Quitclaim Deed For For Sale Of Property

Description

How to fill out Alabama Quitclaim Deed For A Timeshare - Two Individuals To One Individual?

- If you're an existing user, log in to your account and locate the necessary quitclaim deed template. Ensure your subscription is active; if not, renew according to your payment plan.

- Preview the form description carefully to confirm it matches your requirements and complies with local laws.

- If necessary, you can search for additional templates using the search feature. Make sure the selected document corresponds to your needs.

- Proceed to purchase the document by clicking the 'Buy Now' button, selecting your subscription plan, and creating an account for full access to the legal library.

- Complete your transaction by entering payment details via credit card or PayPal to finalize your subscription.

- Download the quitclaim deed template to your device for easy access, and find it later in the My Forms section.

With US Legal Forms, you can trust that you’re receiving comprehensive resources designed for ease and efficiency. Their extensive library, which includes over 85,000 easily editable forms, empowers both individuals and legal professionals to navigate legal documents confidently.

Don't let paperwork hold you back. Access US Legal Forms today and ensure your quitclaim deed for sale of property is processed smoothly!

Form popularity

FAQ

Yes, you can use a quitclaim deed for the sale of your house. This type of deed allows you to transfer your interest in the property to another party without guaranteeing the title. However, it is essential to understand that by using a quitclaim deed for the sale of property, you may not provide the buyer with the same level of protection as with a warranty deed. For assistance in preparing a quitclaim deed for sale of property, consider using the US Legal Forms platform, which provides easy templates and guidance.

Yes, you can create a quitclaim deed on your own, but it is important to understand the process. A quitclaim deed for the sale of property effectively transfers ownership without guarantees. While doing it yourself saves on legal fees, consider using resources like USLegalForms to ensure you complete the deed correctly. Properly filling out and recording the quitclaim deed can prevent future disputes.

In California, quitclaim deeds for the sale of property can be prepared by various entities, including attorneys, title companies, and self-help legal services. While anyone can draft one, it’s always wise to engage a professional to ensure accuracy and compliance with state laws. Platforms such as US Legal Forms can also provide the necessary templates and support for this process.

Yes, title companies often prepare quitclaim deeds for the sale of property. They have the expertise to ensure that all legal requirements are met and can provide valuable guidance to both buyers and sellers. Utilizing a title company can simplify the process and help ensure that your transaction is secure and properly documented.

One significant disadvantage of a quitclaim deed for the sale of property is that it offers no guarantees regarding the property title. If there are title issues or liens, the buyer assumes those risks. Also, quitclaim deeds do not provide protections found in other types of deeds, like warranty deeds, which can lead to potential disputes in the future.

In California, anyone can prepare a quitclaim deed for the sale of property, but it is often best to have an attorney or a qualified legal professional do so. This ensures that all legal requirements are correctly addressed and helps prevent future issues. Additionally, title companies can assist with document preparation, offering added expertise in property transactions.

Yes, you can complete a quitclaim deed for the sale of property yourself. However, it is advisable to be cautious and ensure that you follow the required procedures. Using the right legal forms and correctly filling them out will help avoid potential disputes later. For assistance, you may consider platforms like US Legal Forms to access templates and guidelines.

A quitclaim deed can be considered bad for buyers because it provides no guarantees regarding the property's title. Without warranties, buyers assume all risks associated with potential claims or liens on the property. Thus, understanding these risks is crucial before executing a quitclaim deed for for sale of property.

