Trustee With Deed Of Trust

Description

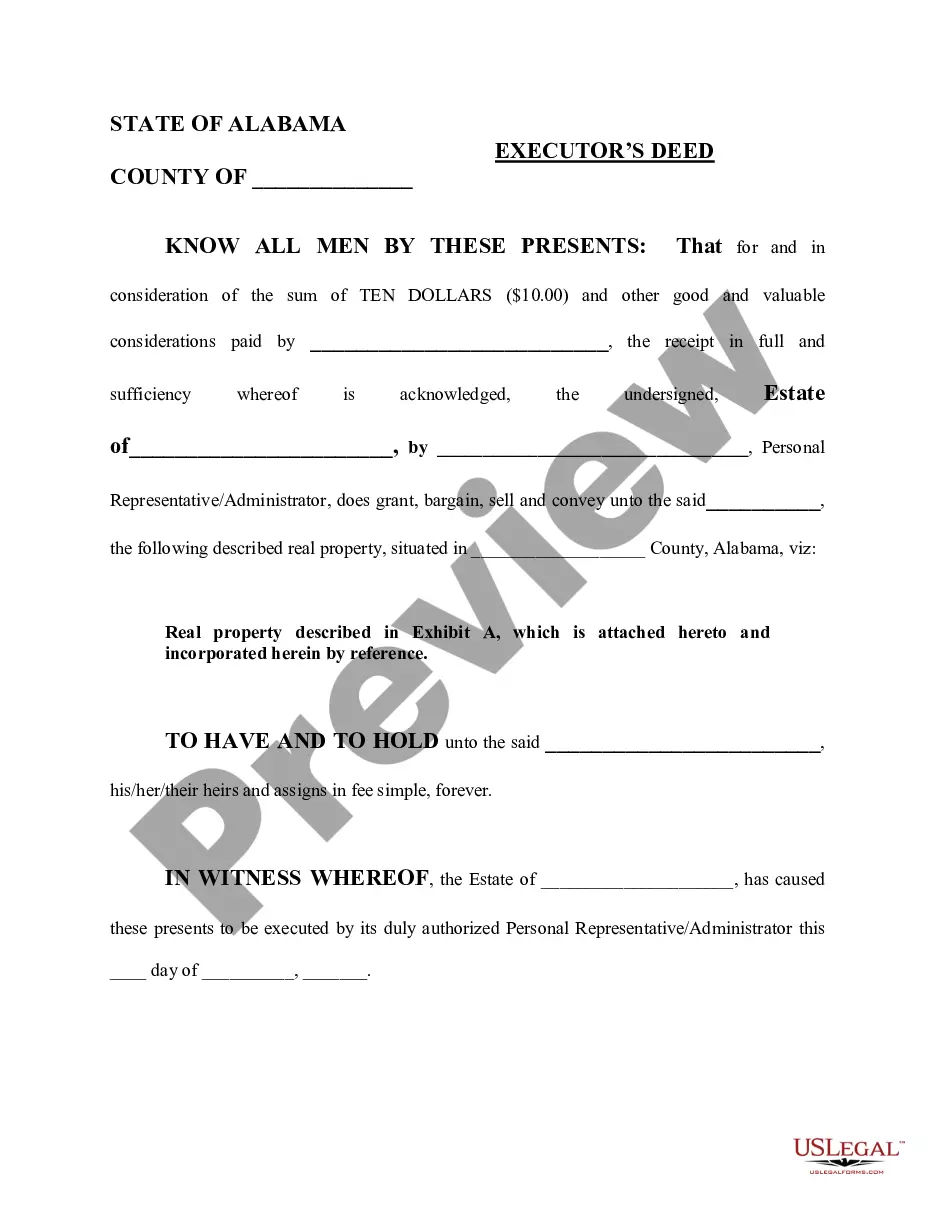

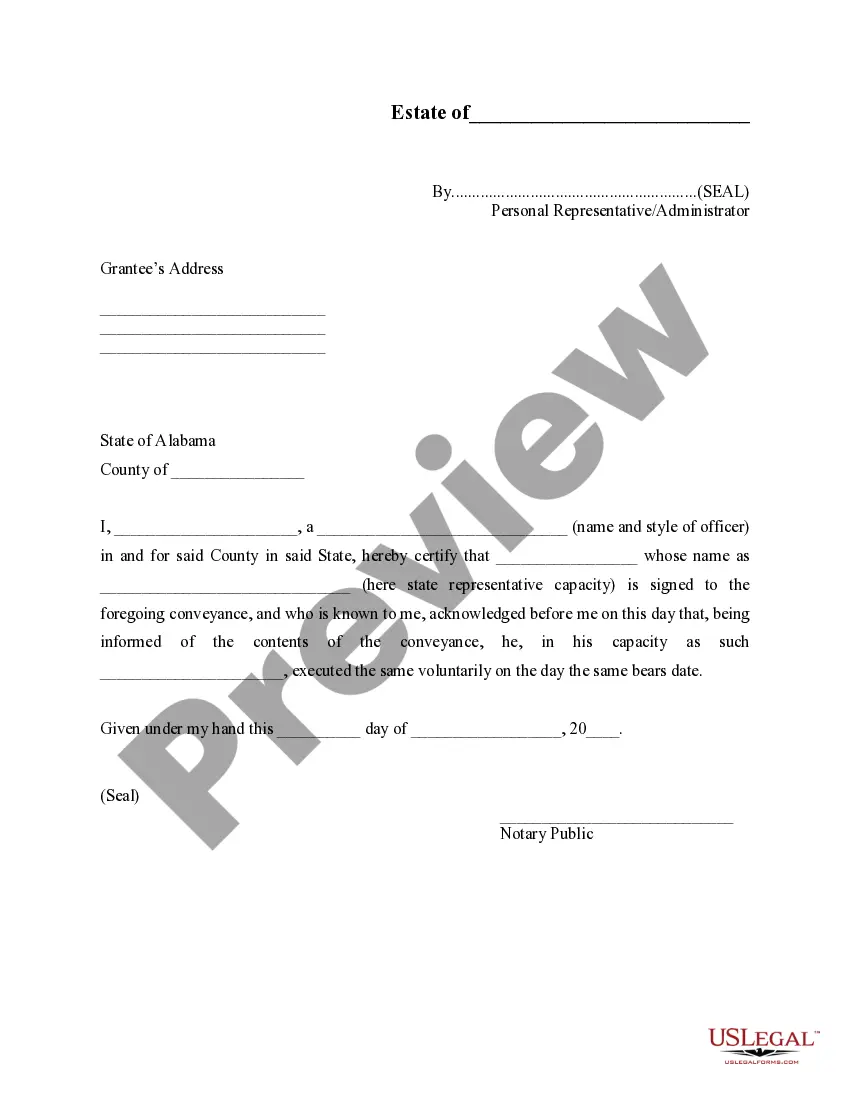

How to fill out Alabama Executor's Deed?

Acquiring legal document examples that adhere to federal and local regulations is essential, and the web provides numerous options to select from.

However, why waste effort looking for the suitable Trustee With Deed Of Trust example online if the US Legal Forms digital library already houses such templates compiled in one location.

US Legal Forms is the largest online legal repository with over 85,000 fillable documents prepared by attorneys for any professional and personal situation. They are easy to navigate as all files are organized by state and intended use. Our specialists stay informed about legal updates, ensuring you can trust that your form is current and compliant when sourcing a Trustee With Deed Of Trust from our platform.

Click Buy Now once you’ve found the correct document and select a subscription plan. Create an account or Log In and pay using PayPal or a credit card. Choose the appropriate format for your Trustee With Deed Of Trust and download it. All documents available through US Legal Forms are reusable. To redownload and complete previously saved forms, access the My documents section in your account. Make the most of the largest and easiest-to-use legal document service!

- Obtaining a Trustee With Deed Of Trust is quick and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document template you need in your desired format.

- If you are a newcomer to our site, follow the steps outlined below.

