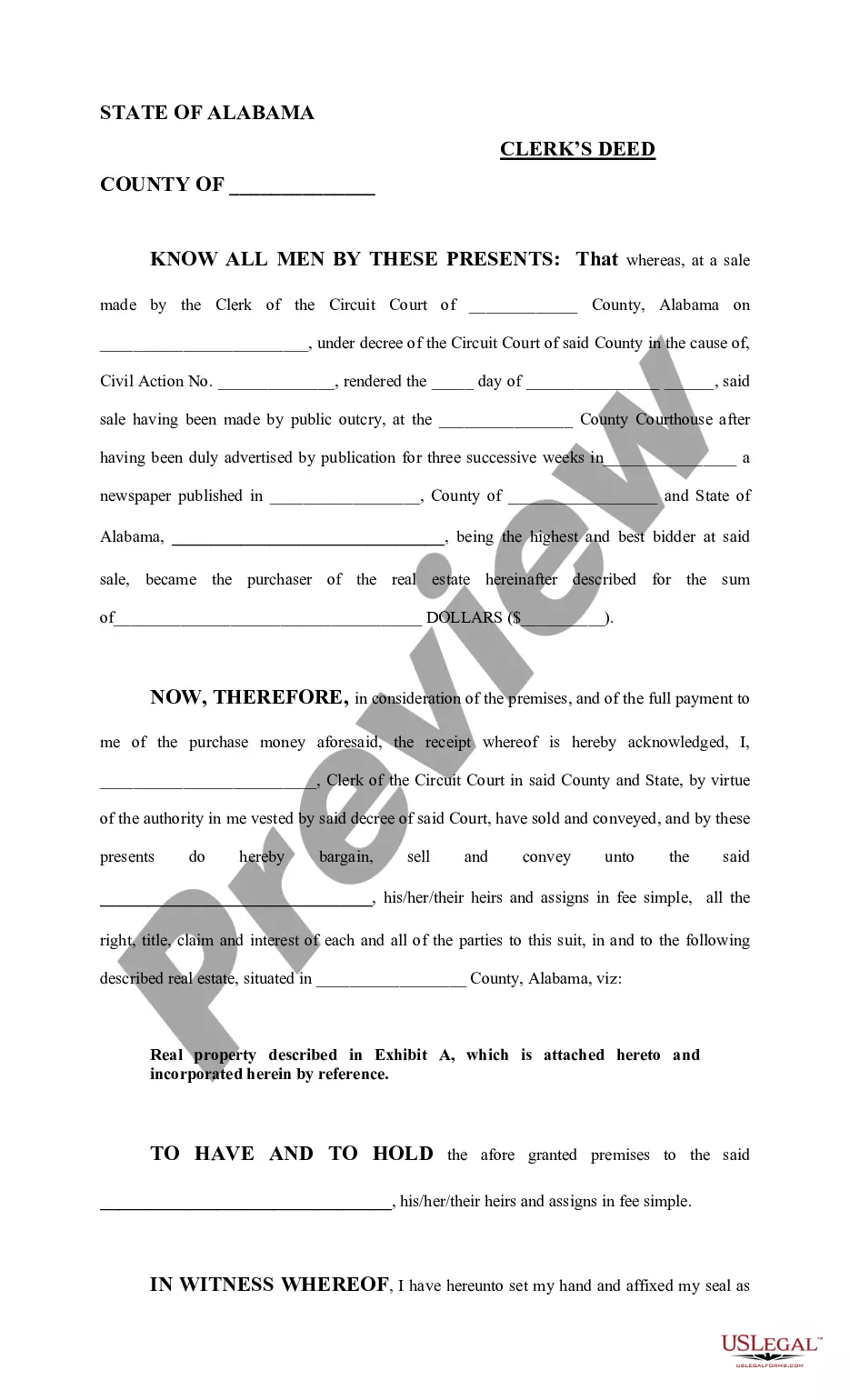

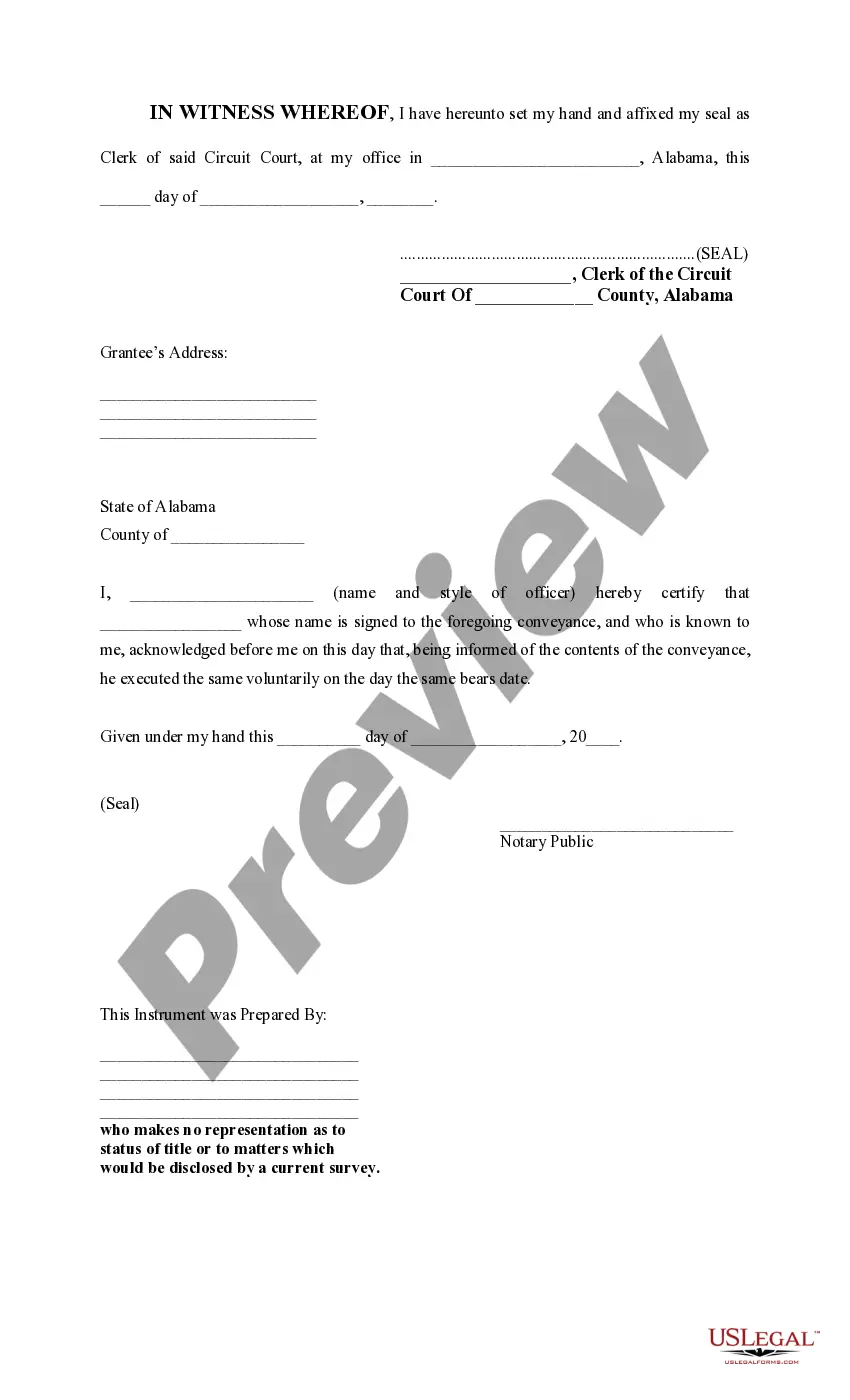

This type of deed is used to convey property by the circuit clerk when there has been a public sale of the property. The form is available in both word and word perfect formats.

Alabama Transfer On Death Deed With Beneficiaries

Description

How to fill out Alabama Clerk's Deed?

Whether for corporate objectives or personal affairs, everyone must confront legal matters at some point in their lifetime.

Filling out legal documents requires meticulous focus, starting with choosing the appropriate template.

Once it is saved, you can complete the document using editing software or print it and finalize it manually. With an extensive US Legal Forms catalog available, you won’t need to waste time searching for the correct template online. Make the most of the library’s user-friendly navigation to find the appropriate form for any occasion.

- Locate the document you require by using the search bar or browsing the catalog.

- Review the form’s description to confirm it aligns with your needs, jurisdiction, and locale.

- Click on the form’s preview to examine it.

- If it’s the incorrect form, return to the search function to find the Alabama Transfer On Death Deed With Beneficiaries template you seek.

- Download the template when it meets your criteria.

- If you already possess a US Legal Forms account, click Log in to retrieve previously stored documents in My documents.

- If you do not have an account yet, you can obtain the document by clicking Buy now.

- Select the suitable pricing option.

- Complete the account registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the file format you desire and download the Alabama Transfer On Death Deed With Beneficiaries.

Form popularity

FAQ

A transfer on death deed offers distinct advantages over a simple beneficiary designation. It allows property to transfer without going through probate, simplifying the process for your chosen beneficiaries. When you implement the Alabama transfer on death deed with beneficiaries, you ensure that real estate is handled directly according to your wishes, potentially avoiding disputes and delays.

