Foreclosure For Home Loan

Description

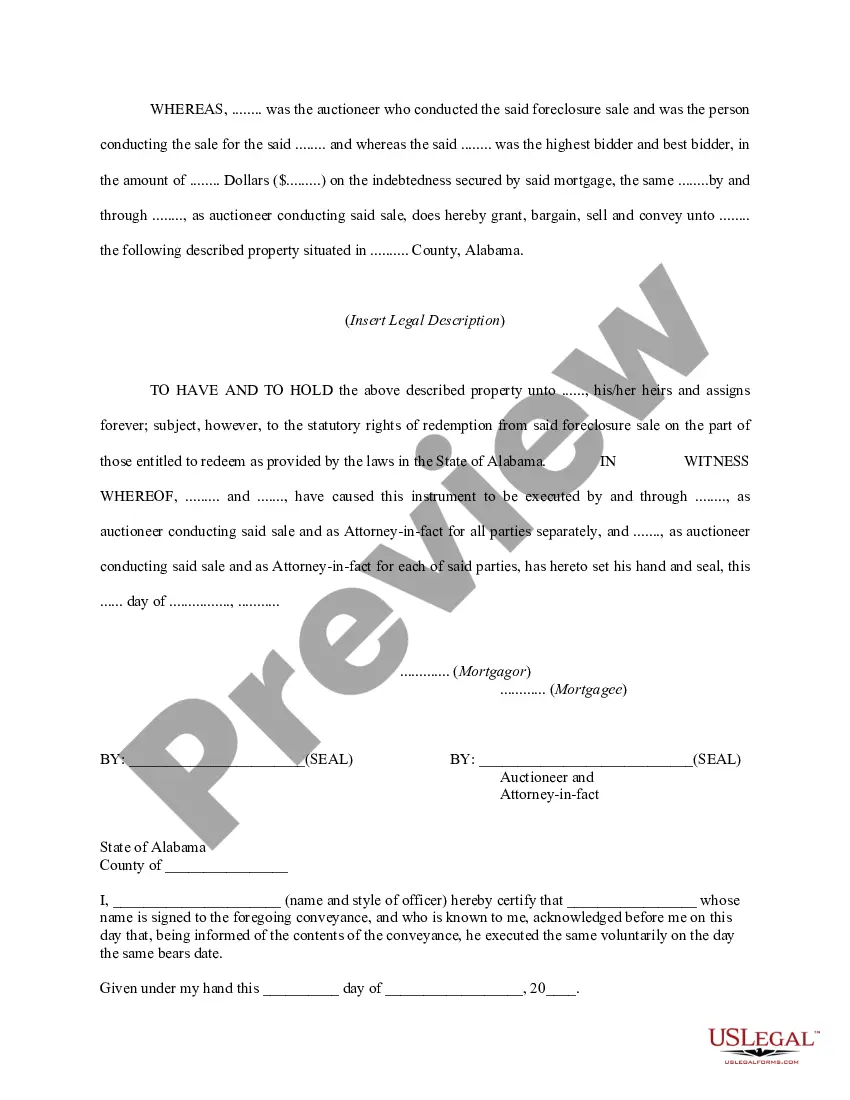

How to fill out Alabama Auctioneer's Deed For Foreclosure Sale?

- Log in to your existing US Legal Forms account. If you haven't created an account yet, follow the steps outlined below.

- Examine the Preview mode and ensure the form description aligns with your requirements. Select a form that complies with your local jurisdiction.

- If necessary, use the Search tab to find alternative templates that may suit your needs better.

- Purchase the document by clicking the 'Buy Now' button, selecting your preferred subscription plan, and registering your account for library access.

- Complete your transaction by entering your payment details through either credit card or PayPal.

- Download your form and save it on your device for easy access. You can also find it in the 'My Forms' section of your profile whenever you need it.

In conclusion, US Legal Forms provides users with an extensive library of legal documents and expert support, making the process of handling foreclosure for home loan issues straightforward. For quick access to vital documents and personalized assistance, visit US Legal Forms today!

Form popularity

FAQ

The timeline for foreclosure can vary, but it usually takes several months from the time of missed payments to the actual sale of the home. Most states require a notice period that gives homeowners time to respond. Understanding your rights and options can significantly impact this timeline. Utilizing US Legal Forms can help you prepare necessary documentation and explore your available options.

Recovering from a foreclosure can be a challenging and lengthy process, often taking several years for homeowners to rebuild their credit scores and regain financial stability. During this time, individuals should focus on improving their financial literacy and managing debts wisely. It’s essential to have a solid plan moving forward, which can include securing alternative financing options. USLegalForms provides guidance and resources to help those affected by foreclosure get back on track.

The person who suffers the most in a foreclosure is usually the homeowner, who confronts the loss of their place to live and financial instability. Additionally, families can experience emotional distress and disruption during this challenging time. Recognizing these risks is crucial for future homeowners. To navigate these challenges, consider engaging with USLegalForms for documentation and advice on maintaining homeownership.

Foreclosure impacts several parties, but primarily, the homeowner faces significant losses, both financially and emotionally. Lenders lose out on their investment in the home, while the neighborhood and community can also feel the impact through declining property values. Understanding the broader implications can help homeowners make informed decisions. Platforms like USLegalForms offer resources to educate borrowers on preventing foreclosure.