Quitclaim Deed With Mortgage

Description

How to fill out Alabama Quitclaim Deed For A Timeshare - Two Individuals To One Individual?

- Log in to your US Legal Forms account if you're a returning user, ensuring your subscription is active. If it has expired, renew it according to your payment plan.

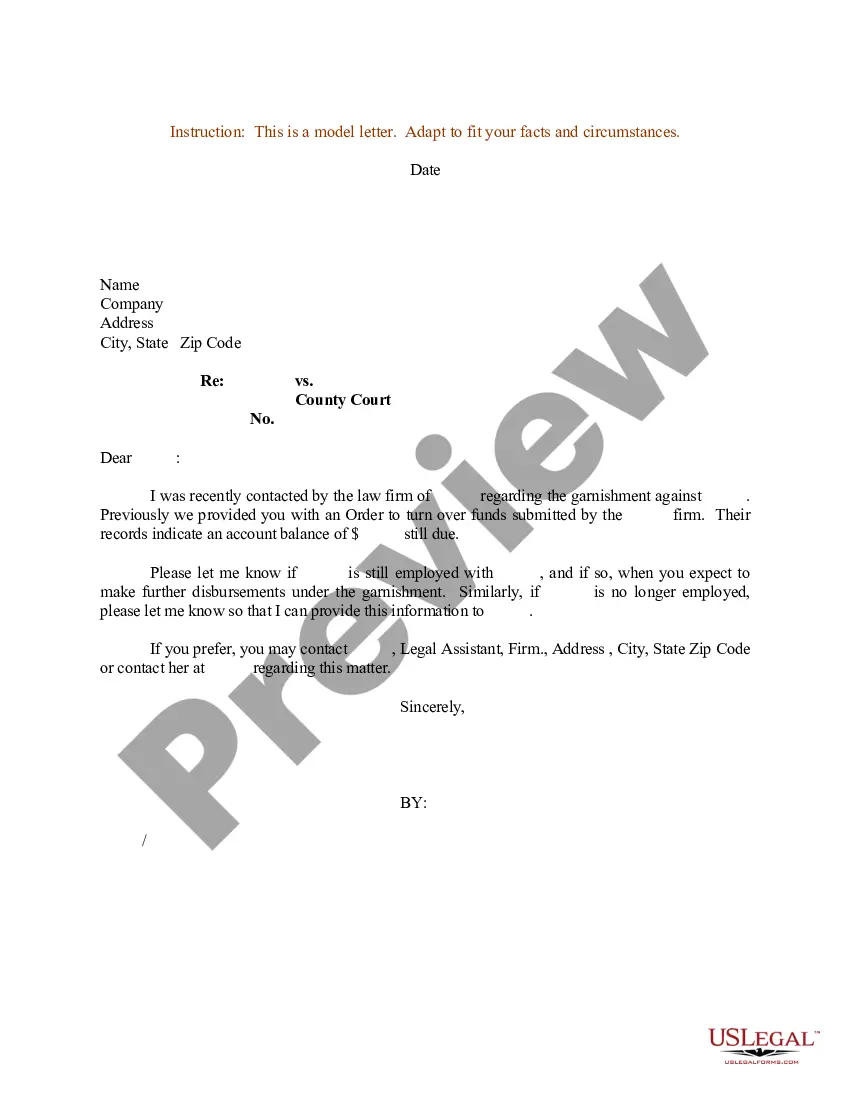

- For new users, start by checking the Preview mode and form descriptions to find the quitclaim deed with mortgage that complies with your local jurisdiction.

- If the specific template isn’t suitable, use the Search tab to find additional relevant forms that better match your needs.

- Once you have the correct document, click on the Buy Now button and select your desired subscription plan, creating an account to access more resources.

- Complete your purchase by entering your payment information, either through credit card or PayPal.

- After payment, download the form to your device and access it anytime from the My Forms section of your profile.

Using US Legal Forms not only grants you access to a vast collection of over 85,000 legal documents but also provides assistance from experts for completing your forms accurately.

Start your legal journey today and empower yourself with the right tools! Visit US Legal Forms to get started.