Absolutely, a transfer on death deed is legal in Alabama. This deed must comply with specific state laws to be valid and effective. By carefully following the legal requirements, you can create an Alabama transfer on death deed with beneficiaries to facilitate a smooth transition of property ownership after death.

Yes, Alabama allows transfer on death deeds. This legal instrument enables property owners to pass their real estate to designated beneficiaries without the need for probate. By using the Alabama transfer on death deed with beneficiaries, you can streamline the transfer process and ensure that your loved ones receive your property directly after your passing.

To transfer ownership from the deceased owner, the surviving owner must bring in the original title and original death certificate of deceased owner for transfer of title. If the names are joined on the title with ?and? or nothing separating the names, it is presumed by the state to be ?AND?.

Primary tabs. Transfer-on-death (TOD) refers to named beneficiaries that receive assets at the death of the property owner without the need for probate, facilitating the executor's disposition of the property owner's assets after their death. This is often accomplished through a transfer-on-death deed.

If transfer involves a deceased owner and owner's estate has not and will not be probated, then the individual signing on behalf of deceased owner's estate must provide a Next of Kin Affidavit (MVT 5-6) and a copy of the deceased owner's death certificate. See Administrative Rule: 810-5-75-.

Payable-on-Death Designations for Bank Accounts In Alabama, you can add a "payable-on-death" (POD) designation to bank accounts such as savings accounts or certificates of deposit. You still control all the money in the account?your POD beneficiary has no rights to the money, and you can spend it all if you want.

Yes, the Will must be probated to have legal effect. Before deciding not to probate a Will one should consult an attorney.