- Review the template using the Preview feature or via the text outline to confirm it aligns with your requirements.

- If necessary, search for another example using the search tool at the top of the page.

Form popularity

FAQ

Licensing Steps Step 1 (Testing - Exam and Reciprocal Information) [All must pass the "Business and Law" exam] Step 2 (Financial Statement) Step 3 (Reference Letter and Insurance) ... Step 4 (Corporations. ... Step 5 (Application, Signatures, and Notarize) Step 6 (Submit Application & $250 fee)

No License: Projects Under $25,000 Tennessee requires all contractors and subcontractors to obtain the proper licensing in order to bid on or negotiate for contracts valued at $25,000 and above. That means projects under $25,000 do not require a contractors license.

A handyman in Tennessee is not required to hold a state license unless the job they are working on is worth more than $25,000. A home improvement license is required for remodeling jobs worth between $3,000 and $24,999. Licenses are awarded by the Department of Commerce and Insurance Board for Licensing Contractors.

Per the State of Tennessee Licensing webpage, a Qualifying Agent (QA) is the person who passed the exam(s) and may be taken by an owner, officer or full time employee. (FYI - The license does not belong to the QA, unless they also the owner of the business entity providing the financial statement.)

The easiest kind of contractor's license is a Class ?B? Contractor's License. This license allows you to do general contracting work.