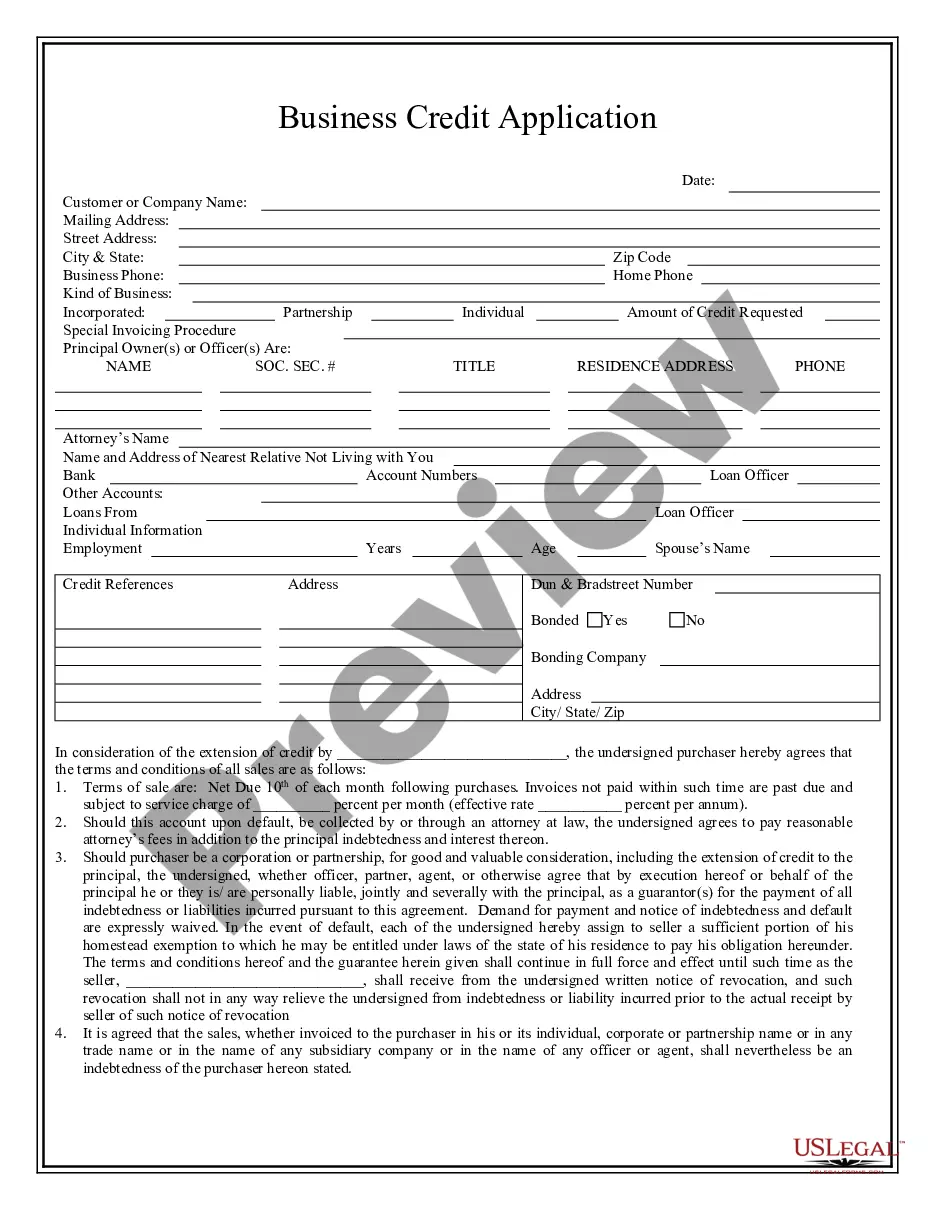

Business Credit Application Requirements

Description

How to fill out Alabama Business Credit Application?

- If you're an existing user, log in to your account to download the form template you need. Ensure your subscription is active, and renew it if necessary.

- For first-time users, start by checking the Preview mode and description of the forms available. Ensure the chosen form aligns with your business needs and complies with your local jurisdiction.

- Utilize the Search tab to find alternative templates if the initial selection does not meet your criteria. Verify that it suits your requirements before proceeding.