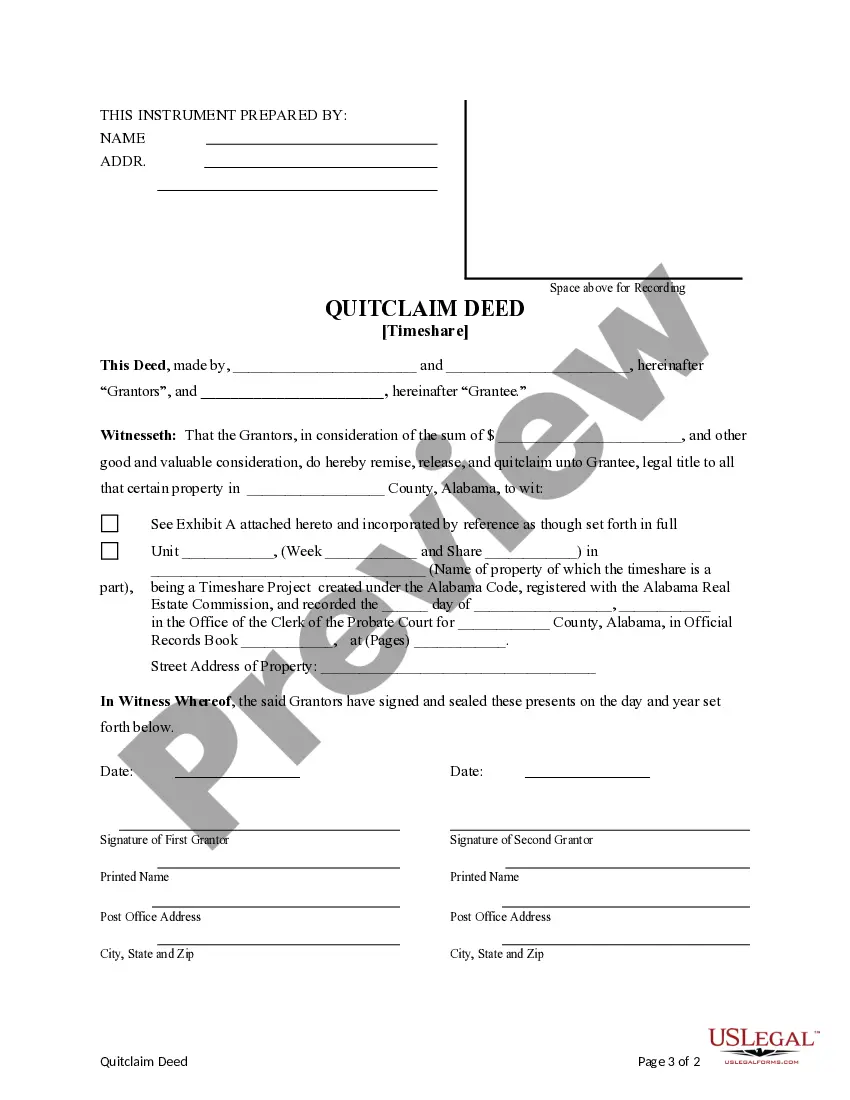

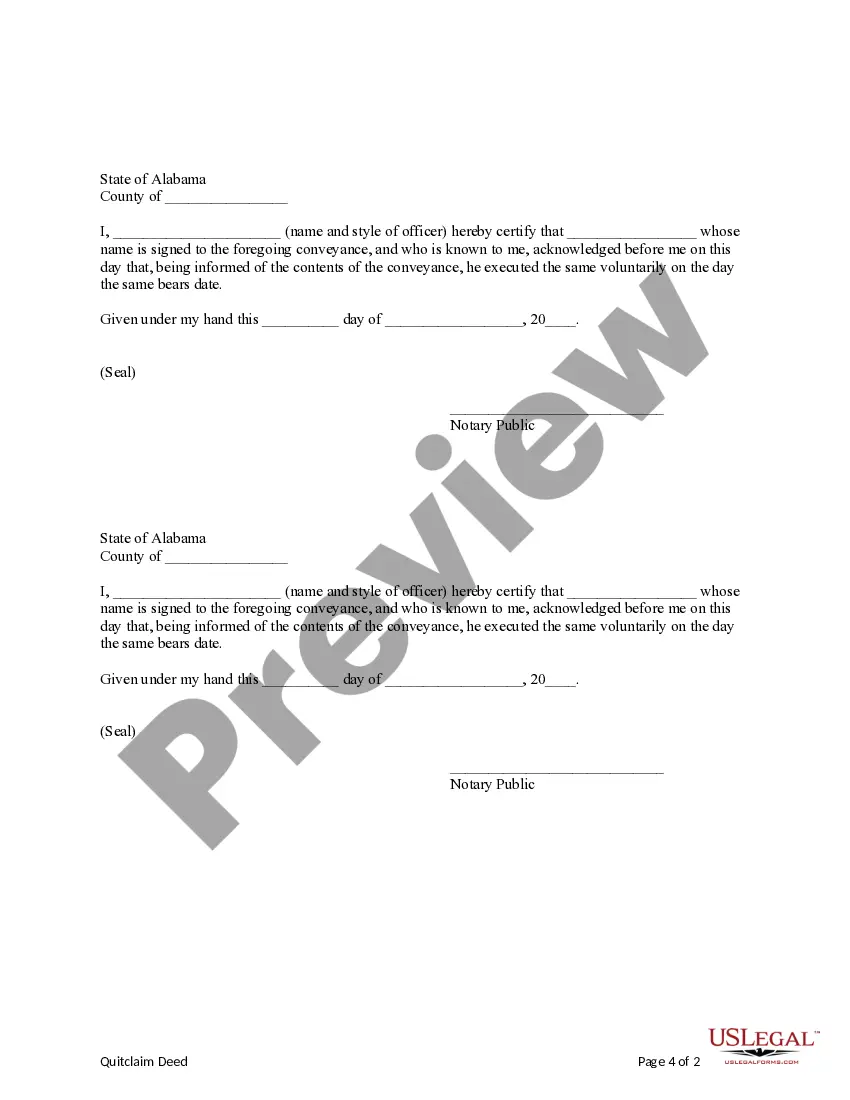

To properly fill out a quitclaim deed, begin by clearly identifying the grantor and grantee. Include a legal description of the property and ensure that the document is signed and dated by the grantor. Using a resource like USLegalForms can help streamline this process, ensuring accurate completion of the quitclaim deed for for sale of property.

A significant disadvantage for a buyer receiving a quitclaim deed is the lack of legal protection. There are no warranties that the seller actually owns the property or has the right to transfer it. This can lead to complications, making the quitclaim deed for for sale of property a riskier option for buyers.