Sheriff Sale For Houses

Description

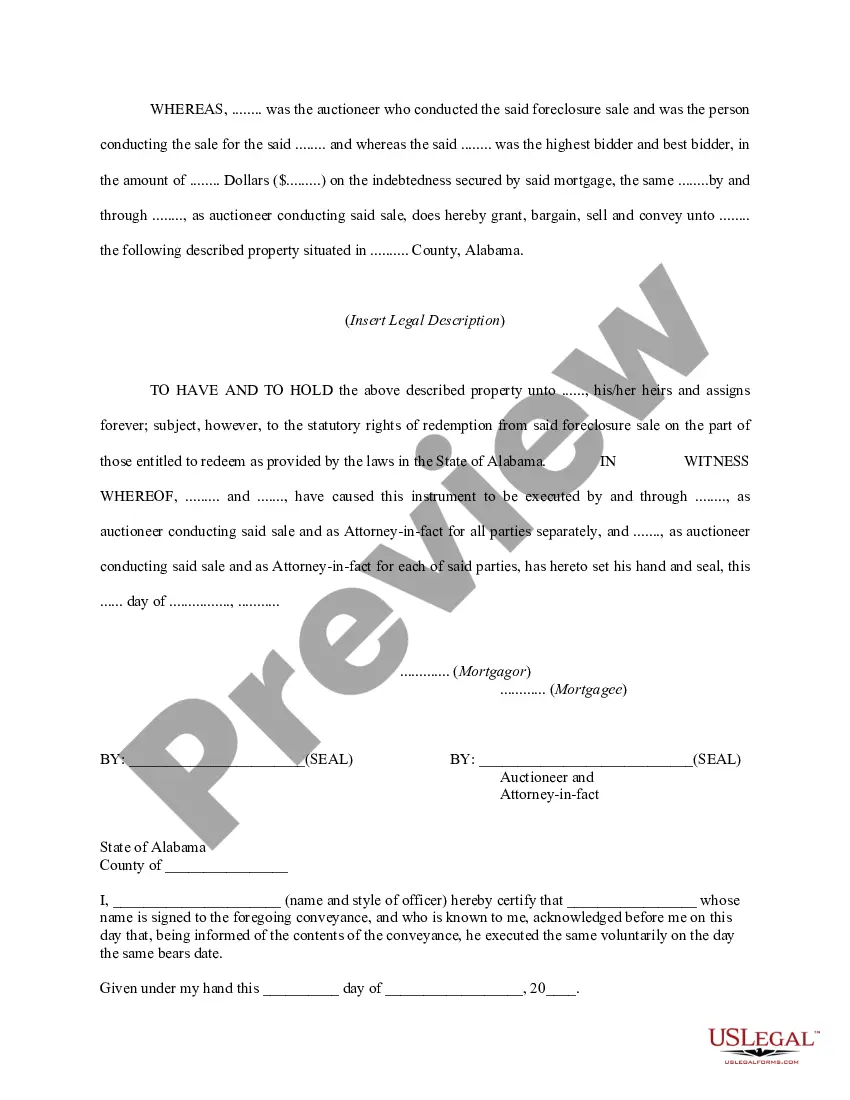

How to fill out Alabama Auctioneer's Deed For Foreclosure Sale?

- Begin by visiting the US Legal Forms website if you are a new user. For returning users, simply log in to your account to fetch the templates you require.

- In case you are new, search for the sheriff sale for houses template that fits your needs and verify that it complies with your local jurisdiction requirements by reviewing the Preview mode and form description.

- If necessary, utilize the Search tab to find alternative templates and ensure that you have the right document.

- Proceed to purchase. Click the Buy Now button and select a subscription plan that suits your needs. You will need to create an account to access the full library of legal forms.

- Complete your purchase by entering your payment information, either through credit card or PayPal, to activate your subscription.

- Finally, download the completed form. You can save it on your device for easy access and also find it later in the My Forms section of your account.

Utilizing US Legal Forms not only simplifies the process but also ensures that you have access to a vast array of legal resources. Their team of premium experts is available to assist you with form completion, further ensuring that your documents are accurate and legally sound.

Start your journey today and empower yourself with the right legal tools through US Legal Forms!

Form popularity

FAQ

To buy a house before it is foreclosed, you should first look for properties that are facing foreclosure or have already entered the pre-foreclosure stage. Engaging with the homeowner directly can sometimes lead to a sale before the property goes to a sheriff sale for houses. Additionally, using platforms like USLegalForms can help you understand the necessary legal documentation and processes involved in purchasing these properties.

In Indiana, a sheriff's sale for houses typically follows specific guidelines and timelines outlined in state law. This process ensures that properties sold have been formally foreclosed upon or seized due to unpaid taxes. The timeframe for executing a sheriff's sale varies, but it generally requires adherence to certain notifications and procedures. Knowing these regulations aids you in making informed decisions when participating in sheriff sales.

A foreclosure occurs when a lender repossesses a house due to the owner's failure to make mortgage payments. In contrast, a sheriff sale for houses happens when the property is sold at auction, usually following a judgment or tax lien. Essentially, foreclosure is a process initiated by the lender, while a sheriff sale is the public auction of the property. Understanding these distinctions helps you navigate the housing market effectively.

A sheriff sale and a tax sale differ primarily in the reasons for their occurrence. A sheriff sale for houses aims to recover funds from unpaid loans, while a tax sale recovers taxes owed to the government. Each sale has unique processes and implications for buyers. Knowing these differences can help you determine which opportunity aligns best with your investment goals.