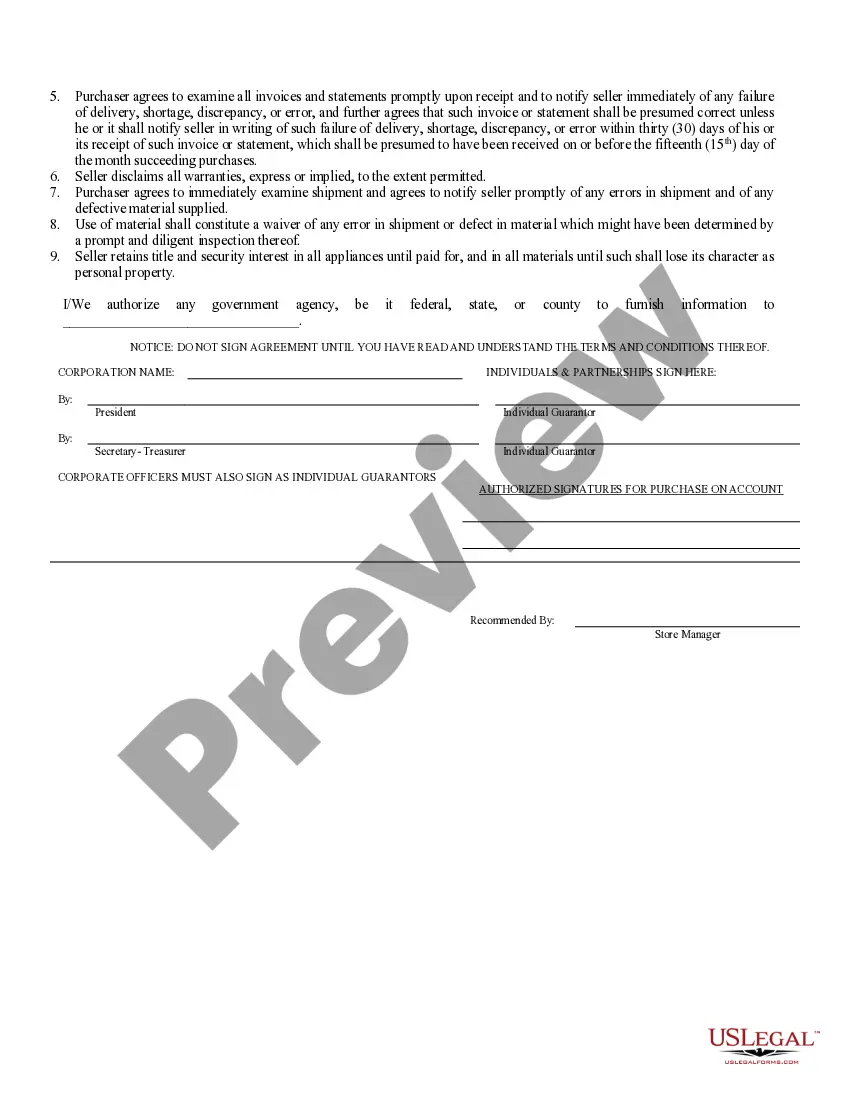

- Purchase your selected document by clicking the Buy Now button, then choose a subscription plan that fits your needs. Creating an account is essential for accessing the extensive legal library.

- Complete your purchase by entering payment details through credit card or PayPal. Once processed, you'll be directed to download your form.

- Download and save your form on your device for easy access. You can also find it later in the My Forms section of your profile.

In conclusion, leveraging the US Legal Forms platform helps simplify the process of fulfilling business credit application requirements. With a robust collection of over 85,000 forms and the option to consult legal experts, you can ensure that your documents are completed accurately and efficiently.

Get started today by visiting US Legal Forms and take the first step towards securing your business financing!

Form popularity

FAQ

Building credit for an LLC can take anywhere from three to six months, depending on your actions following the business credit application requirements. The key is to establish relationships with creditors and consistently make on-time payments. Moreover, monitoring your credit profile regularly can help identify areas for improvement. Using resources like uslegalforms can assist in understanding the necessary steps to take along the way.

The fastest way to build credit for an LLC involves meeting the business credit application requirements, which include opening accounts with suppliers who report to credit agencies. Additionally, ensuring timely payments and managing credit responsibly can expedite the process. Using a business credit card can also help to establish a credit history quickly. Consider leveraging the user-friendly tools on uslegalforms to streamline these steps.

A new LLC generally starts with no credit score because it has no established credit history. To build a credit score, it's crucial to begin the business credit application requirements early. This may involve obtaining a federal tax identification number and opening a business bank account. By making timely payments on accounts and loans, the LLC will gradually develop a credit profile.

When filling out a business credit card application, provide accurate information about your business's legal name, address, and financial details. Include your estimated annual revenue and personal guarantee if required. Careful attention to detail will enhance your chances of meeting business credit application requirements.

Building a business credit profile requires consistent efforts to manage credit responsibly. Start by paying bills on time, borrowing from vendors that report to credit bureaus, and maintaining low balances. Following these practices will assist you in fulfilling your business credit application requirements.

A good credit profile typically includes timely payments, low credit utilization, and a diverse credit mix. Lenders often look for a credit score that meets or exceeds their minimum threshold, which varies by lender. Maintaining a good credit profile can ease the process of meeting business credit application requirements.

To establish business credit for your LLC, begin by separating your personal and business finances. Apply for an Employer Identification Number (EIN), open a business bank account, and get a business credit card. These actions help build credit history essential for business credit application requirements.

To create a credit profile for your business, start by registering your business with credit bureaus such as Dun & Bradstreet. Obtain a D-U-N-S number, open business bank accounts, and establish vendor relationships that report to credit bureaus. These steps set a solid foundation for meeting business credit application requirements.

A company's credit profile encompasses its financial history, including payment behavior, credit utilization, and outstanding debts. This profile influences how lenders perceive the risk associated with lending to your business. Understanding your credit profile is essential when navigating business credit application requirements.

When applying for business credit, report a realistic estimate of your annual business revenue. If you are a new business without historical data, project your first-year earnings based on your business plan. It is crucial to be honest, as lenders verify this information and it impacts your business credit application requirements.