Foreclosure For Property Taxes

Description

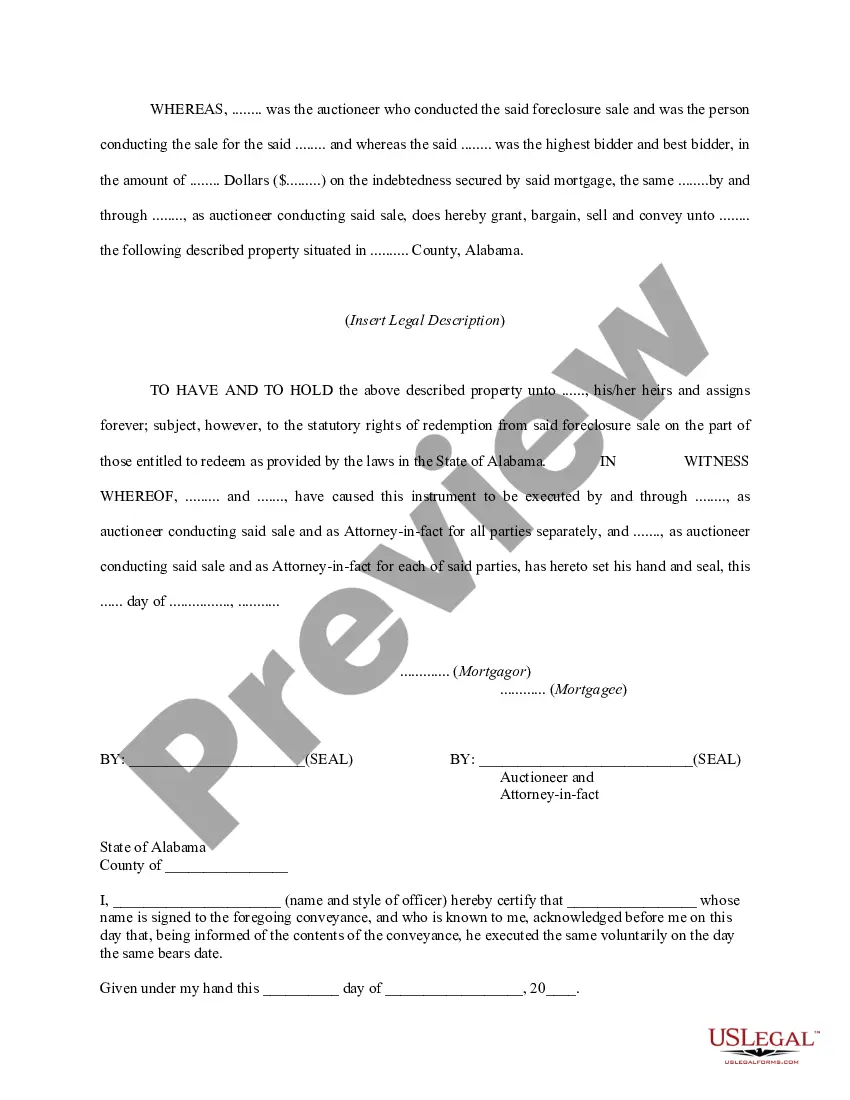

How to fill out Alabama Auctioneer's Deed For Foreclosure Sale?

- Login to your US Legal Forms account if you're an existing user. Make sure your subscription is active to access the documents.

- For new users, start by browsing the collection. Use the Preview mode and read the form description to ensure it meets your requirements according to local laws.

- If the form doesn't align with your needs, leverage the Search tab to find the appropriate template.

- Once you've selected the right document, click on the Buy Now button and choose your desired subscription plan. Remember to create an account for full access.

- Complete your purchase by entering your credit card details or linking your PayPal account.

- After purchasing, download your selected form and save it to your device. You can always revisit it under the My Forms section in your profile.

By utilizing US Legal Forms, you gain access to a vast collection of over 85,000 legal documents designed for ease of use, ensuring you are equipped with the necessary tools to handle any legal matter effectively. Additionally, their experts are available to assist you in completing forms accurately, enhancing the legality of your documents.

Ready to simplify your journey with foreclosure for property taxes? Explore US Legal Forms today and take the first step towards securing your property rights.

Form popularity

FAQ

The primary tax form associated with foreclosure for property taxes is the IRS Form 1040, along with Schedule A if you itemize deductions. If your property was foreclosed and you received a 1099-C, you may have to report that cancellation of debt as income. Knowing the correct forms to file can simplify the process and may help you avoid costly errors. Consider using US Legal Forms to access templates that assist with this paperwork.

The 1099-C form is used to report the cancellation of debt, which can arise during a foreclosure for property taxes. Lenders issue this form when they forgive a debt of $600 or more, which then may be taxable income for you. Understanding how to use the 1099-C is crucial, as it reflects the financial obligation that has been forgiven. Always keep this form for your tax records.

You can report a foreclosure for property taxes on your tax return by including information about any debt forgiven by your lender. This includes detailing any amount that exceeds the property's fair market value, which may lead to taxable income. Ensure you have the necessary documentation to support your claims. It’s often wise to consult with a tax professional for specific advice.

Tax foreclosure refers to the legal process through which the government takes possession of a property due to unpaid property taxes. This process allows authorities to recover the owed taxes by selling the property at auction. Understanding tax foreclosure for property taxes can be crucial for homeowners to navigate potential risks associated with their investments. For those facing difficulties, platforms like US Legal Forms provide resources and guidance to help manage tax obligations effectively.

A property tax foreclosure can impact your credit score negatively. When your property faces a tax foreclosure, it may report to credit bureaus, indicating financial trouble. This unfavorable mark can hinder your ability to secure loans or mortgages in the future. Addressing property tax obligations promptly can help you avoid such complications and maintain a healthier credit profile.

Yes, you can potentially buy a house by paying the back taxes in North Carolina. The state allows individuals to redeem properties during a specific period after a tax foreclosure. By settling the owed property taxes, you may secure the property while effectively participating in the foreclosure for property taxes process. This option can be a viable strategy for those looking to invest or own a home.

Yes, after a foreclosure for property taxes, you will likely receive a Form 1099-C from your lender. This form reports any amount of debt that the lender canceled or forgiven during the foreclosure process. Receiving a 1099-C means you need to report the forgiven debt as income on your tax return. Staying informed on this process will assist you in preparing for any tax obligations that arise.

In most cases, you cannot directly write off foreclosure for property taxes. However, if you experienced a cancellation of debt, this may come with specific tax implications. Be sure to consult tax guidelines or a tax professional to explore what deductions, if any, might apply to your situation. Knowing your options allows you to manage your finances better during this challenging time.

Foreclosure for property taxes can significantly impact your income tax return. If your property is sold and a debt is forgiven, this forgiven amount may be treated as taxable income. Additionally, you might face the loss of deductions related to mortgage interest and property taxes. Understanding these factors is crucial for managing your overall tax liability post-foreclosure.

When you encounter foreclosure for property taxes, you generally need to report any forgiven debt as income. This includes any amount that the lender cancels or writes off. You'll receive Form 1099-C, which details the forgiven amount, and you must include it on your tax return. Ensuring accurate reporting helps you navigate the tax implications of your foreclosure situation effectively.