Form popularity

FAQ

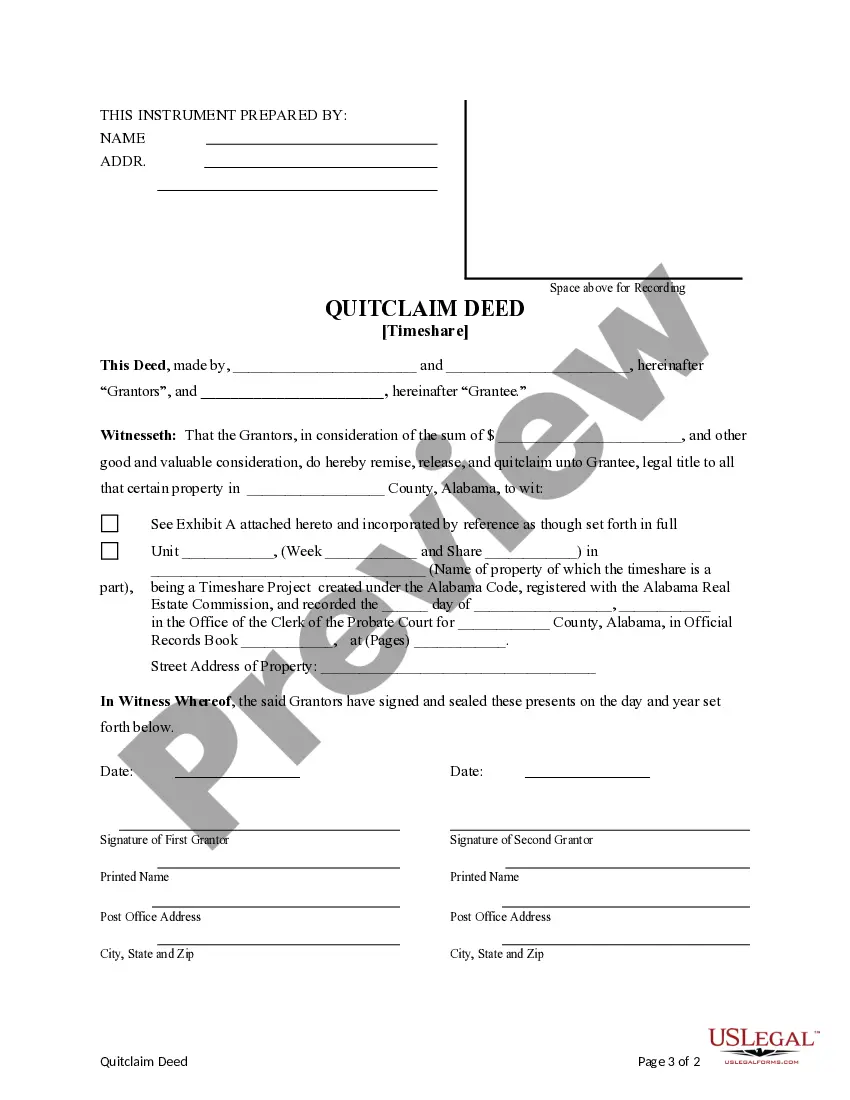

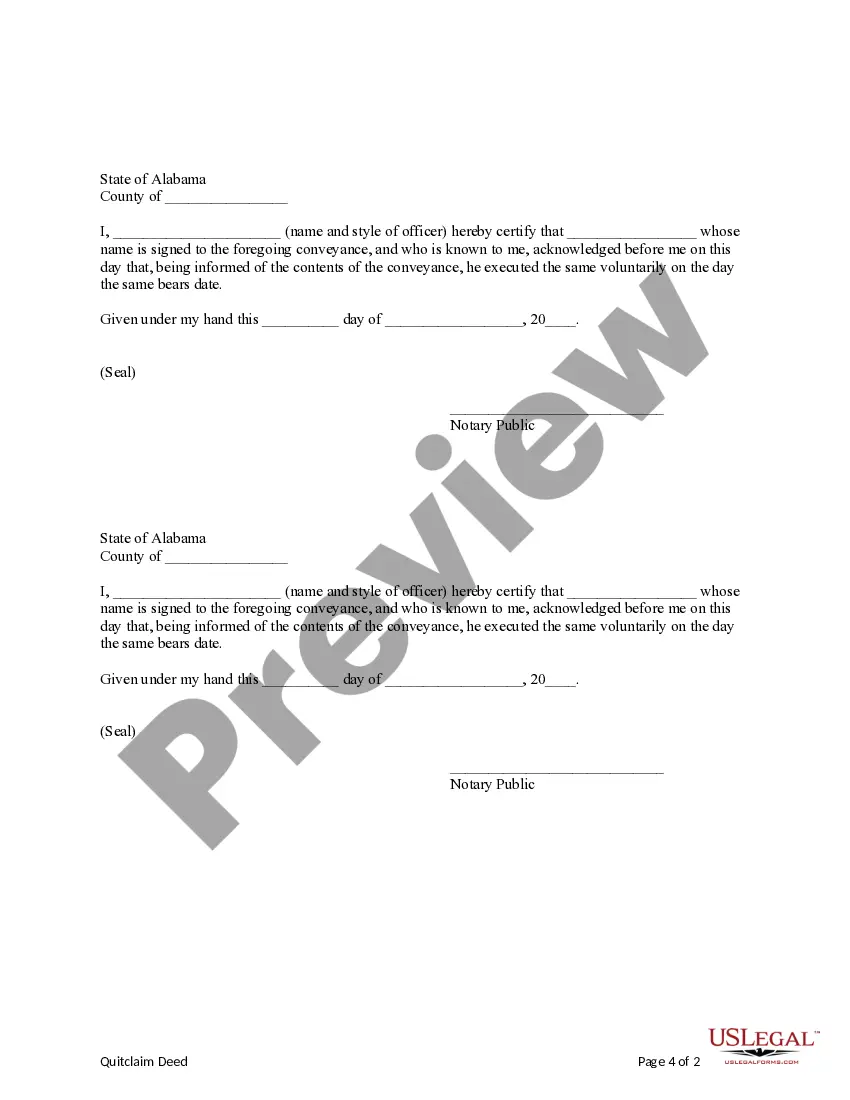

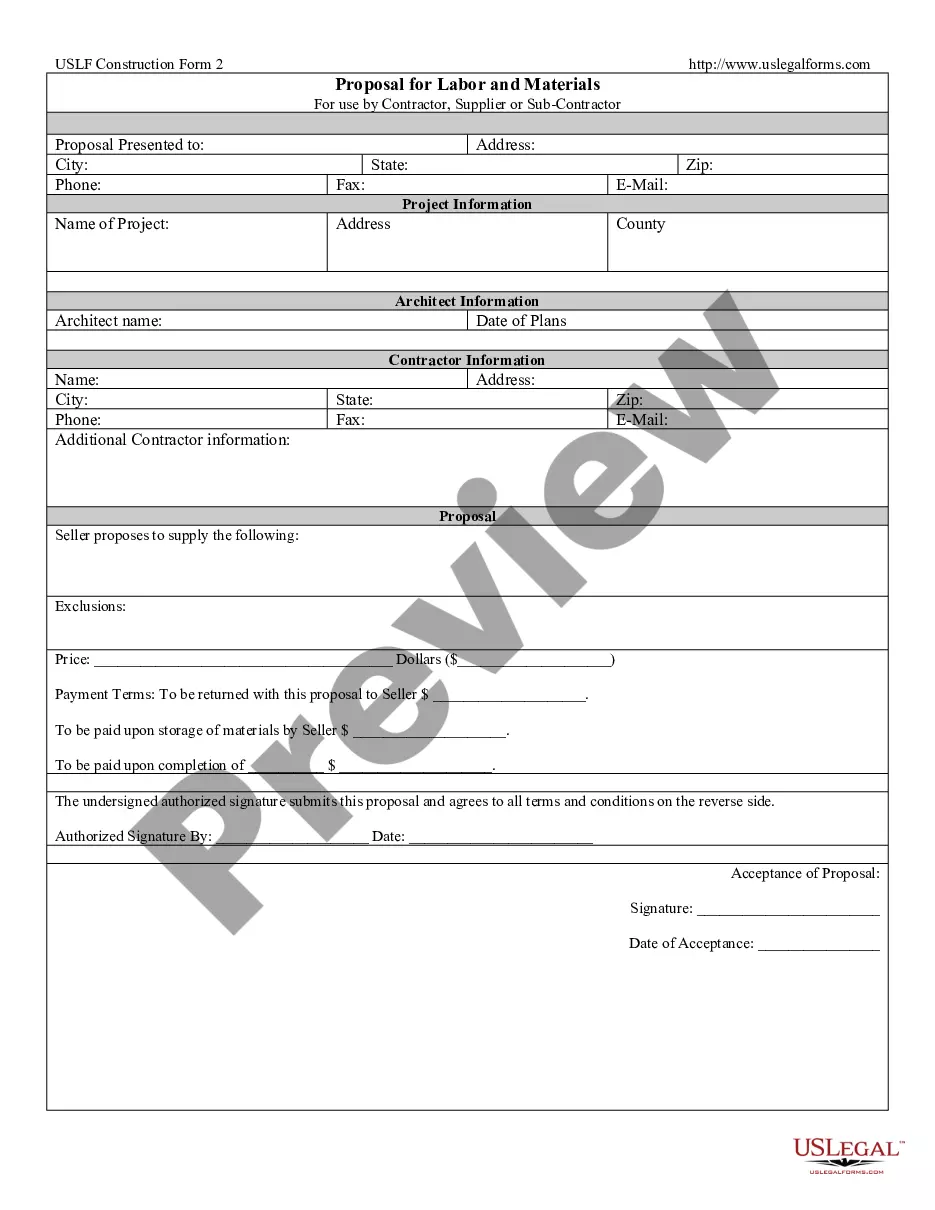

To create a quitclaim deed with mortgage, start by gathering the necessary information about the property and the parties involved. Next, draft the deed, ensuring it includes specific language to clarify that you are transferring your interest in the property while acknowledging any existing mortgage. It is crucial to execute the deed in front of a notary public to ensure its legality. Lastly, file the quitclaim deed with the county recorder's office to finalize the process and make it official.

Generally, the property owner keeps the original deed to a house. When you obtain a quitclaim deed with mortgage, the deed transfer does not change your ownership unless specified. It's wise to store your original deed in a safe place, as it serves as proof of ownership and can be required in future transactions or disputes.

