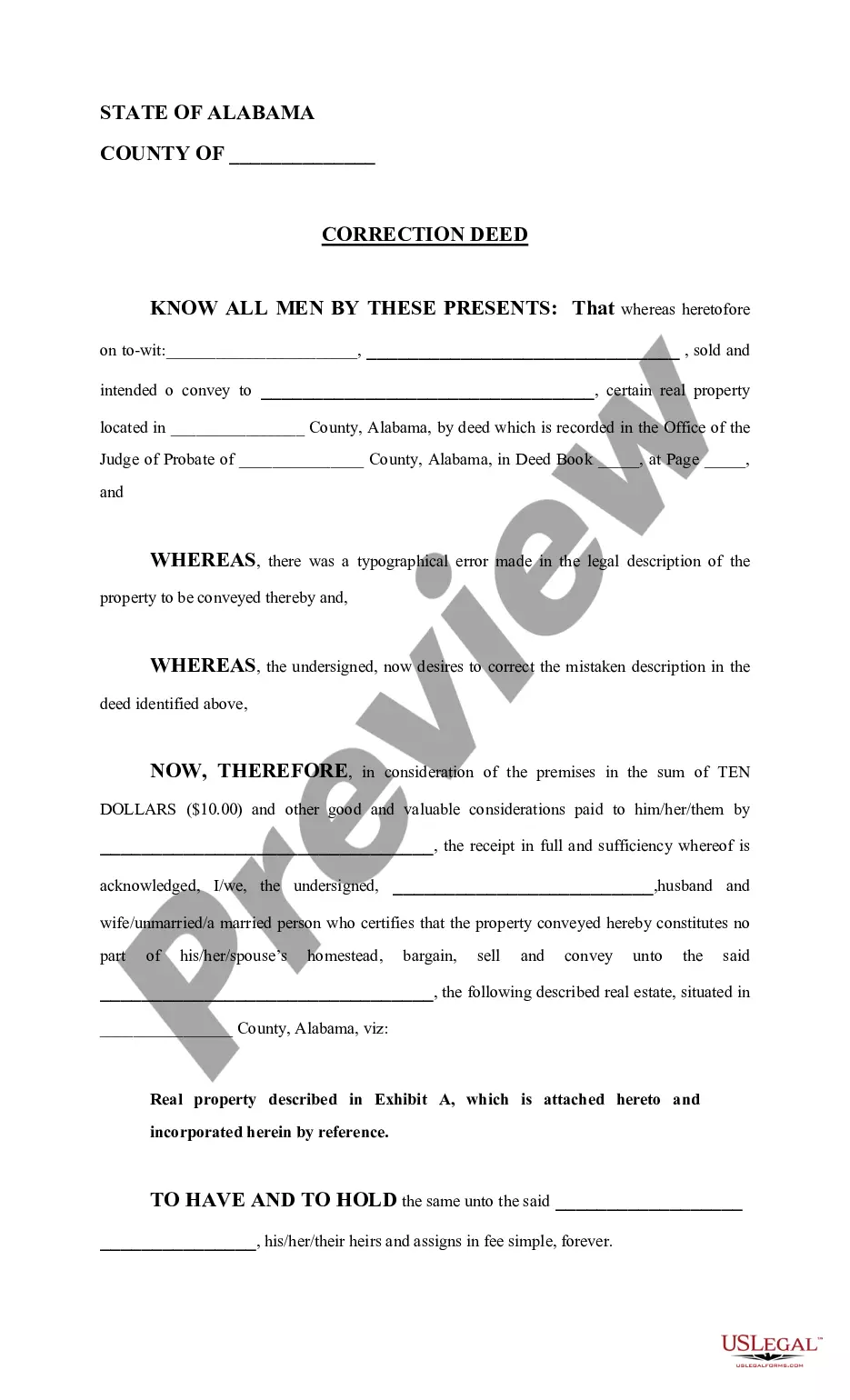

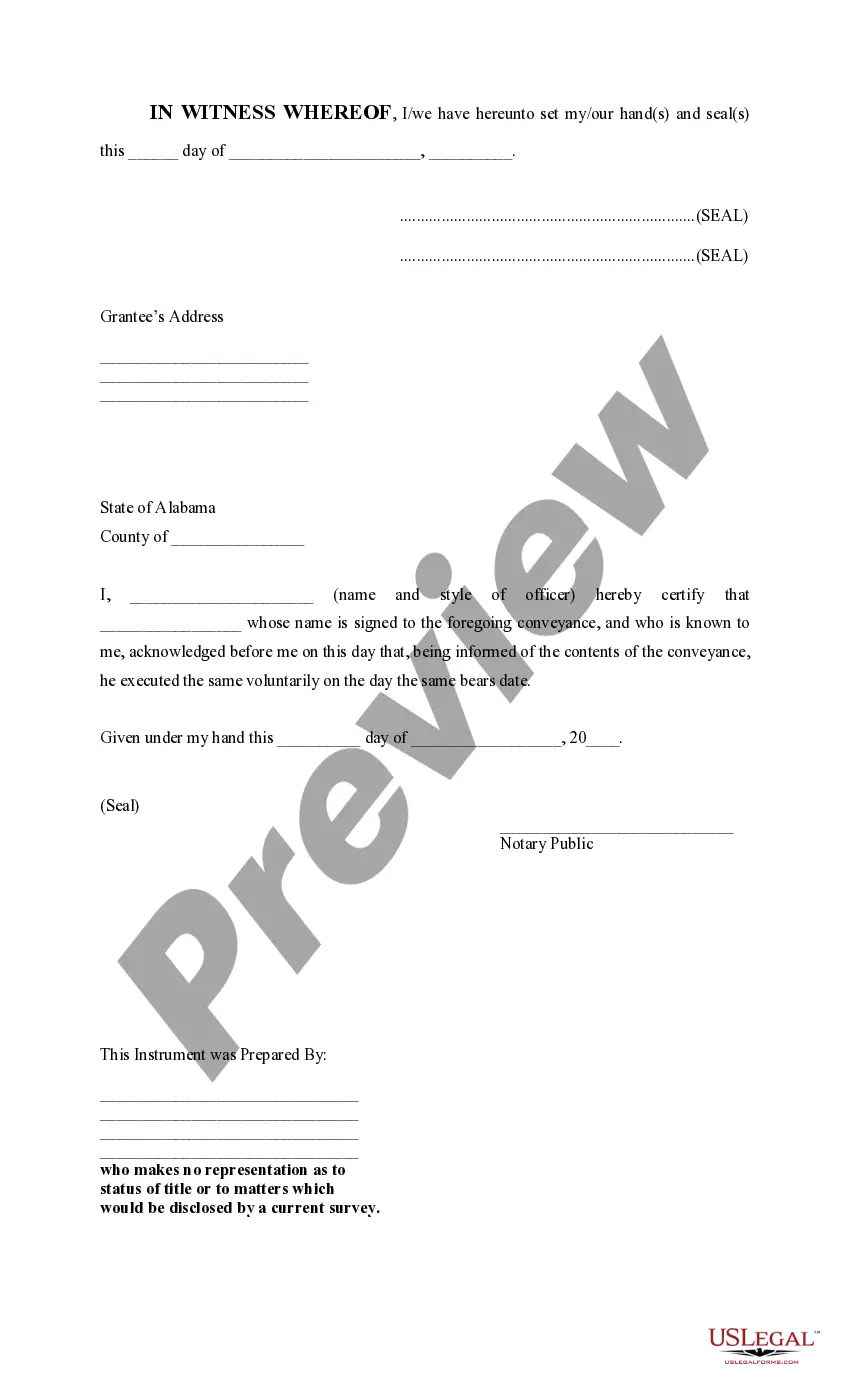

Corrective Deed Form

Description

How to fill out Alabama Correction Deed?