Sheriff's sales can be worth it if you approach them with caution and preparation. Many buyers find excellent properties at competitive prices, yet it demands diligent research and an understanding of the auction environment. Ensuring you have the right tools and information makes your experience more successful. Platforms like US Legal Forms can assist you in navigating the complexities associated with sheriff sales.

If a property doesn't sell at a sheriff sale, it typically reverts to the lender or the local government. In some cases, the property may be put up for sale in a later auction. This situation can present continued opportunities for investors, as the property might be offered at a lower starting bid in future sales. Staying informed about these options can benefit potential buyers.

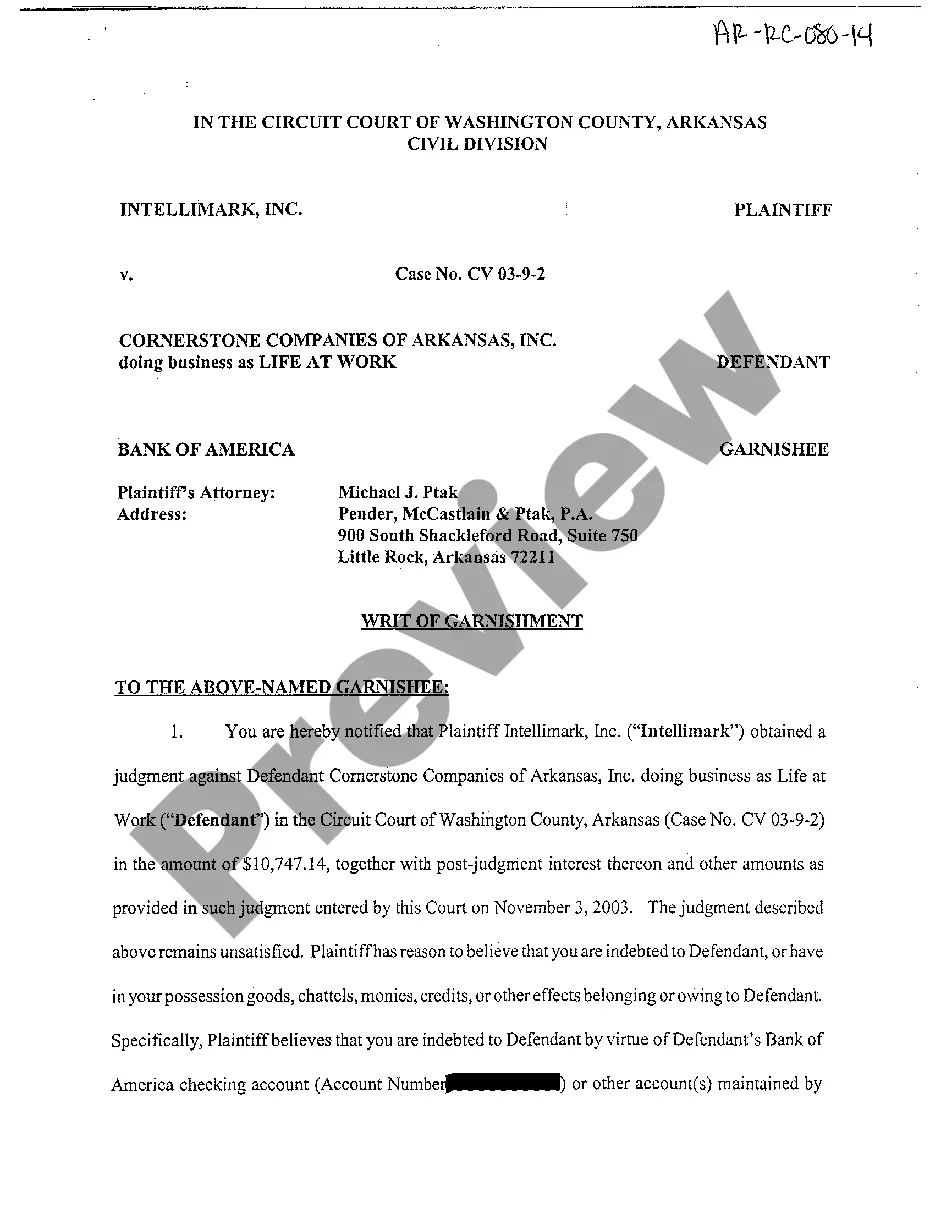

A sheriff sale for houses occurs when a property is auctioned off due to unpaid debts, usually a mortgage. In these cases, local authorities sell the property to recover funds for the lender. Buyers can often find properties at reduced prices, making it an appealing option for many. However, it is important to understand the auction process.

Buying properties at a sheriff sale carries inherent risks. You may face hidden costs, unresolved liens, or properties in poor condition. Additionally, the previous owners might still occupy the home, leading to potential eviction challenges. Conducting thorough due diligence is critical to minimize these risks.

A sheriff sale for houses does not automatically clear all liens. While some liens may be extinguished, others, such as tax liens, can remain attached to the property. It's essential to research the specific liens on a property before participating in a sheriff sale. Understanding this can help you make an informed decision.

Once the sheriff sale for houses concludes, the successful bidder receives a certificate of sale. This document officially recognizes them as the new owner of the property, although it may not transfer full ownership until the completion of certain legal processes. The certificate also outlines any conditions or requirements the new owner must fulfill. It’s crucial for bidders to keep this document safe as it serves as proof of ownership.