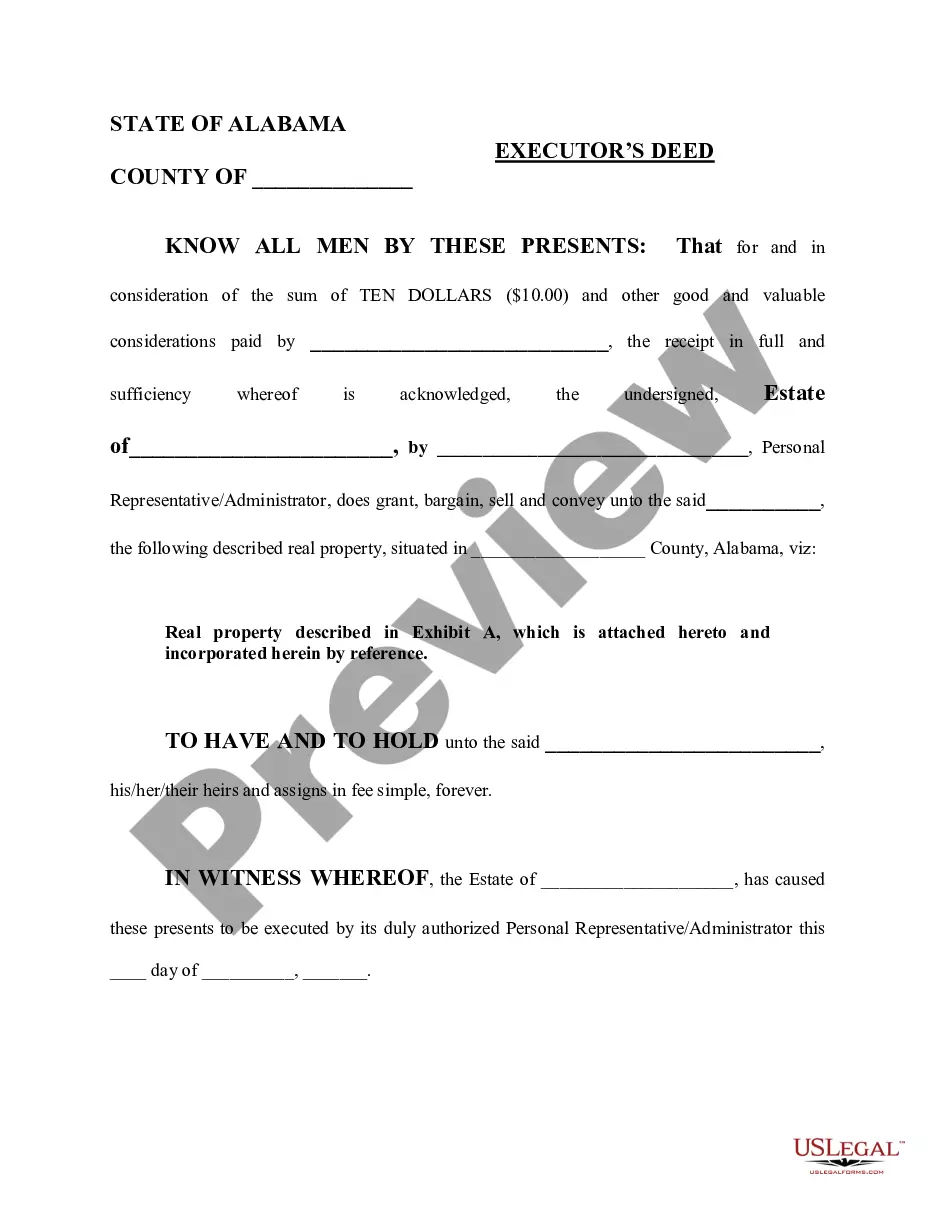

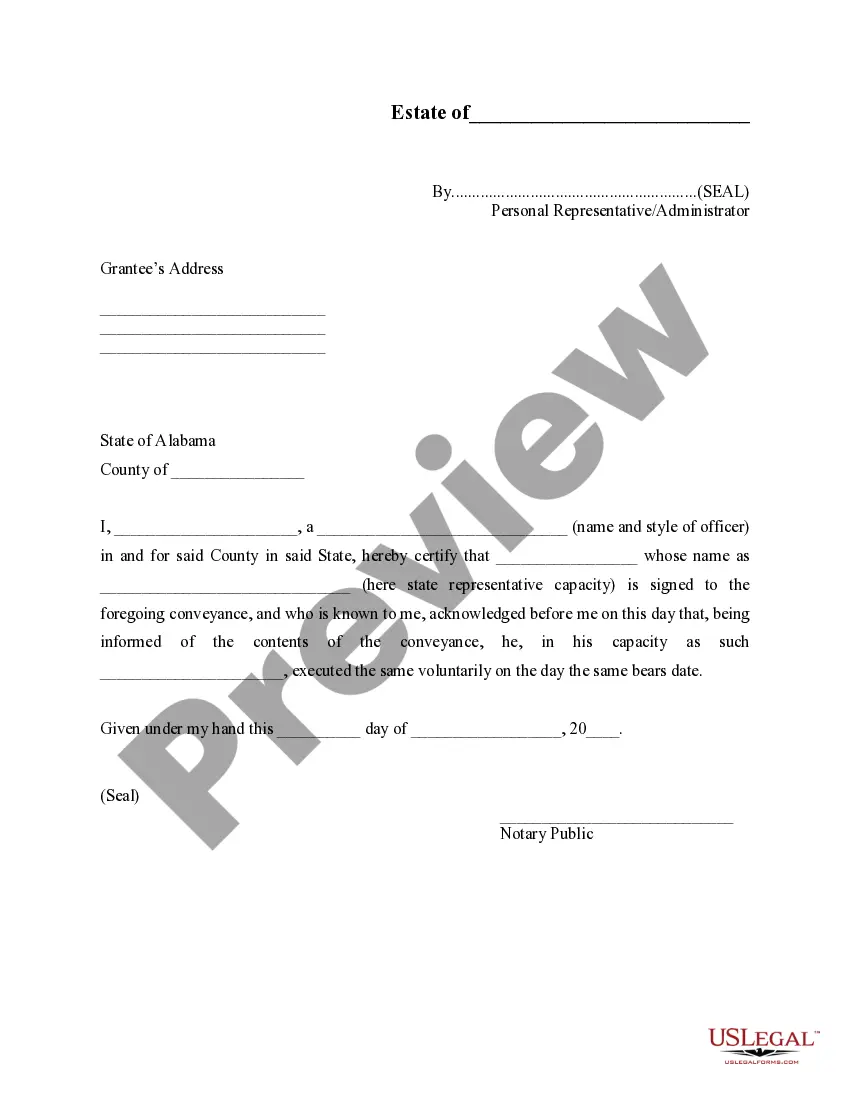

Executor And Deed

Description

How to fill out Alabama Executor's Deed?

The Executor And Deed you view on this page is a versatile legal template created by expert attorneys in accordance with federal and local statutes and guidelines.

For over 25 years, US Legal Forms has offered individuals, businesses, and legal practitioners access to more than 85,000 validated, state-specific documents for various personal and business situations. It’s the quickest, simplest, and most reliable way to acquire the forms you require, as the service ensures the utmost data protection and anti-malware measures.

Join US Legal Forms to gain access to validated legal templates for every aspect of life.

- Search for the document you require and review it.

- Choose the pricing option that best fits you and sign up for an account.

- Select the format you wish for your Executor And Deed (PDF, DOCX, RTF) and download the sample onto your device.

- Print and complete the template manually or use an online multifunctional PDF editor to efficiently and accurately fill out and sign your form.

- Utilize the same document again whenever necessary by visiting the My documents tab in your profile to redownload any previously obtained forms.

Form popularity

FAQ

To become a child's legal guardian, the court must first establish that a guardian is needed and that appointing you would be in the best interest of the child. That requires a legal process that begins with filing a petition in the appropriate court.

If the biological or adoptive parents are for any reason removed as the legal guardian, Tennessee law says that a court can appoint a person or persons to provide partial or full supervision, protection and assistance of the person or property, or both, of a minor as their ?guardian?.

Tennessee Custody Parenting Plan Either the parents agree on a plan, or the judge decides for them after applying the custody factors to determine what's in the child's best interests. The result will be a permanent parenting plan made a court order upon approval and execution by the judge.

Legal guardianship means a court grants someone other than a biological parent the right to care for a minor. Custody (most often) generally describes a parent caring for his or her own child. Guardianship does not always grant custody or definitively mean a biological parent's custody is revoked.

In Tennessee, the default rule is that both parents have custody if the child is born during the marriage. But if the child is born out of wedlock, Tennessee law automatically awards custody to the mother unless parentage has been established and there is a child custody order.

A Tennessee Guardian of Minor Power of Attorney Form is a limited legal document utilized by the parent(s) or guardian(s) only to be used upon an event that is specified: for example, an extended hospital stay, serious illness, temporary loss of employment, etc.

A legal guardian is someone appointed by the court to make personal decisions relating to the child. Typically, the child lives with his/her legal guardian. As guardian, you might make decisions such as where the child will live, what medical treatment the child will receive, and what school the child will attend.

In Tennessee, we have both ?physical? and ?legal? custody. Legal custody concerns decisions regarding the child's health, education, and welfare. Physical custody concerns the child's day-to-day living arrangements.