When you need to fill out Corrective Deed Form in accordance with your local state's laws and guidelines, there can be several alternatives to choose from.

There's no requirement to scrutinize every form to ensure it meets all the legal standards if you are a US Legal Forms subscriber.

It is a dependable service that can assist you in obtaining a reusable and current template on any subject.

The US Legal Forms makes obtaining professionally drafted formal documents effortless. Additionally, Premium users can benefit from powerful integrated solutions for online document editing and signing. Give it a try today!

- US Legal Forms is the most extensive online directory with an archive of over 85k ready-to-use documents for business and personal legal matters.

- All templates are verified to comply with each state's regulations.

- Thus, when downloading Corrective Deed Form from our platform, you can be assured that you have a legitimate and current document.

- Acquiring the required sample from our platform is very straightforward.

- If you already have an account, simply Log In to the system, confirm your subscription is active, and save the chosen file.

- In the future, you can access the My documents tab in your profile and retrieve the Corrective Deed Form at any time.

- If it's your first time on our website, please follow the instructions below.

- Browse the suggested page and verify it for adherence to your needs.

Form popularity

FAQ

To file a correction deed in California, you need to fill out the corrective deed form accurately. Ensure all required details are included, and then submit the completed form to your local county recorder's office. Filing this document updates the official records, preventing any potential disputes about property ownership. Utilizing a trusted platform like uslegalforms can simplify this process.

Changing a deed in California involves filling out a corrective deed form to document the alterations. You must provide information about the current deed and specify the changes. Once completed, submit the form to the county recorder's office for filing. This is essential to maintain clear and accurate property records.

To remove someone from a deed in California, you generally need to complete a corrective deed form. This document outlines the changes and must be signed by the remaining parties. Afterward, you need to file the amended deed with the county recorder's office. This process helps ensure that ownership is accurately reflected.

The two types of deeds most frequently used in California are the grant deed and the warranty deed. A grant deed provides assurances about the title and is commonly used in real estate transactions. Alternatively, a warranty deed offers even more protection to the buyer, guaranteeing that the title is clear of any claims. Knowing the differences between these deeds ensures you protect your interests during property transactions.

The corrective deed form in California is a document used to fix mistakes made in a previously recorded deed. This form is necessary when there are inaccuracies regarding names, property descriptions, or other critical details. By using a corrective deed form, you ensure that the public record accurately reflects the intended ownership and details of the property. This step is crucial for maintaining clear property titles and avoiding future legal issues.

A correction deed is a legal document that amends a mistake found in an existing deed. Its purpose is to ensure that the official property records accurately reflect the true ownership details. When inaccuracies arise, utilizing a corrective deed form simplifies the process of making necessary adjustments. This helps maintain clarity and legality in property ownership.

Correcting a deed in Texas involves drafting a corrective deed form that details the inaccuracies found in the original deed. It is crucial to provide clear descriptions of both the original errors and the corrected information. Following this, file the corrective deed with the county clerk's office to ensure that accurate records are maintained. This step ultimately helps avoid future ownership disputes.

To remove someone from a deed in Texas, you must complete a new deed that officially reflects the change in ownership. This often involves creating a corrective deed form that specifies who is being removed and any necessary adjustments to the property description. After completion, file the new deed with your county's clerk to update public records accurately. This action clarifies the current ownership and rights.

While a ladybird deed offers benefits, it also has some disadvantages. One downside is that it can complicate matters if there are multiple beneficiaries, leading to potential disputes. Additionally, the property is still part of the owner’s estate for tax purposes, which can impact estate planning. If there are errors, using a corrective deed form may be necessary to clarify ownership.

In Texas, a correction deed can be filed by the property owner or anyone authorized by the owner. This includes agents or representatives who have been given the power of attorney. It is essential to complete a proper corrective deed form detailing the specific corrections required. This ensures that the corrections are legally recognized and the property records reflect accurate information.