Transfer Deed When Someone Dies

Description

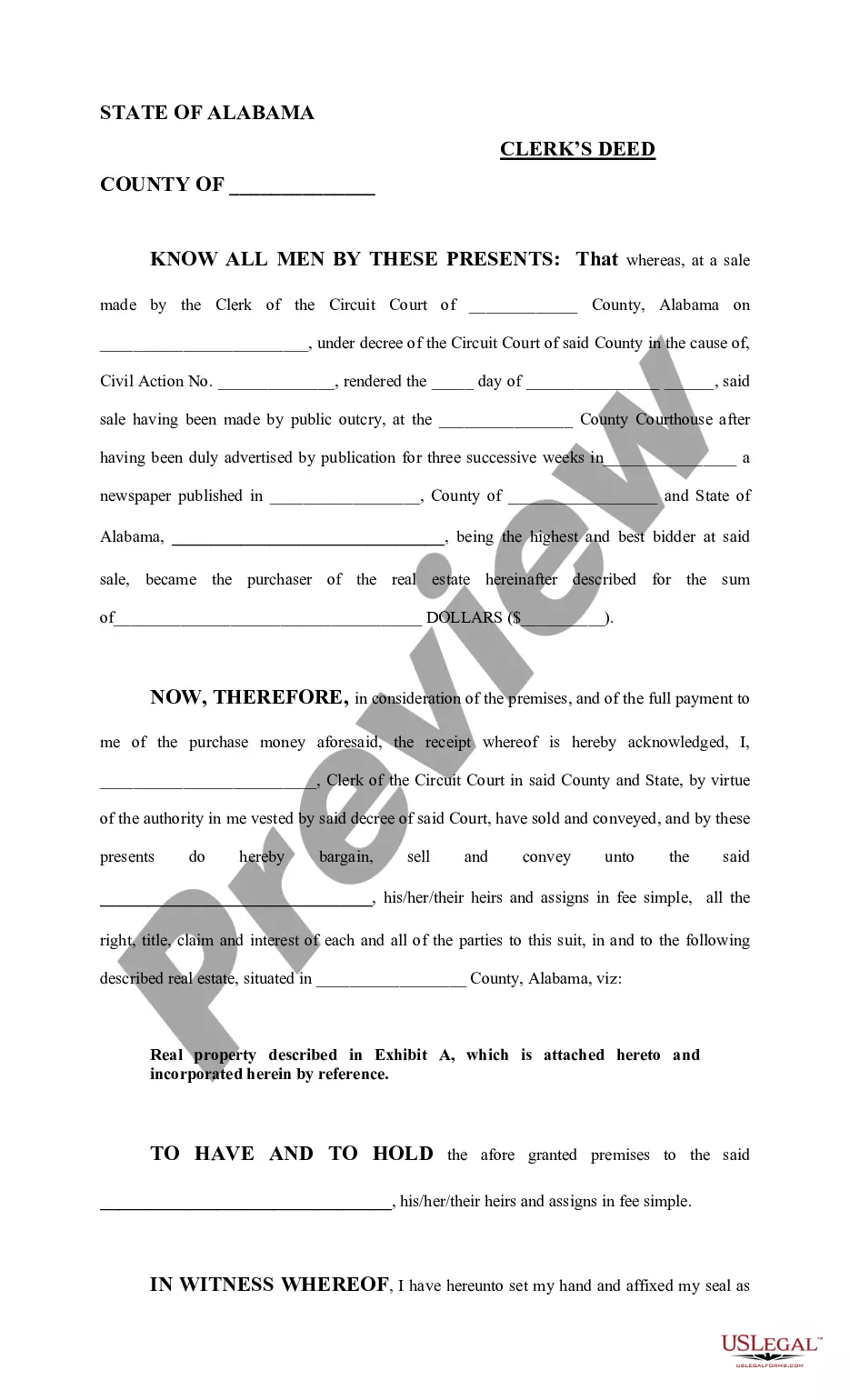

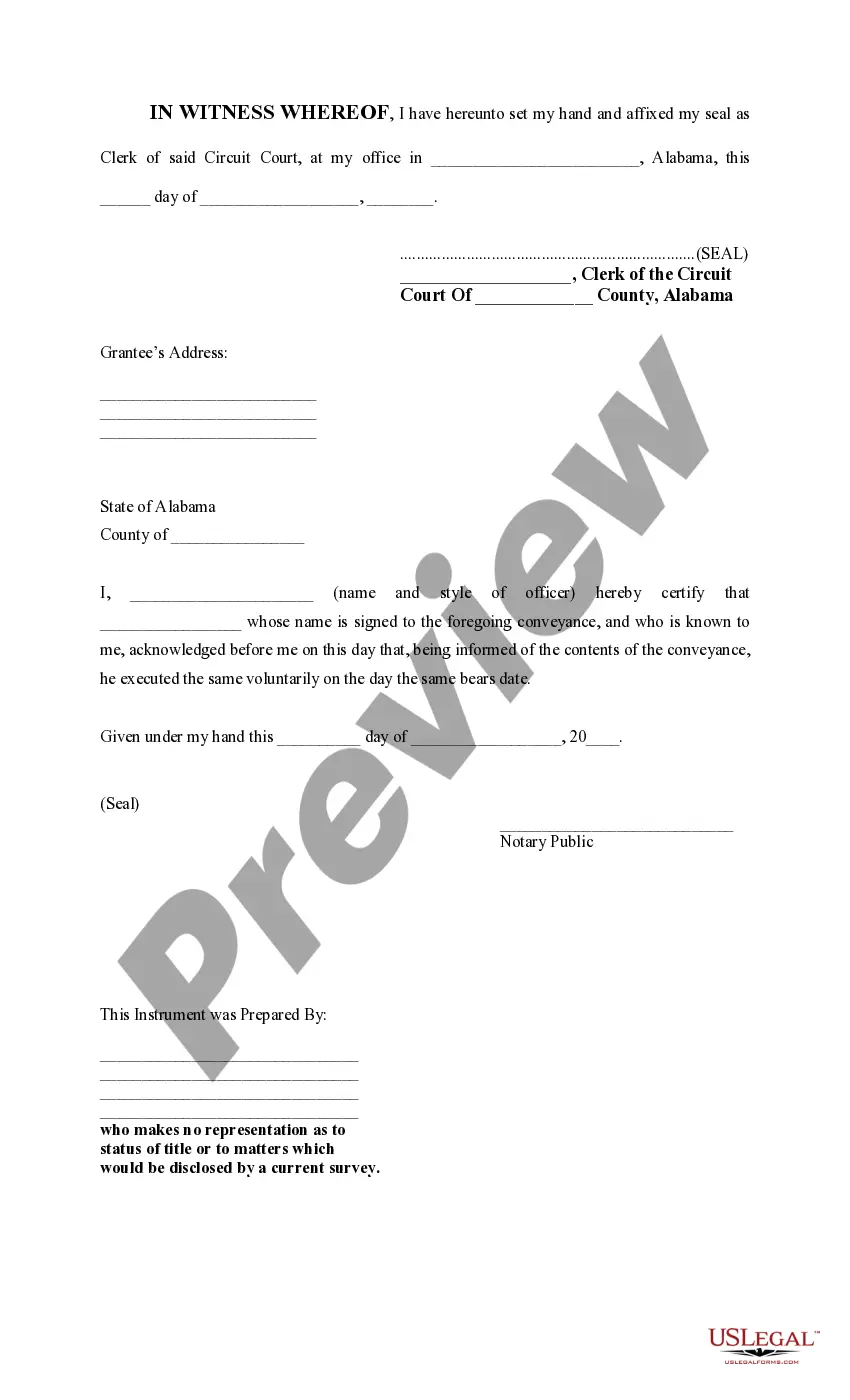

How to fill out Alabama Clerk's Deed?

Finding a reliable source for obtaining the most up-to-date and suitable legal templates is a significant part of navigating bureaucracy.

Selecting the appropriate legal documents requires precision and carefulness, which is why it is essential to obtain samples of Transfer Deed When Someone Dies exclusively from reputable providers, like US Legal Forms. An incorrect template could waste your time and prolong your situation.