Both title and deed are important for different reasons. A title indicates legal ownership, while a deed is the physical document that transfers that ownership. When considering a quitclaim deed with mortgage, understanding the distinction is crucial. Ensure your property title is clear, and consult platforms like US Legal Forms if you need assistance navigating these concepts.

You can prepare a quitclaim deed yourself, but it's crucial to understand the legal requirements in your state. A quitclaim deed with mortgage involves specific steps to ensure it is valid and enforceable. While DIY may seem appealing, seeking legal advice or using US Legal Forms can simplify the process and prevent costly mistakes. This approach ensures your deed meets all necessary legal standards.

Yes, you can obtain a deed even if you have a mortgage. A quitclaim deed with mortgage allows you to transfer ownership without affecting your mortgage obligations. However, you remain responsible for the mortgage payments, so keep that in mind. Consult with a legal expert or use a platform like US Legal Forms to ensure you're following the correct process.

Quitclaim deeds are often viewed with caution because they do not guarantee clear title, meaning the grantor may not have full ownership of the property. This lack of assurance can be a concern for lenders, especially in cases involving a quitclaim deed with mortgage. Additionally, without a title search, the grantee risks assuming any outstanding liens or debts associated with the property. Therefore, understanding the implications is crucial before proceeding with a quitclaim deed.

To properly fill out a quitclaim deed, start with accurate identification of all parties involved, including the current owner and the new owner. Next, ensure to provide a complete description of the property, highlighting any existing mortgages to reflect it as a quitclaim deed with mortgage. Also, do not forget to include signature lines for both parties, as well as a notary acknowledgment to validate the document.

To fill out a quitclaim deed form, begin by obtaining the appropriate form tailored for your state. Clearly provide the names of the grantor and grantee, and include a legal description of the property. While completing the form, ensure you attach any applicable mortgage details since this is a quitclaim deed with mortgage. Lastly, sign the form in front of a notary public to make it legally binding.