Foreclosure With Reverse Mortgage

Description

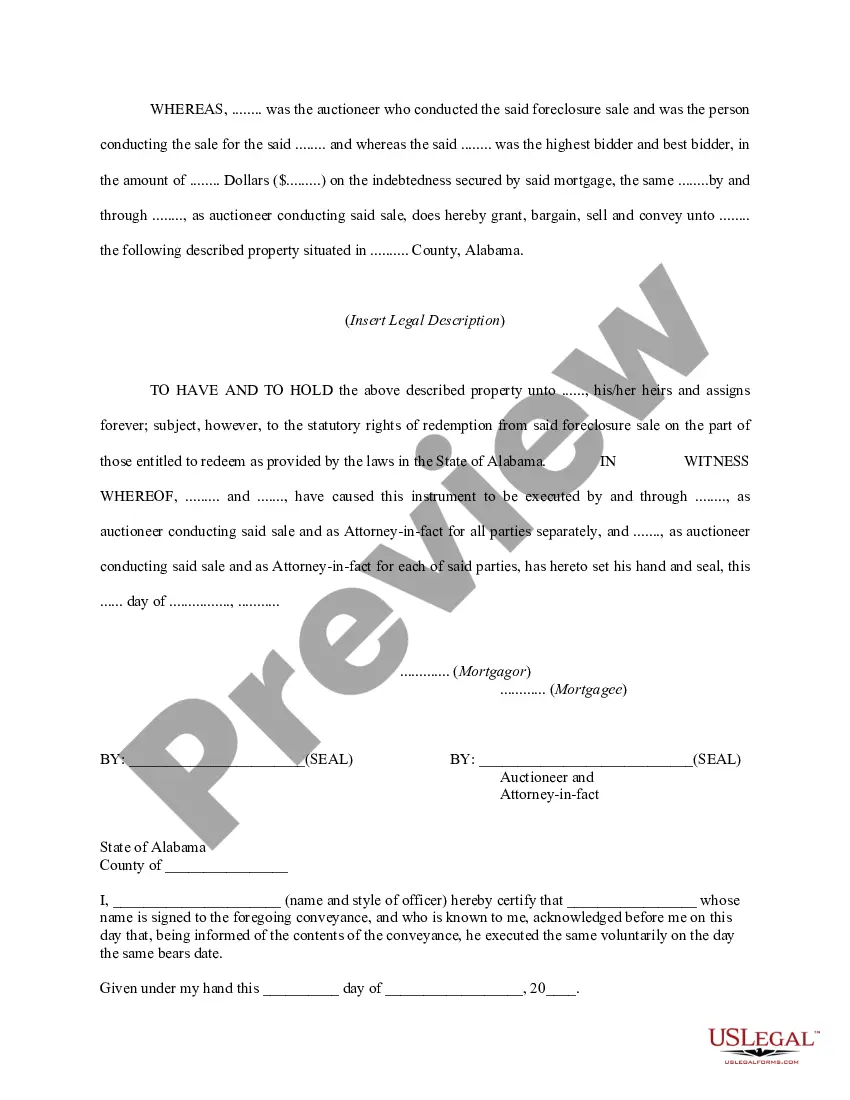

How to fill out Alabama Auctioneer's Deed For Foreclosure Sale?

- Log in to your US Legal Forms account if you're a returning user and download the necessary template by clicking on the Download button. Ensure your subscription is active; renew it if necessary.

- For first-time users, begin by reviewing the Preview mode and form description to choose the correct document that fits your jurisdiction's needs.

- Utilize the Search tab if you can't find what you need; refining your search can help you locate the appropriate forms more efficiently.

- Purchase the document by clicking the Buy Now button and selecting a subscription plan that works for you. Registration is required to unlock access to the extensive library.

- Complete the payment process using your credit card or PayPal. After payment, the form can be downloaded and saved for your records.

- Access your downloaded form anytime through the My Forms menu in your account, making future use quick and straightforward.

In conclusion, US Legal Forms provides a comprehensive suite of over 85,000 legal documents, ensuring you have precisely what you need for a foreclosure with a reverse mortgage. Their dedicated support and extensive resources make legal processes manageable.

Don't hesitate—visit US Legal Forms today to streamline your document needs and protect your financial future!

Form popularity

FAQ

A reverse mortgage can go into foreclosure if the borrower fails to meet key obligations. Common reasons include not paying property taxes, not maintaining home insurance, or failing to keep the home in good condition. This situation can lead to foreclosure with reverse mortgage, which can be distressing for homeowners. It's essential to understand these requirements to protect your investment.

Yes, you can lose your home on a reverse mortgage if certain conditions are not met. Foreclosure can occur if you do not comply with terms like maintaining the property or paying necessary insurance and taxes. Being aware of the potential for foreclosure with reverse mortgage allows you to take preventive measures. Using resources like US Legal Forms can guide you through the process and help you stay informed.

Yes, a home with a reverse mortgage can indeed be foreclosed. This typically happens if the borrower fails to meet certain requirements, such as paying property taxes or keeping the property in good condition. Knowing the risks associated with a foreclosure with reverse mortgage can help you take proactive steps to avoid it. Staying informed is essential for safeguarding your investment.

The foreclosure rate for reverse mortgages can fluctuate, but it generally reflects a small percentage of loans. Most foreclosures with reverse mortgage occur due to non-payment of property taxes or insurance. By using resources like uslegalforms, homeowners can find solutions and guidance to help mitigate these risks effectively.

While specific statistics can vary, research indicates that a significant number of reverse mortgages can end in foreclosure due to unpaid taxes or lack of maintenance. Foreclosure with reverse mortgage issues often arises when homeowners are unaware of their responsibilities. Staying informed and proactive can help you avoid becoming part of this statistic.

The 6 month rule for reverse mortgage states that homeowners must maintain the property as their primary residence for at least six months each year. Failure to comply with this requirement can lead to foreclosure. This rule ensures that the home is used as intended and protects the interests of both the homeowner and the lender. Educating yourself on this rule can help prevent issues related to foreclosure with reverse mortgage.