Eliminate the stress associated with your legal documents. Explore the comprehensive US Legal Forms catalog to discover legal templates, assess their relevance to your situation, and download them promptly.

- Utilize the catalog navigation or search bar to locate your template.

- Review the form’s details to ensure it meets the requirements of your state and region.

- View the form preview, if available, to confirm that the template aligns with your interests.

- Continue your search to find the right template if the Transfer Deed When Someone Dies does not fulfill your needs.

- If you are confident about the form’s relevance, proceed to download it.

- If you are a registered user, click Log in to verify and access your chosen templates in My documents.

- If you do not have an account yet, click Buy now to acquire the form.

- Select the pricing plan that fits your needs.

- Complete the registration to finalize your purchase.

- Finish your purchase by selecting a payment method (credit card or PayPal).

- Choose the document format for downloading Transfer Deed When Someone Dies.

- After you've acquired the form on your device, you can edit it using the editor or print it out and complete it by hand.

Form popularity

FAQ

A transfer deed when someone dies can have implications for inheritance tax, but it does not necessarily exempt you from it. Typically, the person receiving the property may still face inheritance taxes, depending on their state's laws and the value of the estate. It’s beneficial to check your local regulations to understand any tax obligations associated with a transfer on death deed. Consulting a tax professional or utilizing platforms like USLegalForms can help you navigate these complexities.

States with transfer on death deed laws empower property owners to designate beneficiaries effectively. If you are looking to set up a transfer deed when someone dies, you can find this option in states like Arizona, Indiana, and Nevada. Each state may have unique stipulations related to the execution and filing of the deed, so consider consulting legal resources or platforms like USLegalForms for clarity. Taking this step can ease the transition of your assets for those you care about.

Many states in the U.S. allow a transfer deed when someone dies, enabling property owners to transfer their real estate directly to beneficiaries without the need for probate. This process simplifies the transfer of assets and can save time for your loved ones. States that allow this deed include California, Florida, and Texas, among others. It's crucial to verify your state's specific requirements when planning your estate.

Transfer on death deeds can be executed by property owners before their passing. This method allows individuals to transfer property ownership seamlessly to designated beneficiaries upon their death. Understanding how to use a transfer deed when someone dies can be crucial for estate planning. Uslegalforms provides clear guidance and templates to help you set up a transfer on death deed properly.

The timeline to transfer property after death varies based on several factors, including the complexity of the estate and local laws. Generally, you can expect the process to take several weeks to a few months. To ensure a smooth experience, consider utilizing a transfer deed when someone dies, as this can expedite the process. Uslegalforms offers resources to help you understand and manage these timelines efficiently.

Transferring ownership of a house with a mortgage when someone dies requires careful attention. First, locate the mortgage documents and review the deed. Then, you'll typically need to initiate a transfer deed when someone dies, ensuring all beneficiaries agree. Using a service like uslegalforms can simplify this process, helping you navigate any legal requirements effectively.

A transfer on death deed can typically be obtained through your local county recorder’s office or online legal form services. Online platforms such as US Legal Forms offer easy access to templates and instructions for completing a transfer deed when someone dies. This can save you time while ensuring that you comply with your state's legal requirements, making the process smooth and straightforward.

Currently, many states allow transfer on death deeds, including California, Arizona, and Florida, among others. This type of deed provides a streamlined way to transfer property directly to a beneficiary without going through probate. If you're considering utilizing a transfer on death deed, ensuring you understand the laws specific to your state is essential. You can find the necessary forms and instructions on how to complete a transfer deed when someone dies through US Legal Forms.

Typically, property can remain in a deceased person's name during the probate process, which can last several months to years, depending on the state. After the completion of probate, the property must be transferred to the heirs or beneficiaries. Thus, understanding how to effectively transfer a deed when someone dies is necessary, and resources like US Legal Forms can assist you in navigating this legally and efficiently.

To obtain the deed for your deceased parents' house, you must first locate the original deed and identify the county where it was recorded. You can usually find this information through the local tax assessor’s office or the county recorder’s office. If the property was transferred on death, you will need to follow the specific legal steps outlined for transferring a deed when someone dies, which can be streamlined using US Legal Forms to access required documents.